Over the past 4+ months, we’ve been working away trying to keep our readers aware of the risks and concerns that were originating out of some foreign markets and how that might relate to the US markets. We remember a point in time back in June or July 2017 when we, suddenly, started receiving emails and calls from moderately large Indian, Indonesian and other foreign development companies asking to schedule time for an “introduction call”. It is not unusual for us to receive cold calls from development firms looking for new projects, but at one point we were getting 2 to 3 calls a week.

The point behind what we are sharing is that sometimes the signs are right in front of you if you are paying attention to the messages. In this case, a number of things had recently transpired – the biggest of which was the recent US Presidential elections as well as a renewed US equities market and increased volatility in certain currency markets. We also believe the currency controls in India (near November 2016), as well as the Chinese cash restrictions imposed shortly before this, were also factors that played into the current outcome. Our opinion is that these dynamic factors in the global economy, as well as the fact that many government reporting/news agencies are slow to catch onto a dramatic shift in market sentiment, resulting in a latent and somewhat aggressive price rotation in the global markets.

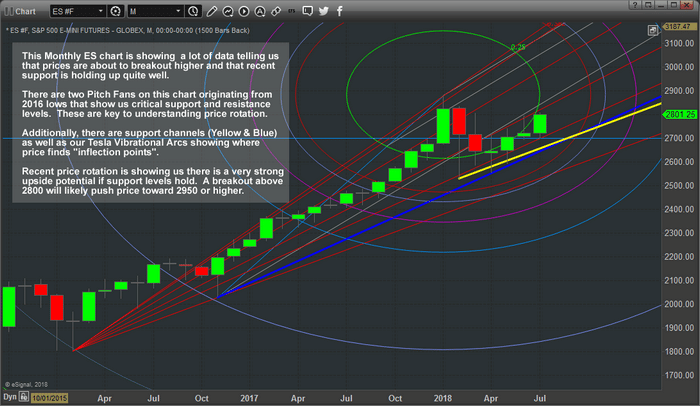

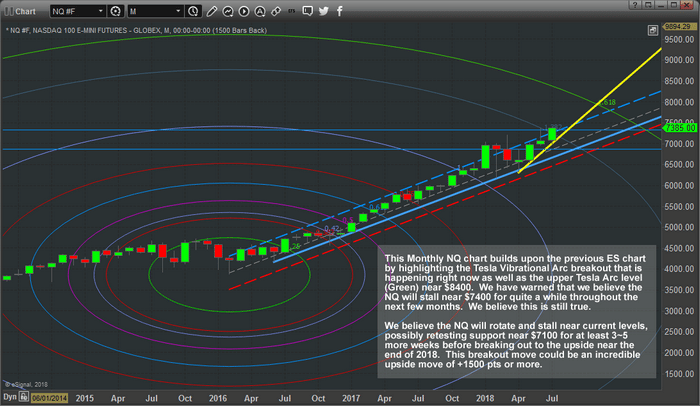

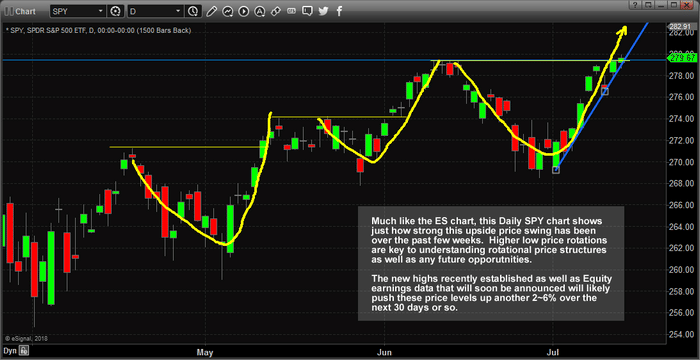

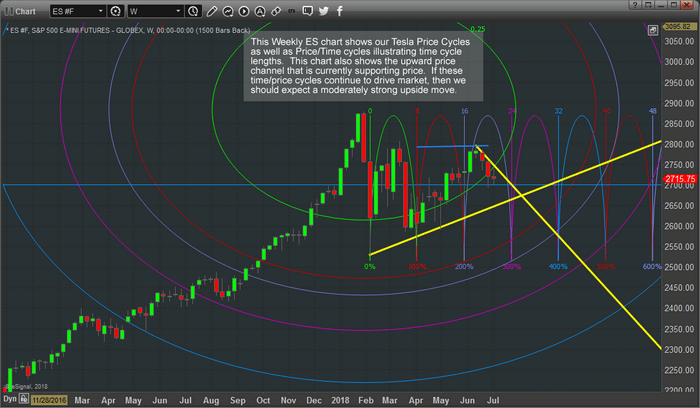

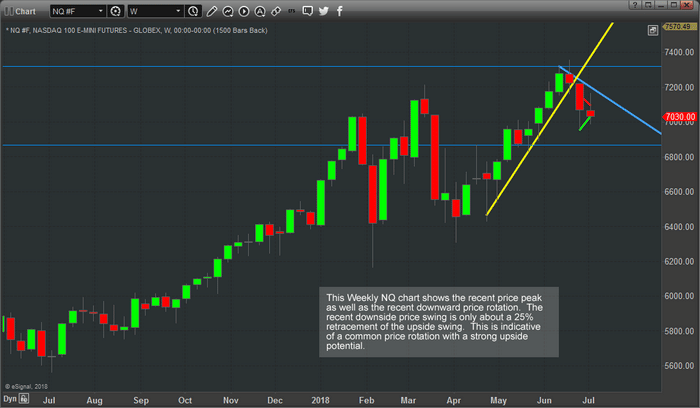

Which brings us to January/February 2018 – when the US and Global markets tanked, unexpectedly, by nearly -13.5%. While many analysts throughout the globe were concerned this rotation could be the start of a much deeper and potentially catastrophic global market collapse, our proprietary predictive price modeling systems and analysis systems kept telling us the US markets climb out of this rut and attempt to rally to new highs. In some ways, we took a lot of flack from others calling for this type of market rally when everyone else was calling for a breakdown in price. Still, look at where the US markets are now in comparison to all of those short-sellers that were convinced the markets were going to tank?

