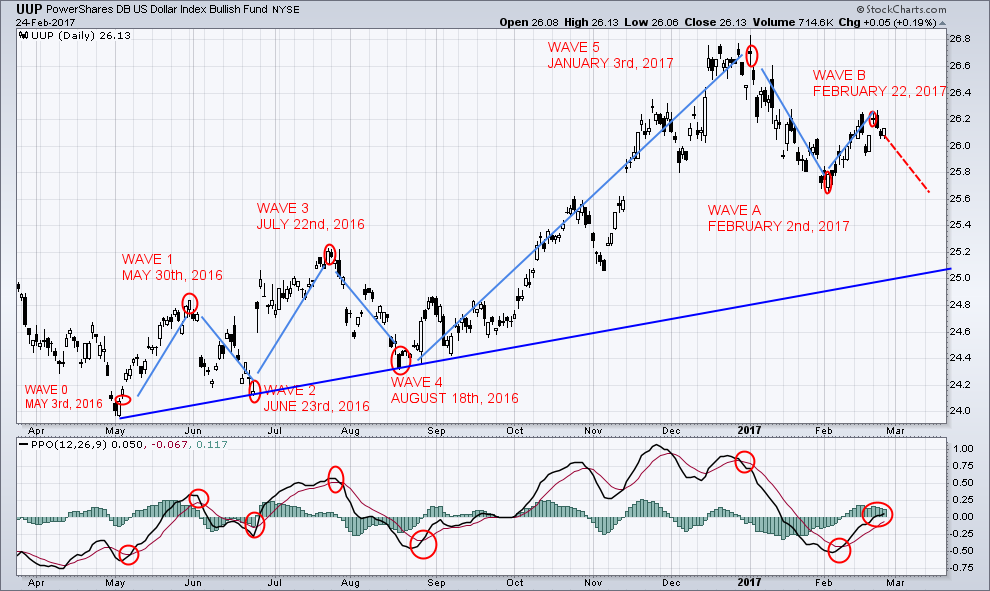

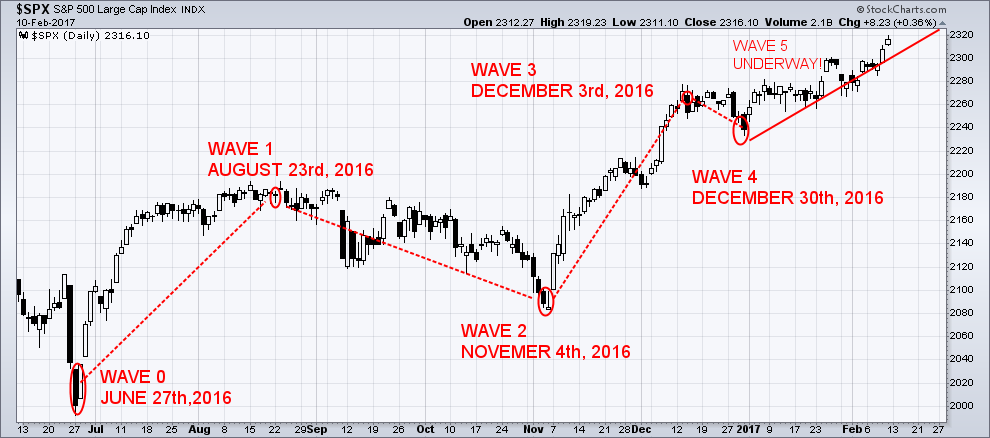

Elliott’s theory is based on the Dow theory in that stock prices move in waves. Because of the “fractal” nature of markets, I have broken them down so that you can trade a daily complete wave count. Fractals are mathematical structures, which on an ever-smaller scale infinitely repeat themselves. Elliott discovered stock-trading patterns were structured in the same way.

This week will be very interesting in the markets. You need to understand what the markets are telling you. The markets are at an “extreme”. I trade the most profitable waves, which are impulsive waves 1,3 and 5. It takes time to develop these great trades, but it is worth the wait as you observe the profits rolling in. Do not get caught up on the wrong side of the trade. Timing the waves correctly is a critical factor for creating these profitable

The Corrective Waves are not as easy to identify as the Impulse Waves because the Corrective Waves have more variations as compared to the Impulse Waves. Corrective Waves of any trading pattern are broadly termed as the “ABC Corrections”. Corrective Waves are always the three wave patterns that unfold in the direction opposite of the larger trend.

