Investors and traders around the world continually search to find or increase their edge in the financial markets to boost profits. The next few months are going to be critical for investors because the number seven is now in play for the stock market.

What does this mean?

In magical lore seven is a magical number., While all numbers are ascribed certain properties and energies, seven is a number of power, a lucky number, a number of psychic and mystical powers, of secrecy and the search for truth.

Seven is used 735 times in the bible and if you total up all words including “sevenfold” and “seventh” there is a total of 860 references.

The origin of seven’s power lies in the lunar cycle. The moon has four phases lasts about seven days. The Sumerians gave the week seven days. Life cycles on earth also have phases demarcated by seven, and there are seven years to each stage of human growth, seven colors to the rainbow, seven notes in the musical scale, seven petitions in the Lord’s Prayer, and seven deadly sins.

More importantly for investors the number seven and multiples of seven have a powerful influence on money. The US stock market is now trading in the seventh year window and it should not be taken lightly.

While I could go into a lot more detail about how I use seven in my algorithmic trading strategy to swing trade the S&P 500 index. This article focuses on the investing outlook.

See this video about seven… http://youtu.be/W8B14NSIWc8

I am fortunate enough that I have been trading since 1997 and have seen the how the stock market cycles affect human behavior and businesses specifically the financial newsletter industry which I have been involved in since the first day my trading career.

The stock market appears to be nearing a critical turning point that will change the lives and behaviors of investors for years to come.

The good news is that I have experienced four of these turning points and human behavior shifts in my career before and we currently entering the fifth turning point. I feel obligated to share this valuable insight with those of you who read my work. The next major market move could have a dramatic impact on your wealth and retirement years.

Insight on Investor Behavior and Business

Being heavily involved in the financial newsletter industry I have not only seen but survived several of these major cycles which forced many newsletters to go out of business. The cycles at play here are the market trend and the behavior of traders and investors.

The combined forces of these two cycles are what cleanse the newsletter industry of poor quality services. It becomes almost impossible to obtain new clients without word of mouth/referrals from happy users and if the quality of the newsletter is poor, eventually they lack enough users to make it feasible to operate. Unfortunately it’s the brutal truth, and over the last couple years I am seeing newsletters and even to top trading magazines that have been around for decades closing their doors.

