8:41am ET, May 21, 2010

Yesterday we started to see extreme panic selling in the broad market. This can be seen by looking at the up/down volume, advance/decline line for stocks and the speed at which the market was dropping. Only a few times a year do we get extreme levels like this and they tend to lead to sizable gains if traded correctly.

A lot has changed with my overall market outlook in the past month. At first I thought the intraday market crash was a human error and should be somewhat ignored but with the level of selling we are seeing now I am starting to think we have formed a market top in April. Don’t get me wrong, I do not have a bias as to which way I want the market to go. It does not really matter as I simply follow the trend and trade the setups.

Here are my charts and thoughts of what is happening in the market:

Broad Market – Indexes and Stocks

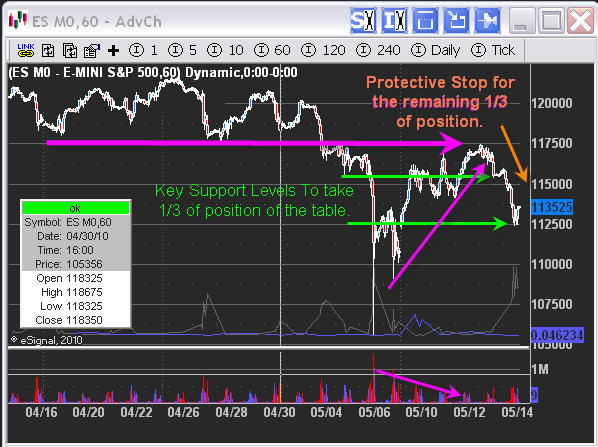

As you can see from the chart below the red broadening pattern is starting to concern me. During a bull market like we are in now, a broadening pattern is seen as neutral or bearish price action. This type of pattern has be on edge because in the past patterns like this have been the top. But I think we should see a bounce up to retrace half of the sell off from the April top. Then we will evaluate the situation from there.

Blue Support Levels currently the market is trading around a support level which tends to force the price to change direction. We have yet to break the May low and that could be broken today depending on the follow though from yesterdays panic selling. We could see the low get penetrated briefly then reverse back up sharply. This quick break of the early May low will shake out the final group of traders/investors before the market bottoms.

Green Panic Selling has helped to point out market lows for all of 2009 and 2010. Yesterday we had new high showing us that there were 37 sell orders for ever 1 buy order on the NYSE. I was getting a lot of emails yesterday from traders in panic wondering what to do. These emails are also an indicator that the market is bottoming…

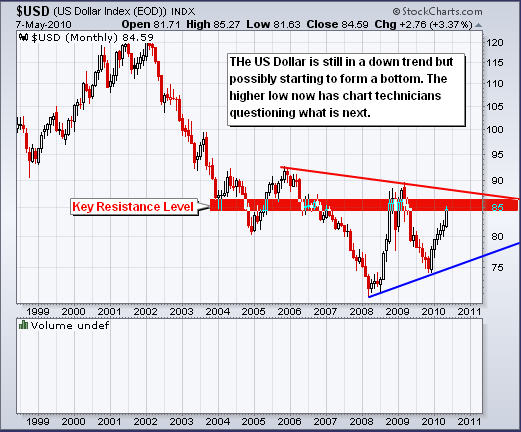

US Dollar Index

The US Dollar chart below looks as though it has topped on the 4 hour chart. We could see the dollar drop for 1-3 weeks which in turn will help boost stocks and gold s they both seem to be bottoming.

Trading Conclusion:

In short, the market is trying to bottom as I mentioned in the Wednesday report. Volatility has spiked, stocks and commodities are jumping around shaking out stops and investors are in a panic selling what they own and getting back into cash…

It’s Friday and when a big move happens on Friday we have to expect some follow through on Monday as all the weekly chart traders and people not watching the market last week will see the sell off and exit their positions on Monday adding more pressure on the market.

With all the recent selling I feel most of the risk has been taken out of the market already but we must remain cautious still. I am looking to buy (scale in over a couple days) the SP500 and Gold using the Best Trading vehicles which members have access to along detailed trading information like entry, price targets, protective stops money management and trading education.

If this is of interest to you be sure to checkout my Stock, ETF and Futures Trading Services www.TheTechnicalTraders.com

If you want to receive my free weekly technical reports be sure to opt-in to this Free Trading Newsletter:

Chris Vermeulen