Understanding market psychology is crucial for a trader’s success. But so many people get caught up in the daily market volatility, media coverage and “noise” of the trading environment, it’s almost impossible to not think and trade in agreement with the majority of traders.

However, effective technical analysis allows us to use trends, patterns and other indicators to evaluate the market’s current psychological state. Fortunately, this analysis can both enable us to independently forecast whether the market is heading in an upward or downward trend and do so against the grain of the majority.

It takes a disciplined trader to be able to watch and listen to the market doing one thing, filter out the noise, then do the opposite – all in a controlled manor. To this day I still find myself fighting the herd mentality at times and that is when I step away from the computer and regroup.

I have a simple rule that has saved me thousands over the years. I would rather miss a trade and learn what caused me to get confused, then to take a loss.

Rule # 1 – When in Doubt, Stay Out!

There are two types of traders:

1. Herd Mentality Trader – Someone who trades off fear and greed buying near tops and panic selling out at the bottom with the masses.

2. Black Sheep Trader – A trader who stand out from the masses and trades opposite to the “herd” during extreme levels.

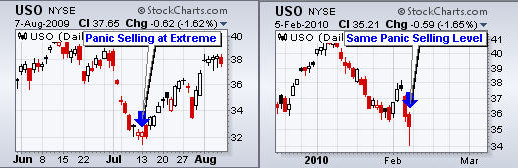

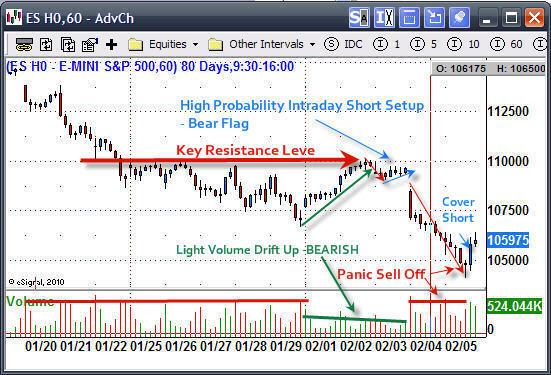

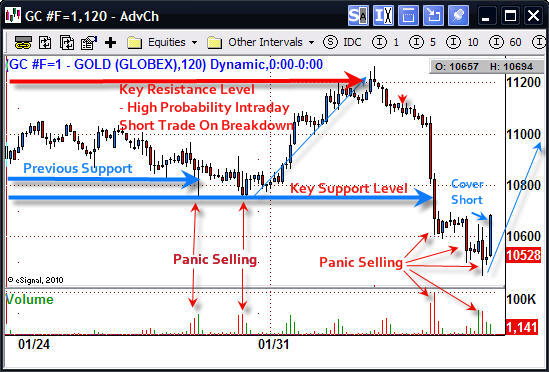

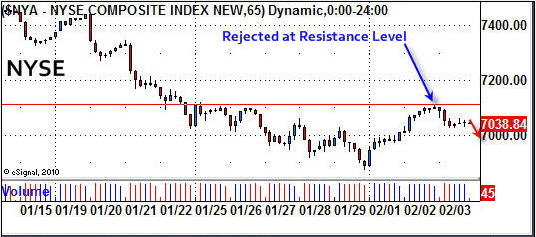

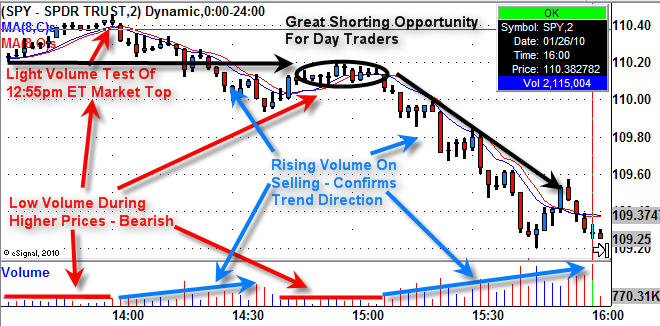

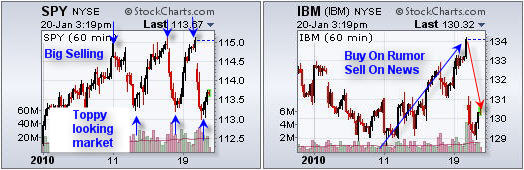

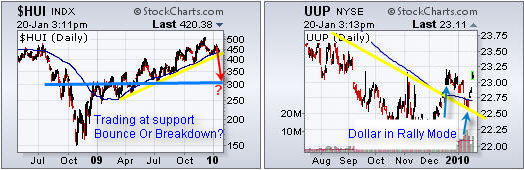

Last weeks market action really allowed us to see which way the masses were moving. The extremely high selling volume and sharp price decline notified us that the market was trading off FEAR. And, last Thursday we actually saw PANIC which tells us the balance of the market (retail investors, John Doe’s, The “Herd”) were exiting their positions.

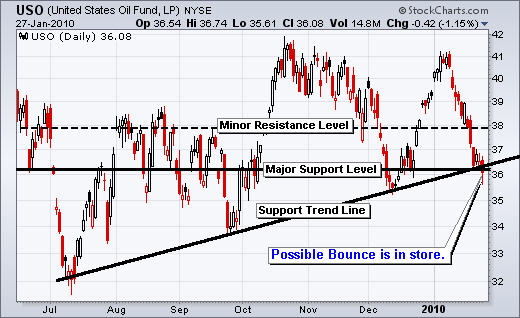

When we see this happen, it’s generally a good time to start scaling into long positions, as most of the down side has already happened.