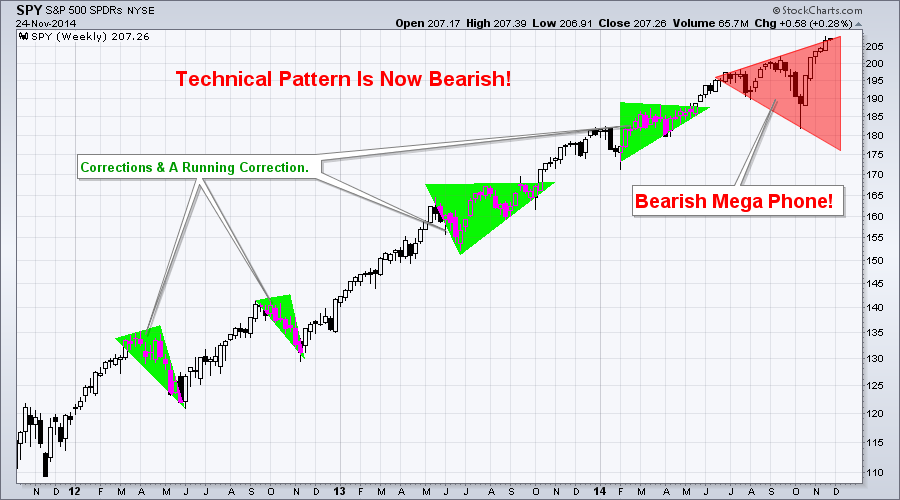

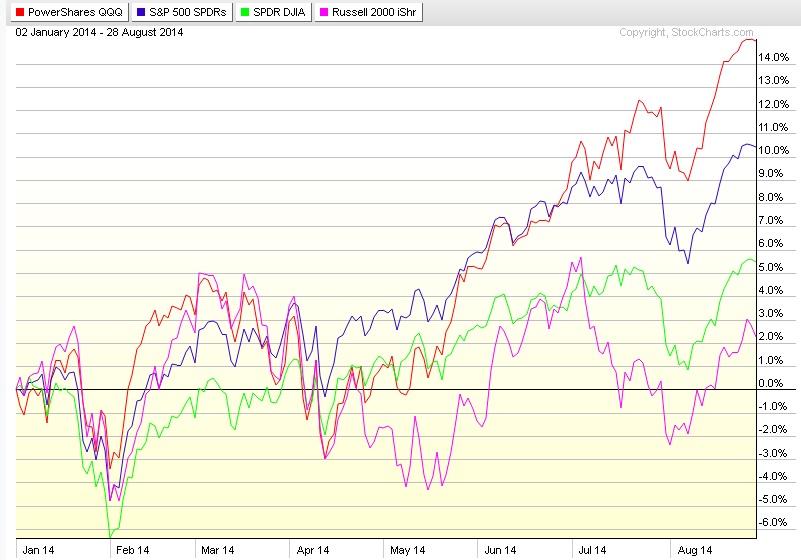

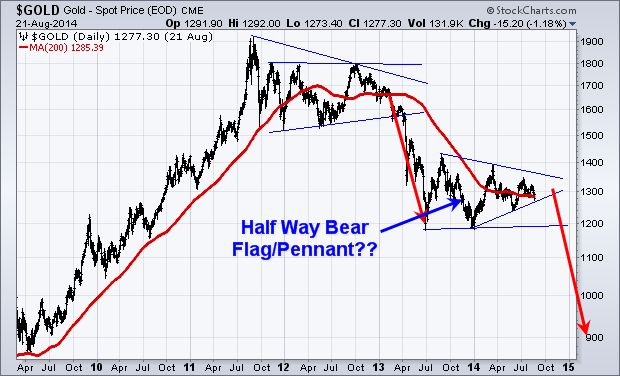

The business cycle can easily be explained by observing the chart below of the SP500 index. In short, when the stock market has been rising for six or more months investors start to become confident in that they can make money on their own. And in fact they can if they buy and hold during a bull market.

But what happens as the market continues to rise for many years is that more and more investors and traders realize they can make money on their own. The longer the uptrend remains intact the less will need the help of a trading and investing newsletter making it difficult to get new customers in this highly competitive industry.

Currently investors are behaving almost identical to what I saw during 1999 – 2001, from 2006 – 2007, and now 2014 – 2015 market tops.

Did you notice anything with those market tops? They are 7 years apart…

Let’s now take a look at the best times in the business cycle where traders and investors are in desperate need of help and start subscribing to multiple paid financial newsletter services. The strongest times for business took place during 2002 – 2003, and again in 2008 – 2010. This is when investor not only lost most of their wealth, but their faith in how they invest, who they invest with, and the stock market as a whole.

Did you notice any there also? They are 7 years apart also…

Investors 7 Year Financial Outlook

Those of you who follow me know that I do not pick market tops or bottoms. Rather I focus on identifying trends and cycles in the market and only trade and invest with the active confirmed trend.

You also know that trying to pick market tops and bottoms is a suckers game and a sure fire way to lose a lot of money and build a serious complex that the market is manipulated, not tradable, and that it may be time for you to give up on trading all together.

Well, I am here to say that the market is tradable, and can generate traders and investors a boat load of money once you understand how and why it moves. Most importantly you need to understand money/position management and be patient for consistent long term gains.

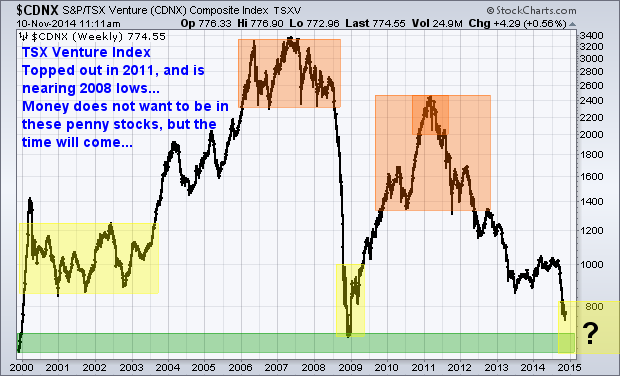

Take a look at the chart below for a clear visual of 7 year cycle highs and lows at play.

While I do not invest based on this major seven year cycle I do actively trade a smaller market cycle which provides roughly 35 – 65 trades per year. This strategy allows me to profit during these major bull markets and also during the multi-year bear markets when the majority of investors are losing boat loads of their hard earned money.

The reason I do not invest in the seven year cycle is because the market can still have 30+% price swings within bull and bear markets and that type of volatility is beyond what I am comfortable with. Also because I can actively invest with my automated trading system so I don’t need to lift a finger or watch the stock market each day, week or month.

I hope you found this report useful in some way, and I ask that you share it with others.

Chris Vermeulen

www.TheGoldAndOilGuy.com