The Next Market Move Investors Don’t Expect

The strong rally in the US Dollar since the past year has led to commodity markets selling off as investors pursued the equity markets led by years of accommodative monetary policy in a search for higher yielding assets. However, what goes up must eventually come down and the US Dollar is no different. With the markets trading at extremes the markets are likely to see a correction in the near term as the US Fed prepares for interest rate liftoff this December. Given the current monetary policy conditions and the markets being prepped for a rate hike, there is further upside to the UUP while the price of Gold continues to decline to new multi-year lows.

UUP – Powershares DB US Dollar Index

The UUP Powershares DB ETF which tracks the trade weighted US Dollar Index has gained a further 5.56% on a year-to-date basis, while rallying a massive 18.06% since early 2014. The strong momentum in the US Dollar Index was largely due to the efforts by the US Federal Reserve which deployed the unconventional monetary policy tools, the QE or Quantitative Easing in a bid to stimulate the economy. While the UUP has been on a strong parabolic uptrend, commodity markets have been trending lower, clearly reflecting the deflationary pressures, or rather the lack of inflation.

The UUP touched multi-year highs of 26.50 around March this year as the Fed prepared the markets for a potential rate hike (which got kicked down the calendar and is now slated for an imminent rate hike in December).

UUP recently broke out from its large descending triangle pattern and also closed above the short term support/resistance level at 25.65 – 25.7. Marking the minor trend line connecting the lows of 14th October, 24.43 and 2nd November 25.18, the steep rising trend line will be an important trend line to watch. As long as prices hold above the trend line, UUP could see further upside with the most immediate target coming in at 26.50.

To the downside, support comes in at 25.75, which if tested can offer a good price level to enter long on the UUP.

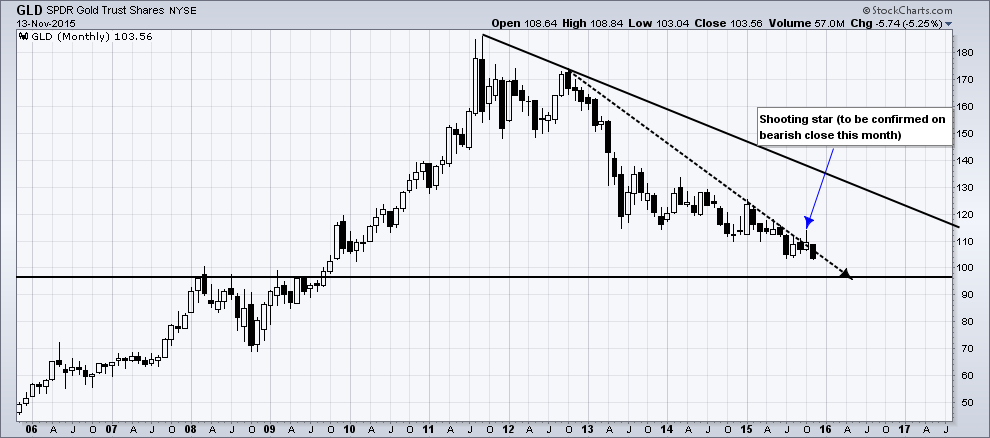

GLD – SPDR Gold Shares ETF

The SPDR Gold shares ETF, on the weekly charts shows that Gold prices have been trending in a gradual downtrend with the most recent price action attempting to break out from the minor trend line, but failure to hold above the trend line break saw a strong decline lower. There is a long term support/resistance at 98.71 region, which looks to be quite likely to be tested in the next month or two. A dip to the 98.71 will most likely offer a bounce back higher.

Looking at both the UUP and the GLD charts, it is quite certain that we can expect to see the US Dollar continue to trend higher, although the momentum is slowing down in UUP. Likewise, GLD is trading close to the 98.71 level. An interesting view is that the GLD’s monthly chart is the shooting star pattern that has been formed. Although we need a confirmation by having a bearish close this month (November 2015), the shooting star pattern validates by the rejection of the minor trend line. A dip down to 98.71 would confirm the multi-year correction, which should potentially mark a bottom in Gold prices.

