Follow our analysis and read all of our past research posts by visiting www.TheTechnicalTraders.com. Learn how we can help you stay ahead of these moves and find new opportunities in the markets. 53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Archive for year: 2018

Recently, the Solar Energy sector has popped up on our watch-list of potential sectors to pay attention to. Over the past few weeks, the Solar Energy sector has been under some pricing pressure and has retraced nearly 50% of the previous trend across the sector. We, the research team at Technical Traders Ltd. understand the Trade War and uncertainty resulting from geopolitical tensions can sometimes create opportunities in the markets for all traders/investors. We just have to be smart enough to find them end execute them efficiently.

Is Solar Energy the next big trend to hit in the Energy sector? What is the potential for these stocks to move 10%, 20% or even 30%+ higher? Let’s take a look.

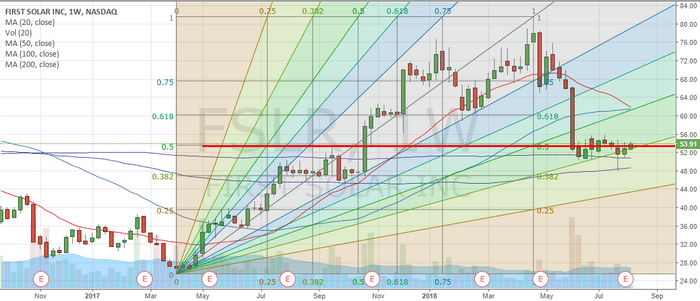

This first chart, a Weekly chart of First Solar (FSLR) presents us with an interesting price setup. After a dramatic price decline in May and June of 2018, the price decline abruptly halted near $52.00. In fact, this downside move ended almost as if prices “legged down” to the last known true support level. Historically, looking all the way back to the lows of 2012, this downside move represents just a little over a 38.2% retracement from the highs and coincides almost perfectly with a 50% retracement from the lows in 2017. These two numbers interest us because they show us that $53.50~55.00 is very likely a strong support level that is currently being tested.

Simple Fibonacci expansion analysis tells us any upside potential could target $61.35 (+12.65%), 69.95 (+28.44%) & 76.20 (+39.99%). These levels don’t take into consideration the potential for new breakout highs above $82.50. If this were to happen, we could see a +50% or more price upside happen.

Before we get too far ahead of ourselves, what would cause the Solar sector to begin a price advance at this stage in the economy? Renewed interest in the new technology of new infrastructure/government contracts? Replacing older technology with newer, higher performance, technology? Renewed interest from personal and corporate clients? What could cause this move?

You may remember that we’ve been suggesting that capital, cash, is always attempting to find solid sources of growth and opportunity while avoiding risk and depreciation. We’ve been suggesting that the spare cash on the planet has been rushing into the US stock markets by the boatload to take advantage of the strong dollar and the strong US stock market values. Could it be time for that capital to shift away from the FANGs and other leaders and move back into opportunistic equities that are somewhat off the radar?

Earnings for these companies for Q3 are set to be announced near October 28, 2018. With FSLR, the Q3 earnings have typically been fairly strong. One could attempt to assume Q3 2018 sales value may surprise the markets again and this could be a good time to consider the Solar Sector as an opportunity.

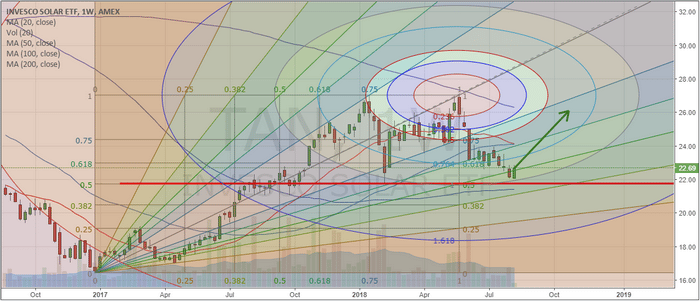

Our next chart is a Weekly ETF chart of INVESCO SOLAR (TAN). This chart presents a similar picture as the previous chart – a relatively strong pullback from April~June of 2018. The price pullback ends near a 50% Fibonacci retracement level and coincides quite nicely with our Tesla Vibrational Price Arc. We’ve drawn an arrow on the chart that suggests where we believe prices could be headed as long at this $21.75 support level holds.

Again, it does not take a genius to understand that any price advance from the $22.70 level to above $26.00 (or higher) would represent an almost +15% move. Any move above $28.00 from current levels would represent a +23.34% move. There is room for profits if our analysis is correct.

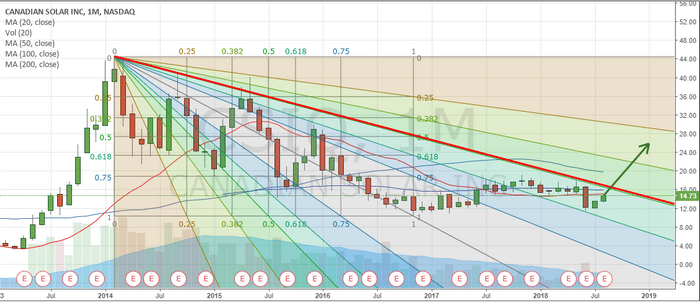

Lastly, we want to highlight what might be the most interesting setup in the Solar sector so far – Canadian Solar Inc (CSIQ). This Monthly chart attempt to show our readers exactly what has been transpiring in the Solar Sector for the past 5+ years. After peaking in early 2014, Solar technology lost its sparkle with investors. Slowly, over time, prices waned and dropped while attempting to find support. Technically, we view that support as the lows established in 2016 (prior to and near the US Presidential elections).

After that point it time, it is pretty clear to see that some renewed interest in the Solar Sector began to take place. Slowly, price advanced from the low as volume stayed somewhat muted. New rotational highs were established while the most recent low is still testing the 2016 lows. This tells us that the price trend, at least until we see a new breakdown low, is attempting to move higher.

CSIQ is currently trading near $14.75 and has upside potential above $21.00 on a breakout move. We are not saying this is definitely going to happen, but we do believe the Solar sector is setting up for an upside move and we do believe the potential for a new rotational high price to be established is quite strong. This means, finding the proper entry point and understanding the downside risk of these trades is critical.

Once CSIQ breaks our Red downward price sloping line, we would assume the price channel has been broken and we would expect the price to begin to rise dramatically.

As a member of our subscription services, you will be alerted to these, and other triggers, as our research team identifies them for the best chances at future success. Please take a minute to visit www.TheTechnicalTraders.com to learn how we can help you find new opportunities in the markets and stay ahead of these trends. Our most recent trade in UDOW returned 12.6% for our members last week. Please take a few minutes to understand how a small, dedicated, team of researchers with 53+ years of experience can make a difference in your future.

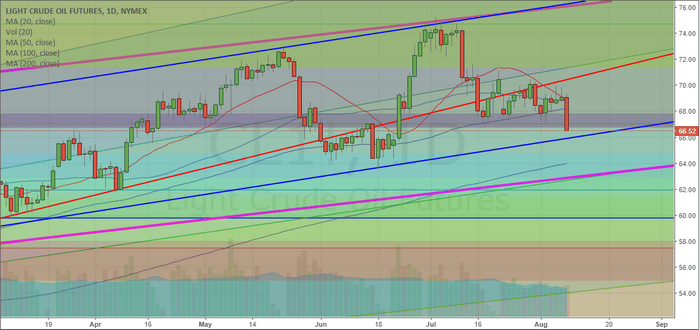

If you have been following our analysis and research of the Crude Oil trend and the energy sector, you know we’ve been suggesting Crude would attempt a move lower and attempt to retest the $58~63 level. It appears the breakdown in prices has begun.

Our research team, at www.TheTechnicalTraders.com, uses an array of proprietary technology, price modeling tools and price cycle modeling tools to attempt to keep our followers up to date with trend reversals, trend expansions and more. This recent downside price move is something we have been expecting for the last 20+ days. The breakdown of support in the Crude oil market, as well as the oversupply of oil on the planet, is setting up for a downside move that could be extraordinary.

