Extended Gold Mega Base Could Prompt An Incredible Rally

Here we go again.. We've been nailing the Precious Metals moves for many months and we've heard from many of our followers and members about our research. Some of you might remember our November 24, 2018 prediction that Gold would rally…

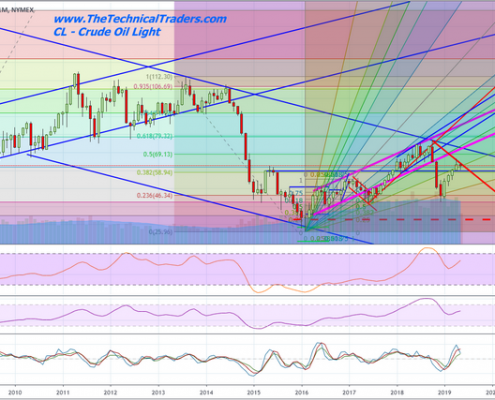

A Bullish Trade In Commodities

Chris Vermeulen, Founder of The Technical Traders joins me to focus on a couple of commodities sectors. We start off with oil and a level that Chris is watching closely to buy. Then we look at the precious metals.

3 DAYS LEFT TO GET YOUR…

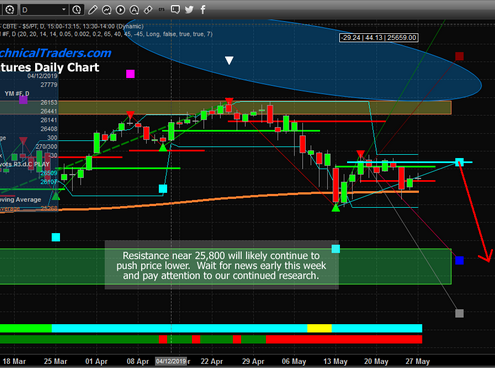

US Memorial Day Weekend Market Analysis

The US Memorial Day weekend is set up to become a very interesting time for investors. The EU voting is complete and the change in EU leadership may move the markets a bit. China appears to be playing a waiting game – attempting to hold…

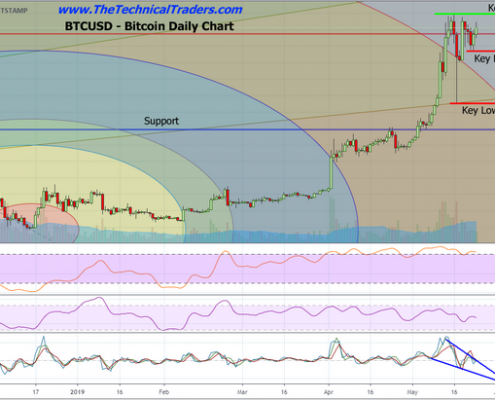

Bitcoin Stalls Near $8100

After an incredible 7+week rally in Bitcoin, from $3700 to above $8000, the current price action is setting up for what may become an extended Pennant/Flag formation with quite a bit of sideways trading ahead.

Our researchers believe the…

Stocks Topping, Dollar Up, Gold Getting Closer

Chris Vermeulen joined us today. He believes that the stock market is topping out if it hasn’t already. This will lead to increased volatility and a move back to safe haven assets, i.e. gold. He believes that oil will break down briefly into…

Eye Opening Currency Charts – Why Metals Are Falling

The incredible strength of the US Dollar over the past 12+ months has put downward pricing pressure on Gold and Silver. I believe this downward pricing pressure could be muting any upside price advanced in Gold and Silver by as much as 20%…

Global Economic Tensions Translate Into Oil Volatility

Our continued efforts to alert and assist fellow traders to the incredible setups that are currently happening throughout the globe with regards to increased global economic tensions are starting to take root. We are hearing from our readers…

Oil, Hot Stocks, and Currencies – Part III

In our continued effort to help skilled traders/investors understand the future risks associated with geopolitical market turmoil, the EU Elections next week and the continued US/China trade war, this Part III of our Sector Rotation article…

US vs. Global Sector Rotation – What Next? Part 1

Our research team, at www.TheTechnicalTraders.com, have been pouring over the charts and data to identify what is likely to happen over the next 60+ days in terms of global stock market volatility vs. the US stock market expectations. Recently,…

Major Gold caps getting more attention than Juniors

Get Chris' Trade Alerts Now - Click Here