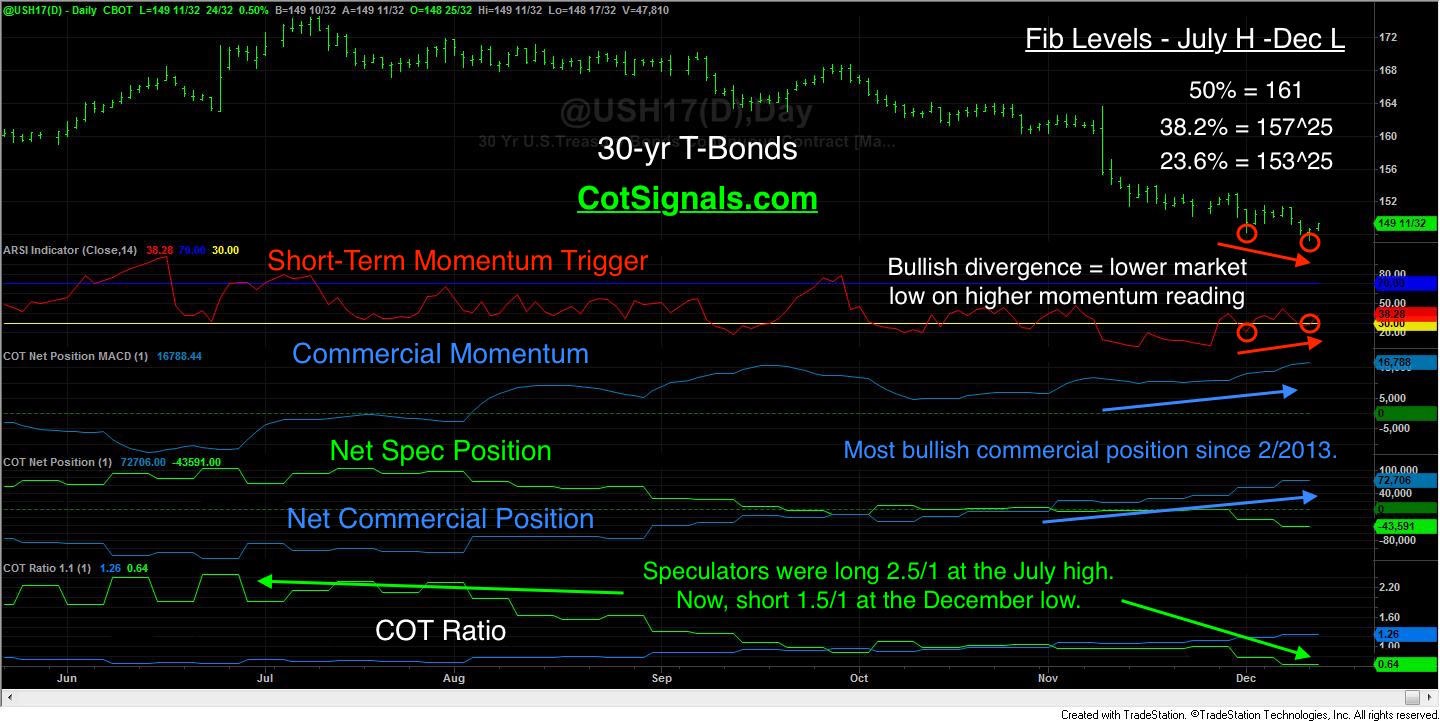

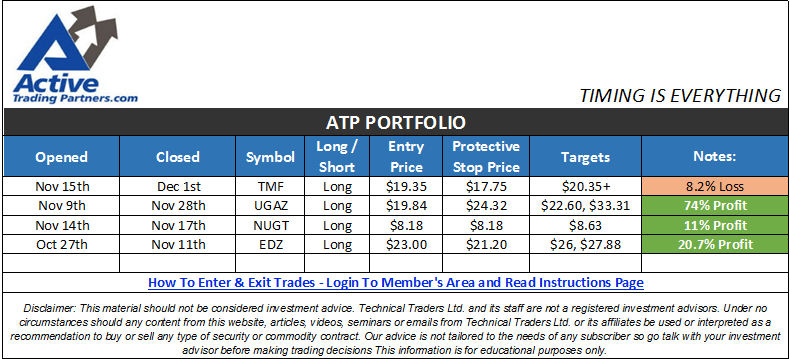

The Commercial Hedgers are considered the smart money. The Speculators are considered the dumb money.