To conclude, the UUP US Dollar is trading close to multi-year resistance levels and a breakout to the upside would send a shocking blow to gold, silver and other countries.

The Fed Rate & Dollar Will Move the World

The US Dollar rallied to 100.36 in the European trading session last night. It is re-testing the yearly high of 100.39 made on March 13, 2015. That was its highest level since April 2003. As the US Dollar rallied, gold and silver continued to fall. Both made new 5-6 year lows last week, with silver dropping to $13.85/oz. on Monday, November 23 2015, and Gold testing $1050/oz. on Friday, November 27, 2015.

World equity markets continued their rallies last week, with many reaching their highest levels since early August 2015. The SPX resumed it “corrective” uptrend in order to complete the final last stage of this past bull market. Entering December this week, market watchers will intensely focus on what the Federal Reserve Board will do with their short-term rates. It seems almost a given that they will announce a rate hike. This Friday, December 4, 2015, the payroll report could likely be the catalyst for that decision.

With ‘global growth’ occurring worldwide, why are central banks around the world continuing to hit the panic button?

Europe, Japan, Sweden and Switzerland are continuing to devalue their currencies and cut interest rates to record lows, while others seem to be resorting to negative interest rates in order to stimulate growth. This is not supposed to be happening after seven years of ‘economic recovery’.

The FED could raise rates in December 2015. If they do, this could throw the U.S. economy into a depression.

The FED has been telegraphing the markets, implying that they are going to raise the FED Funds rate by 25 basis points next month during their December 2015 FED Meeting. The financial markets think they are serious this time and, therefore, have been pricing in this 25 basis point rate hike for the past six weeks.

The FED has told us that they have been ‘data-dependent’ for the past seven years, regarding changes to monetary policy. So, the real questions are; what has really changed in economic data, for the positive? Why now, of all times, do they decide to raise rates? Are they raising rates for the right reasons?

The above are just some of my concerns as the FED embarks upon their final FOMC Meeting on December 16th, 2015.

Is the FED motivated to raise rates now, just to show that they can actually raise rates? It is obvious to everyone in the global financial markets that there is no need to raise rates. Actually, the FED should have raised rates three or four years ago or, at the very least, last year when GDP was more robust during the second half of 2014. Despite them being ‘data-dependent’, the FED missed their opportunity to raise rates then, according to economic data and the overall global economic environment.

With the prolonged weakness in oil prices continuing to keep inflation low, all central banks around the world are expected to further loosen monetary policy.

Mario Draghi, president of the European Central Bank, paved the way for an extension of QE. The Bank of Japan may well decide to go the same way, to bring inflation back to target. In China, the central bank may also cut rates further to stimulate growth. The outlook for emerging markets is harder to gauge. If a FED hike were to trigger turmoil across Africa, Asia and Latin America, countries there may choose to cut rates to help the economy, or increase them in order to deter investors from taking their money abroad.

Higher U.S. interest rates translates to a stronger U.S. Dollar that will depress the value of emerging market currencies, at a time when many emerging economies are already weakening; their currencies have already slumped against the greenback. The FED’s rate rise could exacerbate the emerging economies currency turmoil, and even help precipitate a full-blown crisis.

Even before the most powerful central bank in the world makes a move, the effects are reverberating throughout the global economy. While there’s a supposed probability of roughly 75% that the FED will raise rates, there is still a lot of skepticism. An economic nightmare seems to be unfolding and there is nothing we can do about it but be prepared with our investments to ride out the storm the best we can.

HOLIDAY SPECIAL

LEARN HOW TO PROFIT FROM THE COMING COLLAPSE:

WWW.THEGOLDANDOILGUY.COM

Chris Vermeulen