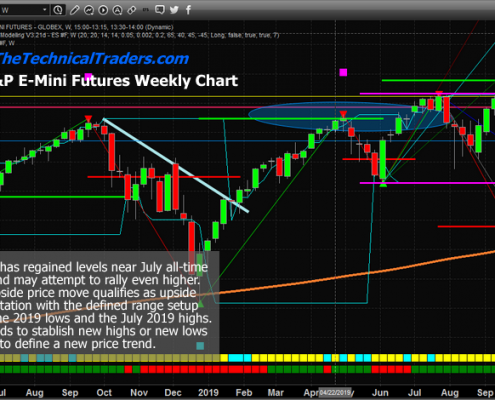

US Indexes Continue To Rally Within A Defined Range

This week ended with the S&P, Dow Industrials and Nasdaq stalling near recent highs. From a technical perspective, both Thursday and Friday setup small range price bars (Doji candles or small Spinning Top type bars) after the upside price…

Crude Oil Setting Up For A Downside Price Rotation

Crude Oil has been trading in a fairly narrow range since mid-August – between $52 and $57 ppb. Our Adaptive Dynamic Learning (ADL) predictive modeling system suggested the downside price move in late July/early August was expected and the…

Energy Sector Reaches Key Low Point – Start Looking For The Next Move

The Energy Sector ETF has been on fire recently with big price trends. We called a bottom/buy trigger in ERY in early July that resulted in a nearly +20% rally. Then, on August 29th, we called for ERY to rotate lower, targeting the $46…

Chris Vermeulen on Gold, Silver, Miners, Crude Oil, Bonds, and Bitcoin.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital.…

Metals & The US Dollar – How It All Relates – Part II

This research post continues our effort to keep investors aware of the risks and shifting capital opportunities that are currently taking place in the global markets. We started in PART I of this article by attempting to highlight how…

Metals & The US Dollar: How It All Relates – Part I

The recent movement in the precious metals markets, an incredible 33% upside price move since August 2018, has reflected an increased level of fear and greed throughout the global markets. Particularly, throughout the foreign markets. …

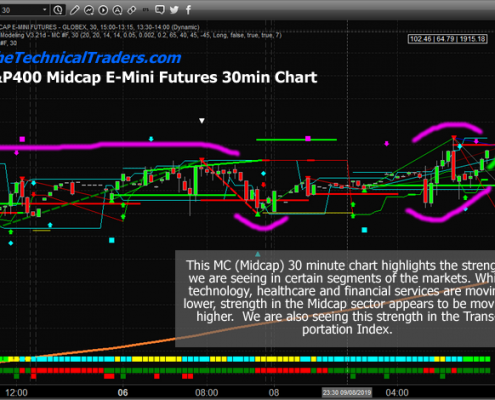

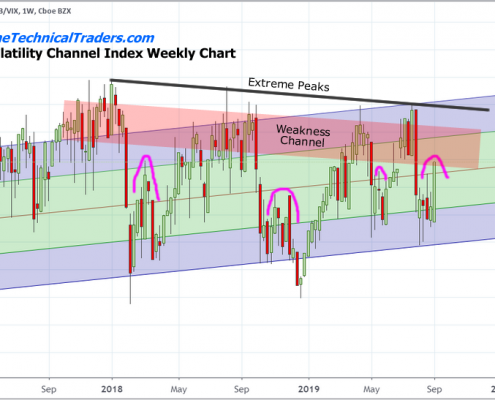

Sector Rotation Giving Mixed Signals About The Future

It seemed the markets wanted to make a point to alert us that volatility may be here to stay very early in trading this week. After a fairly flat overnight session with very little price volatility, the markets opened up to a moderately…

Price Structure Still Suggests We Are Within Volatile Rotation

This shortened holiday week has been full of crazy price rotation, political intrigue, surprise news events and, we are certain, full of headaches for some traders. Still, we managed to pull out four consistently profitable trades for…

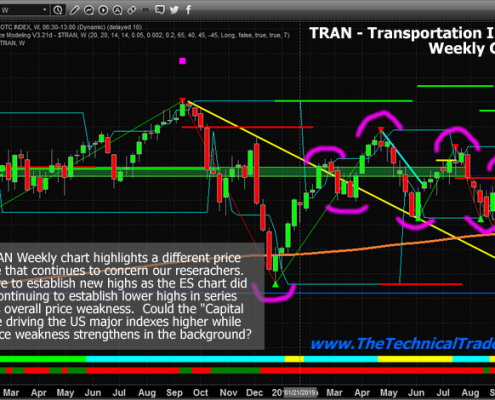

US Stock Market Hasn’t Cleared The Storm Yet

As much as we would like to report that the US Stock market has recently cleared the future concerns of a global economic recession as well as expanded into a new growth phase, we simply can't make that claim give the data we are seeing…

Can Oil Stay Above $50 To Support Producers Expectations?

Recent news suggests that oil producers are attempting to increase production levels after failing to attempt to push prices higher by cutting production levels. Globally, oil producers want to see oil prices rise above $65 ppb in an effort…