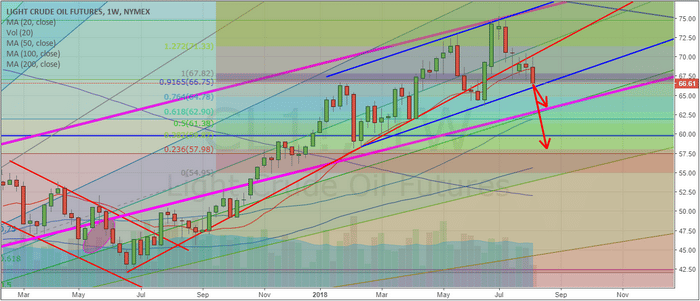

This Daily Crude Oil chart shows some of our trend following work where we attempt to identify break ranges, channels, Fibonacci levels and other advanced technical analysis studies. The daily chart only shows a shorter time span and is perfect for attempting to identify immediate support or resistance levels for the price. One can see from this chart that the current breakdown in price is attempting to breach a number of key Fibonacci levels. Should the $66.50 level be broken, we would expect Crude prices to fall to near $64.75 or $62.90. These are the next support levels below the current Fibonacci levels.

The Blue and Magenta levels on this chart are price channels that will become more evident on the next chart – the Weekly chart.

This Weekly Crude Oil chart provides a better, longer-term, perspective of the Oil market. We can see from this chart the Magenta price channel originates from 2016 price rotation. The Blue price channel originates from early 2018 price rotation. The lower, Red, support level originates from the low in June 2017. All of these play an important role in understanding how the price is breaking free of these price channels and may attempt to move dramatically lower.

We’ve already broken the Red support levels, are attempting to breach the Blue price channels and that only leaves the Magenta price channels as final support. Breaking all three of these levels would put Crude prices below $63.00 ppb and we believe that type of move could draw prices to below $60 ppb.

Pay close attention to the size of the most recent Weekly candles – they are much bigger in range than the late 2017 candle ranges. This indicates that volatility in the Crude Oil market is extended and any breakout/breakdown trend could be very aggressive in nature.

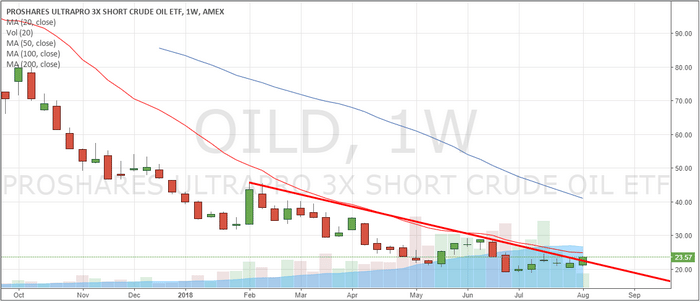

The last chart we have for you today is the OILD 3x Short Oil ETF. It is pretty easy to see that any downside price break in oil, with any longer-term capitulation, would likely drive the OILD prices from about $23.50 to possibly well above $27~32. This type of move could present an opportunity for a 20~40% ROI on a small position if Crude Oil breaks further to the downside. Any opportunity to buy OILD below $22.50 should be considered a strong potential setup as we believe Crude Oil will move to between $60~63 ppb before attempting to find any real support.

Follow our analysis and read all of our past research posts by visiting www.TheTechnicalTraders.com. Learn how we can help you stay ahead of these moves and find new opportunities in the markets. 53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

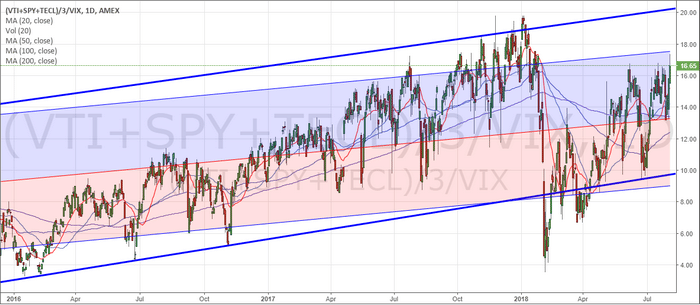

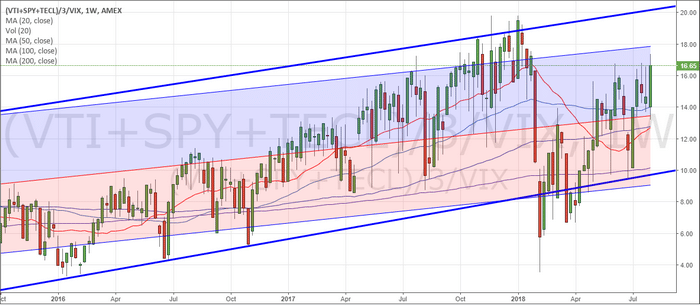

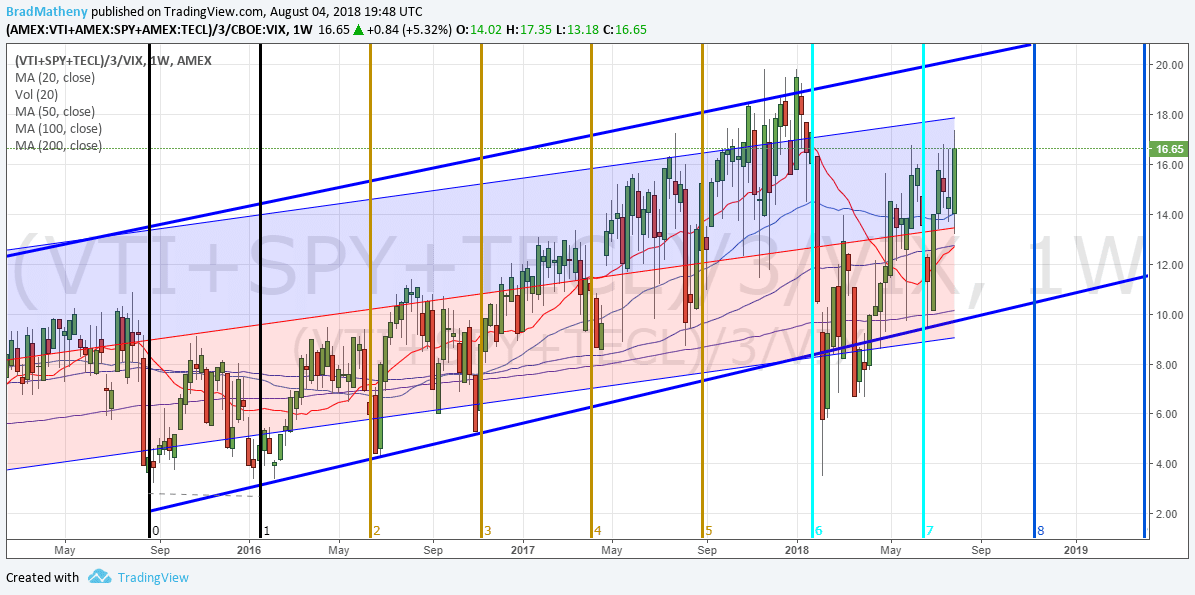

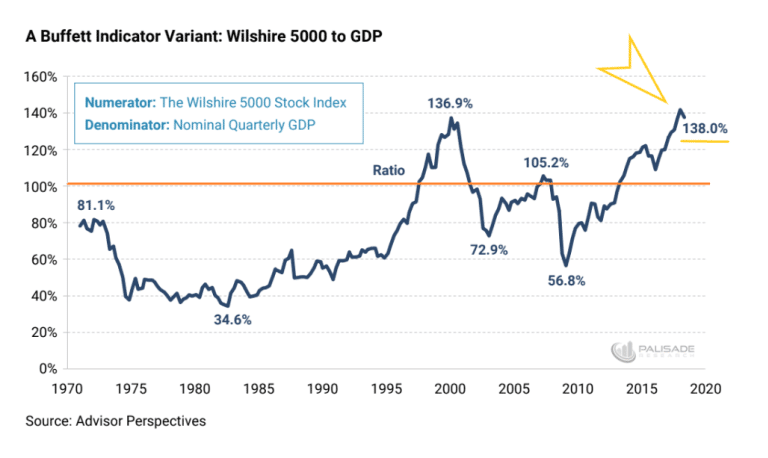

Now, we are ready to share some new research that will help all of us understand the current and future market conditions given the ratios of the capital markets to GDP as represented in our previous article Part I. The research team at www.TheTechnicalTraders.com believe we have identified a means of structurally understanding the US capital markets in relation to risks or reversal and crisis contagion. As the Buffet Indicator is now warning that the US capital market may be nearing a critical price top, we can now attempt to put this data into perspective in relation to capital flows and capabilities. Yes, in terms of historical price appreciation, we are now at or near levels that have historically been associated market tops and price collapses. Let’s look at how the Buffet Indicator has reacted at times using our new Custom Market Cap Volatility Index.

