What to Expect in April for Stocks & Precious Metals

I hope everyone had a great weekend and Easter Holiday!

This is quick update as its Easter Sunday and it’s a time to relax with the family 🙂

Below are two charts and my thoughts on what I am looking for in the coming days and weeks.

Gold Exchange Traded Fund – Daily Chart

As you can see the price action of gold has been trading within a few patterns the past couple months. First we saw a nice ABC Retrace correction and now it looks like a possible reverse Head & Shoulders or Wedge pattern is forming.

All three of these patterns are bullish but resistance must be overcome before I will start putting my money to work.

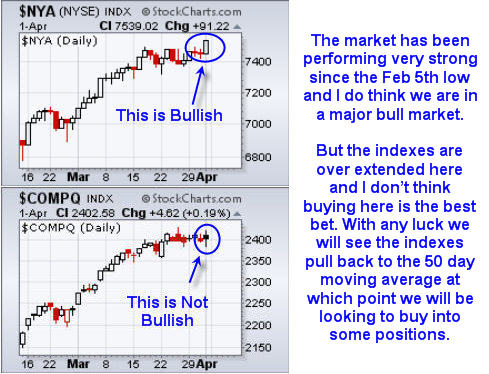

NYSE & NASDAQ Indexes – Daily Charts

We saw the broad market trade sideways for the majority of the week. As usual we had a pre-holiday pop in prices with the week closing slightly positive for stocks. These gains are generally given back the following week as volume picks back up.

The one thing that has me scratching my head is that the major indexes like SP500, Dow, NASDAQ and Russell 2000, all stayed below their previous weeks high. But the NYSE as shown below as the top chart clearly broke out to a new high.

I look at the NYSE as leading indicator and this makes me think we could see stocks grind higher right into earning season. All we can do at this point is wait for more data points on the chart and continue analyzing the market one day at a time.

Weekend Trading Conclusion:

As I mentioned last week, the market is over extended as we enter earning season. The market is in the same situation as we saw going into the January earning season.

I do not think we will have a huge pullback but I think a 3-5% correction is likely in the coming days or week. Once we get a pullback we should see support around the 30 or 50 day moving averages and then see the market head toward new highs once again.

The precious metals sector is getting a lot of attention because of the whistle blower on JP Morgan stating that metals are seriously manipulated with a huge amount of short positions still in place. I think this could be helping this sector and I hope we get a low risk setup in the coming week or two.

If you would like to Receive My ETF Trading Signals please visit my website at http://www.thegoldandoilguy.com/specialoffer/signup.html

Chris Vermeulen