By Futures Portal

Chris Vermeulen www.TheGoldAndOilGuy.com a full time trader shares

his experience of trading futures and ETFs.

——————————————————–

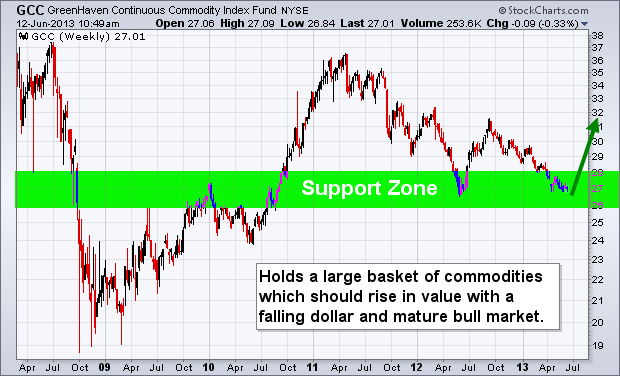

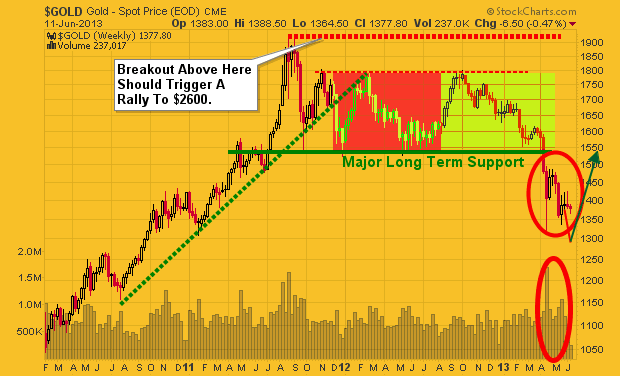

You call yourself the “Gold and Oil Guy”, are the gold and oil sectors are your specialties?