This Daily Custom Market Cap Volatility Index shows data from 2016 until now. It clearly shows the deeper price rotation near the elections in 2016 and the deep price rotation in February 2018. Let’s compare these levels to the Buffet Indicator reactions. In 2016, the Buffet Indicator fell nearly 15% as the US stock market indexes fell 13.5%. In February 2018, the Buffet Indicator fell nearly 8.5% as the US stock market fell 11.88%. Our Custom Market Cap Volatility index operates as a range of price rotation that assists us in determining if and when the price is outside normal price ranges. We are attempting to map price appreciation in relation to volatility in a historical form. When price retraces or contracts, volatility spikes higher. With this process of volatility increasing and price decreasing, the increased VIX levels will show up as very deep Custom Market Cap Volatility price corrections. The VIX will increase much faster than price will collapse, thus any price collapse will likely stay within these ranges, or fall outside these ranges if the price collapse is more extended.

Extended price collapses will result in much higher VIX levels while prices continue to decrease. If the price collapse is very aggressive, the increase in VIX will shoot higher and our Custom Market Cap Volatility Index will crash to very low levels. If the price collapse is an orderly price decline, then the VIX levels will increase as price decreases more gradually and the Custom Market Cap Index will likely stay within moderate ranges. At least we hope this works as we are suggesting. Let’s take a look a longer-term data.

This Weekly Custom Market Cap Volatility Index shows the same date range as the previous Daily chart. We should be able to see the Blue channel levels that originate much earlier as normal price channel ranges. We have added a Std. Deviation channel to this chart originating from the 2010 lows that show the range as associated by the deviation ranges.

This data tells us that US stock market prices have recently rallied from near the middle of these historical channels and still has quite a bit of room to the upside. This would indicate to us that the US stock market is not overly priced and that capital is still working into the US stock market in ways that support further price appreciation. Once price reaches above the Std. Deviation channel and above our Blue price channel levels, then we would start to become concerned that prices may retrace as they did in February 2018.

Take a look at the rally from 2016 until now. Notice how the lows near 2016 represented a relatively depressed price channel range with our Custom Market Cap Volatility Index. In other words, prices were hovering near the lower channels with no real signs of risk as prices did not collapse below these levels. One correlation we can make with the Buffet Indicator that may become evident in our Custom Market Cap Volatility Index is that as US Bond rates increase, capital is usually moving away from the stock market and into Treasuries. When we consider the past actions of the US Fed and the correlations of the Buffet Indicator to these central bank actions – we might find a direct correlation.

Yet we believe our Custom Market Cap Volatility Index is valuable for a number of reasons; first, we can use this index as a measure of price rotation and standard deviation low price identification. This will allow us to determine when prices are poised to form a bottom setup and when an opportunity exists for upside price acceleration. Second, we can identify when prices are nearing the upper channel as an early warning that prices may be attempting to hammer out a longer-term top formation – allowing us to reduce risk and scale back our positions. Lastly, we can look for cycles that may help us determine key dates for price rotation.

This cycle chart highlights the deeper low price rotations in our Custom Market Cap Volatility Index. These low points are when the US stock market has seen increases in volatility and moderately deep or deep price corrections. Notice how the early 2018 price collapse is clearly shown as a very deep price rotation in our Custom Market Cap Volatility Index. Notice how the 2016 and 2017 deeper price rotation on the Custom Market Cap Volatility Index correlate with price rotation in the US major indexes. Also, pay attention to the price appreciation that took place after these deeper price corrections.

These cycles suggest that the US stock market should continue to push higher for at least the next 90+ days till near November 2018. Near this date, there is a relatively strong likelihood that some type of deeper price correction will hit the US markets – possibly a bit sooner or after this date. The cycle frequency and accuracy of these bottoms suggest that the price of the US stock market will likely push higher over the next 30+ days – then possibly stall while attempting to form a potential top. It is likely that this top formation or horizontal price range will become extended consolidation before any deeper price correction begins. In the meantime, we believe the US stock market will continue to push higher as our Custom Market Cap Volatility Index shows.

Our suggestion at this point is that the Buffet Indicator is failing to correlate the global capital pool that exists currently and is also failing to adequately reflect the capital migration that is currently taking place throughout the globe. We believe the US stock market could continue much higher at this point, depending on how the global markets react to this shift in capital and the longer term debt issues that are playing out. We certainly don’t want to mislead anyone – so we are alerting you that November or December of 2018 appears to be a time where prices may rotate a bit more violently to the downside. This may be correlated to some type of global crisis event or it could be an extended capital shift away from the US stock market where capital flees to new opportunities in other global markets. All we know right now is that the US stock market is still on a path to move higher and we still have quite a bit of room for market cap growth over the next 3+ months.

If you want to know how our other proprietary price modeling systems and indicators help us keep our valued members and subscribers informed of future market moves, then visit www.TheTechnicalTraders.com to learn how we can help you find and execute better trading decisions with our specialized research, daily video updates, detailed trading signals and more. Don’t let the other news fool you with generic content and comments – true researchers pull from resources or create new resources to give them a much clearer understanding of the market dynamics ahead. Get ready for further upside prices and watch for an end of year price rotation that could be dramatic.

53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Our research team at Technical Traders Ltd. have been laboring over the recent market moves attempting to identify if and when the market may be likely to turn lower or contract. We’ve been pouring over all types of various data from numerous sources and have concluded the following is the most likely outcome for when the US stock markets may find a reason to pause of contract. As you read this research post, please allow us a brief introduction of the facts that supported our research.

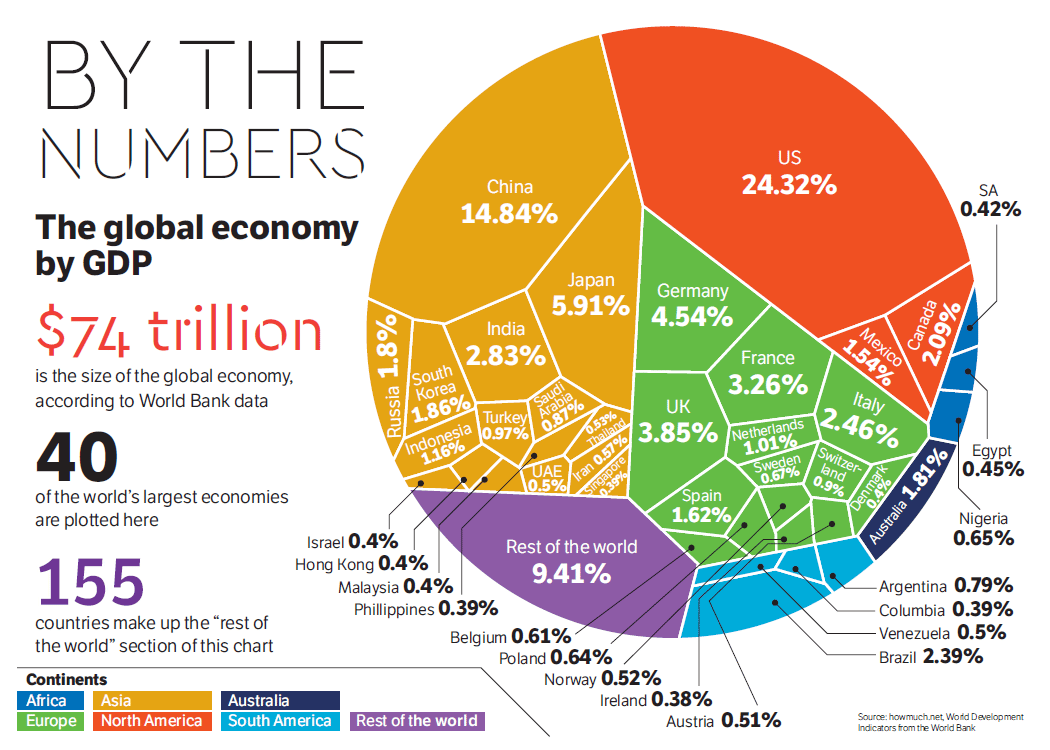

First, our research team started this investigative work after watching the Buffet Indicator climb from the 2015~16 rotation levels to new highs and achieve some recent news events. This indicator, being one of Warren Buffet’s favorite tools for understanding market valuations in comparison to debt levels provides some interesting components for our team to study. Yet, we believed this indicator chart lacked something relating to the global markets and the use of the debt capital to spur future global economic activity.

