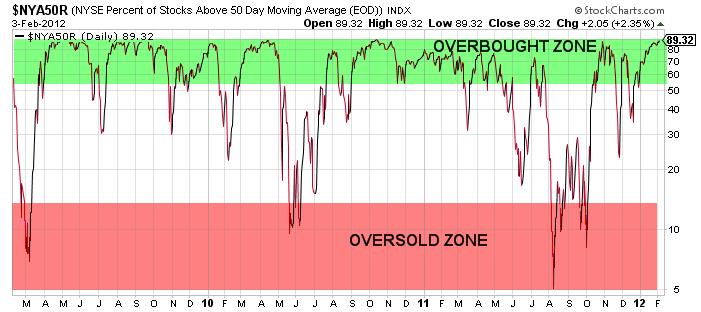

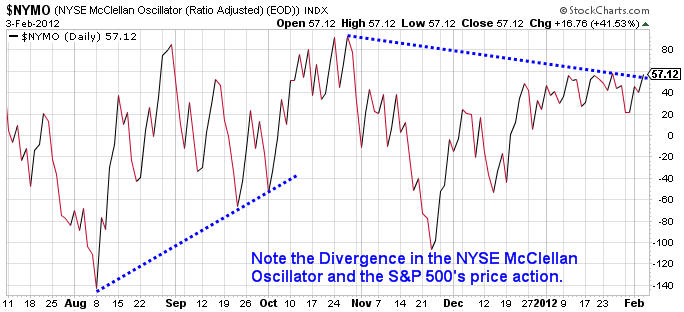

For the first time since the last week of December of 2011, the S&P 500 Index closed lower on the weekly chart. Recently I have been discussing the overbought nature of stocks based on a variety of indicators. However, the real question that should be asked is whether last week was just a short term event or if we see sustained selling in coming weeks.