“ABC Corrections” is the broad name given to the Corrective Waves. The corrective patterns formed by the Corrective Waves are against the direction of the trend. Wave 1 is corrected by the Wave 2 and Wave 3 is corrected by the Wave 4. After wave 5, the wave pattern finishes and the entire move which will be corrected. This correction will occur a multiple wave move. “ABC” numbered waves are also the Corrective Waves.

Based on research that I have just completed, when the January and February months are both bullish, the equity markets moved much higher for the rest of the year! (http://www.marketwatch.com/story/still-room-for-stock-bulls-to-run-as-historic-breakouts-take-shape-analysts-say-2017-02-23/email).

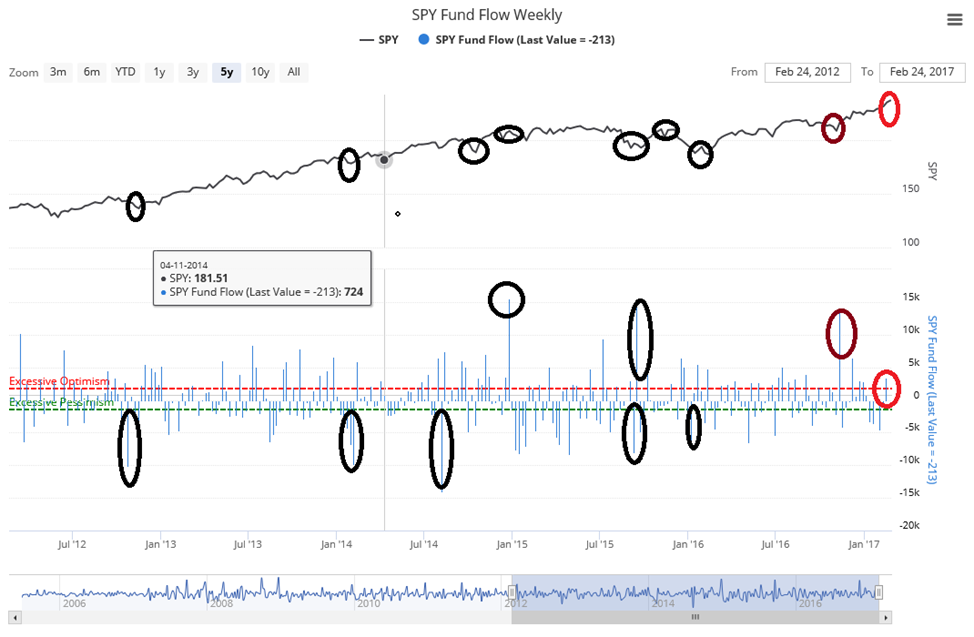

The SPY Fund Flow represents the weekly flows in and out. This is a ‘Contrary Indicator’. When it becomes extremely pessimistic, I then look for a reversal to the upside. When fund flows are very high, I become concerned about a correction as expectations may have become too optimistic.