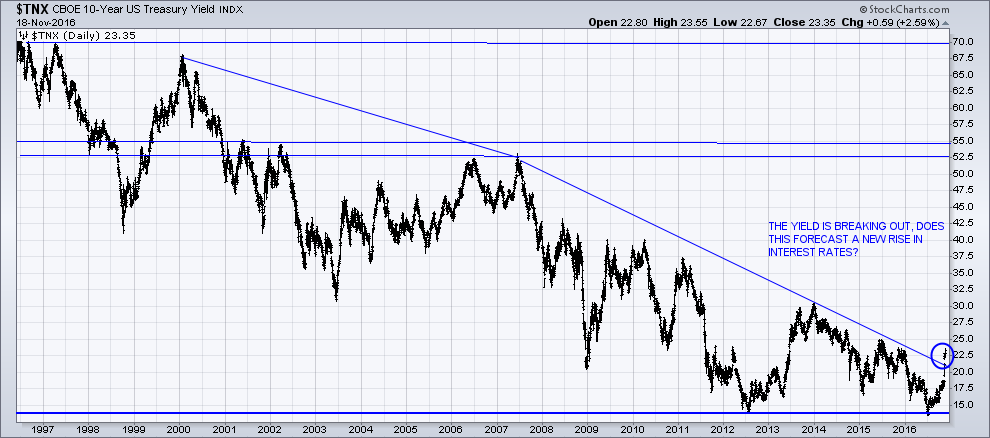

The rise in yields corresponds with the decline in Treasury prices. A bounce is ahead of us in 2017.

Commercial traders have built up their most bullish position since February of 2013.

Commercial traders are now long 50% more long than they are short. This is the most bullish COT Ratio reading since July of 2011.

The speculative side of this trade have built up their most concentrated short position since February of 2013 and their largest net short position since March of 2012. The speculators are usually wrong. They set their recent COT Ratio high two weeks before the market topped out. The concentration of their short position should give pause to new short sellers.