Therefore, our team went off in search of something that could help us rationalize these high Buffet Indicator levels in true relation to the global markets and in relation to the capital shift that we believe is currently taking place throughout the planet. The first component of our assumption about the global markets is that capital is rushing away from riskier markets and towards more stable markets. The second component of our assumption is that national debt obligations are being re-evaluated based on perceived risks and contagion issues throughout the globe. The last component of our assumption is that the new US President is shaking up quite a bit of the old constructs throughout the globe and that the processes and policies put in place by President Trump are creating a very dynamic global capital market environment at the moment.

When you consider these three components and their combined results on the global capital markets, we have to understand that there is a very strong possibility that the largest GDP producing countries on the planet, and their banking, institutional and investor classes, are all operating within some aspect of these three components. This means there is a potential for at least $7 to $15 Trillion (10~20% of total global GDP) US Dollars that are actively sourcing and seeking secure returns while avoiding risks and debt contagion. This is a massive capital shift that is taking place currently – likely the largest the planet has ever seen.

As the Buffet Indicator is showing, the US stock market is nearing or passing all-time highs in valuation in relation to US debt levels. Yet, how does the Buffet Indicator correlate the global capital shift that is taking place and equate these dynamics into fair value. The US market, being the likely target of this massive capital shift, is a fair source for valuations comparisons, but we are experiencing a capital shift that has never before been seen at the levels we are currently experiencing. Sure, there have been shifts of capital before – but not at the $10 to 20 trillion USD level.

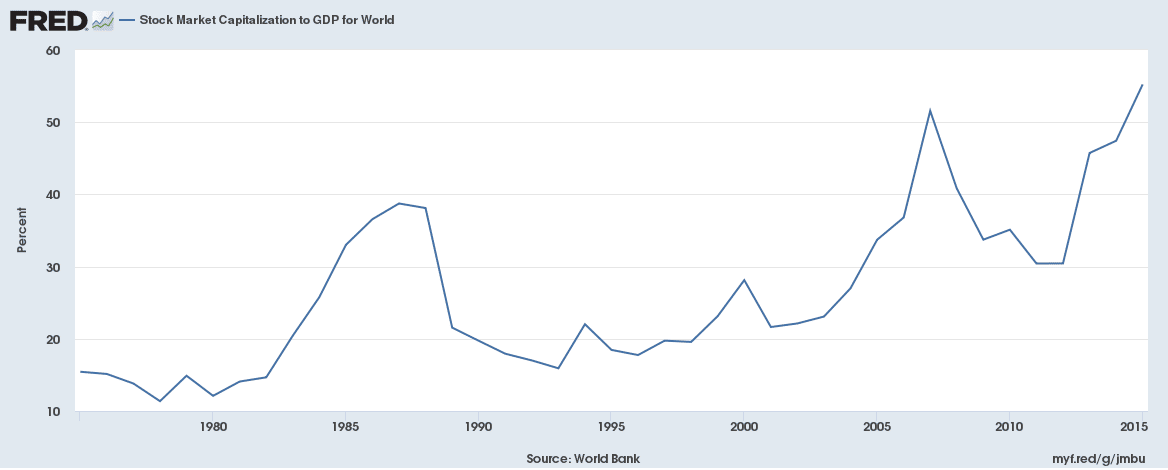

If we compare the Buffet Indicator to this Fred Global Stock Market Capitalization to GDP chart, some interesting facts begin to take shape. First, the peaks in 1974, 1999, 2008 and 2018 on the Buffet Indicator are not as evident on this chart. The 1974 peak is relatively nonexistent. The 1999 peak is a much more muted (28%) peak than on the Buffet Indicator chart and the 2008 and 2018 peaks are relatively correlated to the Buffet Indicator chart. One should be asking the question, “why are the two most recent peaks more correlated than previous peaks on this global capitalization to GDP chart?”. Our answer to that question is that after the 1999~2000 US market peak, the globe entered into a much more cooperative economic phase with the EU, China, South America and many other nations operating as global peers vs. global competitors. It was after this time that the capital markets began to “sync” in some form to the central banks policies and the unification processes that were taking place throughout the globe.

We should, therefore, assume that any global market contagion or crisis will likely take place in some measured form throughout nearly all global markets when it happens. Additionally, as regional debt or capital market crisis events occur in certain nations, capital that was deployed in these nations or capital markets will likely rush to new, safer environments for periods of time. Capital is always hunting for the safest and most secure returns while attempting to avoid risk and devaluation.

The central bank policies of the past two decades have allowed a massive increase in the available capital throughout the globe. Global GDP has risen from $33.57 Trillion in 2000 to $80.68 Trillion today – a whopping 140% increase in only 18 years. Historically, global GDP has risen by approximately these levels every 15~20 year for the past 50+ years. This is likely the result of the US moving away from the Gold standard and foreign nations following along with fiat currency central banks since after the 1960s~70s.

This tells us that the peak in 2000 on this global capital market to GDP chart resulted in a moderately isolated capital market peak that was uniquely available within the US and major economies – not globally. The 2008 peak represented a more globally equal capital market peak. This means the majority of the global capital market experienced capital appreciation. The same thing is happening right now – the global markets are experiencing an overall capital market appreciation that is a result of the past 20+ years of central bank policies and economic recovery efforts.

Stay Tuned for PART II Next with Charts and Trading Analysis!

53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

The US Federal Reserve is one of the only central banks to attempt to raise rates consistently over the past few years, has possibly learned a very valuable lesson – no good comes from raising rates to the point of causing another market collapse. The news that the US Fed will leave interest rates where they are, temporarily, is good news for a number of reasons.

First, this allows the markets to shake out weaker players and weaker components of the corporate world. Where corporate debt levels are concerned, interest rates are tied to debt repayment liabilities and refinancing costs. Firms that are unable to manage at current interest rates certainly would not be happy about rising rates. This allows these corporations to either struggle to resolve their debt issues or collapse under the weight of their own debt. This will also play out in the foreign markets as well.

Second, it allows the housing market and private debt markets to shake out some of the “at risk” consumers. We authored an article a few months ago about how foreclosures and pre-foreclosures were starting to increase in nearly all markets. At the time, many people in the real estate field shrugged off these increases as par for the course. With the decreasing foreign investment in real estate and the increasing pressures on the local consumer markets, we saw a dramatic slowdown in housing starts and sales activities recently. This is because the demand side of the market is falling much faster than the supply capacity.

The uncertainty in the foreign markets, global central banks, and foreign investments have prompted many people to pull out of the local markets – even the hot markets. The at-risk consumers that were trying to sell near this top suddenly found the buyers were just not there or ready to make the commitment. This put the at-risk consumers in a difficult position as they could not flip their houses as easily as they could 6 months ago.

Yet, in the global equity markets, investors can sell or buy with much faster transaction times – at the click of a mouse button in most cases. This allows equity investors to pull capital away from risky investments and migrate that capital into more secure investments in a matter of minutes or hours – not weeks or months. And that is exactly what has been happening over the past 30+ days in the global markets.