Right now, there is a very interesting dynamic at play that may not last forever – and most of the industry analysts are starting to catch onto what we’ve been talking about for months. That fact is that capital is very fluid and will migrate to the healthiest and most suitable investment environment possible when the environment where this capital currently resides is unfavorable or deteriorating. As we learned in the movie “Wall Street” – “Greed, for lack of a better word, is good” (Gordon Gekko: 1987 “Wall Street”). In our interpretation, Greed is the essence of the survival of capital in different market environments. Greed and Fear are two very similar emotions and they both, at times, are very good to have in measured levels. Both of these emotions drive capital into and out of markets as a natural occurrence of the global markets.

This dynamic, the capital migration that has been taking place for approximately 12+ months, may come to an end at some point in the near future and we have to be prepared for it. If we think about this scenario, what would cause this capital migration to subside or end and change dynamics? We can think of two scenarios that would be likely to play out to result in this transition :

- Emerging markets stabilize, forming near-term bottoms and establishing some optimism regarding opportunities for upside price advances. This, in our opinion, may be enough of a catalyst for capital to move back into these markets in an attempt to capture returns with diminished risk factors – resulting in GREED outweighing FEAR.

- Something decreases the US and major global market standing in terms of currency strengths and global market dominance. In this case, we believe some massive credit or debt risk factor would have to occur that greatly decreases the capabilities of the mature global markets (US, UK, Canada, Japan & Europe). Should something like this happen, where the biggest and most stable markets on the planet are diminished, then capital may aggressively move away from these markets and into any other market that may appear to benefit from these diminished expectations.

Until either of these things happen, we believe continued pricing pressure will exist in China/Asia, the BRICs markets and, to some degrees, in the European Union markets.