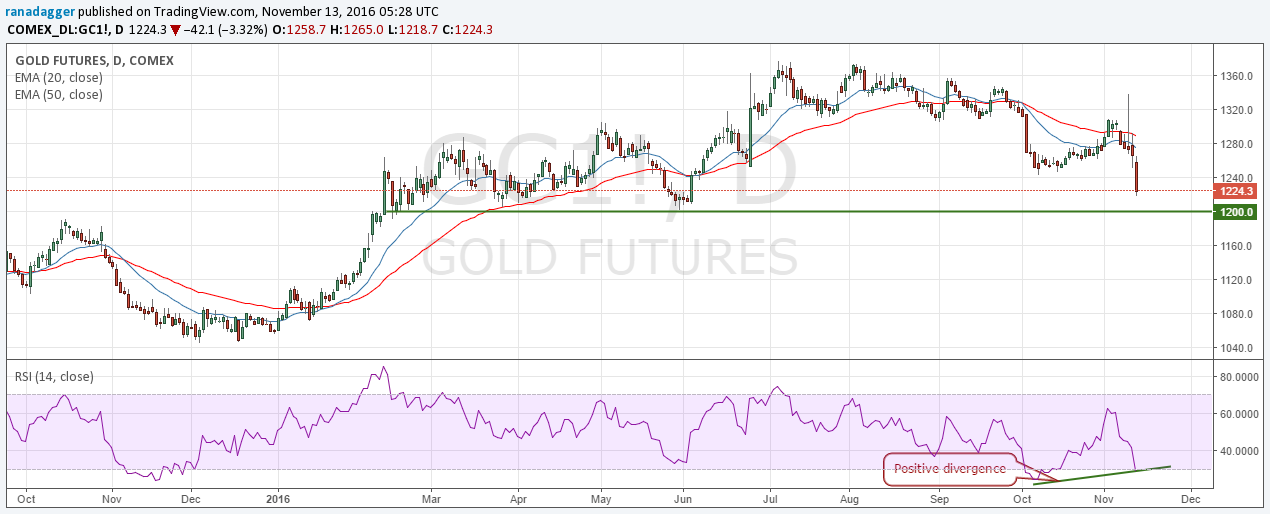

The technical picture suggests a bounce is due.

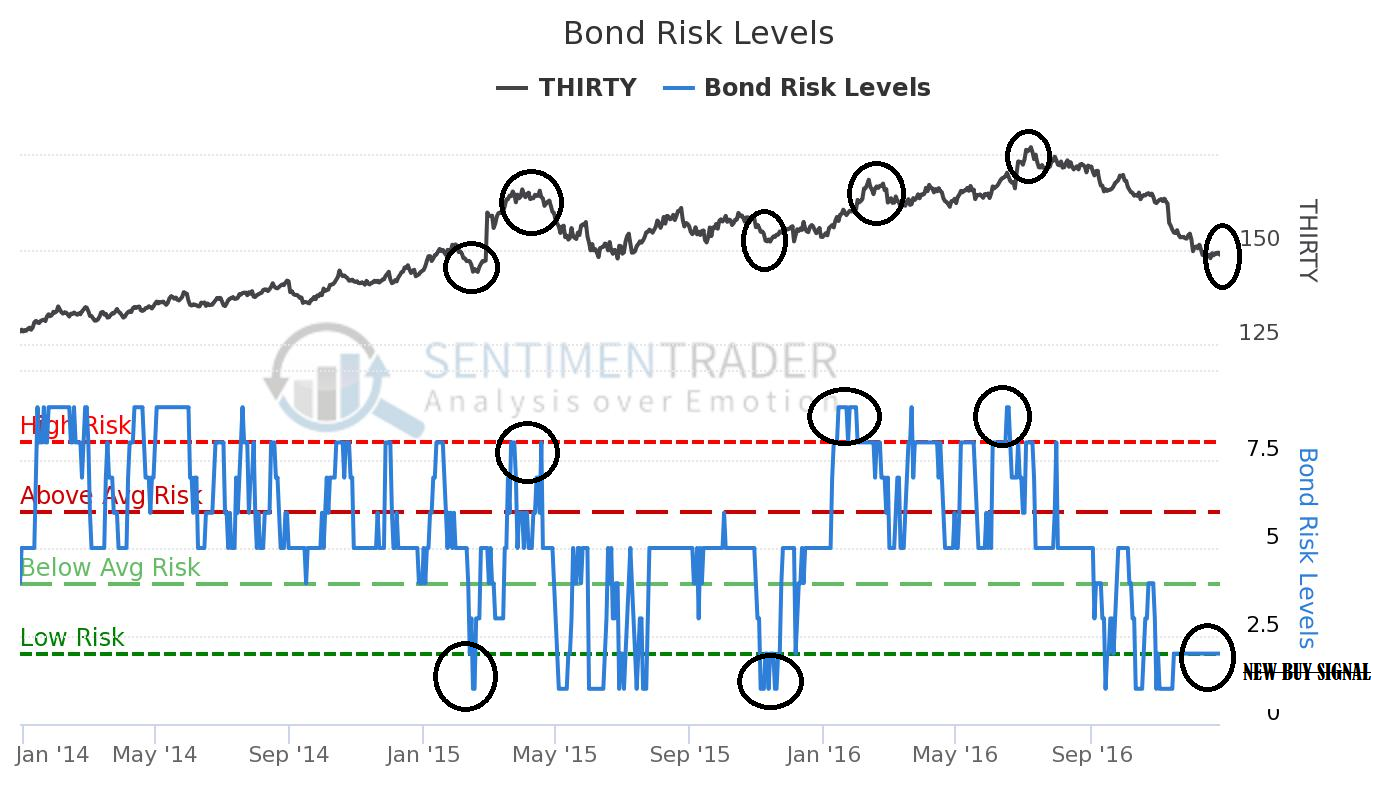

BOND RISK LEVELS

Latest Value(s):