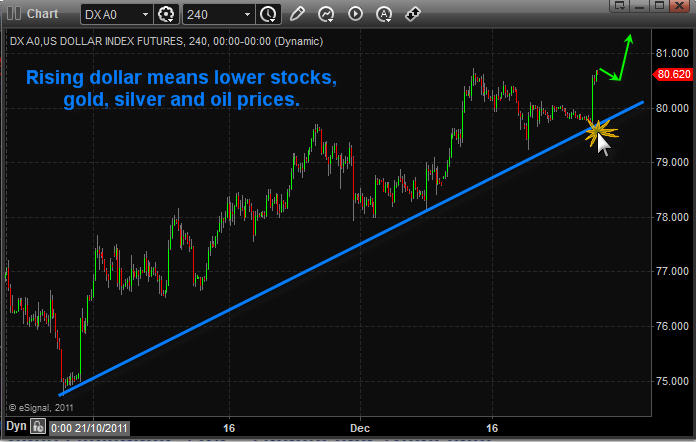

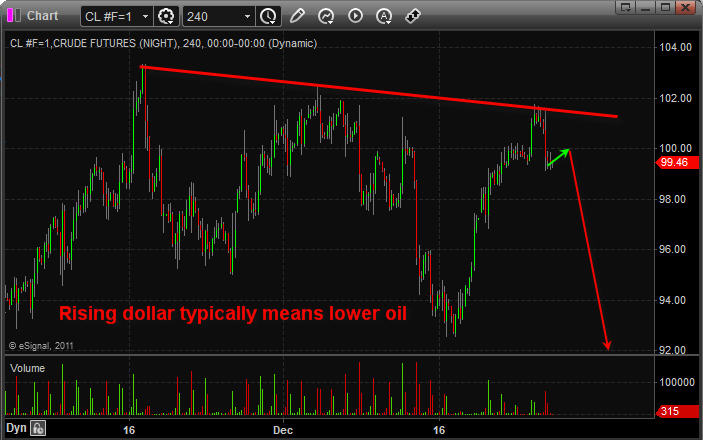

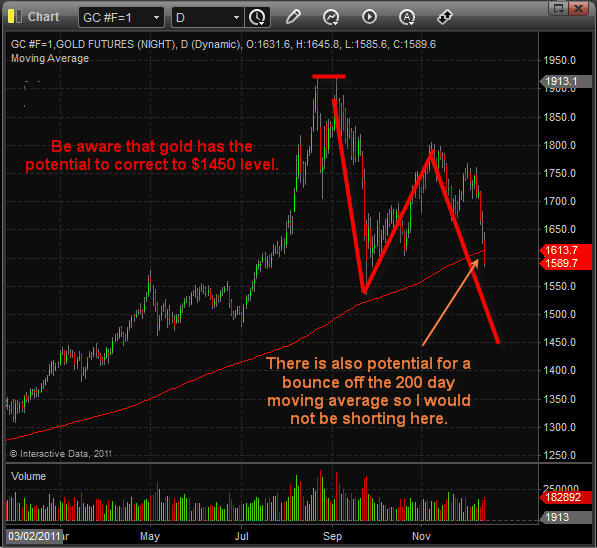

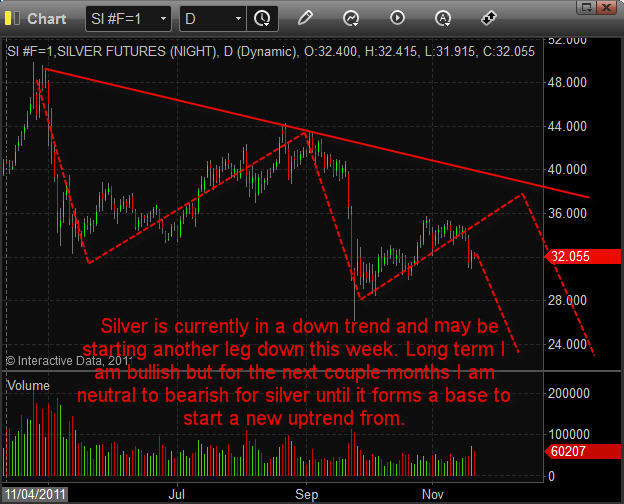

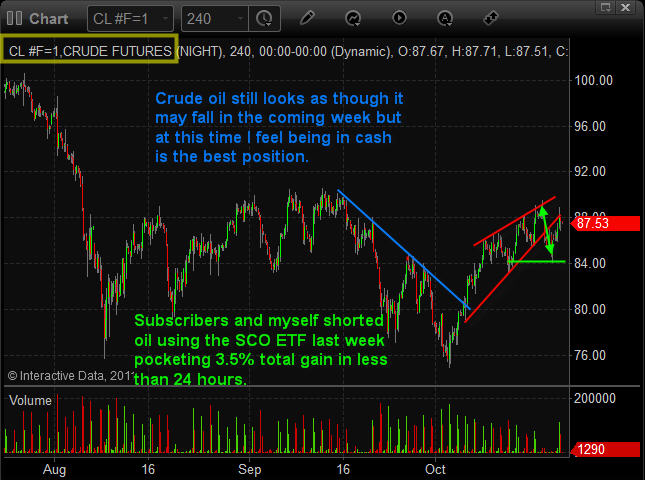

The issues occurring in Greece spooked the markets somewhat on Friday as Eurozone fears continue to permeate in the mindset of traders. The U.S. Dollar Index is the real driver regarding risk in the near and intermediate term future. If the Dollar is strong, market participants will likely reduce risk. However a weakening Dollar will be a risk-on type of trading event which could lead to an extended rally in equities, precious metals, and oil.

Friday marked an important day for the U.S. Dollar Index futures as for the first time in several weeks the Dollar held higher prices into a daily close. The U.S. Dollar appears to have carved out a daily swing low on the daily chart from Friday. Furthermore, the potential for a weekly swing low at the end of this week remains quite possible. The chart below illustrates how the 100 period simple moving average has offered short term support for the past few weeks.

