Part II – We Are Concerned About The Real Estate Market

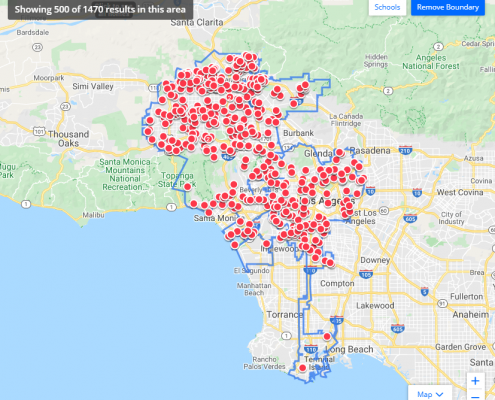

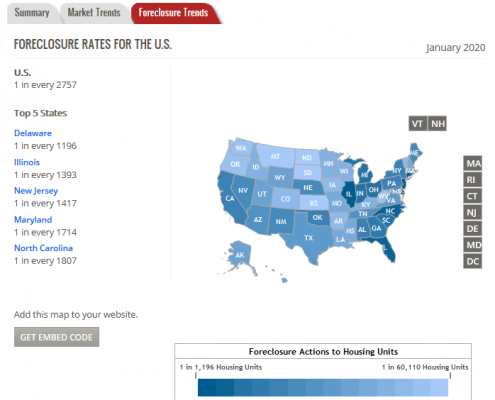

In this second part of our research into the potential collateral damage, the Covid-19 global virus event may cause in the housing and commercial real estate markets, we want to start by sharing some information that severe cracks are already…

Concerned About The Real Estate Market? Us Too!

The current global Covid-19 virus event has upended everyone’s forward expectations related to the US and global economy. Recently, President Trump has announced a 12-month reprieve for homeowners who find themselves without income, or a…

Cash Is King, Not Gold, Not Bonds

Exactly one month ago, on February 20th, the SP500 made an all-time high and reversed its trend to the downside. What a wild ride the last month has been across virtually all asset classes.

Out of all the major indexes, commodities, and currencies,…

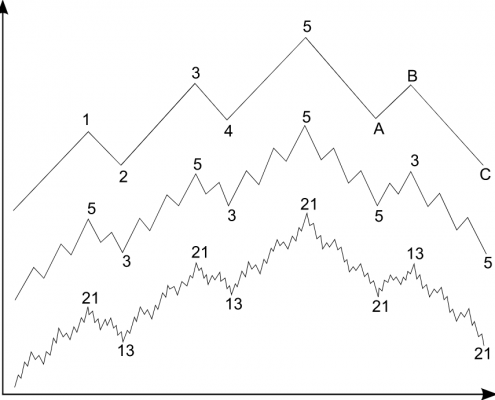

Coronavirus Induced Bear Market with Chris Vermeulen

Chris Vermeulen says money is moving just as it has in the past 5 waves of panic. This is a normal technical behavior in this type of market. There will be a huge move when money comes back into the stock market within several weeks. This will…

Four Key Questions To This Crisis Everyone is Asking

Recently, I was asked to participate in a live radio talk with Arnold Gay and Yasmin Wonkers at Money 89.3 Asia First and was sent the following questions to prepare for the show. I thought this would be a great way to share my thoughts…

Market Volatility, Safe Havens, Gold, Crude Oil

Have we seen this pattern before?

Be prepared for some really ugly earnings data in Q2 and Q3 of this year, then we’ll figure out if our expectations were accurate or not and what we should be doing to plan going forward.

The type of…

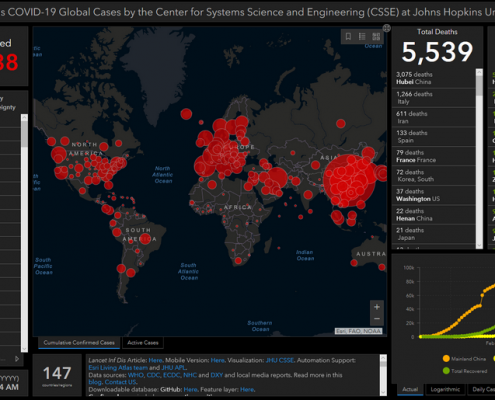

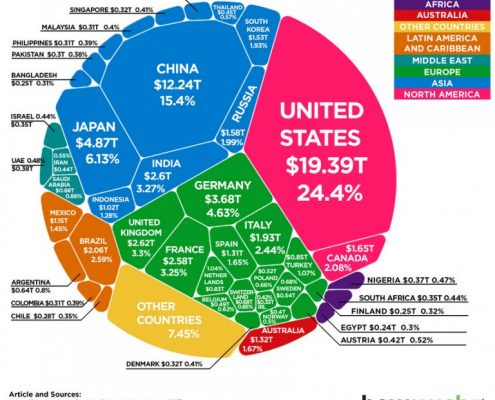

Part III – Crunching Some Numbers – Virus, Market Crash, Rate Cuts

In this section of this multi-part research article related to the potential economic destruction of the Covid-19 virus event across the global markets (Part I, Part II).

We’re going to peer into data related to the GDP and other factors…

Crunching Some Numbers – Our Researchers Share Their Data – Part II

Continuing our earlier multi-part research post related to our extensive number crunching and predictive modeling systems expectations going forward many years, (Part I) this second part will highlight some existing data points and start to…

Crunching Some Numbers – Our Researchers Share Their Data – Part I

This is one of those articles that are packed with resources showing your what to expect for various assets both long-term and short-term and will guide you through these volatile times and this year.

Our friends and followers continue to…

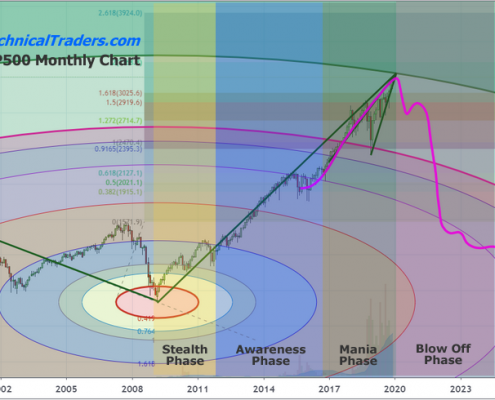

Where’s the Bottom? – Cycles Paint A Clear Picture

Has the selloff ended? When will it end? What will the bottom look like and am I at risk of taking further losses? What should I do?

Do you want to take a guess at how many of our friends and family members are calling us over the past…