- Last Reading: 2.0 December 27th, 2016

Extreme Values:

- Excessive Optimism: 8.0

- Excessive Pessimism: 2.0

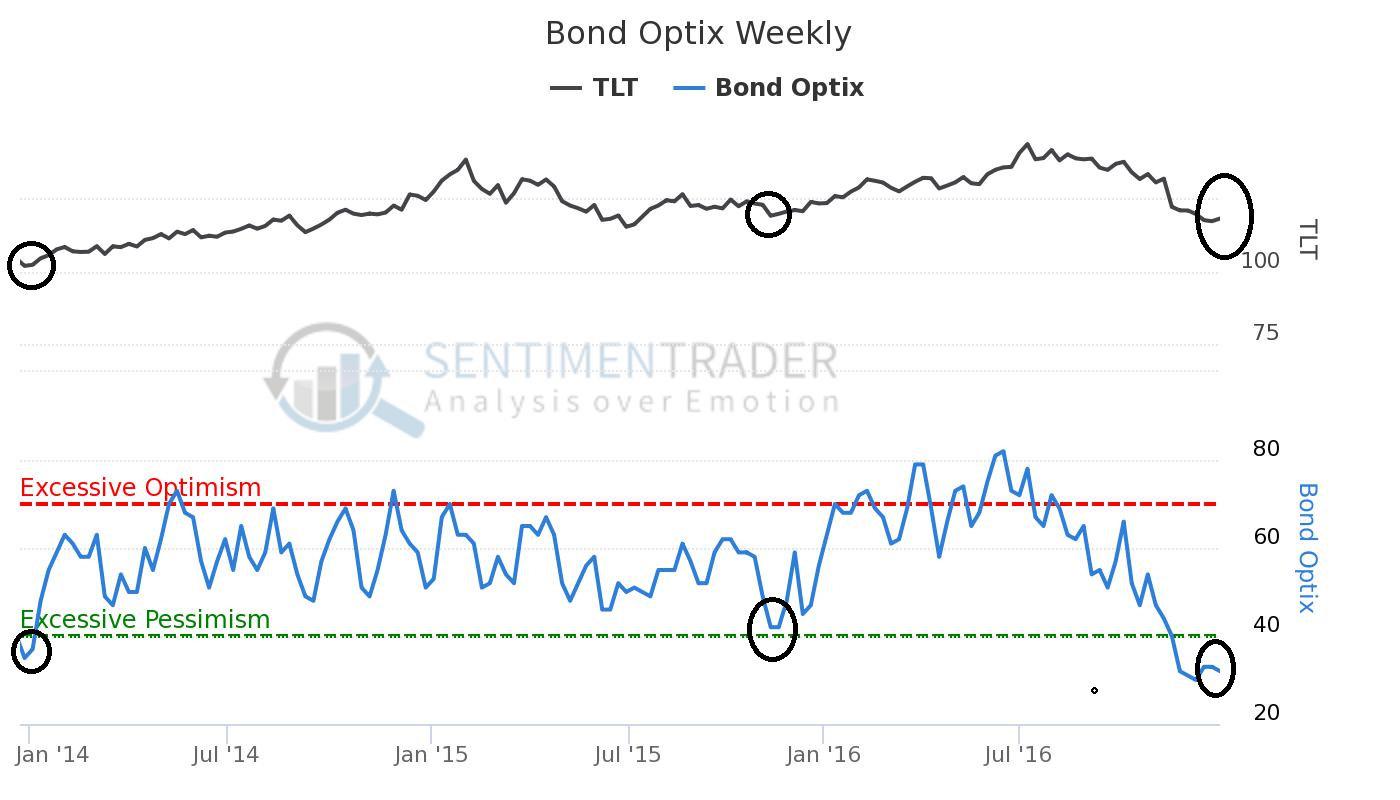

BOND OPTIX WEEKLY

Latest Value(s):

- Last Reading: 33.0 December 23rd,, 2016

Extreme Values:

- Excessive Optimism: 70.0

- Excessive Pessimism: 40.0

The Treasury prices are oversold on the March 30-year Treasury Bond futures.