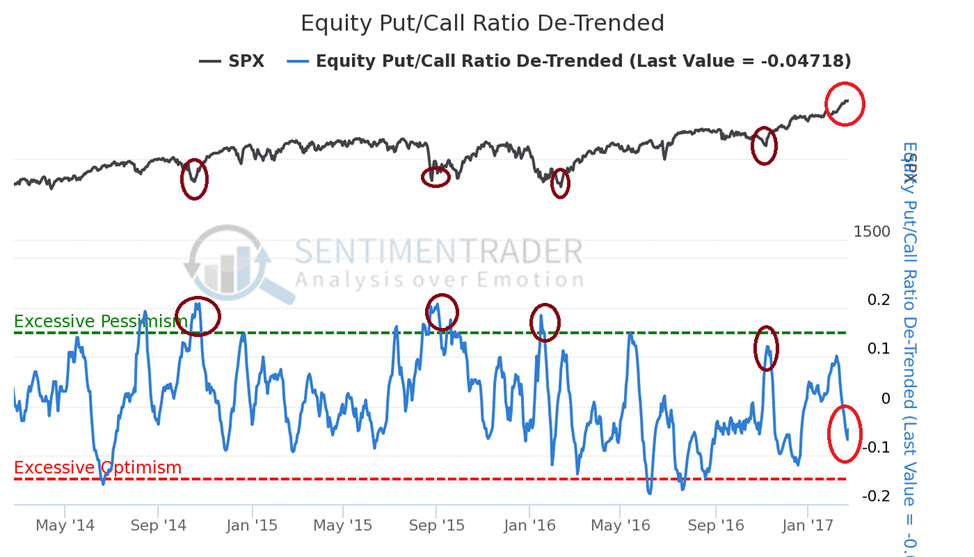

The total put/call ratio is the volume of puts divided by the volume of calls traded on individual equities on the Chicago Board Options Exchange, on any given day. Generally speaking, heavy volume in put contracts shows large-scale fear by options traders, while heavy call volume is usually a reflection of increased investor optimism in regards to rising prices. When there is heavy put buying and low call buying, the put/call ratio will be high. When an extreme is reached, this becomes a bullish contrarian indicator and we should expect higher market prices ahead of us. When option traders are optimistic and there is low put volume in relation to call volume, then the put/call ratio will be low and we may be nearing a market high. The interpretation of this indicator is the same as the equity put/call ratio itself – high readings show fear and are generally bullish for the market. Low readings, show excessive optimism as the market typically declines after they are seen.

