In the previous article, “Learning How to Profit from Theta When Trading SPX Options,” I discussed the basics of the famed option Greek, Theta. A fundamental knowledge of Theta is imperative in order to understand the mechanics and construction of option strategies. In many cases, Theta is either the profit engine or the means by which experienced option traders reduce the cost of opening a new position. Theta can even take an ETF that pays no dividend and create a monthly income stream utilizing a technique known as a covered call write.

The most exciting thing about options is their versatility. You can trade them in so many different ways. A trader can define a positions’ risk with unbelievable precision. When traded properly utilizing hard stops, options offer traders opportunities that stocks and futures simply cannot provide. Theta allows option traders to write spreads which generally offer nice returns with very limited risk.

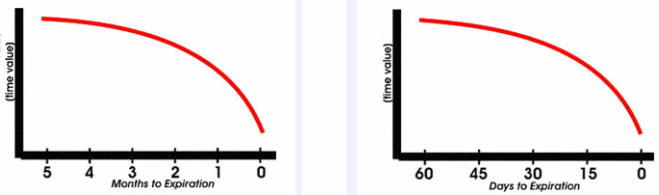

Theta is the fundamental reason behind the slow and relentless deterioration of option values over time. As a series of options gets closer to expiration, Theta becomes a very powerful force. As stated in the previous article, the final two weeks of option expiration put Theta into overdrive. Courtesy of Optionsuniversity, the two charts listed below illustrate the rapid decay of Theta.

These charts illustrate effectively that option contracts which are out of the money and consist entirely of time premium decline rapidly in value on their way to 0 potentially. While Theta must be respected, it is Theta’s relationship with implied volatility that really makes it a force that must be monitored closely.

While I will not discuss implied volatility in this article, in future articles it will gain considerable attention. Implied volatility is paramount in every decision that an option trader makes. Ignoring implied volatility and Theta is a recipe for disaster, the kind of disaster where an entire trading account is wiped out in less than 30 days. In most of the trades that I place, Theta is regularly a profit engine. I never purchase options naked, in every option trade that I construct I am utilizing some form of a spread in order to mitigate the ever present wasting away of time premium. In many cases, Theta is the driving force behind my profitability.

In any other case, Theta decreases the cost for me to purchase options allowing me to minimize my risk to an acceptable level. Vertical spreads come in two variations: debit spreads and credit spreads. A vertical spread is a multi-legged option trade which involves more than one strike price. As an example, we will assume that GLD is trading around $119/share. If I were to have placed a call credit spread trade at the close on Thursday I could have sold the GLD August 120 call strike and purchased the GLD August 121 call strike, thus receiving a credit in my account.

At current prices as I type, the August 120 call strike would have resulted in a credit to my trading account of $53 dollars while the August 121 call strike would have resulted in a debit in my account of $29 dollars with a one lot position size. If I were to place this trade, I would have a strong feeling that the price of GLD was going to decline. The reason this trade is called a vertical credit spread is because the total trade results in a credit to my account of $24 dollars less commissions. The vertical aspect of the trade is based on the arrangement of the positions on the options board, also called an option chain.

When an option trader places a credit spread, they are relying on time decay, Theta, to provide them with profits. In many cases, option traders will utilize vertical spreads to play a directional bias. In the example above, the bias on GLD would be to the downside. However, the maximum amount I can lose is limited because I purchased the 121 call. The most I can lose is $100 dollars minus the credit of $24 dollars. Thus, the worst case scenario for this call credit spread would be a loss of $76 dollars for every contract I had put on. If I had put on 5 contracts, my loss would have been limited to $380 dollars plus commissions.

A call debit spread is constructed exactly the opposite direction. If I believed that gold was going to increase in value I could buy 1 August 120 GLD call for $53 dollars and sell 1 August GLD 121 call for $29 dollars. Notice that the sale of the GLD 121 call reduces the cost of the GLD 120 call. By selling the GLD 121 call, I reduce the cost of this spread down to $26 dollars. However, my maximum gain is limited to $74 dollars minus commissions. The point of this illustration is more to focus on the way Theta helps option traders in practical situations.

When an option trader utilizes a credit spread, Theta operates as the profit engine. When an option trader does the exact opposite by placing a debit spread, Theta acts to reduce the overall cost of the spread reducing the overall risk exposure. As one can see, understanding Theta is crucial when trading options. While vertical spreads are very basic, they can provide nice returns while having the unique ability to control risk with an extremely tight leash.

In future articles, we will dissect the various option trading strategies which option traders can utilize in different situations, at different points within the option expiration cycle. While this article will conclude the basic overview of Theta, future articles will discuss intimately the key relationship that Theta and implied volatility share. In closing, I will leave you with the famous muse of Benjamin Franklin, “Time is money.”

Get our Free Weekly Options Education Articles and Options Trading Signals by joining out free newsletter at www.OptionsTradingSignals.com

Chris Vermeulen – Gold Analyst/Trader

J.W Jones – Independent Options Trader