Capital is repositioning for the next phase of this market; where the US economy is strong, housing continues to weaken and at-risk consumers continue to feel the pressures of the US Fed interest rate policies. Where foreign consumers attempt to deal with their own version of “central bank hell” and asset devaluations in an attempt to find more secure investment vehicles for their capital. Money market funds, investment funds and, of course, the US value/blue-chip equities are looking very promising right about now.

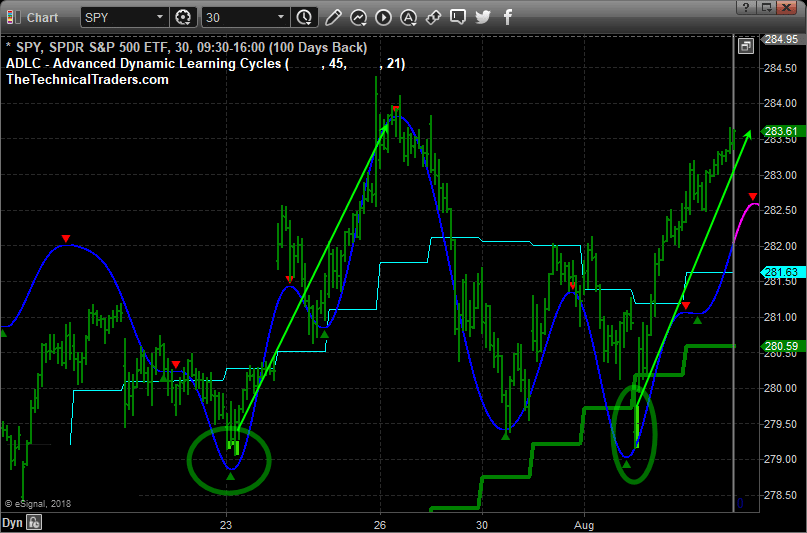

This Daily SPY chart shows our recent ADLC indicator (price cycle turning points) and our oversold extreme price levels shaded with lime green. When these two things align the market tends to rally for 1-3 days with strong momentum. During pre-market last week, we told our followers that the big gap lower in price was going to be bought and price should rally for 2-3 days, which is exactly what has unfolded thus far.

Global capital will continue to rush into the US markets as long as the US Fed does not do anything to derail things. Our research team believes the US Fed may even decrease the interest rates by 0.25% before the end of the year depending on how much pressure is placed on the economy by these “at risk” participants.

We will continue to keep you updated as to our findings and we want to urge you to visit www.TheTechnicalTraders.com/FreeMarketResearch to read all of our most recent research posts. You really owe it to yourself to understand what is happening in the global markets right now and how we have continued to stay 30~60 days ahead of these moves for our valued members. There are so many opportunities setting up in the markets for traders it is almost hard to understand the dynamics at play right now. If you want a dedicated team of researchers and traders to help you navigate these markets, then visit www.TheTechnicalTraders.com to learn how we can provide you with even more detailed daily research and support.

Chris Vermeulen

Now is the time for traders to really pay attention to the rotation in the US Stock market as well as the continued price rotation in certain sectors. As we have been warning for the past few months, this really is a stock pickers market. Take a minute to review our past articles highlighting these sector moves and the general market sentiment over the past few weeks: June 24: Could A Big Move In The Global Markets Be Setting Up? & Q2 GDP vs. Technology Concerns vs. Foreign Markets. As traders, we need to understand how capital migrates towards opportunities and safety and how it migrates away from risks and price collapses.

Over the past months, our research team at Technical Trades Ltd. has been pouring over the charts to identify these moves and to keep our subscribers ahead of these trends. The US Dollar and the recent Q2 earnings season reporting have acted like pouring fuel onto a burning fire. BOOM. We highlighted the potential for increased volatility and price rotation weeks ago and we continue to try to identify the best opportunities for our subscribers.

Today, our research has really paid off with moves in sectors that we’ve highlighted and been trading for weeks. Our proprietary price modeling systems have shown us what to expect in the markets going forward many weeks and months. We’ve been calling for the NQ to hover near 7400 while we’ve been expecting the DOW and S&P to continue to rally higher. We’ve been sharing our research that we believe the Transports, Russell and many of the Blue Chips will perform much better than the hot technology sector and other sectors and its starting to happen now.

Capital appears to be migrating out of technology on weakness and expected continued pricing pressures and that capital will be attempting to find new sources of security and growth. Earnings numbers have been generally strong, therefore, we expect this capital to migrate into stronger, dividend producing and transportation based equities. With the 4.1% GDP number, the expectations going into the end of this year should be that the economy may stay hot and these sectors could continue to rally.

This Weekly IWM Chart shows dual Fibonacci extension levels that coincide near $184. These levels show us that the upside potential for this move in the Russell 2000 ETF, which is really only an 8~10% price rally) could accelerate upward throughout the end of this year as the US economy continues to push harder and the migration of capital continues to roll out of the hot technology sector and into more traditional sectors.

We’ve highlighted the projected price point where this targeted level seems to be a key element of our analysis. This level also coincides with key Fibonacci price projection points. It makes sense to us that as capital moves out of technology and other risky sectors, this capital will be seeking a safe and secure investment in stocks that have the opportunity to perform well throughout the end of the year with a strong US economy. Retail, Transportation, the Russell 2000 and more traditional Blue-Chip equities seem to be the renewed targets for this capital.

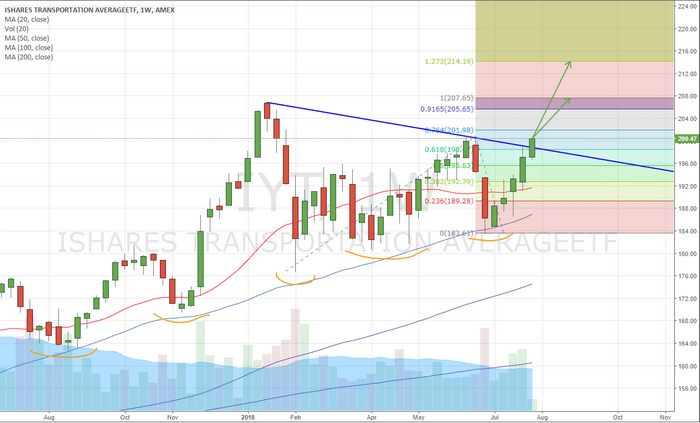

This Weekly chart of the IYT (Transportation ETF) highlights the continued higher low price rotation patterns that have driven continued rallies in price. The last three low price rotations were key to setting up a new Pennant Formation Breakout that has just started. This breakout pattern is key to understanding the upside potential for the Transportation Index. These upside targets are 3.6% & 6.8% higher than current prices. This represents a very solid opportunity for traders over the next 4+ months as we head into the Christmas and Thanks Giving holidays – the Santa Rally.

What was hot over the past 4+ months, may start to flatten out and rotate lower over the next few months as capital migrates into newer opportunities headed into the end of 2018 with a strong US economy. Our opinion is that technology will become a weakening market sector for at least the next 30~60 days as revisions to earning and expectations, as well as continued issues from China and globally, drive a capital re-balancing process across the globe. This migration of capital will move into new, more traditional, equities as a source of security and growth. Capital always attempts to find the best environment for security, growth and limited risks.

For example, we just locked in a 12% profit on the financial sector using FAS, and we feel it is still headed higher, all this happened while technology stocks sold off.

If you want to see what our proprietary modeling tools are saying about the markets and what to expect in the near term future, then visit www.TheTechnicalTraders.com to learn how we can help you find and execute better trades while staying ahead of these market trends and cycles. Our proprietary price modeling tools are second to none and have proven to be extremely accurate over the past 6+ months. Don’t miss the next big moves in the markets. Learn how we can help you find and execute better trades with our specialized research, daily videos, proprietary modeling systems and more. Watch how these markets rotate over the next few weeks to see how accurate our analysis really is.

Chris Vermeulen

www.TheTechnicalTraders.com

This past week has been very interesting in the US markets for a couple of reasons. It is time we took a hard look at what to expect going forward and how this news will likely drive future market moves.

