Where will Silver, Oil and the SP500 Bottom?

The price action in precious metals and oil this past week has been breathtaking. The last time we have seen this much volatility in commodity prices was amidst the financial crisis in 2008 and the early part of 2009. Does this mean we are at the brink and risk assets are going to decline precipitously? Obviously that question cannot be answered with any certainty, but the underlying price action in the S&P 500 has been relatively strong compared to gold, silver, and oil.

Talking heads everywhere are predicting the commodity bubble has burst and pointing fingers at excessive speculation in silver and oil. Margin requirement changes in silver futures have been fingered as the primary catalyst for the nasty sell off. Silver had gotten way ahead of itself in terms of price and parabolic moves higher are usually followed by parabolic moves lower. For silver buyers on Friday, April 29 a painful lesson has been learned as their investment has declined more than 30% in 5 days.

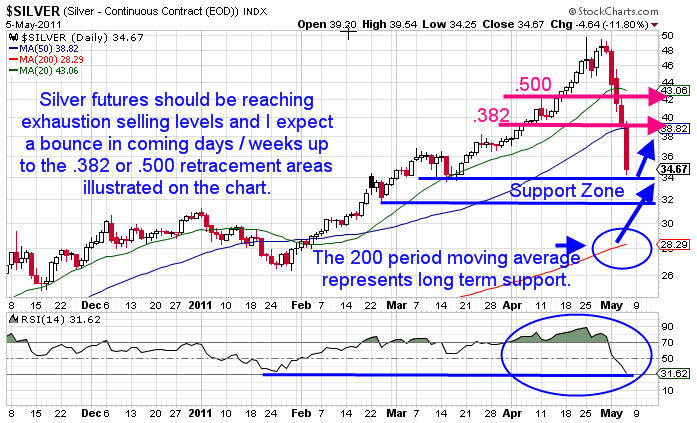

It doesn’t take a genius to realize that we are going to bounce higher at some point. With a sell off of this magnitude it would not be shocking to see at least a 50% retracement of the entire move in coming weeks. It is also possible that this is a buying opportunity for precious metals and oil. It is too early to be certain, but a bounce next week is likely as silver went from being severely overbought to severely oversold on the daily chart in one week. The chart below illustrates the 50% retracement and the RSI reading for silver futures:

In the month of April OptionsTradingSignals members were able to capitalize on rising silver prices to close a trade that produced an 18% return in less than 5 days using a double calendar spread in order to produce outsized profits based on maximum risk. Members regularly receive trade alerts focusing on gold and silver using ETF’s GLD & SLV which have extremely liquid options.

While silver prices have been absolutely crushed, gold prices have held up a bit better. In fact, in this selloff gold has been less volatile in terms of intraday percentage price movement and has not suffered from near the losses that we have witnessed in silver. The gold futures chart below illustrates key price levels:

Members of the OTS service received a trade alert on April 6th for a calendar spread that was converted to a vertical spread. When the vertical spread was closed on April 26th the members realized a gain close to 56% based on the maximum risk of the trade.

Recently we have received some poor economic data which has put a drag on equities the past few weeks. This morning we are seeing a strong bounce in the S&P 500 futures and if we have another light volume Friday prices tend to drift higher throughout the trading day. The S&P 500 futures spiked to around 1,370 on the news of Osama Bin Laden’s death and then sold off from that point. The chart below illustrates the S&P 500 futures rally and subsequent sell off highlighting current key price levels:

Members of OptionsTradingSignals received a trade alert on April 12th to put on a call vertical spread to capitalize on rising prices. On April 21st partial profits were taken and eventually stop orders closed out the position on May 4th locking in a total gain of around 32% for the trade based on maximum risk.

Oil prices have sold off sharply, albeit not as sharp as the downside move in silver recently from a percentage standpoint, but a significant amount of the risk premium has come out of oil prices. I continue to believe that oil prices over the long term have only one direction to go based on tightening supply / demand going forward and lower production levels in the future. Similar to silver, a .500 retracement of the entire recent move is rather likely in coming weeks. The daily chart below illustrates key price levels in oil futures:

I continue to believe that oil prices are going to work higher over the longer term for a variety of reasons, but a drop in gasoline prices would not hurt U.S. Consumers and the domestic economy. Higher oil and gasoline prices weigh on the U.S. Economy heavily so this sudden decline in price is beneficial to most Americans which could juice consumption if prices stay lower for a longer period of time.

Overall, price action in the commodity space has been extremely volatile the past week with silver and oil really getting hammered lower. Gold and the S&P 500 held up a bit better and it would not be shocking to see the S&P 500 put on a rally from here if oil prices stabilize. However, if the U.S. Dollar continues its recent rally it will force the commodity space as well as equities lower. The daily chart of the U.S. Dollar Index futures is shown below:

In closing, I am expecting a bounce in coming days and a .382 or .500 retracement of the entire move in gold, silver, and oil would make sense so I would not be too aggressive shorting. However, I would not necessarily be an aggressive buyer either. It is going to take time for market participants to digest the recent moves. In weeks ahead it will be more apparent what price action is likely to do and I would be shocked if we did not see a few low risk, high probability trades setting up.

Speaking of low risk, high probability trades, the month of April was the best performance for the OptionsTradingSignals service so far year to date. Seven total trades were opened and six trades have been closed with sizable profits. Recent returns included an 18% return in SLV, a 56% return on a GLD trade, 32% return on an SPY call vertical spread, a 12% return on a RUT Calendar spread, and a 37% return on an AMZN calendar spread. The total cumulative return in April was 155%.

Assuming a trader had a $10,000 account and risked a maximum of $1,000 per trade, the gross gains would have been well over $1,400 in April alone. The overall service is up over 15% year to date handily beating the S&P 500 return while assuming less risk. Take advantage of the special offer going on now where new members get 3 months for the price of one!

Get JW Jones’ Weekly Reports Free Here: http://www.optionstradingsignals.com/profitable-options-solutions.php

By: JW Jones

Co-Author: Chris Vermeulen