U.S. Dollar Index Futures Daily Chart

I would also point out that the MACD is starting to converge which is a bullish signal and the full stochastics are also demonstrating a cross on the daily time frame. As long as the 100 period moving average holds price, a rally is likely in the U.S. Dollar Index in coming weeks.

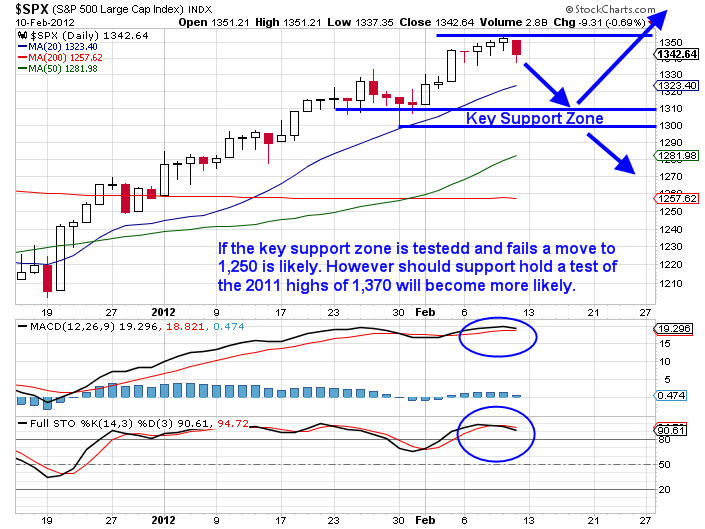

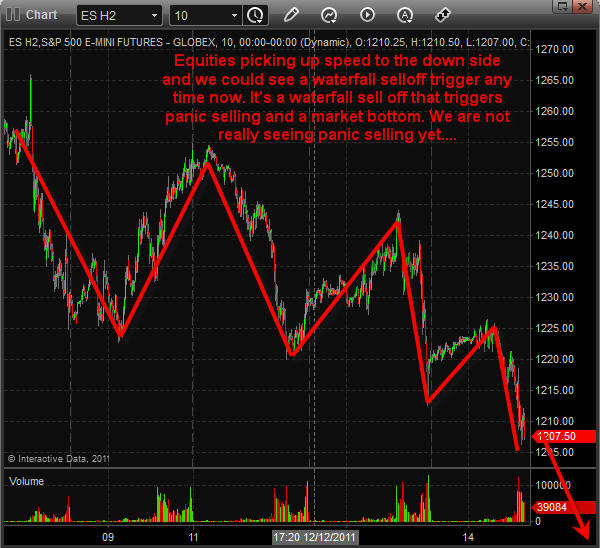

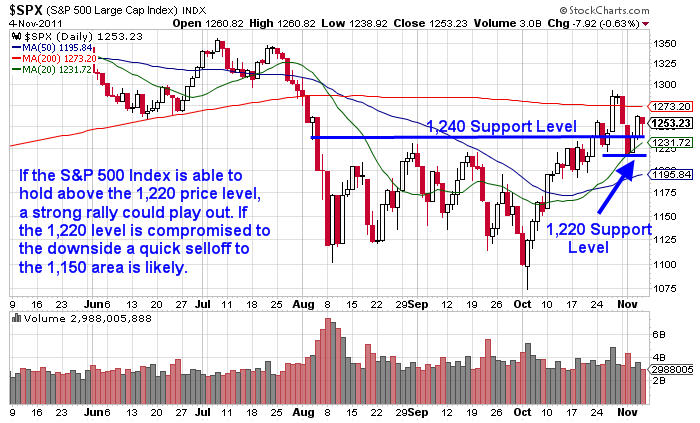

Should that rally play out, it will likely push risk assets lower. My primary target for the S&P 500 would be around the 1,300 – 1,310 price range if the selloff transpires. It is important to note that headlines coming out of Europe could derail this analysis in short order.