First, the Q2 GDP number came in as a huge boost to the US economy and for the future expectations of economic growth in the US. 4.1% GDP for Q2 is massive compared to the previous administrations GDP levels. Granted, these levels may not be sustainable in the long term above 4%, but we can only assume levels above 3% are going to last for a while unless something dramatic changes the economic footing within America.

Secondly, Facebook and Twitter both missed on earnings and growth numbers. These two stocks got crushed in the process. One thing to consider is that Facebook is within a transitional phase with the Federal government and the SEC investigating the company for illegal activity and for illegally allowing external firms to data-mine the user base. These issues have likely resulted in a decrease in the total user base for Facebook and in a general dissatisfaction for existing users. A certain group of people will simply stop using Facebook because they don’t agree with or condone these activities and don’t want to be a part of these issues.

Twitter, on the other hand, has had a rough go of it for years. With a failure to properly monetize the company and users on top of recent concerns that “shadow banning” and “political bias” has infiltrated the SOP (standard operating procedures) of the company’s leadership, it appears Twitter is not being targeted as a “biased social platform” that could result in further headwinds for success.

The end result is that these two stocks don’t make up the entire stock market – they are just relatively large components of a much bigger market of stocks.

As we have been stating for months, the capital migration from foreign sources into the US markets have been a major driving force over the past 24 months. This capital is searching for safe and equitable growth opportunities. We are certain that a large portion of this capital found a home in Facebook and Twitter – as well as other stocks. These investors may be shocked by the recent collapse of FB and TWTR, but we are relatively certain that these investors will likely continue to hold their positions for one reason – the expectations that the US economy is strong and the recovery of these two stocks will likely take place over the next 6 to 12+ months without much issue.

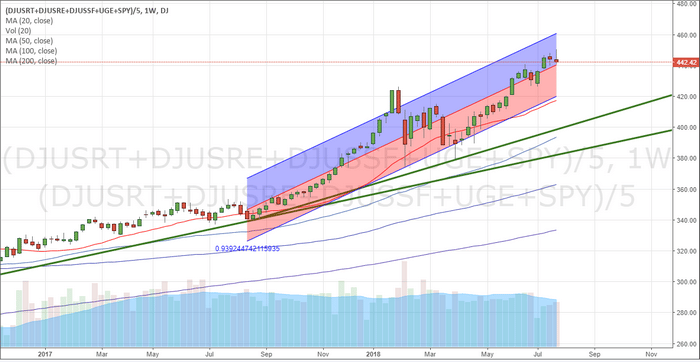

When we take a look at the longer term charts, we can see a fairly clear picture of the recent price rotation (January 2018) and the most recent upswing in prices. This, our Custom US Index Weekly chart, shows exactly what we see in terms of trend and expectations. The Std. Deviation channel is key to understanding future price rotation, if it happens. As long as the lower Std. Dev channel is nor breached, price should find support and rotate higher as expectations continue to drive prices higher and as foreign capital continues to rush into the US markets.

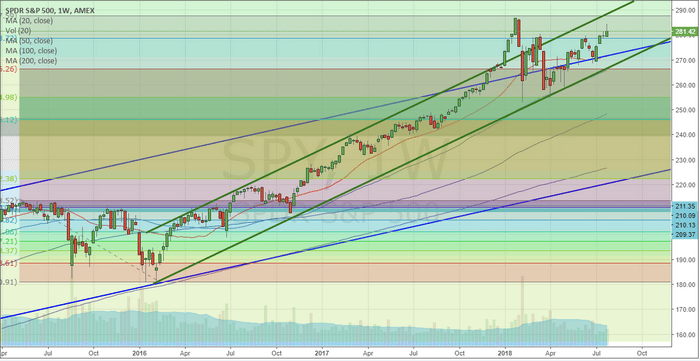

This Weekly SPY chart shows a similar price channel setting up from 2016. Actually, there are two price channels at play. The Blue levels originate from the lows in 2009 and track price trends all the way through 2015~2016. The upper Blue channel is currently creating support for prices moving forward. The Green channels are more recent and originate from 2016. Ideally, as long as price stays above the lower Green price channel, the trend is Bullish and we should expect mild price rotation.

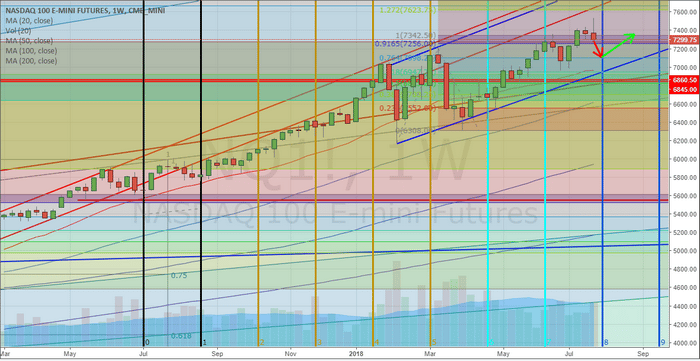

Lastly, this NQ Weekly chart shows a bit more detail including our Time/Price cycles that indicate we should see some moderate price rotation over the next few weeks. We don’t expect this rotation to be deep or excessively volatile, but we do expect some type of narrow price rotation to occur. You can see from the arrows we’ve drawn on the chart that we expect prices to hover below or near 7400 for the next 3~5+ weeks – as we’ve been warning about for the past 30+ days. The NQ will likely become range bound below 7400 for the next few months – possibly throughout the end of 2018.

The price channels shown on this chart, in Blue, are still critical to the longer term trends. Once these channels are broken to the downside, then we would be more concerned of further and deeper downside price pressures. As of right now, nothing is showing us any real concern and the Q2 GDP numbers will act as a booster rocket for the US economy unless something derails over the next 3~6 months.

The short sellers that have been setting up for a massive and deep price correction may see a bit of profits in some stocks that rotate lower, like FB and TWTR, but our analysis is showing these traders are taking a risky position getting setup for a deeper and broader market rotation downward. At this point, with incredible GDP growth, strong earnings, a strong US economy and foreign capital rushing into the US market/stocks – we just don’t see the downside potential that others seem to see.

For months we have been posting our analysis stating the markets would push higher from the February lows. We have stood by our analysis and weathered some criticism over the past few months. Still, the markets continue to push higher and the news just seems to support our predictive modeling systems analysis. Currently, a unique sector rotation is taking place that traders need to be aware of. This will likely not become a broad market rally where everything goes up for weeks of months. This will likely become a select sector rally in the markets based on expectations and opportunities. Last week to locked in 12% profit on the financial sector using FAS, and we feel its still headed higher!

If you want to learn more about our analysis and our opinions regarding what will move and when, then visit www.TheTechnicalTraders.com to learn how we can help you find greater profits in these markets. Our predictive modeling systems have been calling these markets almost perfectly for the past 8+ months. Isn’t it time you invested in your future success and take advantage of the features and benefits we can offer to you?

Become A Technical Trader Today and Profit! – CLICK HERE

Our research team has been watching the foreign currency markets with great interest. Recently, the strength of the US Dollar has put extended pressures on many foreign currencies. The recent crash of the Chinese Yuan has alerted many traders to the concerns that China could be edging over the precipice in terms of debt and credit market collapse.

As traders/investors, we need to understand how these currencies move, and future moves may drive the global equity markets to new highs or lows. Let’s take a brief look at how some of our proprietary indicators are set up on these Weekly charts.

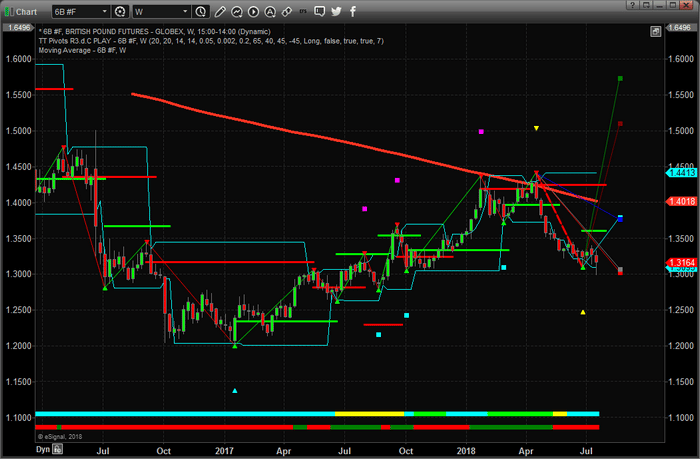

Weekly British Pound chart

This Weekly British Pound chart showing our proprietary Fibonacci Price Modeling system presents a very clear picture that the current trend is Bearish and that price is contracting. The Weekly Fibonacci price modeling system functions as an adaptive price modeling system – allowing the price rotations (peaks and valleys – highlighted by the yellow, cyan, magenta and white markers on the chart) to develop into a concise and efficient current model of price expectations and projections. The multiple price projection levels (the six projected lines to the right of the current price bar) show us where price may attempt to target should a breakout move happen.

