Silver Jumps As Equities Near Major Market Top Next Week

This analysis is by Mike Swanson as we share a similar outlook on the various markets. Last week we saw a nasty drop in the stock market following the BREXIT vote, but this week it has rebounded.

I am surprised by the size of the move up from the S&P 500 2000 area for sure and have gotten several emails asking me what I think of the US stock market now.

My view really hasn’t changed about the markets from where it was before the BREXIT vote.

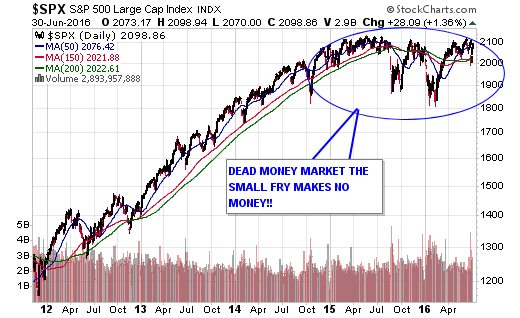

I see the stock market as completely dead money for most people as it has been for well over a year while gold and silver are in new bull markets.

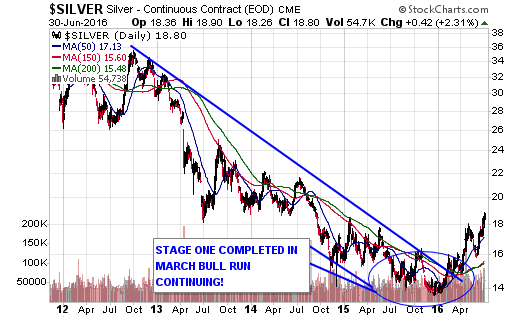

Yesterday silver had a big surge as it smashed through $19.00 an ounce.

Money is to be made in such moves!

Mining stocks have been the best performing sector of the market this year in the entire stock market.

Gold of course is up again in pre-market action.

In the past week gold cleared $1,300 an ounce.

Gold, silver, and mining stocks have totally broken away from the US stock market.

They are acting as safety trades for people who want to get out of stocks and bonds, but are also acting as pure momentum plays for people who want to invest at the start of new bull markets to grow their brokerage accounts.

Most American investors though are totally ignoring them as they remain fully invested in the US stock market too lethargic to make any changes and mesmerized by the up and down action and CNBC calls for massive gains to come.

But CNBC bubble bulls have been making such predictions for over a year while those fully invested in the US stock market are making no money.

To make meaningful money in a market you need that market to make a new high and then keep going higher, but the US stock market has not done that in a long time now.

It’s in a giant topping pattern.

Look at this.

The big high volume drop in the market that hit recently made me get worried about the stock market small fry who is fully invested in the market.

I see it as a bullet that hit the market much like the August and January drops did.

These hits damage the internals of the market and convince me that the topping pattern will lead to a collapse.

So a few days ago I told people that they should reduce their long exposure and do some serious selling.

And GET OFF MARGIN.

The market bounced though so no one is going to listen to any warnings.

Yet what is crazy is that there is money to be made going long silver and gold that these people simply won’t take advantage of.

A lot of exciting things are happening with gold and gold is quickly becoming the necessary investment to own in a portfolio and the safest thing to trade.

It is in fact stock market problems that is also making gold ownership a necessity.

Like you I have seen the boom of 1999 and the bust of 2008 and the wild moves of the past few months in the US stock market.

And I have seen the Federal Reserve take action to make the stock market go up.

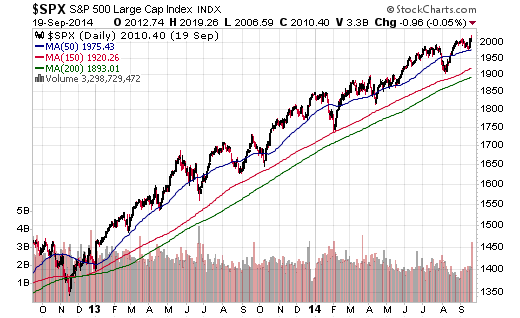

In 2008 the Federal Reserve lowered rates to zero and in 2009 it began money printing operations called quantitative easing to force the stock market back up after it crashed.

And they did this in 2010 and 2012 in order to keep it up too.

In fact after they did it in 2012 the stock market went up for two years at a forty-five degree angle without ever pulling back.

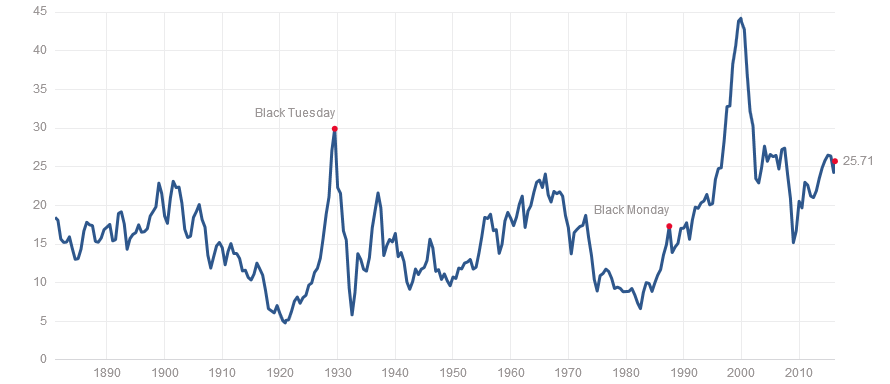

Look at this chart and you can see what I mean.

