Markets Rally Hard – Is The Volatility Move Over?

Many traders are watching the recent 3-day rally thinking “this is the end of the downside price move” and targeting new entry positions for the eventual upside price breakout. We're here to warn you that our ADL predictive modeling system…

Crude Oil Fails At Critical Fibonacci Level

Crude Oil recently rallied up to the $63 level and failed. This level is a key Fibonacci price level based on our proprietary adaptive Fibonacci price modeling system. It represents a Fibonacci Long Trigger Level that would suggest that a…

How Sustainable Is The Move Into Safe Havens?

Chris Vermeulen. Founder of The Technical Traders joins me to share his thoughts on the recent flow of money into safe haven assets. During the selloff, yesterday in US markets money moved into bonds, gold, and back into the USD. We discuss…

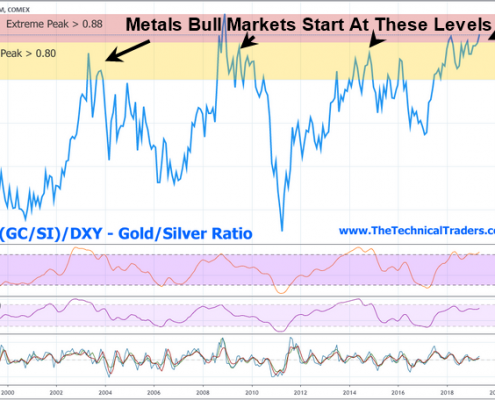

Our Long-Anticipated Gold Momentum Rally Begins

Over the past 6+ months, we've been covering the price rotations in precious metals very closely. We've issued a number of amazing calls regarding Gold and Silver over the past few months. Two of the biggest calls we've made were the late…

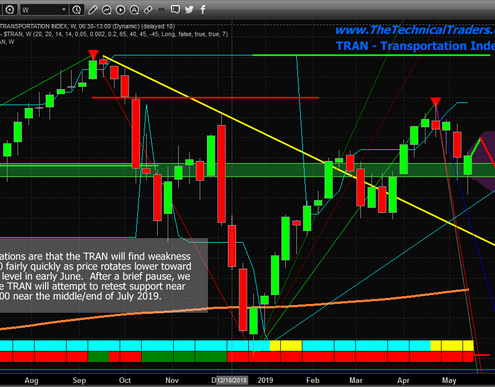

Trade Issues Will Drive Market Trends – PART II

In PART I of this report we talked about and showed you the charts of the Hang Seng and DAX index charts and what is likely to unfold. In today’s report here we touch on the US markets. As we've suggested within our earlier research posts…

How To Trade The Current Market Volatility/Crash/Recovery

This is a delayed video sample of what I share with members to my Wealth Trading Newsletter each and every morning

before the market opens. Learn, Be Alerted, and Profit!

http://www.TheTechnicalTraders.com

How Chinese Trade Issues Will Drive Market Trends

It is becoming evident that the US/Chinese trade issues are going to become a point of contention for the markets going forward. We've been review as much news as possible in an attempt to build a consensus for the future of the US markets…

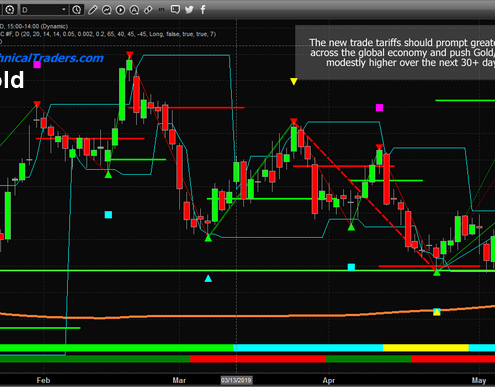

US Increases Trade Tariffs Against China – Markets, Gold, and Silver

Today, the US increased tariffs on $200B of Chinese goods as the US/China trade deal breaks down. China has vowed to retaliate for the move. The past week has seen the global markets shocked by two items: Iran sanctions and US/China trade…

The Shake-Out Continues – Where Is The Bottom?

Smart traders are already asking themselves “where is the bottom for this move”. They've likely been through these types of rotations in market price before and understand the fundamentals of the US economy are strong enough to support…

Bitcoin Setting Up For Another Drop

Last year just days before the big Bitcoin breakdown we notified everyone publicly to get ready for a swift drop from $6000 to $4000 which played out perfectly within a few days. Our cycle system and technical analysis skills combined can pack…