US Election Cycle Will Create Increased Volatility

FREE MAGAZINE

See Page 59

US Election Cycle Will Create Increased Volatility

Throughout recent history, the US Presidential election cycle has prompted increased volatility and price consolidation. This happens because the US Presidential…

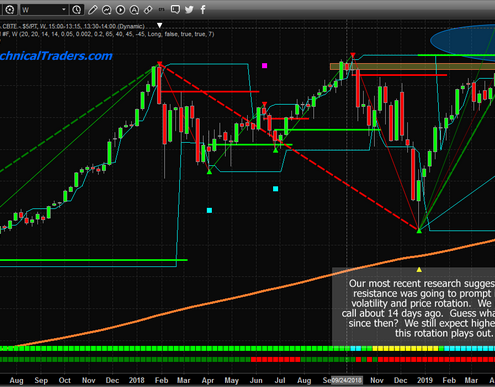

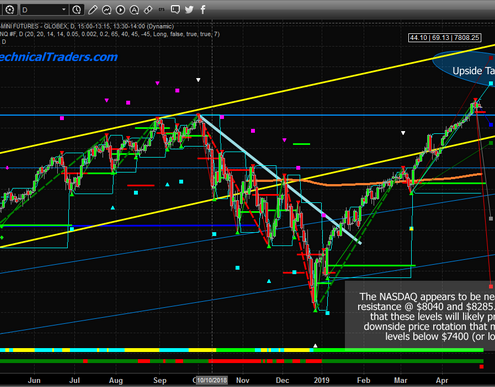

US/China Trade Issues Create SHOCKWAVE Around The Globe

Unless you were following our research, see below, and were already aware of the many warning signs we've been posting in our continued efforts to help traders and to help educate skilled investors, you were probably caught completely off guard…

Silver Sets Up A Long-Term Wave B Bottom

Precious Metals traders have been hanging on every turn in the markets over the past 2+ years. The upside price move in early 2016 setup a very strong expectation that further upside price moves were about to result in an upside price explosion…

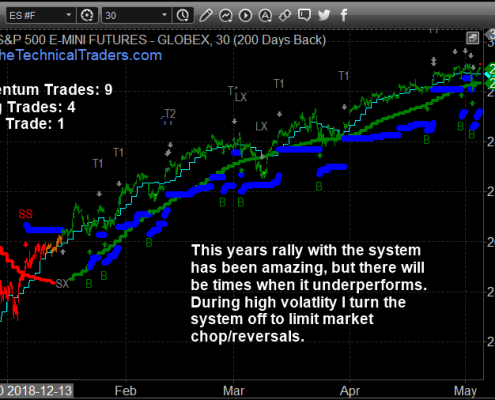

Index Trading Signals for Momentum, Swing, and Trend Following

Since 2001 I have been refining my index trading skills and strategies in the hope that one day I would provide a steady stream of trades and income and possibly even be able to automate the trading for me.

Now, 18 years later I have made…

Interest Rates, US Dollar, Canadian Dollar

UNIQUE OPPORTUNITY

First, we typically see stocks sell-off and as the old saying goes, “Sell in May and Go Away!”

So what does this mean? It means we should start to see money flow into the safe-haven assets like the Utility sector,…

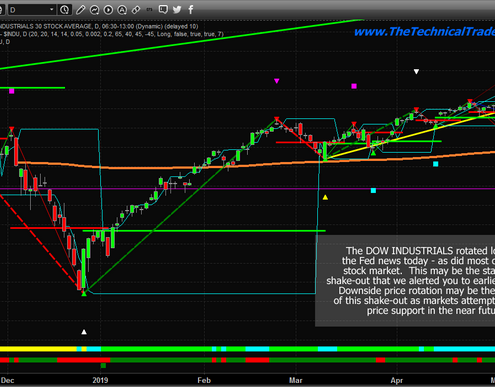

US Fed Leaves Rates Unchanged – The Shake-Out Begins

The US Federal Reserve announced today they are leaving rates unchanged based on their latest meeting. The markets should take this as a sign of relief. Yet, hear all-time highs and expecting the Fed may actually decrease rates a bit, the…

WATCH FOR A ROTATION OF MONEY OUT OF THE RISK ON ASSETS

Chris Vermeulen, Founder of The Technical Traders joins me to take a look at the overall makeup of money in the markets. With a couple of the major averages hitting all-time highs recently the run looks to be getting a little tired. Chris thinks…

How Close Are The Markets From Topping?

Now that most of the US Major Indexes have breached new all-time price highs, which we called over 5+ months ago, and many traders are starting to become concerned about how and where the markets may find resistance or begin to top, we are going…

Gold May Give Us One More Chance With New Lows

Our proprietary price cycle tool is showing us that the Daily Gold cycles may dive a bit lower, possibly into the $1250 to $1265 level, over the next 3~7+ days before reaching an ultimate low. We've been covering the precious metals markets…

LONG Top 3 Stocks to Rally in the 21 Days PYX, ARRY, CY

https://youtu.be/Bgl_FeYZpTA

For more videos and articles like the one here, please visit: https://www.thetechnicaltraders.com/