Algorithmic trading is not something I ever thought I would be doing and it did not really exist 15+ years ago with I started investing. Fast forwarding to today all we seem to hear about is “HFT” high frequency trading, automated, black box trading, and algorithmic trading and how they are making people a boat load of money or almost bankrupting companies overnight like Knight Capital…

Since 2001 I have been sharing my technical analysis, knowledge, and trades with fellow traders online. And over the years through one-on-one coaching, or through financial newsletter it became very clear that emotions and human tendencies will never change when it comes to emotions (fear & greed) along with ones commitment to stick with a plan/strategy without deviating off course no matter how boring or slow it may be.

“The financial industry wants you to think investing is complex,

but the truth is: investing is and must be kept simple

and the best way is through algorithmic trading!”

After five years of personal coaching and newsletter writing for swing and day traders trying to help with their habits, techniques of what I knew worked very well for me, was not something most clients could not succeed at even when they had every step/rule identical to what I was doing to make money. This problem led to me thinking outside the box to figure out why and how I could get others to mimic what I do best so they too could enjoy the freedom and peace of mind knowing they are in control of their life.

After several few months communicating with clients, professional traders and educators across the globe and covering many different topics on education I found what I was looking for. The problem lies with us being human. You see, people are very emotional and during heightened times of excitement or fear they tend to react from instinct rather than to follow a set of rules.

People have the tendency to stop doing a task over time that is repetitive in nature, even if it’s making money for them. And it was this conclusion that triggered my thinking to build a system that will trade my strategies using my rules and execute trades automatically without myself or clients having to do anything. This is when my focus on algorithmic trading became my new passion and the driving force of my automatic investing system for individuals.

What is My Simple Automated Algorithmic Trading System?

In short, an algorithmic Trading System is a set of rules and formulas programmed into a trading platform. The algorithmic system places trades automatically according to the sets of rules we create. These rules are built to allow investors to have increased income potential that a properly traded strategy can provide without the need to watch the computer screen all day and manually enter and exit positions when you think the time is correct.

With the use of technology we can now benefit from our strategies by converting them into computer formulas and optimize them for specific investments and make complete automated algorithms. My S&P 500 algorithms were designed and built so I could have more free time while still making the same amount of money if not more and to trade without my emotions getting in the way. This strategy has worked extremely well over the year and I now want to make it available to a select group of individual investors to get the full benefits of what my system provides me with.

Investors BIGGEST Problem and How to Avoid It With Algorithmic Trading

In short, the problem we all have as traders is the fact that we are human. Riddled with bad investing habits, and responding to market fluctuations emotionally rather than logically is why we have trouble making money consistently over the long run.

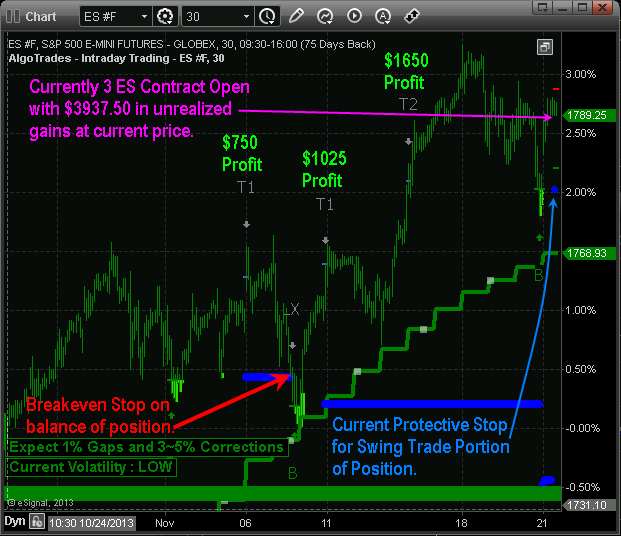

Here is a recent screen shot of my trading systems intraday algorithmic trading strategy used during an uptrend. Trading the ES mini futures this algorithm pulled $3,425 in two weeks when most traders were getting shaken out of trades. No keep in mind this is one strategy out of the twelve that are traded with my complete algorithmic trading system. Other strategies are based on the various time frames, trends and volatility to be sure we have all types of market fluctuations covered.

The rich do what’s hard;

that’s why their life is easy.

The poor do what’s easy;

that’s why their life is hard.

Next I want to show you how to trade like an emotionless robot, how it works, why, what to trade, and how much capital is required to have this algorithmic trading automatically traded in your brokerage account to make a decent living trading the S&P 500 index which is the least volatile and most liquid investment available to traders and investors. A really exciting part about it is that you do not need to learn or installed anything. It is a truly 100% hands free investing system that provides annual results that will make your financial advisor envious!

Stay Tuned For Part II Of How & Why You Should Be Algo Trading…

Chris Vermeulen