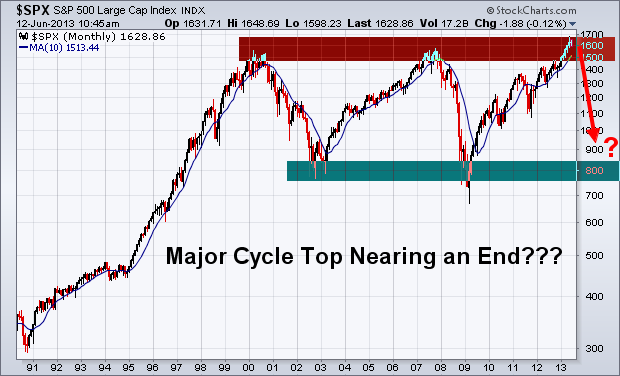

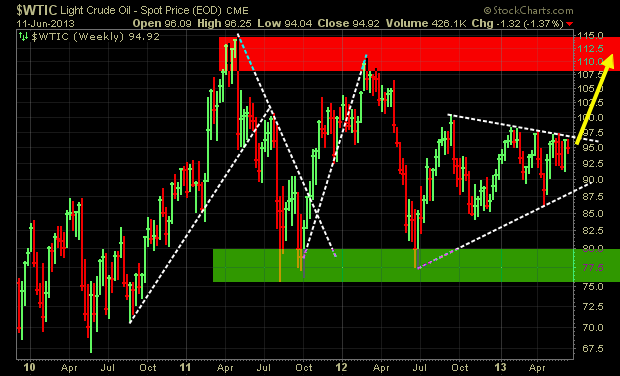

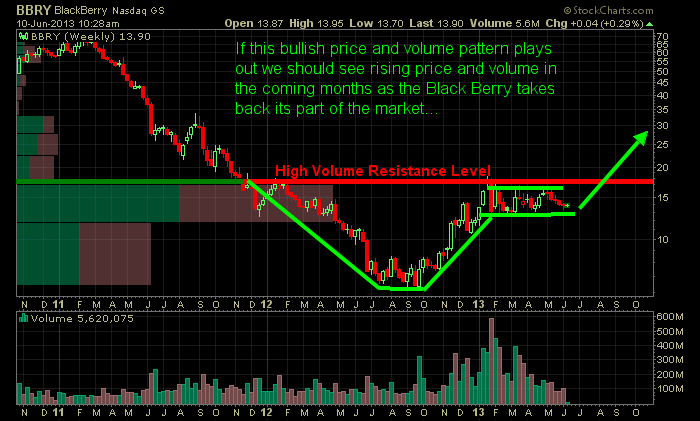

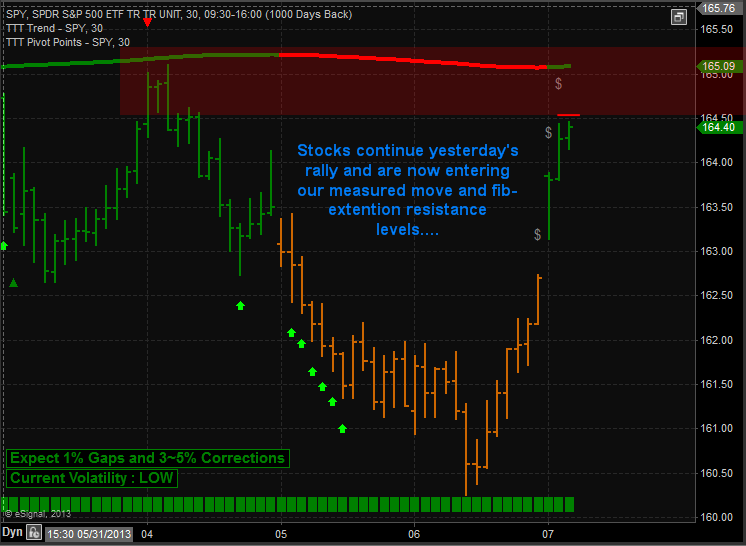

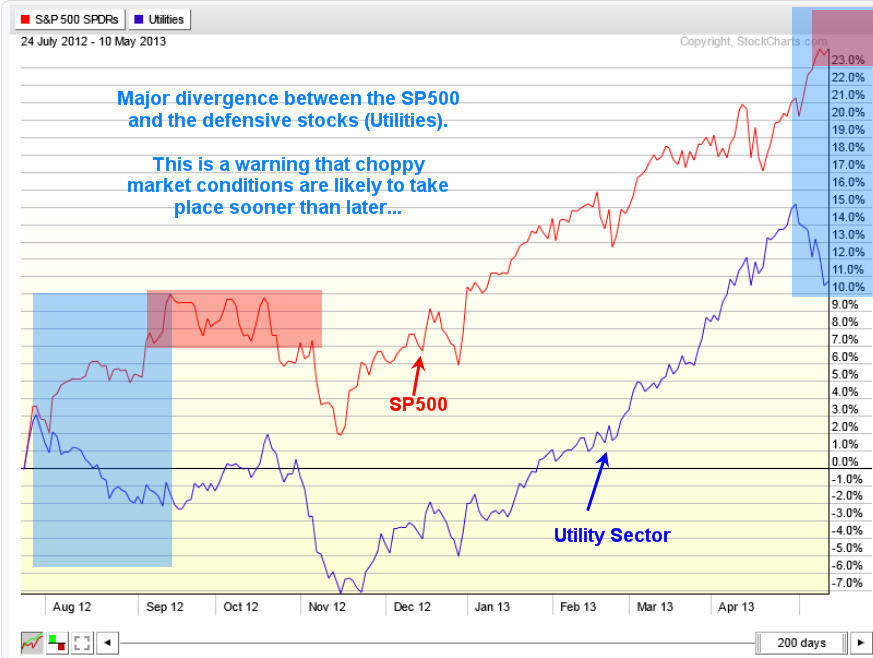

I follow gold and oil closely and give my analysis, thoughts and trades ideas to my followers each morning before the market opens. While I follow them closely the SP500 is my baby and what I prefer to trade. I found that emotions run wild in the stock market and once you understand what state of mind the majority of traders are in, then you are able to accurately track and forecast future moves 1-3 days in advance.

