Global Central Banks Move To Keep The Party Rolling Onward

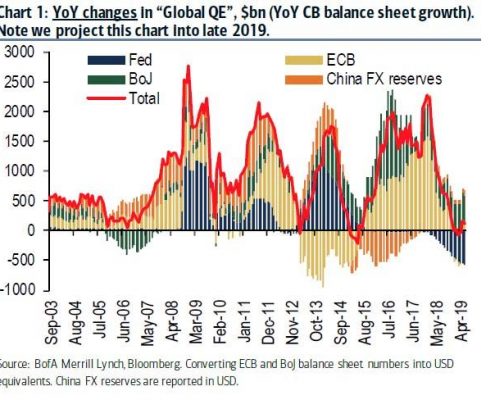

The recent news that the US Fed, China and many of the global central banks are continuing to make efforts to lower rates and spark further consumer spending and economic activity is reminiscent of the late 2010~2013 global economic recovery…

All Eyes On Copper

Copper is a fairly strong measure of the strength and capacity of the global economy and global manufacturing. Right now, Copper has been under quite a bit of pricing pressure and has fallen from levels above $4.50 (near 2011) to levels…

Part II – Metals and VIX Are About To Pull A “Crazy Ivan”

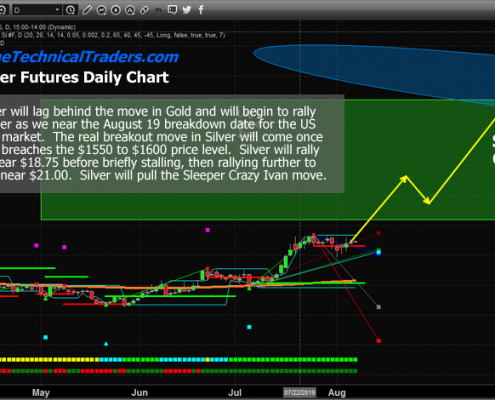

In the first part of this multi-part research post, we highlighted what we are calling a Crazy Ivan price event (borrowed from the movie Red October - (source). The one thing we want you to take away from this article is that August 19,…

Up over 24.16% in Gains this month and its only Aug 8th Sent Thursday, August 8, 2019

I hope this weeks sell-off and rally whipsaw didn't catch you off guard? Subscribers of TheTechnicalTraders Wealth Building Newsletter pocketed a whopping 24.16% return this week with three positions (SDS, UGLD & SIL).

…

Metals and VIX Are About To Pull A “Crazy Ivan” – Part I

We're borrowing a term from the movie Red October (source) that describes an unusual change of direction for a Russian submarine with the intent to seek out enemies and unknown targets – called a “Crazy Ivan”. We are using this term…

Lead Story in TradersWorld Magazine – Free and A Must Read pg 7

Larry Jacobs the owner of TradersWorld magazine which is the best publication for technical analysis and technical trading featured a great article on the where the stock market is as of today, and how this exact setup in price is what we…

A LOOK AT THE DOWNTREND IN US MARKETS AND OIL, AND THE UPTREND IN GOLD

Chris Vermeulen, Founder of The Technical Traders joins Cory Fleck today to share his thoughts on the recent downtrend in US markets and oil, plus a couple of comments on the gold uptrend. Long term trends are still the most important and…

Natural Gas and Crude Oil – Diverging Setups For Technical Traders

Over the past few weeks and months, we've been alerting our followers to the incredible setups in Natural Gas and Crude Oil. If you've been following our research, you already know on May 21st we called for Oil to break down from $62 level…

Where’s the Market bottom? Is This It?

Last Friday, August 2, 2019, we posted an article suggesting this current downside move in the US stock market may be setting up a “washout low” price rotation and we suggested all traders be very cautious over the weekend. Obviously,…

Is This The Start Of The Next Bear Market?

Over the past few days, we've received hundreds of emails from our followers and members asking if this is the big breakdown that everyone has been expecting in the markets. Yes, we've warned that it will likely happen before the end of…