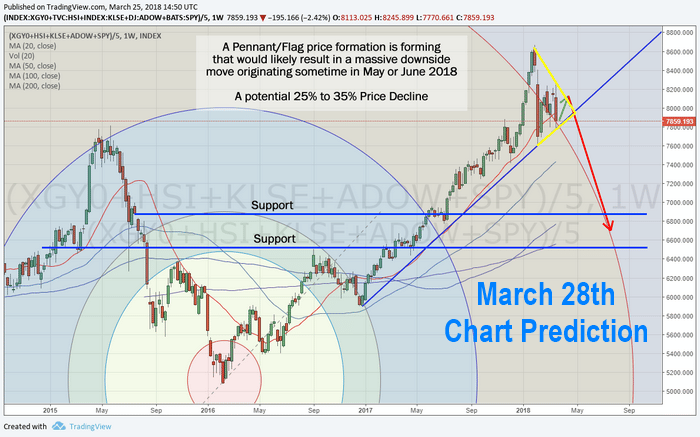

Take a Look at Our Previous Forecast on March 28th

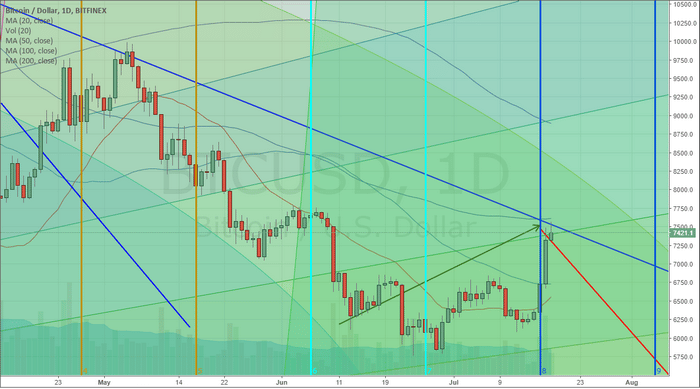

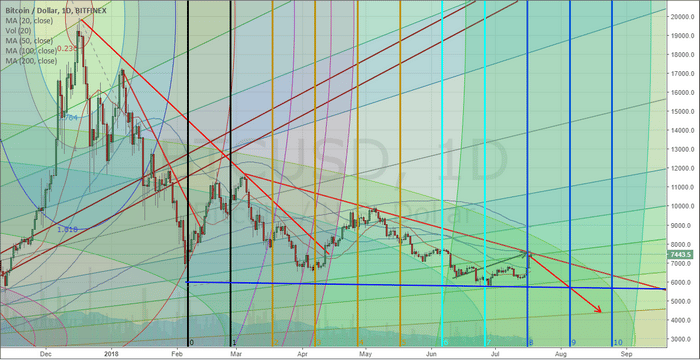

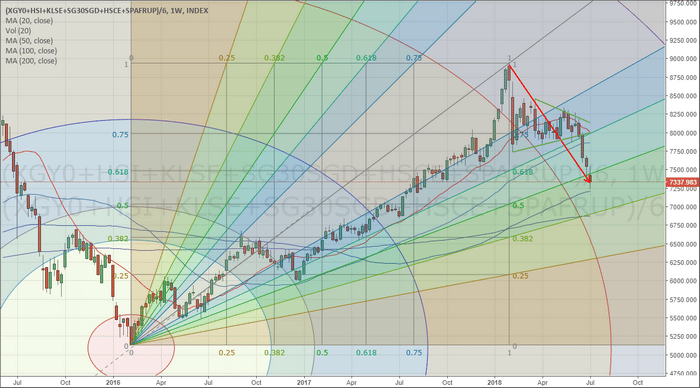

This chart clearly shows where prices were expected to move, which was sharply lower through spring and this summer. See complete 5 part series on global indexes

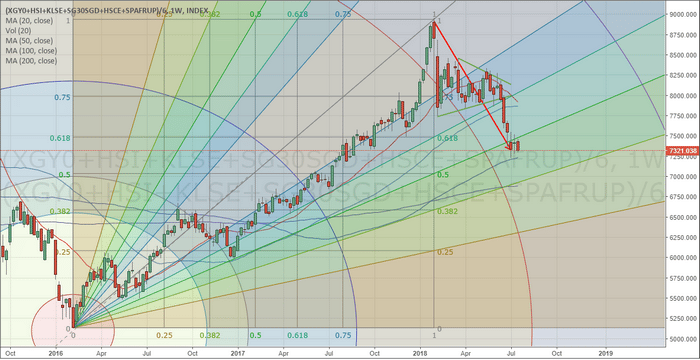

Now, let’s start off by checking this Weekly chart of our China/Asia custom index and where it is today. One can clearly see the pennant/flag formation (the Green lines) that originated in early 2018. This pennant formation recently broke out to the downside and has already fallen nearly half way to our downside target which is incredible.

The current downside move aligns with a 38.2% retracement from the highs and we believe this move could be just starting. In other words, we believe a full 50%, or more, a pullback from these highs could be in the works if the data originating from China/Asia recently is correct. The entire region of China and SE Asia is open to interpretation and legal issues with little certainty about anything.