How did you get started trading?

I started years ago in college trading from my laptop. It didn’t take long before I decided this was what I was meant to do for a living. I have never stopped since. I work with several financial websites and professional traders each week and trade each day either managing swing trades or taking a day trades.

What instruments do you trade the most?

Depending on the risk and type of trade (swing, momentum or day trade) I jump between trading ES Mini Futures, 1x ETFs, 2x ETFs and 3X ETFs. I prefer index trading specifically the SP500 as that has been my main focus for day one. It’s better to be really GOOD AT ONE THING than average at a bunch of things. This strategy has many benefits to it including less time searching for trade setups, less stress, lower risk levels etc…

How did you choose the time frames you trade on?

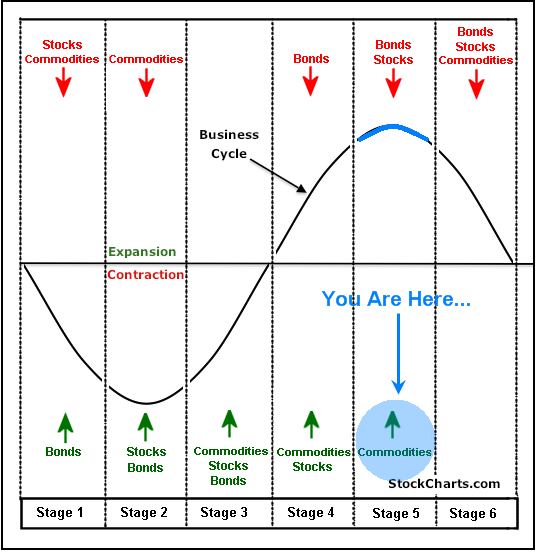

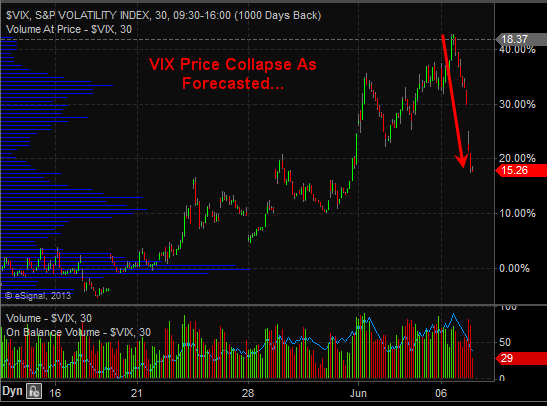

Choosing the time frames to trade took many years of trial and error. But I did eventually find a couple time frames which have proved to be VERY accurate when trading the SP500 specifically. Money flows in and out of the market in waves (cycles) and once I realized these cycles and could identify fear and greed in the market place finding and timing trades was the difference between night and day.

The really exciting thing about the SP500 and its cycles/timeframes is that I can trade full time and have trades almost every other day or site back and wait for the longer term swing trades and enjoy time with my family, friends and exercise. I have built a trading system that automatically breaths with the market using current volatility levels, various cycles, buy/sell volume levels and momentum and it alerts me in pre-market trading each day if I a buy, sell or position adjustment is to be made. The time frames I focus on are the daily, 30 minute, 10 minute and 3 minute.

Do you trade leveraged instruments? Do you trade them differently from non-leveraged investments?

I trade all types of instruments based around the SP500. In short, the more leverage I use the smaller the position I take and the shorter term the trade is.

For example I will trade the ES mini futures for day trades which are always closed out at the end of the day.

Momentum trades which last 1-3 days I will use a 2x or 3x ETF like SSO or SPXU to get more juice from a play but maintain a healthy risk level as overnight trading and price gaps cut both ways.

Swing Trades I take the largest positions in up to 50% of my trading account in a single position using a 1x ETF like the SPY. These trades can last up to 4 months at times.

