Energy Sector Setting Up For Another Big Trade

Our research team has been nailing some really great trades recently in Gold, Silver, Crude Oil, ETFs, and many other market segments. Some of these trades have resulted in fantastic gains of +10% to +20% for our members.

One trade…

Markets Ready to Pop, But Up or Down?

CONCLUDING THOUGHTS:

Be sure to opt-in to our free market forecast newsletter

Ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis.

…

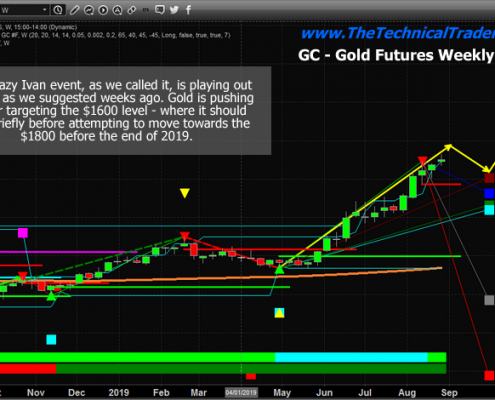

Precious Metals About To Pull A Crazy Ivan

Nearly a month ago, we authored our “Crazy Ivan” research post suggesting that precious metals were about to pull a massive “crazy price move” while the US and Global markets breakdown in an attempt to revalue risk, support, resistance,…

Has the Basing Setup In Natural Gas Completed?

Back in June 2019, we posted a research article suggesting that Natural Gas was setting up an extended basing pattern below $2.35 preparing for a seasonal rally that typically initiates in late August or early September. We believe the…

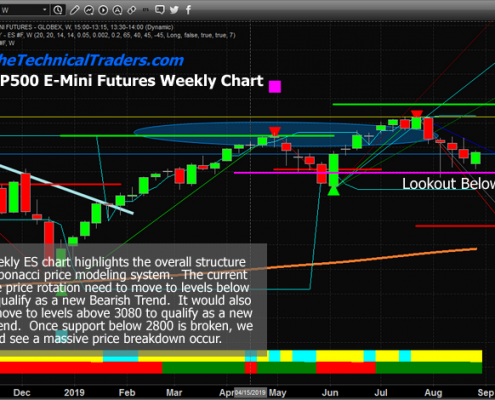

ES Must Hold Above 2800 Or The Selling Will Intensify

First off, we were so happy to hear from all of our followers over the weekend and early today regarding their support for our incredible market predictions – specifically the call about the August 19th breakdown prediction. We stuck…

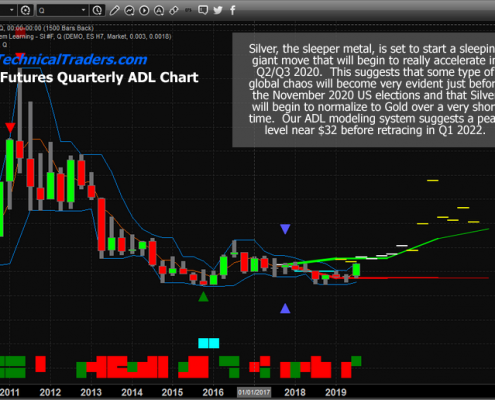

Precious Metals ADL Predictions Getting Ready For A Big Move

This weekend we thought we would share some really important data and charts with all of you precious metals bugs/traders (like us). You probably remember our October 5th, 2018 call in Gold that has set off an incredible series of events…

The August Stock market Breakdown Prediction and Analysis

Our August 19th breakdown prediction aligns with our other analysis tools and predictive modeling systems. The key to understanding price action lies in two modes of operational aspects for analysts. Either the analysis is going to be…

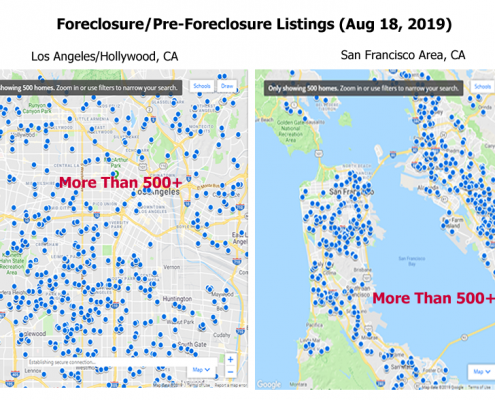

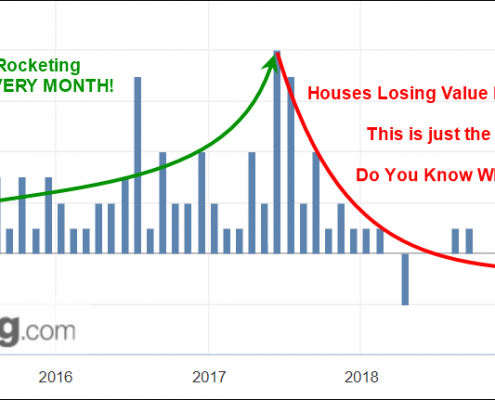

Part III – Is the Fed Too Late Prevent A Housing Market Decline?

So, the reality is that based on our modeling system and our research, there are only two ways that the US Fed (and likely the global central banks) can navigate out of this inflation killing debt glut that has sunk the global markets into…

THIS IS A KEY WEEK FOR US MARKETS, GOLD, AND OIL

Chris Vermeulen, Founder of The Technical Traders shares his thoughts on why this week is important for the US markets, gold, and oil. All of these are near strong support or resistance levels where if a break happens could result in an…

PART II – Fed Too Late To Prevent A Housing Market Crash?

In Part I of this research, we highlighted the Case-Shiller index of home affordability and how it relates to the US real estate market and consumer economic activity going forward. We warned that once consumers start to shift away from…