Revisiting Our July 2019 Crude Oil Predictions & 2020 Forecast

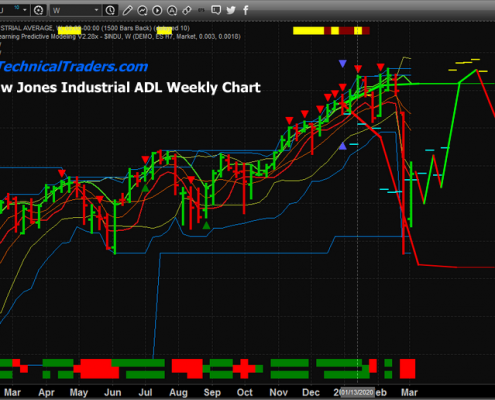

When it comes to our Adaptive Dynamic Learning (ADL) predictive modeling system, we get asked questions from our friends and followers about how it could predict a virus event or how it could predict a price event so far out into the future. …

Is This A Bear Market When Stocks Crash 20% and Bonds Spike 30%

It is another blood bath in the markets with everything down, including TLT (bonds) and gold. Safe havens falling with stocks is not a good sign as people are not comfortable owning anything, even the safe havens, and this to me is a very bearish…

Why You May Want to Avoid Buying Options This Week

If you do not understand implied volatility and you are buying put or call options or some combination, you have been warned!

The market continues to move very fast, has large swings, and one would think that makes it an excellent time to…

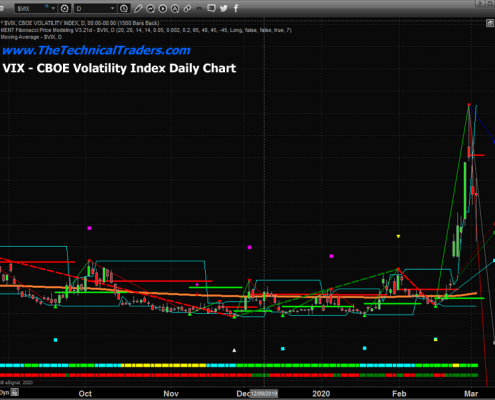

Fear Reaches A Level Seen Only 4 Times Since 2008 – Signature Pattern

Since 2009 the stock market has had for major waves of investor fear (volatility) take place which was in 2010, 2011, 2015, and 2018. Each time the market corrected we saw a drop anywhere from 12% – 18% and both traders and investors became…

Have We Seen The Peak In The VIX?

The recent price breakdown in the US stock market (near the end of February 2020) prompted a very big spike in the VIX – could we see another HUGE spike with a deeper price selloff in the near future?

Our researchers believe this first…

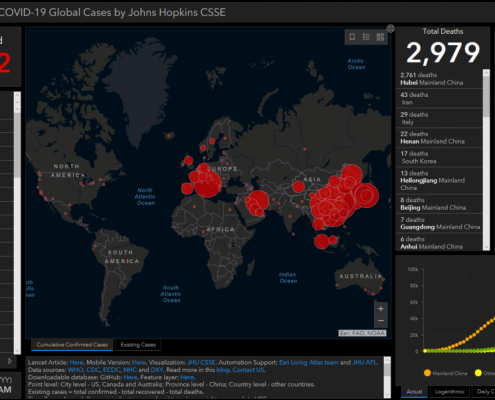

Emergency Technical Traders Market Crash Update & Video Analysis

The US stock market opened Sunday, March 8, 2020, dramatically lower. Oil collapsed 25% to near $30. Gold shot higher to levels just above $1700. All of the major US indexes were lower than 5%. As of this morning, the US major indexes…

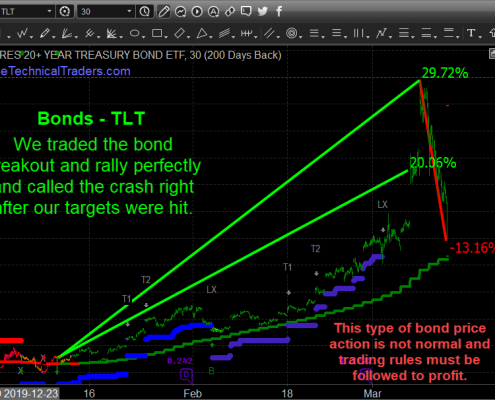

TLT Trade of the Year and What Is Next!

We just closed out our TLT position, which opened up 20.07% from our entry price, amazing. Who said bonds are dull and boring? haha

Only three times since 2008 have I seen bonds rally more than 20% from a new swing trade entry. Each time…

US Fed Panics – Predictive Modeling Shows You What’s Next

March 3, 2020: the US Fed issued an emergency rate cut of 0.50% to move rates to levels near 1.0% as a result of global economic concerns related to the spread of the Coronavirus and the potential damage it may do to the global major economies. …

Stock Market & Flu Breakdown Metrics – Where’s The Bottom?

The end of February was brutal for traders that were not prepared for the breakdown in the US stock markets. The breakdown in price actually started on February 20th and 21st. Most traders didn’t pay attention to these minor downside price…

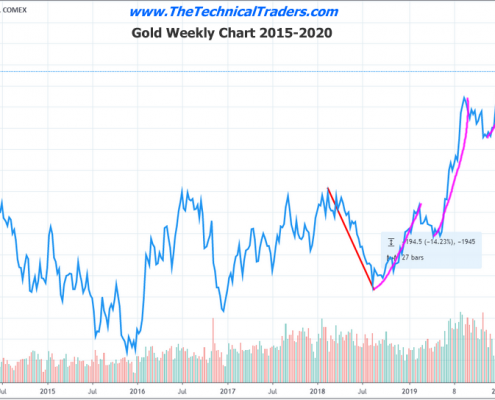

Gold Sets Up For Another Massive Move Higher

Our research team believes the recent downward price activity in Gold and Silver are indicative of past price patterns we saw in Gold over the 2007 to 2012 rally. Throughout almost every rally in precious metals (Gold), there have been a number…