I do at times make things a little more complicated when trading with a strong trend. Sometimes when I get a swing trade buy signal I will buy a position using the 1x ETF. If in the next 3 days I get lower prices of more than 1% against me while the uptrend remains alive I will add more of a position using a 2x and 3x ETF also. Once the market bounces back a little I close out the leveraged positions to a quick gain and continue to ride the swing trade. I do this same thing in down trends when I am on a hot streak and in the zone with the SP500.

What has been your biggest hurdle becoming a full time trader?

The toughest part of trading for me is keeping laser-beam focus on my strategy as it is mandatory for success. I work with, talk to and read a lot of market opinions of other traders each day and it can cloud my judgment causing me to break my own rules.

In your opinion, what do most traders don’t realize about the “game” of trading?

Most traders/investors do not understand risk/reward for positions. I would say 90% of people I talk with take much too large of positions in investments which carry very high risk. Also they do not use protective stops based of technical analysis/risk tolerances. Those are the two main things, but this list could go on and on… There are a lot of moving parts in the market and each must be closely monitored, managed and understood clearly.

Again, It’s better to be really GOOD AT ONE THING than average at a bunch of things meaning you should be jumping around trading random stocks, sectors, commodities and investment types like options, equities, forex etc… Just learn one, master it and then expand.

Without revealing your proprietary method, could you please tell us what tools you use for trading? Any specific indicators?

I am a technical trader so I focus 100% on Price, Volume and Momentum. News, economic data and rumors mean absolutely nothing to me. The only thing that pays traders is price action so that is what I follow. It’s simple supply and demand. High volume means there is power behind a move and momentum is how fast the price is moving on various time frames.

As long as you trade with the daily trend direction forget about picking market tops or bottoms you instantly have the odds in your favor. Problem is people always want to try and outsmart the market by going against the trend and trying to pick these tops and bottoms.

As for the indicators I use. Again they are simple and based off price, volume and momentum. Each of my indicators has been customized for the SP500 and is unique. I do like stochastics and bollingerbands but they each need to be tuned for the underlying investment to provide a trading edge.

What advice would you give new traders to start on the right foot?

I would tell a new trader to spend a lot of time thinking about what their ideal/dream lifestyle would be like if they could choose. Do you want to be looking at the computer and trading every day? Or do you want to always be in positions and actively managing them on a weekly basis so you can enjoy life little more? Or A mix of both?

Then you need to figure out what you would like to trade. Stocks, Options, ETFs, Futures, or currencies?

Once you know these things then you should spend a lot of time looking for a successful trading doing EXACTLY what you want and do everything in your power and never give up to learn, master and live that lifestyle. Learning to trade is not cheap. You either lose a lot of money or spend a lot of money to fast track things… either way it’s going to cost you thousands of dollars.

Personally I do a hybrid with laser-beam focus. I focus on only one investment (SP500). And I have learned and created my own trading system so I can day trade, momentum trade and swing it. This give me total freedom as I can spend 20 minutes a day looking at the market to manage my swing trade if needed and then walk away. Or can be replying to emails and see a setup unfolding on the intraday chart and take a quick trade and pocket a few hundred bucks on a day trade.

Final question is about drawdowns. How do you handle them in your trading?

Drawdowns are simple really… Depending on the type of investment you are trading the percentage amount will vary. But the same rule should apply. You should have a maximum loss per trade set so that you never blow your account up. Hopefully your protective stop is set way before that level is ever reached but sometimes price moves beyond normal volatility levels.

My general rule is to never lose more than 1% of my account in a trade. So once I spot a setup and then calculate where my stop should be and figure out how much capital to put to work so that if my stop is hit I do not lose more than 1% of my trading account. Because I focus on the SP500 the volatility is low compared to trading individual stocks so moves in price as easy to digest and reduces fear/stress when in a position.

Chris, thank you very much for sharing your experience with us and our readers.

Best of luck on everything.

FuturesPortal.com Editorial