Weekend Gold, Silver, Nat Gas, Oil & SP500 Report

Sunday April 25th

Last week the market slowly recovered from the recent sell off in stocks and commodities. So far the market is unfolding as we expected and with any luck there will be a surge of low risk setups across the market in the near future. Take a look at the charts below.

GLD – Gold Chart

GLD/Gold is trading at a key pivot point. This week there will most likely be a sizable move either up or down. Past chart analysis is pointing to lower prices which would complete an ABC trace pattern and this makes for a larger and stronger rally once prices to turn back up. Silver is trading in much the same situation. Gold and silver tend to move together with silver having more volatility than gold.

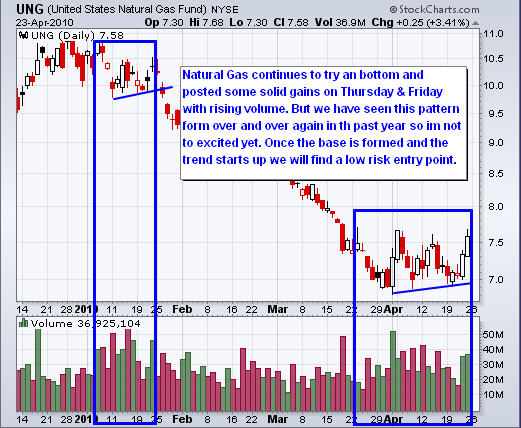

UNG – Natural Gas Chart

Natural Gas continues to try and bottom and posted some solid gains last Thursday & Friday with rising volume. But we have seen this pattern form over and over again in the past year so I am not excited yet. Once the base is formed and the trend starts up we will find low risk entry points for this commodity. I would look for shorting opportunities but natural gas is so oversold I feel the risk is higher than I prefer.

USO – Crude Oil Chart

Looks like the trend line break down flushed out a lot of weak positions as seen in the volume surge. Oil momentum is still down but we are now starting to look for a buy signal.

SPY – SP500 Chart

Equities recovered nicely from the previous week’s sharp sell off. We saw volume rise with higher prices which is a strong sign of the overall strength of the market. But it is important to note that the market sentiment has reached an extreme level with 53% of traders now being bullish on the market and only 17% being bearish. This extreme level is the same level reached just before the January correction earlier this year.

Equities and Commodity Trading Conclusion:

If recent historical prices repeat again then we are looking for a small move higher on Monday and then a couple days of weakness for both stocks and commodities later in the week.

The market is very close to generating several low risk trading signals which is very exciting.

If you would like to receive my ETF, Stocks or Futures Trading Signals please check out my website at www.TheTechnicalTraders.com

Chris Vermeulen