It sure has been an exciting few days to see my book do so well and to see my first 1000 copies of the paperback with the special offer in the book at Amazon be almost sold out. It looks like only 73 books left and I expect them to be gone today or tomorrow once all 25,000 readers and followers get this email and to good to refuse offer.

If you have already purchased my book I would like to Thank You for your support and congratulate you on getting the free lifetime membership to my new investing newsletter as the free bonus gift which expires Jan 1st or when the book on Amazon sells out. Which ever comes first. To order the book go here.

Anyway, the main point of this email is to update you with some information and feedback from the book to be sure you and I are on the same page.

One person is upset about the book and I want to share it with you along with my response as you may be feeling the same way or have the same question.

—————————————

They sent me this email:

“Hi Chris,

I read through your book quickly, and about to read through it again… It was a good read… but I was a little disappointed on lack of examples of putting your teaching into practice – and hope that you can point me to some more information on your website.

Can you point me toward more training videos or other information for a beginner? I have a bit saved up, and need to start investing… previous attempts really have been glorified gambling… a point you made well in your book… that hit home. “

Thanks,

Lark

My email to them:

Lark,

“Thank you for your support on the book and recent subscription. Let me clarify things for you.

The free lifetime membership to my new investing newsletter is going to do everything I talked about in the book for you based on the SP500 so your big money (retirement nest egg) can be on the right side of the market more times than not and make money during bear markets.

It will be educational and the real-life examples I think is what you are saying you would have liked to see more of. So you will get this information each month once the first issue is published in a week or two, and you will continue to get it every month.

On a side note, we are just working on a solution for everyone to have access to the custom indicators and tools available online so you will not be required to use any specific trading platform. This is going to be a month or two still but it will be awesome!

Thank you for your feedback it is greatly appreciated and I hope this helps?”

Chris

—————————————

I’m still running my special book promotion. If you buy my new book Technical Trading Mastery in the next 24 hours then you’ll get my INNER-Investor Monthly Newsletter free forever as a bonus. To order the book go here.

BOOK REVIEW: STAN TAMULEVICH

Stan recently bought and read my book and during this process he sent me a few emails. If you do not know Stan, he is a well respected stock, etf and futures trader with a solid following of his own so I am very please that he purchased my book and had such great feedback!

Here are the email comments I received from Stan during the days he read the book:

Email #1

“You will find yourself in this book. Everyone will find something that adds insight to their trading skills. This plucks the heartstrings of everyone who has ever traded.”

Stan Tamulevich

Email #2

“It’s a book that you scan the first time, and dig into on the re-read.

It’s much deeper and thought provoking than a how to book.

Requires sitting down and taking some time to let it all sink in. Not a jump up and take action thing, but an evolving experience. Sort of a “go to” book that one should reference again and again…..”

Stan Tamulevich

Email #3

“The more I think about it, the more I realize that it’s all the essential stuff that one has to formulate and put together early in the game as well as review periodically.

I don’t know of any successful trader that is not well organized with a defined plan with notes. Always looking inward to define what constitutes their winning edge and game plan.”

Stan Tamulevich – Marketline Advisory Services

How to Get Your Free Lifetime Subscription

My new book “Technical Trading Mastery – 7 Steps To Win With Logic” is now available for you on my website Order Digital Version Here. In two months the paperback will be on Amazon.com Pre-Order on Amazon.

I am going to tell you about something really special. But first let me tell you about the book itself.