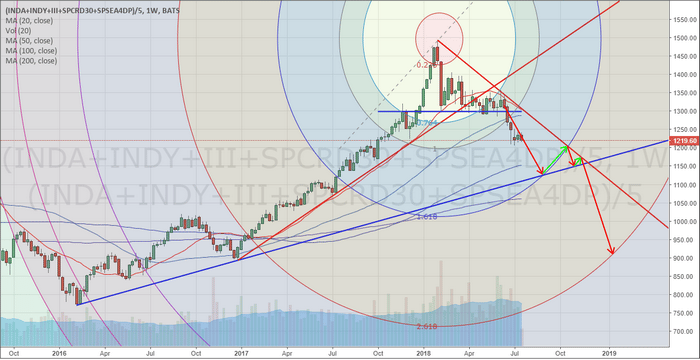

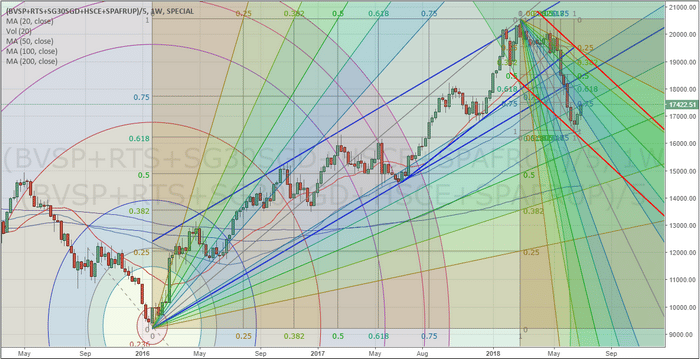

This next Weekly BRICs chart shows a similar pattern. A sideways pennant formation originating in early 2018 that broke out to the downside. A clear breach of price support and a more than -38.2% price drop so far. Our Blue price support line, originating from 2016/2017 lows, shows us that critical support is currently about -11% lower than the current price. You can see from our drawn arrows that we believe this level will create price support and price will rotate well into the end of 2018 before breakout out of this new pennant formation and moving dramatically lower. Right now, time will tell how this plays out 5+ months into the future, but at this time, unless the global market dynamics change dramatically, this is what we believe is the most likely future outcome.

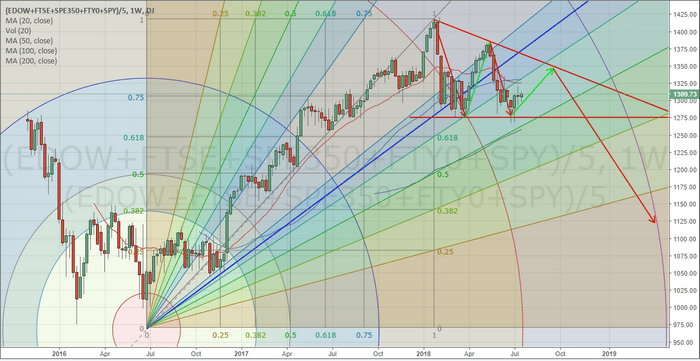

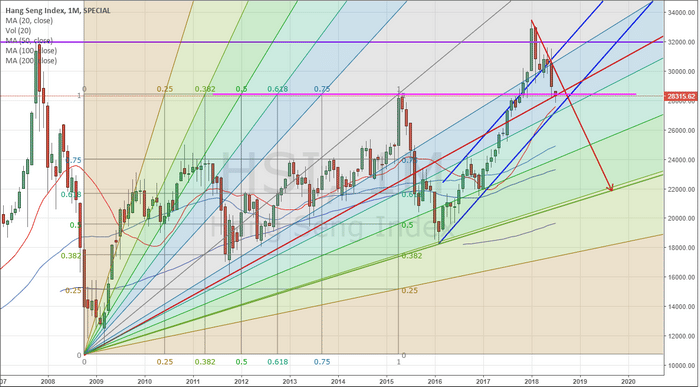

Lastly, this is the Weekly European Custom Index that shows, yet again, a somewhat similar pattern without the recent price breakdown. Originating in early 2018, a deep price rotation has created a very clear price rotational cycle. This rotation is forming a very clear pennant formation, again, and we believe the final outcome, at this point, will be a breakdown of price in the European markets as the Brexit and other regional economic and political issues continue to play out. As a word of warning, our last Red arrow (drawn on this chart) does not point to a target price level – it is just indicating that we believe a breakdown in price is the likely outcome.

If we were to add a simple Elliot Wave count to this in an attempt to isolate potential future moves, our estimate (with limited data) would be that we are in the midst of a Wave D correction. In other words, this is a corrective price trend “in an uptrend”. The move lower, as we are predicting, may not drop below the 50% retracement levels shown on this chart before finding support and attempting to start a new upside price move.

Pay attention to the global market news and the news of certainty or uncertainty originating from the global economies. Capital is “Greed and Fear and work every day”. Capital will always attempt to exit hostile or dangerous economic environments and find a more suitable environment for growth and stability. As the continued global market turmoil continues to unfold, understand that Trillions of dollars will be sourcing the safest and best returns on the planet. As these dynamics play out, there are tremendous opportunities for traders and investors to follow the cash and ride the waves. There may, certainly, be some wild rotations and waves as this capital moves around, but the longer term trends that should establish as this capital moves around should be substantial. Get ready for some excellent trading opportunities over the next 12 to 24 months.

Our exclusive member service provides detailed market research, daily market video analysis, detailed trading signals and much more to assist you in developing better skills and greater success in your trading. One of our most recent trades is already up over 12%, we already took some partial profits, and we believe much higher share prices is just around the corner. We urge you to visit www.TheTechnicalTraders.com to learn how we can assist you in finding new success.

53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Get our advanced research and market reporting, Daily market videos, detailed trading signals and join the hundreds of other traders that follow our research every day and profit.

Chris Vermeulen

Technical Traders Ltd.