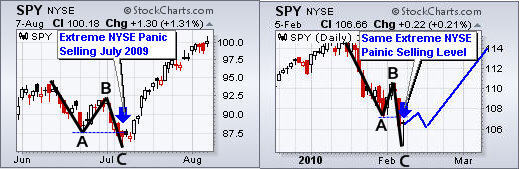

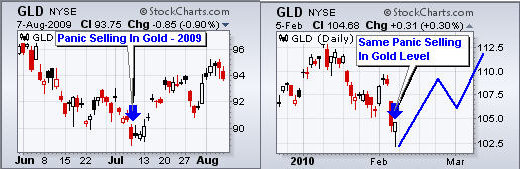

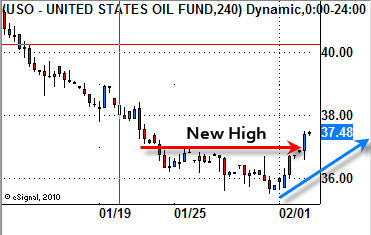

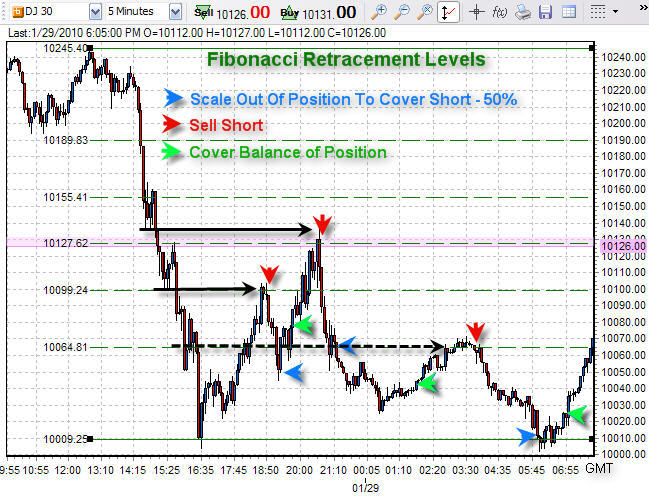

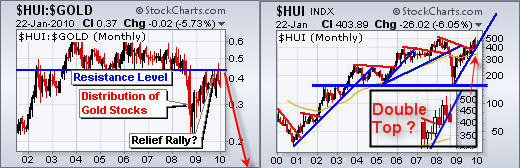

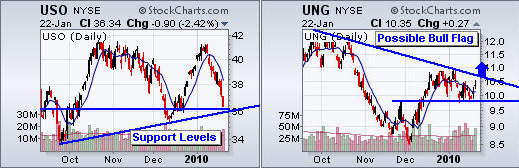

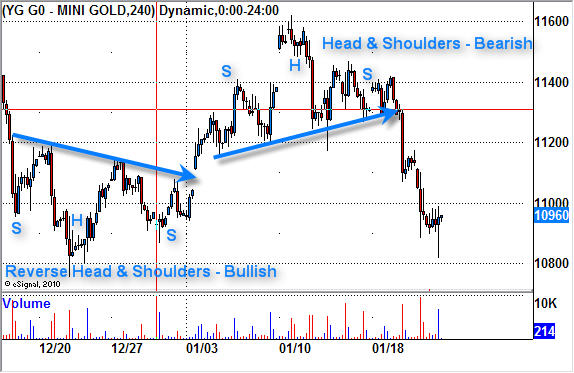

I have been talking about an ABC retrace pattern for the indexes and gold for some time and last week we got just that. An ABC retrace is when we have 3 waves which are, down, small up, then another leg down.

In short this wave breaks the uptrend of higher highs and lows, as it forms a lower low telling novice traders to sell and go short. This is what causes the high volume and sharp sell offs.

Below are a few charts showing the 2009 July lows and where we are now, February 2010:

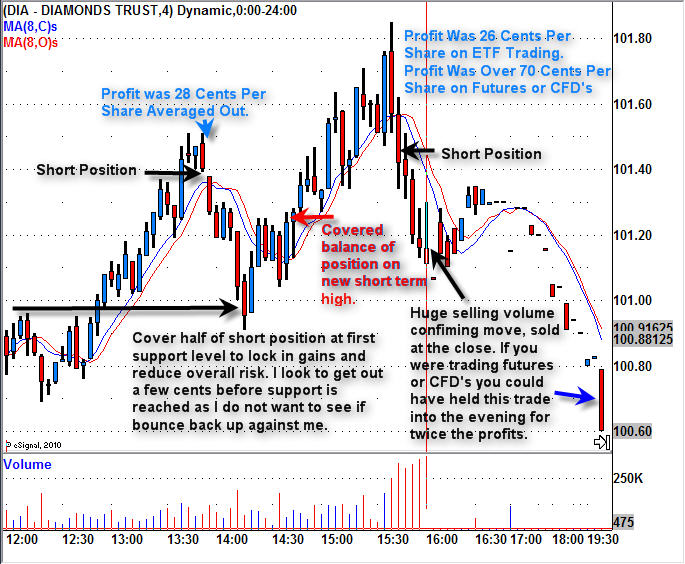

Intraday Price Action – If you want to see some exciting intraday trading charts check out the setups last week: http://www.thegoldandoilguy.com/articles/how-to-trade-intraday-gold-and-sp500/

Market Psychology Trading Conclusion:

Most get involved with the stock market because it looks like something they can quickly learn and start making money from home. But it doesn’t take long before they quickly realize there is more to trading than meets the eye.

While trading looks easy from a glance, in actuality I think its one of the toughest jobs out there.

Why? Well, this is what you are up against:

1. You are trying to predict something that is unpredictable

2. You are trading against millions of other highly skilled traders

3. You are trading against automated computers with complex algorithms

4. You are trading with your hard earned money which causes fear and greed

5. You must accept losing trades as that is part of the business

6. You must trade with a proven trading strategy and follow the system

7. You must understand money management and apply it to every trade

8. You must truly love the market cause it will break you down mentally

I don’t want to say you must be a contrarian, but in reality you must do the opposite of the masses during times of extreme price behavior.

These extremes happen on a daily basis when trading intraday charts and every 4-6 weeks when looking at daily charts. The toughest part is to pull the trigger when emotions are flying high in the market and you are looking to do the opposite. It takes several trades before you even start to get comfortable doing this.

I hope this helps shed some light on market psychology.

If you would like to Receive My Gold Trading Newsletter and Analysis please visit my website:

Chris Vermeulen

www.GoldAndOilGuy.com