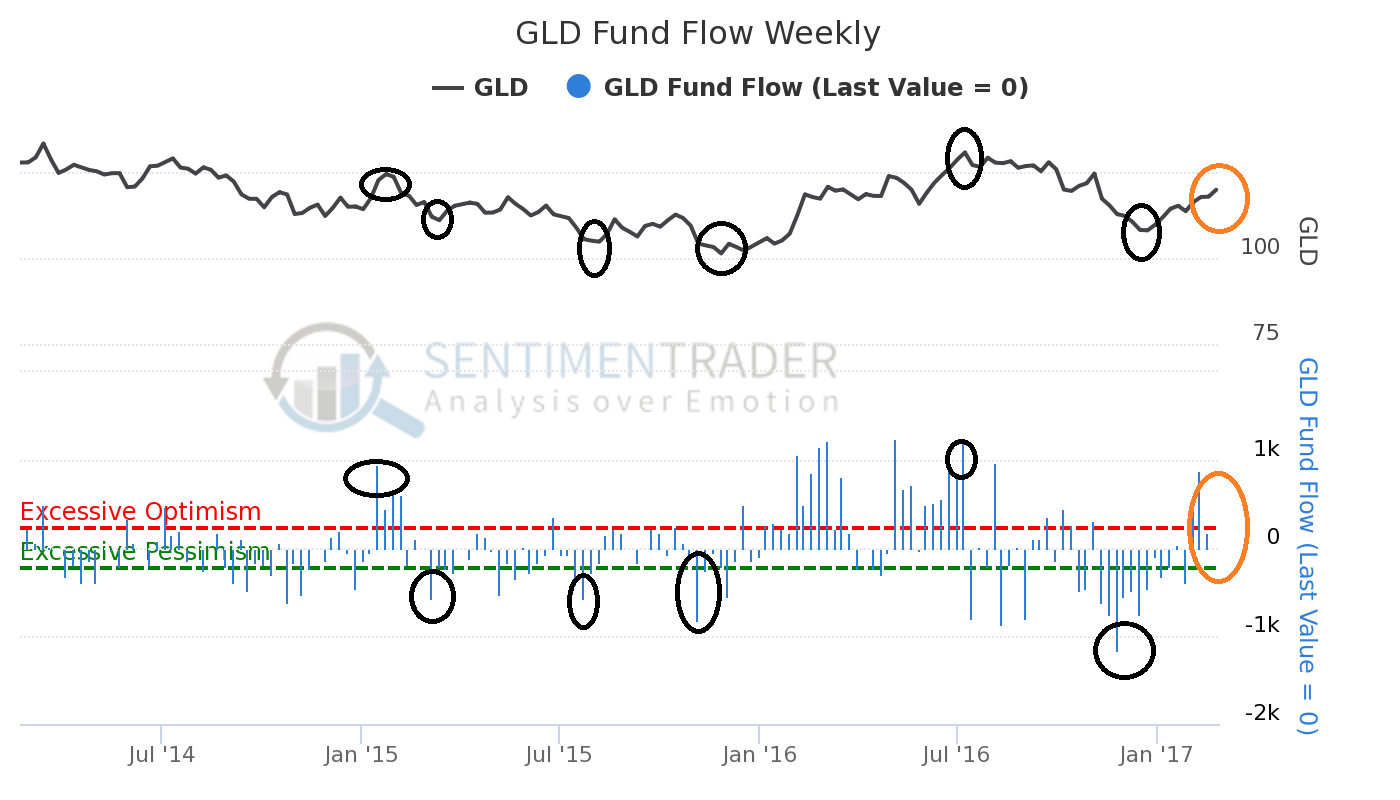

The GLD Fund Flow Weekly Indicator represents the daily flows into and out of GLD: (http://www.wikinvest.com/wikinvest/api.php?action=viewNews&aid=8343471&page=Stock%3ASPDR_Gold_Trust_%28GLD%29&comments=0&format=html).

Contrary Indicators are measuring the fund flows. When it becomes extremely pessimistic, then I begin to look for a possible reversal to the upside. When fund flows are very high, then I become concerned about a correction as expectations have become too optimistic. Why gold is great again: (https://www.forbes.com/sites/ralphbenko/2017/02/25/president-trump-replace-the-dollar-with-gold-as-the-global-currency-to-make-america-great-again/#23cdf01f4d54)

