ETF Trading for GLD, SLV, UNG, USO Funds

Commodity ETF trading charts allow us to track and trade the underlying commodities with ease. I have provided a few daily charts to show were current commodity prices and chart pattern are at.

GLD Gold ETF Trading – Daily Chart

As you can see from the chart below GLD had a nice 4 day rally breaking out of a longer term pattern (weekly chart – pennant pattern). This bullish action triggered several different types of traders/investors to buy into the move including us. After taking some short term profits we continue to hold a core position with a stop in place to lock in more profit if we see the GLD ETF move lower from here.

Interest for GLD is decreasing which you can see from the volume divergence on the chart. This is a bearish sign, but we remain long until the price action tells us to get out and wait for a new short term trade.

GLD ETF Trading Newsletter

SLV Silver ETF Trading – Daily Chart

SLV ETF has been trending upwards for about a month and is now trading in the middle of its trend channel. We could see silver trade sideway or down for a couple days as the price consolidates. We continue to hold a core position and wait for a technical breakdown to lock in more profit, or have other possible low risk setups to add more to our position.

SLV ETF Trading Newsletter

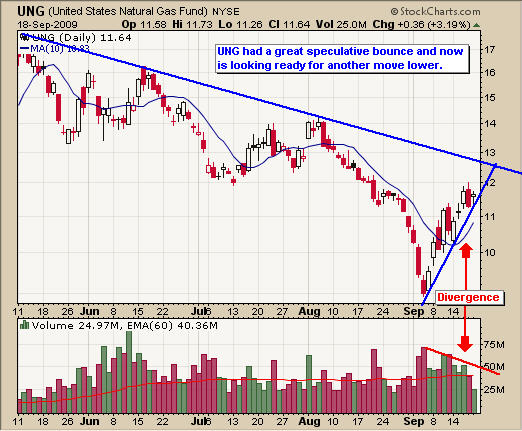

UNG ETF Trading – Daily Chart

The UNG etf looks like it may be ready for a pullback and shorting this fund or buying a nat gas bear fund could be a good trade in the coming days. Notice the two price moves lower back in May & July. They were both followed by two bounces before making another leg lower. UNG could easily move up to $12.50 level but a technical breakdown will trigger speculative sellers. Shorting a fund like this which has terrible contango can actually help improve your returns. I will post an update for members if we have a short play on it later this week.

UNg ETF Trading Newsletter

USO ETF Trading – Daily Chart

USO etf trading has been slow in the past couple months because of the sideways price action. With any luck we may get a low risk buy signal before the longer term (weekly Chart – Pennant Pattern) breakout, which will trigger speculative traders to buy oil again. I continue to follow this fund for potential buy signals for my clients.

USO ET Trading Newsletter

USO, UNG, SLV and GLD ETF Trading Conclusion:

GLD traders should be ready to take profits if we see a continued move lower below our blue trend channel. I am always sure I do not take a loss on a trade once it becomes profitable by 2% or more and this is the key to consistent gains.

SLV ETF traders have been rewarded nicely in the past couple weeks. The price of silver has more room to fall before breaking down or bouncing so wait for one or the other before jumping. Following a trading model allows you to make consistent returns and catch large rallies over time for much larger gains. But you must follow the charts with a technical eye and discipline.

UNG traders had a very nice 25% rally from the perfect waterfall sell off a few weeks back. The price is now getting close to a resistance level so tighten your stops to lock in maximum gains before the price rolls over. I may have a short play for this commodity if we get a proper setup.

USO crude oil traders have been twiddling their thumbs as they wait for a breakdown or new rally higher. This chart pattern looks similar to the GLD breakout we had so oil could put in a much larger percent move than GLD with any luck in the coming months.

In short we continue to hold our positions and ride the market with protective stops in place. Lest see what happens this week.

If you would like to receive my Free Weekly Trading Reports via email please enter your email address on my website: www.GoldAndOilGuy.com or Stock Trading Reports at www.ActiveTradingPartner.com

Chris Vermeulen