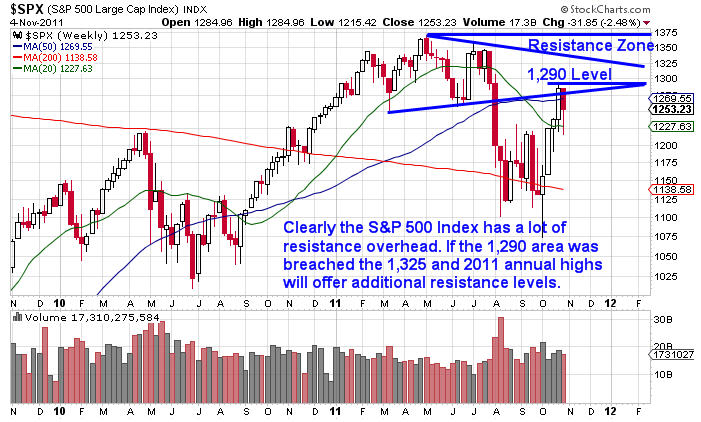

Assuming that a selloff in the S&P 500 occurs it will present a difficult trading environment for market participants. Market participants are going to be in a tough position around the 1,300 price level. A rally from 1,300 could serve to test the 2011 highs. In contrast, a confirmed breakdown of the 1,300 price level could initiate a more significant selloff towards the 1,250 area.

Should price move towards the 1,300 price level the bulls and bears will be battling it out for intermediate control of price action. This is my preferred scenario for the short-term time frame, but I would only give it about a 60% chance of success at this point in time. We simply need more time to see how price action behaves the first few session of the forthcoming week.

S&P 500 Index Bearish Scenario

The alternate scenario which has about a 40% chance of success would be a sharp rally higher which likely would be produced by news coming out of Greece and/or the Eurozone that pushes the Euro higher. Right now risk is high due to the sensitivity of price to headline risk. With that said, the bullish alternative scenario is shown below.

S&P 500 Index Bullish Scenario

At this point we just do not have enough price information to give us clarity regarding the most probable outcome. The price action in the Euro is going to drive price action for the S&P 500 and other risk assets in weeks ahead.

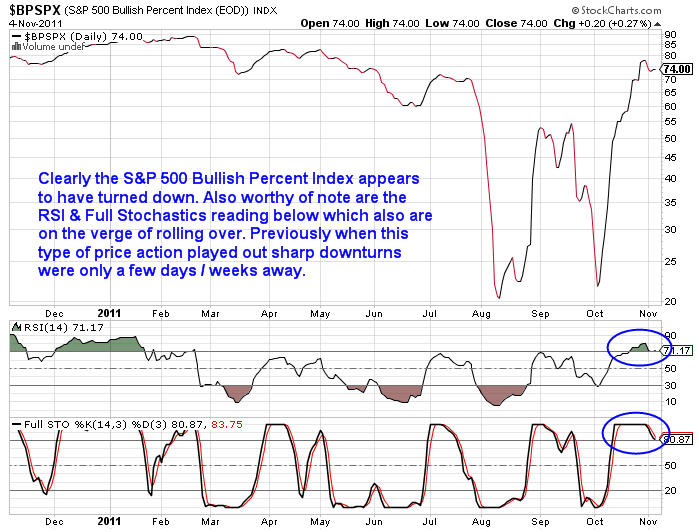

Anything is possible in the short-term, but I have to give a slight edge to the bears simply based on the price action Friday and the fact that almost every indicator I follow is screaming that the equities market is severely overbought. The price action this week should be telling. Headline risk is excruciatingly high, trade safely in the coming week!

By: Chris Vermeulen – Free Weekly ETF Reports & Analysis: www.GoldAndOilGuy.com

Co-Author: JW Jones – Free Weekly Options Reports & Analysis: www.Optionnacci.com

This material should not be considered investment advice. J.W. Jones is not a registered investment advisor. Under no circumstances should any content from this article or the OptionsTradingSignals.com website be used or interpreted as a recommendation to buy or sell any type of security or commodity contract. This material is not a solicitation for a trading approach to financial markets. Any investment decisions must in all cases be made by the reader or by his or her registered investment advisor. This information is for educational purposes only.