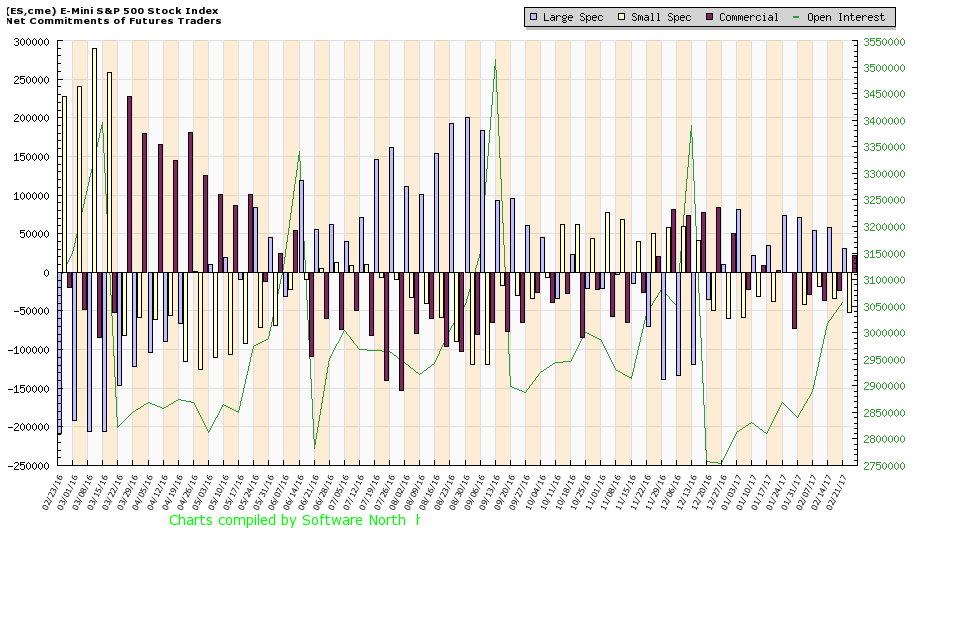

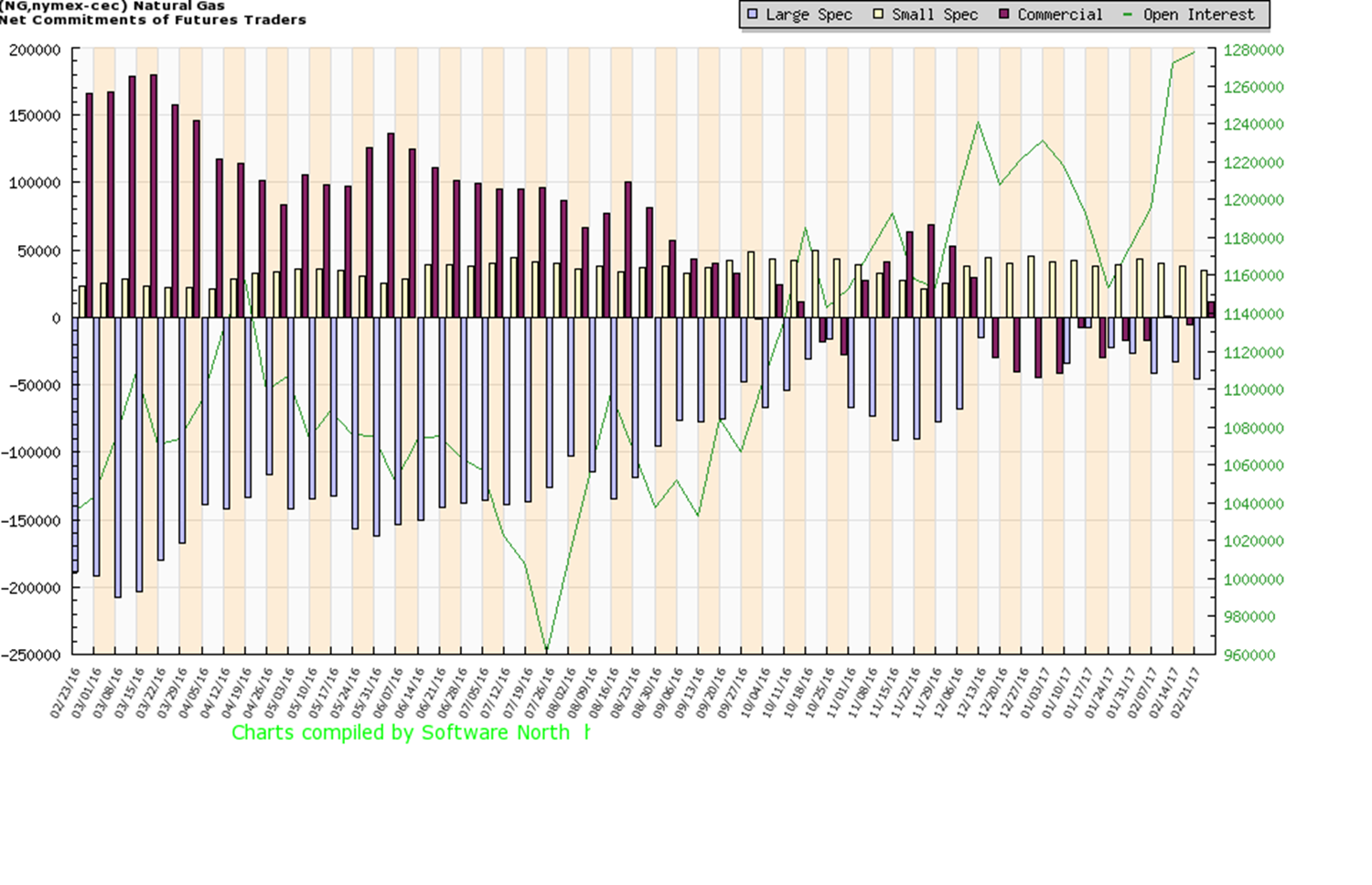

The Commitment of Traders (COT) Indicator gives you the overall picture of what is happening behind the scenes. It tells you who is buying and who is selling! This information is an important key for your trading success!

The commercial traders are considered the “Smart Money”. The chart below displays, as of February 21st, 2017, that the commercial traders have taken new long positions. This matches up perfectly with my long-term Elliot Wave forecast of 2550, in the SPX.

Red Bars: The Commercial Traders

(i.e.: Farmers, Hedgers, Producers, and Factories)

Blue Bars: The Large Speculators

(i.e.: Banks and Large Financial Money Managers)

Green Bars: The Small Speculators

(i.e.: You and me)

Yellow Line: The overall open interest in the market.