The evidence is displayed with the buyers of US Treasury Bonds. I side with the commercial traders. The dramatic imbalance in positions between the commercial and speculative traders suggests a bounce higher is imminent.

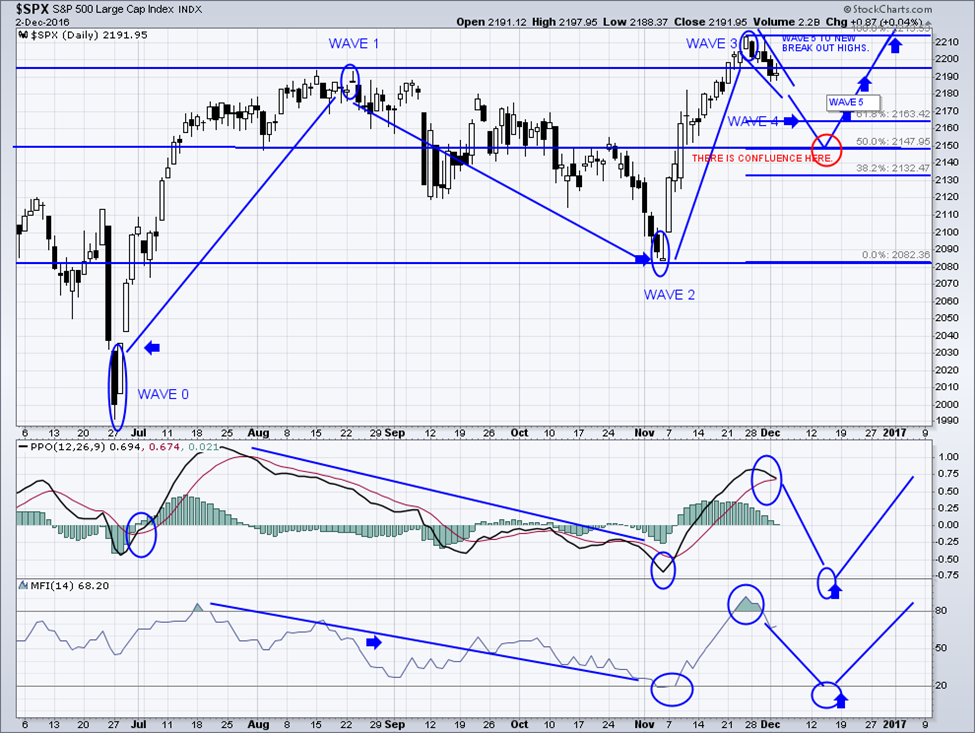

My Elliot Wave Of Bonds – TLT:

Elliott Wave 2 Theory

Elliott Wave (2) is the first correction against the new trend

Elliott Wave (2) corrects wave (1), but can never extend beyond the starting point of wave one. Typically, the news is still bad. As prices retest the prior low, bearish sentiment quickly builds, and “the crowd” haughtily reminds all that the bear market is still deeply ensconced. Still, some positive signs appear for those who are looking: volume should be lower during wave two

Elliott Wave 3 Theory

Elliott Wave (3) is usually the strongest and longest wave

Elliott Wave (3) is usually the largest and most powerful wave in a trend. The news is now positive and fundamental analysts start to raise earnings estimates. Prices rise quickly, corrections are short-lived and shallow. Anyone looking to “get in on a pullback” will likely miss the boat. Trading the Wave (3) is usually the most profitable. This will be a muti-year rally!

