Getting Coal in Your Stocking May Be Exactly What You Want

Chris Vermeulen – www.TheGoldAndOilGuy.com

We all want new and exciting electronic gizmos and gadgets for the holiday season. Unfortunately they have the tendency to lose almost all their value within weeks because of newer versions etc… but what if you just got a lump of dirty old coal in your stocking, how would you feel?

The only individuals who would appreciate a dirty gift like that would be those forward looking investors who see major opportunities before they become the next big movers and headline news.

Knowing how to spot Stage 1 patterns is one of the most important bits of information you need to know as an investor. This one pattern is how I found RIMM which now up 100% in the past 30 days, ANR up 30% in two weeks, FSLR up 20% in 20 days and the list goes one. My main focus is on ETFs because of lower risk they provide but very powerful when applied to individual stocks.

Coal and coal stocks have been out of favor for almost two years now. But these unwanted and hated shares may soon be owned by the masses, or at least by traders and investors. A few weeks ago to I talked about the four stages all investments go through and which patters you must be able to spot in order to make huge money investing while having very limited downside risk.

You can read about them here where I used Apple and Research In Motion shares as my example: http://www.thegoldandoilguy.com/collapse-of-apple-rise-of-the-blackberries-stock-market-cycle/

In summary, Trade with the BIG BOARD and only focusing on buying stocks, ETFs etc… as they are coming out of a Stage 1 Accumulation Basing Pattern. This puts the odds greatly in your favor for not only winning the majority of your trades but to generate above average returns.

The BIG BOARD – NYSE – Weekly Major Stock Market Trend

The New York Stock Exchange is the big board. This chart formed a reversal candle last week which points to lower prices. Its likely we see a 1-2 week dip before buyers step back in. Until then individual stocks should pause or form mini bull flags until the sellers are finished and buyers step back into risk on assets (equities).

Coal Sector ETF Showing Stage 1 Basing Pattern

Coal stocks have been bouncing bottom for some time and if you did not review the Stages Report using the link above then do so now so you know what to expect in detail.

KOL coal exchange traded fund is a basket of coal companies and is starting to show signs of a new bull market. A breakout and close above $26.00 should trigger strong buying with the potential of a 21% gain before it hits my first price target. This could go way past that but one target at a time folks.

Naturally I would like to see a bull flag or pause in KOL over the next couple weeks, then look to get long using the pivot low of that pause/bull flag as my protective stop. I’m not jumping in here as the broad market looks ready to correct and ¾ stocks follow the big board which will pull KOL down.

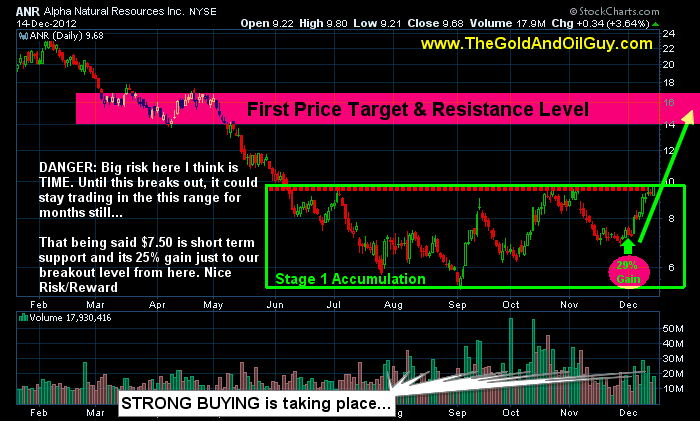

ANR – My Top Coal Stock Pick

I pointed out ANR at $7.50 at the beginning of December to followers as it was the best looking coal stock I could find. The two key indicators “Price” and “Volume” were clearly pointing to higher prices and the potential gain even if it was just played up to the Stage 1 Resistance Level still netted a 30% move. Crazy part is that there is the potential for a 100% rally to my first price target. Follow my free ideas here live: https://stockcharts.com/public/1992897

You want Gizmos or Coal in You’re Stocking???

In short, I really like the coal sector for the first quarter of 2013. I’m not too worried about the fiscal cliff as it’s not the end of the world and the US along with most other countries are all bankrupt together in my opinion. New rules and ideas will be implemented and life and business will continue… I am not to worried.

I am expecting stocks to continue sideways or higher into May at which time a serious correction could take place. But not to worry as we take things one week at time and will be adjusting my outlook accordingly.

Get My Trade Ideas & Alerts Delivered To Your Inbox: www.TheGoldAndOilGuy.com

Chris Vermeulen