The next setup for going long on Natural Gas.

The U.S. dollar: Waiting for trend confirmation.

Learn how to build wealth during 2017!

Every week, there are new actionable trade ideas. Avoid what I refer to as “Herd Mentality” which will put you on the losing side of the trades more often than not.

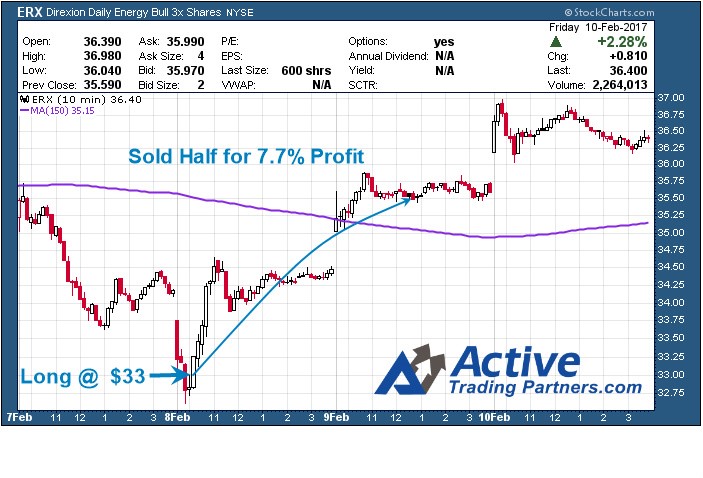

Our most recent trade was UGAZ:( http://etfdb.com/etf/UGAZ/) on February 21st, 2017. We sold half of this position to lock in a quick 10+% profit in two days. Previous trades generated a 112% profit within 25 days (NUGT), and 7.7% profit (ERX) within 24 hours.

Stock Market bulls will continue their historic breakouts!

The Trump Administration’s promises of tax cuts and regulatory easing is the catalyst for the markets’ recent strong advance. Mr. David Dodd’s timeless classic saying: “The market in the short term is a voting machine, but in the long run it is a weighing machine”. This is the second most bullish market, after an election, since President Kennedy took office.

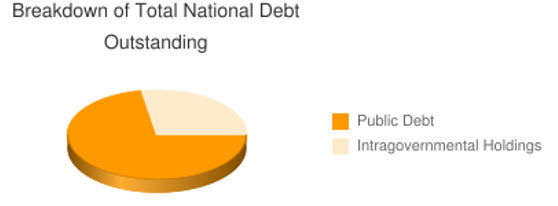

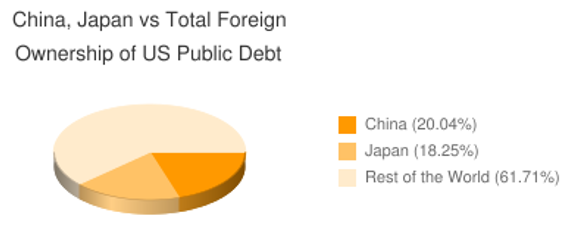

The Research Investment Committee commented “Monetary, fiscal and regulatory policies could be key drivers in 2017, but the timing of those actions could cause volatility”. New regulatory action will favor many stocks in the financial and energy sectors. Repatriation will occur under President Trump’s new corporate tax plans. The U.S. currently operates under a tax system in which the domestic earnings of U.S. corporations are taxed at the federal U.S. corporate rate (35%) and any overseas earnings that are repatriated are taxed at this rate less a credit for foreign taxes paid on those same earnings. Foreign earnings have been parked offshore, allowing corporations to avoid the taxes associated with bringing them back to the U.S. These U.S. Companies would be granted an eight-year period to pay their tax liability. President Trump’s plan calls for a one -time deemed repatriation of overseas corporate profits at a 10% tax rate.

Conclusion:

In short, the US stock market is back in full blown bull market with truck reenergizing things. While I feel a short-term correction is due any day, it is just that, a short-term pullback followed by higher prices into June/July.

Tuned For More Analysis and Trades at: www.ActiveTradingPartners.com

Chris Vermeulen