In Conclusion:

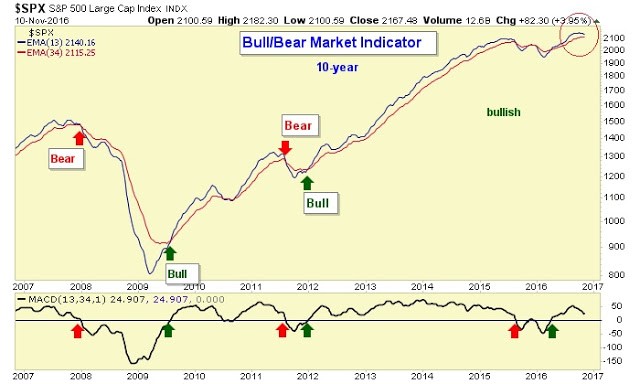

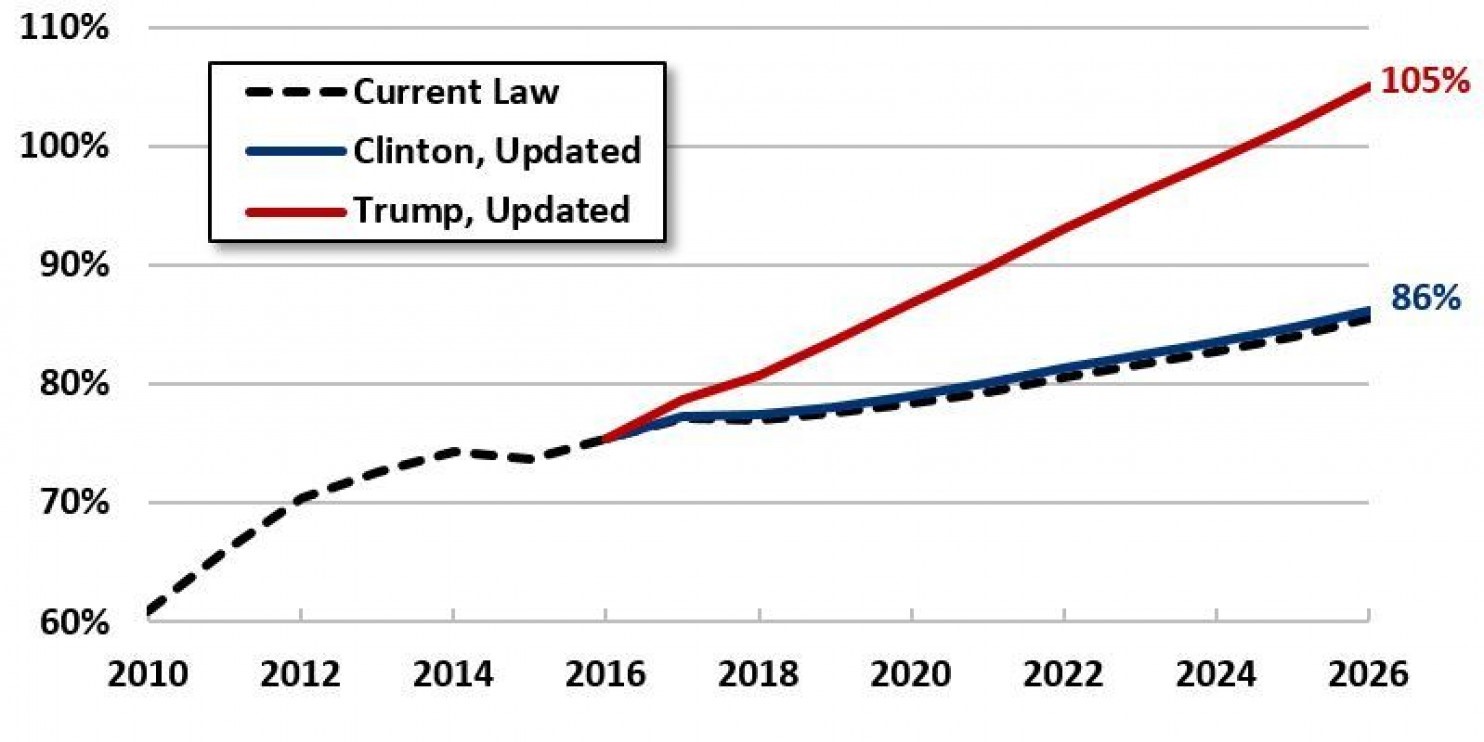

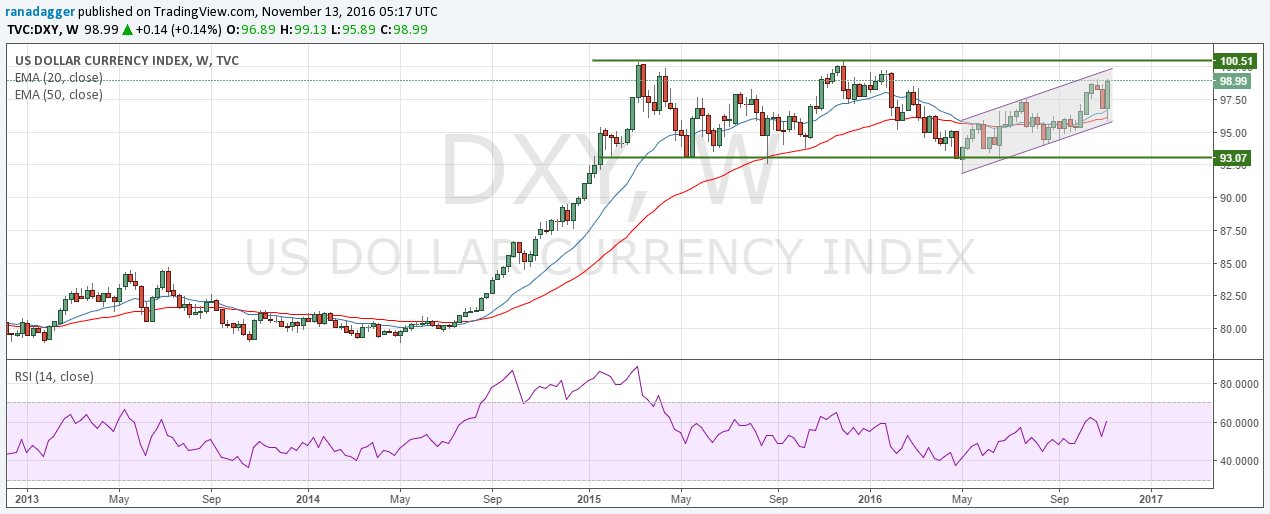

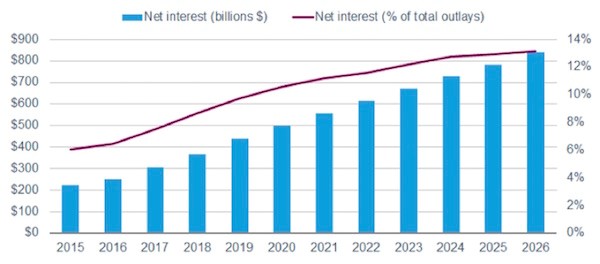

The new year of 2017 will not be a good one for global economies. There will be a big slowdown throughout the global economies. The equity markets, as well, will be extremely negative in 2017. The next yearly closing should be at a low level. The low of 2016,1800 in SPX, may be breached. The analysis is trying to say yes! Be prepared to exit your long stock positions at the midpoint of 2017 and enter “safe havens”. See my gold forecast – Click Here

Bonds should start to rise and hold up through 2017. But will only rally in a big way once there is a major global event/crisis or the later stages of a bear market in US equities. Either way, likely not going to happen till late 2017 or beyond.

Get my swing trades and long-term asset positions at www.TheGoldAndOilGuy.com

Chris Vermeulen

(

(