Notice that the current British Pound price has reached and stalled near the 1.3100 level – which is exactly where two of our Fibonacci price modeling system has predicted with the Red and Grey projection levels? Also, notice how the Blue and Cyan projected levels are aligning near 1.3775? This would be a proper expected price level should price find some support near the 1.3000 level and attempt a short recovery.

As get further into these charts, please understand the key elements of these charts and what they are attempting to illustrate to all of us. With each pivot high or low, this price modeling system identifies a “trigger price level” that is used to confirm a trend reversal (if it happens) as well as to identify key future support/resistance. These are drawn as Green and Red horizontal lines. You’ll notice a Green trigger price level near the current price bar – this is the “upside price trigger level” that would have to be breached if we were to see any further upside price advance. As long as price stays below this level, we should continue to expect a downside price move with a strong potential for new lows.

Summarizing this charts analysis, the current trend is Bearish. The current bullish trigger level is near 1.3600. Price is trending lower from a previous Bearish price trigger level near 1.4240. Price has reached the two (Red & Grey) projected price levels which means we should expect some price consolidation near these levels before establishing a new price trend (extending lower or rotating higher). Recent, new price bar lows show a very strong potential for further downside price activity. At this point, we see that support from a previous bottom, near 1.3060, will likely cause the price to stall near this level. We believe the price will continue to fall below the 1.3000 eventually as the strength of the US Dollar continues to push higher and the Brexit issues continue. The British Pound could fall well below 1.2500 before finding real support. Wait for this consolidation period to end and watch for lower prices to continue.

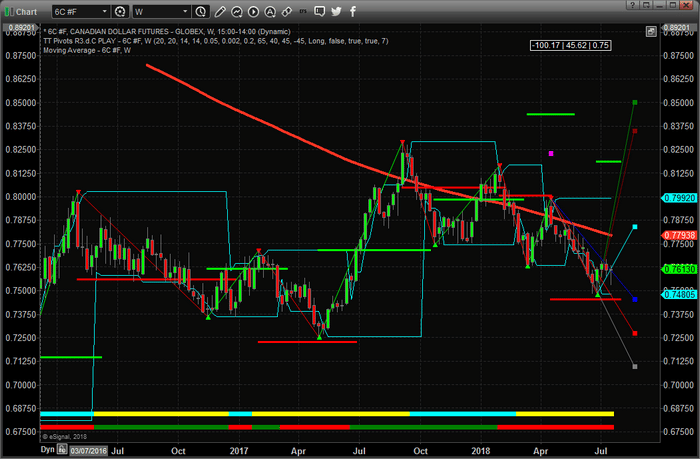

Weekly Canadian Dollar chart

This Weekly Canadian Dollar chart below shows a very interesting setup with our proprietary price modeling system. Notice the wide range between the trigger price levels (Green and Red) near the right edge of this chart? This extended range of the trigger price levels happens when the adaptive price modeling system finds price trend rotation. Previously, on this chart, we can see the trigger price levels were closer to price and within rotational ranges – the most recent breached trigger level being a Red (Bearish) trigger – indicating the start of a new bearish trend near February 5, 2018.

At this point, should price fall below 0.7450, we should expect price to continue to drop towards 0.7250. Upside resistance should be near the Cyan projected price level – near 0.7850. Unless the Canadian Dollar finds support near 0.7500 and rotates higher to breach 0.81875 – this is nothing but extended price rotation. Typically, as price sets up an extended Top or Bottom, the trigger price levels will eventually tighten to establish a breakout trend setup. Right now, the extended ranges of these trigger levels is showing us that volatility and price rotation should be expected and the downward sloping Moving Average level will likely operate as a key resistance zone. The YELLOW markers at the bottom of the chart show us that price range is expanding and volatility is increasing. We could see some bigger swings in the Canadian Dollar over the next few weeks and months – but the trend is still bearish.

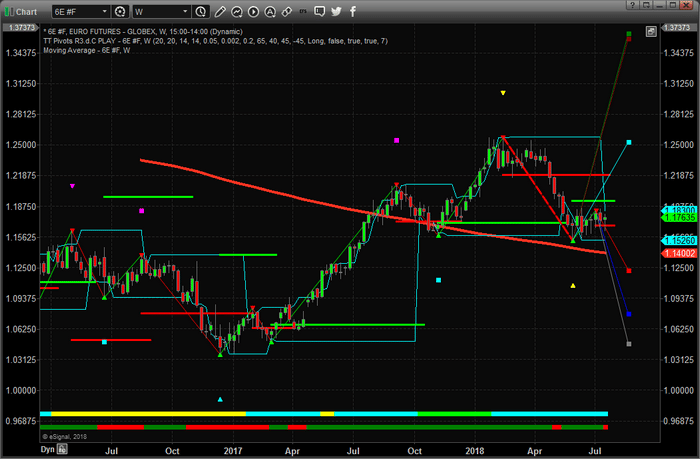

Weekly Euro chart

This Weekly Euro chart shows a more traditional price rotation setup with our Fibonacci price modeling system. Notice how the trigger price levels are very narrow and close to the current price. You’ll also notice the Cyan price trend indicator, near the bottom of the chart, that is indicating that price range is contracting. The two price trigger levels (Red and Green) provide very clear breakout trigger levels (bullish near 1.1913 & bearish near 1.1687). The most recent trigger level to be breached was the Bearish level near 1.2200. A recent low price rotation has established a new low price pivot that is projecting much higher price projection points. Additionally, a more recent high price rotation has established new lower price projection points.

This sideways price rotation will be broken and a new trend will be established in time. At this point, we know the 1.1913 level is the bullish trend trigger point and the 1.1687 level is the bearish trend trigger point. Price trend is still bearish and any lower price breakdown below 1.1576 would be a strong indication that price is breaking below current support and should attempt to move to near 1.1000. To summarize, the Euro appears to be under extended pressure and any price breakdown could be a great short for traders.

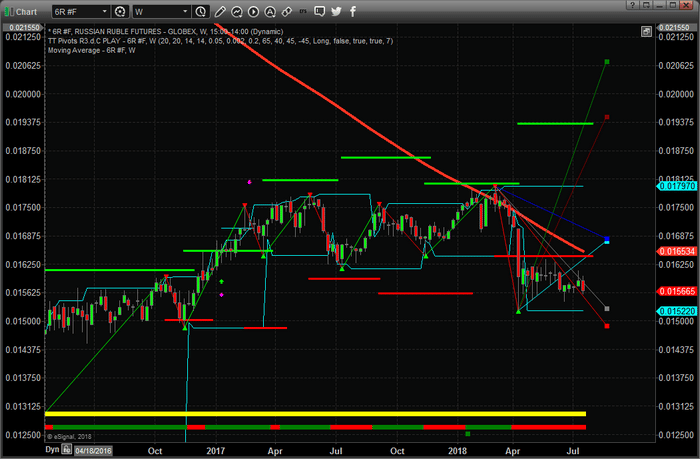

Russian Ruble Weekly chart

Lastly, this Russian Ruble Weekly chart shows, again, price rotation and volatility. Notice how the bullish trigger price levels have been expanding throughout this sideways price rotation for the past year or longer?

As we stated early, the adapting modeling component of our proprietary Fibonacci price modeling system identified this rotation as “extended price congestion” and attempts to identify broader market breakout levels as a means to confirm a true change in price trend. The most recent bearish trigger price level was breached on April 9, 2018. Price is trending lower/bearish and the price trend indicator near the bottom is showing yellow – price volatility is expanding. We should expect further downside price moves with expanded volatility. Any price move below 0.01520 will indicate a very strong downside price move with the potential for price to reach 0.01250.

