Gold & SP500 Day Trading Gone Wild & What’s Next?

May 2, 2010

The past couple weeks we have seen sellers control the price of gold. This can be seen on the charts by the light volume drifts up then heavy volume sell selling sending this metal sharply lower. This type of price action provides some excellent intraday shorting opportunities.

On the other hand the SP500 has been doing quite the opposite providing some very profitable intraday buying opportunities for those who have the time to trade during the day.

Below I show a couple of low risk intraday trading opportunities which lasted a couple days providing massive gains, tiny down side risk and immediate price action. But what I think is about to happen in the next week or so will turn the tables with gold providing great buying opportunities and the SP500 with some great shorting opportunities, opposite to what is happening now.

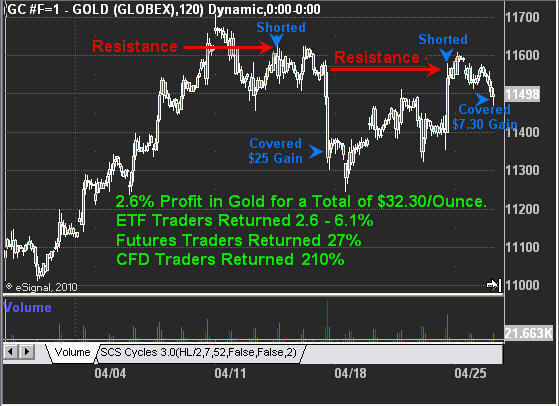

Two Shorting Opportunities in Gold Making 210% Return in 3 Days

The fist two weeks of April gold had formed an excellent mini head & shoulders topping pattern. This is a pattern which I find very profitable when trading the intraday charts.

The first chart is of the 2 hour intraday gold chart spanning 25 days. On this chart gold had formed a mini head & shoulders topping pattern which day traders were able to take advantage of with very little risk.

Once the first wave of selling was finished and gold reached our price target of $1134, we exited our position and waited for another intraday setup. It was only a couple days later when gold has setup for another opportunity to short which an even more potential than the first trade as it had the possibility of dropping to the $1115 level. This would have provided a $40 move in gold washing the market of weak positions setting itself up for another big rally.

Our first price target was reached at $1147.7 where we took some profits and moved our stop to break-even (our entry price) for the balance of our position. Doing this guarantees the trades will be a winner no matter what happens. As you can see on the chart depending what investment type you trade you would have earned 2.6% – 210% return on your investment.

Gold’s Surprise Rally – Spain Was A Pain

Last week Spain was downgraded causing large selling pressure on the Euro as everyone sold the Euro and moved their money into a safer investment like the US Dollar and Gold. This sent both dramatically higher at the same time. The chart below shows the same 2 hour chart of gold but is zoomed out so you can see farther back and also the most recent rally in gold.

The red arrow on gold shows where gold was most likely to go in the coming days, but instead it rocketed higher on the Euro-land news hitting the wires. Most of the price advance happened within the first 4 hours and since then the price has drifted sideways and grinded its way a little higher.

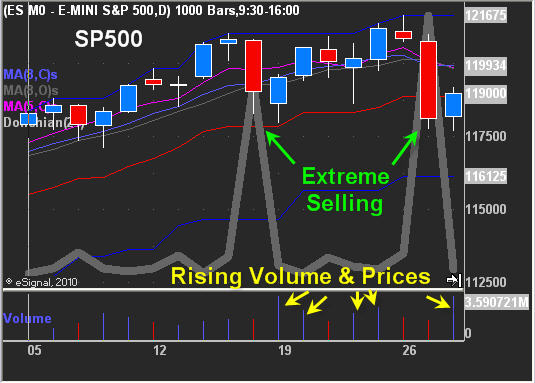

SP500 Buying Opportunity Makes 135% Gain in 3 Days

During the day on Wednesday I had low risk entry point for day traders on the SP500. The setup is simple really. Tuesday’s panic selling sent the market tumbling in a very short period of time putting the market in an oversold condition. A condition like this provides excellent low risk/instant price movement type of setup.

Take a look at the volume on the chart… Volume on the ES Mini SP Futures contract was not very heavy during the sell offs. But the days following shows strong buying volume indicating big money was buying up stocks at these discounted prices. This is great to see.

60 Minute SP500 Trading Chart

As you can see from the chart below Tuesday’s heavy volume sell off was an almost straight drop. That type of move generally provides a trad-able bounce or drift higher within a few days which tests the level were prices started to drop originally (the breakdown level).

The price of the SP500 drifted up into resistance with declining volume meaning traders are not willing to pay the higher price for the index. This is a sign of weakness and worked out perfectly with our price target of $1205-1206 at which point we took money off the table and moved our stop up to lock in some solid gains if the market did in fact reverse back down after reaching the key resistance level.

Gold & SP500 Trading Conclusion:

Some very exciting times lie ahead as I feel gold and the SP500 are changing short term trend directions. Gold which was down the past month is now headed higher as we are looking for low volume pullbacks to take long positions.

And the SP500 looks ready to take a swan dive to correct/digest some of the monster rally it has put in since the February low. With any luck we will get a nice shorting opportunity to catch some of the move down and then we should be setup for another large rally.

In short, we are looking for gold to dip to enter long and the SP500 to breakdown this week then form a low volume bounce/drift into a resistance level which we will try to short once the bounce loses its upward momentum. I feel we will have a bunch of day trades in the near future along with some great swing trades at the key turning points.

Get My Gold and SP500 ETF Swing Trading Signals: www.TheGoldAndOilGuy.com

My Intraday, Swing Trades and Trading Strategy: www.FuturesTradingSignals.com

You can also Trade Explosive Stocks with me at: www.ActiveTradingPartners.com

Chris Vermeulen

Disclaimer: I currently do not own gold and SP500 ETFs or Futures contracts.