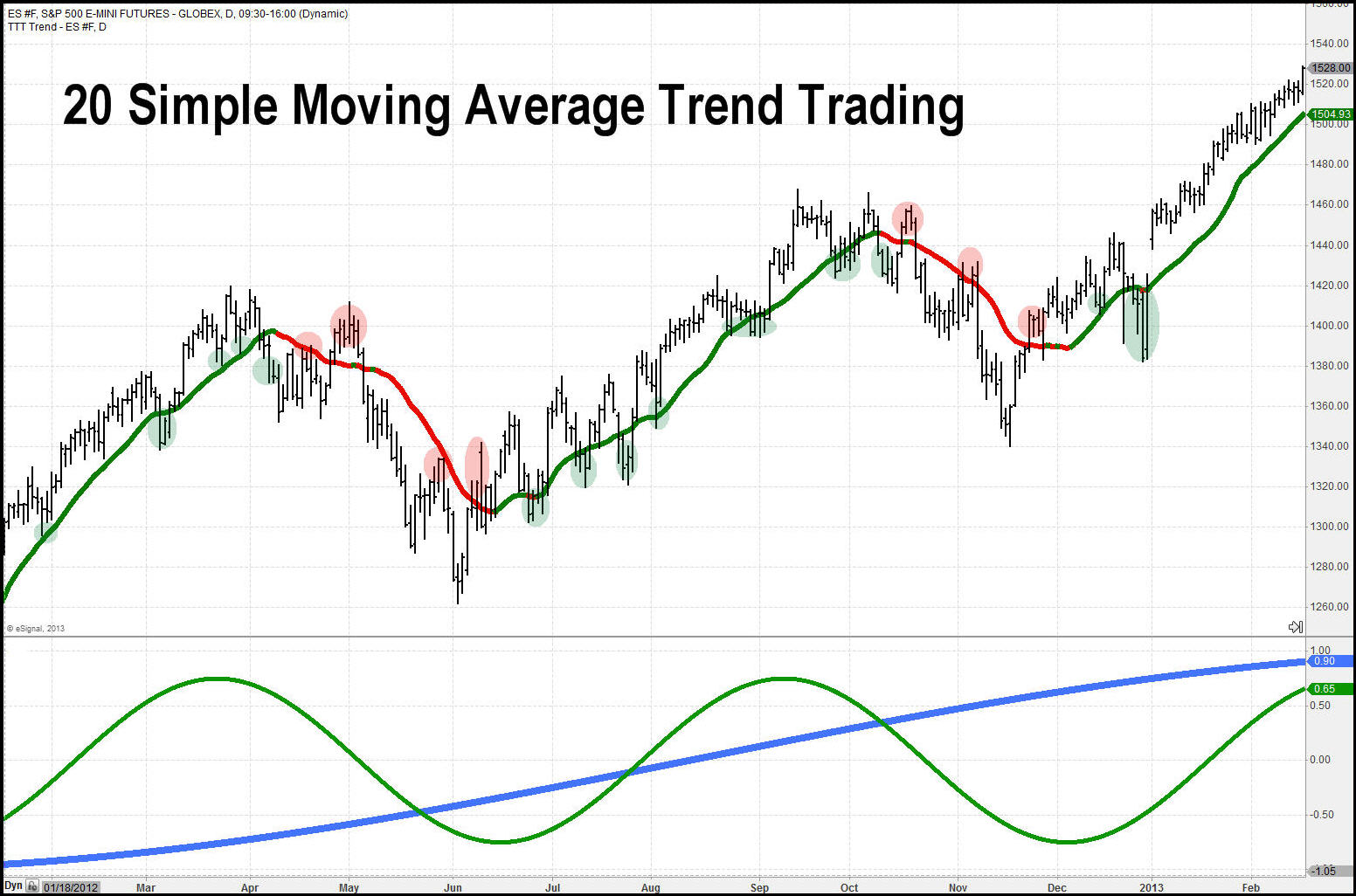

I have been planning to writing an investment/trading book for you for years and believe you will be really happy with it once you get it. Unlike most trading books that are like big encyclopedias full of the same concepts explained in a different way, my book is going to show you a new way to analyze the markets to find low risk trading and investing opportunities. My new style of analysis I call INNER-Market Analysis along with what has actually worked for me over the years are covered in detail.

You will find my process of knowing what to trade, my specific indicators and strategies in the book to be simple, unique, and exciting. Its everything I have used to manage my money and navigate big swings in the market with great success.

This is really logical way of trading not only makes sense but you can implement some of it to your trading literally overnight.

I wrote the book for you to be able to read it in two or three sittings and I share with you my story of becoming a trader which I’ve never shared before. I think that you will enjoy reading it as much as I did writing it for you.

To order the book go here.

Chris Vermeulen