Concluding Thoughts:

Overall, we need to remember the recent political, economic and geopolitical conundrums are reflecting in expectations within global economies and currencies to be put under greater concerns. What was once a given, that the world would continue to operate without much disruption in the global balance of thing, is now open for debate. We are watching global concerns and liabilities as a result of China’s recent downturn and currency devaluation reflect in additional concerns throughout the global currency markets. We have to be aware that these issues typically don’t end quickly or without some form of government intervention. This means we may have quite a bit of time to play these moves and find good trades.

Right now, the Russian Ruble, British Pound and the Canadian Dollar appear to be poised for a breakdown in prices in the immediate future – breaking through support and possibly dropping to recent historical lows. The Euro is setting up for a breakout/breakdown move with a very narrow trigger price level range. The Euro may follow rally, briefly, if the US Dollar retraces a bit from current levels. Remember, these are weekly chart and help to understand the broader price trend. A breakdown in the Russian Ruble, British Pound and Canadian Dollar would likely coincide with a rally in the US Dollar and possibly the Euro. Therefore, watch for weakness in these markets and strength in the US Dollar as these moves happen.

If you’ve been follow our research recently, you already know why our members and followers stay dedicated to our team and our services. We have called nearly every move in the markets over the past 8 months perfectly. We urge you to visit www.TheTechnicalTraders.com to read some of our most recent research and to stay ahead of the markets by joining our membership services where we provide access to our most advanced predictive analysis tools and research. You owe it to yourself to have a dedicated team of professionals that can help you find success and stay ahead of the markets if you want to build greater success in your future.

53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Get our advanced research and market reporting, Daily market videos, detailed trading signals and join the hundreds of other traders that follow our research every day and profit.

Chris Vermeulen

Technical Traders Ltd.

The following Weekly charts are illustrations of one of our proprietary price modeling systems that shows trends, market breadth and much more. We use this almost exclusively on longer-term (Weekly, Monthly, and Quarterly charts) to help us understand where longer-term support and resistance levels are, where the market ranges are truly important and to determine true market breadth. When we are studying Daily chart or intra-day charts – the shorter term price rotation can often clutter our interpretation of the long term expectations. Yes, we have other modeling systems, predictive analysis systems, Fibonacci systems, Adaptive Cycles systems and more. Our collection of proprietary analysis tools is very deep. Yet, one has to know how to use these tools and what value they can provide at different times.

This proprietary modeling system is designed to model price swings/rotation and provide clear overall objective analysis of key price levels/pivots. We call it “TT Charger”.

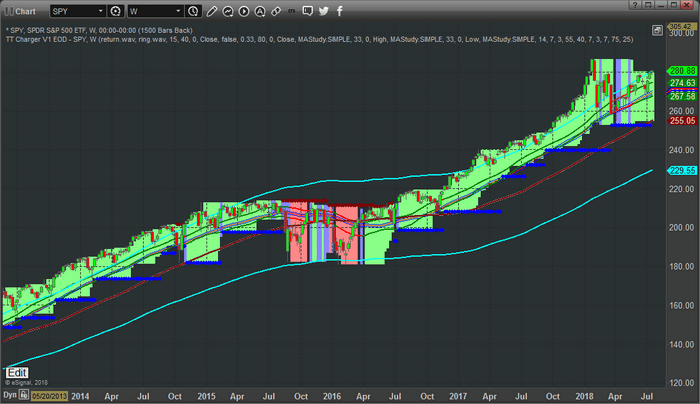

Weekly chart of the SPY using our TT Charger modeling system

This first Weekly chart of the SPY using our TT Charger modeling system is clearly still bullish. The price breadth contracting a bit near the current prices and support is currently functioning near $252. The current market price has recently broken higher above the short term price channels in addition to the longer term price channels. This is a pretty good indication that price may attempt another rally attempt that may extend for many weeks. In 2017, we witnessed more than 5 to 15+ weeks of extended price rally above both of these channel levels at times. The recent rotation in February 2018 may operate as a “recharging of price” in terms of a future rally attempt.

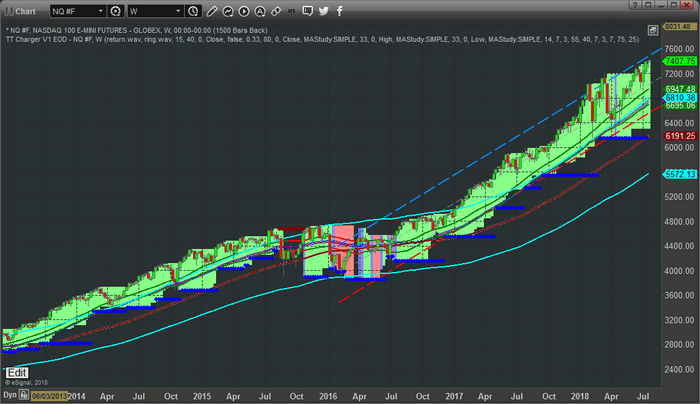

Weekly NQ chart with the TT Charger

This Weekly NQ chart with the TT Charger applied for shows an even more incredible setup. Support is currently setting near $6190 and price has extended beyond both of the price channels for more than 11 weeks now. Market Breadth is expanding, therefore the implied volatility is increasing as well. Although we may not see a very big volatility rotation in price, the capability of increased volatility is still valid.

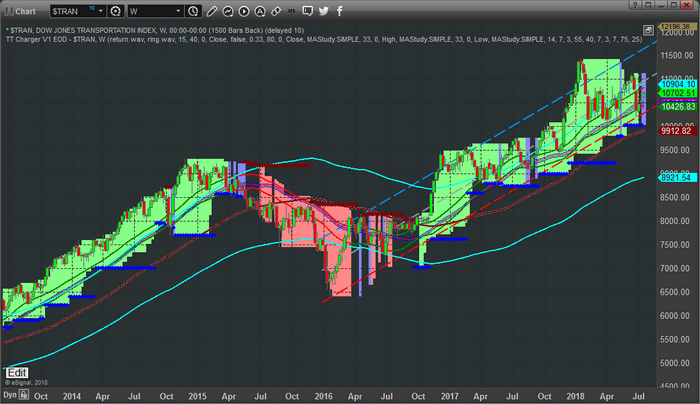

Weekly Transportation Index chart

This Weekly Transportation Index chart paints a clearer picture of the struggling Transportation Index in terms of the recent price rotation. The TT Charger analysis still shows a solidly bullish price trend with support at $10,005. Price is within the longer term price channels and just above the shorter term price channel. The Transportation index typically leads the US equities markets by about 4~8 months, so it is important that we see the Transportation index rally in support of the equities markets rally. If this fails to happen, then we are likely experiencing a “capital appreciation” that is not supported by economic fundamentals. In other words, without a rally in the Transports, any price advance in the equities markets is likely short-lived (3~6 months at best) before one of the two will break.

At this point, our interpretation of these charts is that the US earnings season should drive equities prices higher, within and above these price channels, and create a real opportunity for investors/traders. Yes, support is quite a bit below the current price levels, but these support models will adjust as price advances. Unless a reversal trigger is generated, which does not seem likely right now, or the support levels are broken, which is not likely right away, we should be looking for advancing prices and breakout rallies over the next few weeks or months.

Our members have access to much greater insight and analysis than we can share with the general public. We reserve our most advanced price modeling systems, predictive analysis and research for our exclusive membership levels. We are warning you that a massive upside swing is about to setup and you’ll want to be prepared for it because this could be a true “once in a lifetime” type of move. We also urge you to consider joining www.TheTechnicalTraders.com as a member to receive all of our detailed updates, daily videos, trading signals and more. If you don’t believe we can assist you in your future with our research, analysis and other features and benefits, you can cancel your subscription and move onto something else.

Either way, we urge you to be prepared for this next move higher and take a few minutes to read over our most recent public research posts at www.TheTechnicalTraders.com/FreeMarketResearch/.

Chris Vermeulen