The stock market had never traded like that before in it’s history.

It had never gone up like that for so long without a real correction before.

This was the impact of Federal Reserve manipulation through its money printing.

And as long as the stock market continued to go up like this people had fun, because it seemed like it was easy to make money in it.

But then in 2015 the stock market stalled out and the stairway to heaven came to an end and it has not made a new high ever since. It’s just wobbling. Oh it has big rallies after big drops, but all that is happening is people lose money than make it back and lose again.

You need real bull markets in which a market makes a new high and keeps going up for real for people to make good money.

So now all people are doing is watching the stock market make these big swings up and down as it goes nowhere leaving them feeling confused by the market.

The tough reality is that very few people are making any money in the stock market anymore and most people have no idea what to do with the market to make money now.

But most are not even sure that they know what is happening to the financial markets.

First you need to know that there are three things that have happened to make the stock market behave like this.

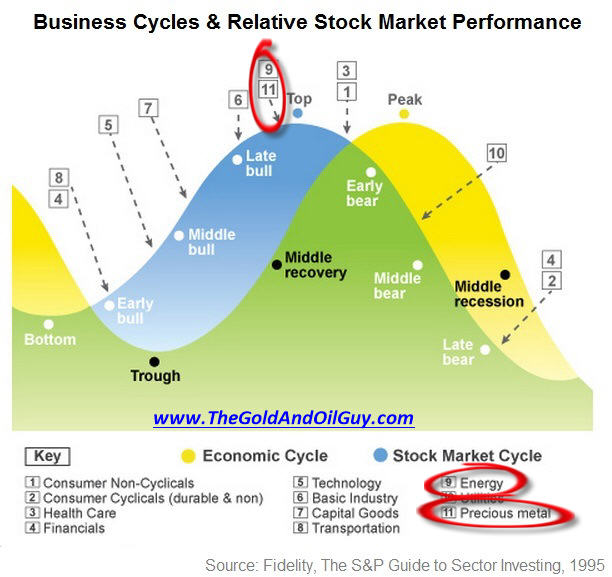

Financial markets move in bull and bear cycles.

I call them stages and you can tell what type of risks you are taking for what potential return by identifying what stage in a financial market you are in.

There are four stages to a financial market cycle in a stock or entire financial market. As you know you can have a bull market. Before a bull market starts though you usually have a stage one basing phase in which a market simply goes sideways and builds a base.

Then it breaks out and begins a full blown stage two bull market that typically lasts for several years. Then there is a stage three topping phase and then a stage four bear market.

I can quickly show you one important indicator to watch to identify the trend the market is in.

That’s the long-term 150-day moving average, which is simply a line plotted on a chart using the average price number of the past 150-days.

In a bull market this line slopes up on a chart and the price of the market tends to stay above it, so it acts as a nice price support level in a bull market to make for a good entry point timing mechanism.

In a bear market this line slopes down on a chart and the price of the market tends to stay below it and it acts as resistance.

The stock market was in a stage two advance way back in 2013 and 2014 and that was a long time ago.

But now the long-term moving averages are going sideways to down so the times have changed.

But the stock market did go up so much in that big bull market run that it became overvalued from a valuation standpoint.

In terms of the cyclically adjusted P/E ratio in fact it had only reached a valuation level like this three times in its prior history.

Those times were in 1929, 1999, and in 2007.

The simple fact of the matter is that the more highly valued a stock or market gets the more risky it becomes.

So the market is actually at risk of suffering from more stock market drops.

But this situation is now happening to stock markets all over the world and you have been seeing constant central bank interventions to try to manipulate the markets and prop them up.

But these moves are not all working anymore.

The stock market in China has crashed, despite government action there.

And in January the Japanese Central Bank announced a giant money printing operation to try to make their market go up.

But all it did was pop and dump.

Then just a few months ago the European Central Bank announced a giant money printing program of their own and the markets have done nothing over there.

Those markets have since gone done.

The problem is that such programs cannot create brand new giant bull markets at this stage of the market cycle.

But they do create big moves up that last weeks and sometimes months and so far have kept the US stock market afloat.

But the big swings up and down are confusing to most people and so in the end they do not make any money out of this, because it’s hard to catch a good wave that lasts.

So most people are just caught in this central bank money trap spinning their wheels not knowing what to do and taking more risks every day to make nothing.

The reality is the stock market is becoming a big mess.

But there is a solution to this problem.

This solution is to own gold.

And today gold is easy to own and trade in any brokerage account with exchange traded funds and you can buy mining stocks that mine gold for extra juice.

I am personally making a lot of money this year and a big reason why is because I am invested in gold and mining stocks.

I want you to get involved in these markets, but almost all of the emails I get are just from people bullish on the stock market who want it to go up for them and get angry when warned about the risks they are taking.

They are being lazy when if they took the time to get learn about gold and get involved in it they could be making money.

But it isn’t just the risk of losing money they face, but simply missing out on making money in real bull markets.

Let me make a big point.

A few years ago if you watched CNBC and Mad Money Cramer and the Fast Money boys like pony tail you would see them recommend momentum stocks that made new highs as buys.

Often those stocks would breakout of their highs keep going up.

They no longer do that.

So now they look for bottoms and “rebounds” in stocks to buy.

That is a very difficult way to make money.

This shows the difference in the market structure now.

You see the momentum of new highs and higher highs is now in gold, silver, and mining stocks.

So they are the place to be along with a few others…