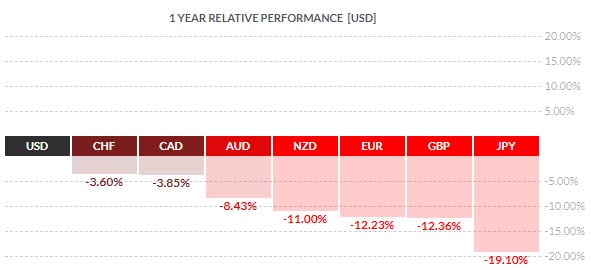

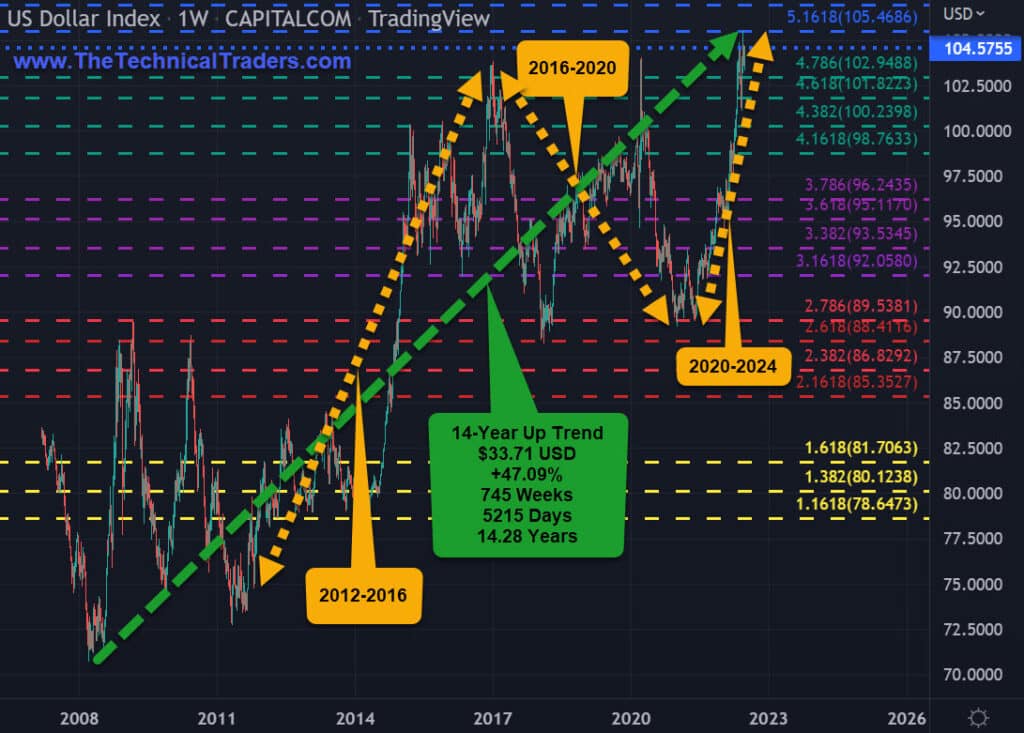

The U.S. Dollar is one market that continues to stand out as a stronghold for traders and investors. The world’s primary reserve currency, the USD, remains solidly above all other major global currencies.

As we move into the summer, the stock indices have not only been choppy but continue to trend lower.

Commodities, metals, and energy appear to be topping and experiencing distribution.

Cash is King as traders are now placing a value on liquidity. As losses mount and capital evaporates, traders are liquidating many different assets to meet margin calls and raise needed cash.

Going to cash and salvaging what is left is a survivalist strategy. It has many benefits providing peace of mind as well as the future potential to generate significant returns down the road. If a trader does nothing and their capital continues to evaporate, it can be fatal to a trader’s overall attitude and hinder their ability to generate future profits.

Markets go up, and markets go down. What makes the big difference is how we manage risk and how well we do in following the direction of price. Knowing and controlling one’s emotions dictates how long we can play the game or how successful we will be.

Now is not a good time for traders to become complacent or ignore their basic money management and risk principles.

U.S. DOLLAR 14-YEAR UP TREND

- U.S. Dollar has been up 14.28 years from 2008 to 2022.

- 2012-2016 U.S. Presidential Cycle: USD appreciated +37.20%

- 2016-2020 U.S. Presidential Cycle: USD depreciated – 12.80%

- 2020-2022 U.S. Presidential Cycle: USD appreciated +17.35% to date

- U.S. Dollar New 14-year high

US DOLLAR INDEX • DXY • CAPITALCOM • WEEKLY

U.S. DOLLAR ‘UUP’ ETF +16.96%

- January 6, 2021, to present USD ETF UUP + 16.96%

- Pullbacks or corrections have typically been 3-4%

- Pullbacks or corrections have typically lasted 20-50 days

- Price target extensions for potential resistance are at $36, $42, & $48

INVESCO DB USD INDEX BULLISH FUND ETF • UUP • ARCA • DAILY

U.S. DOLLAR VS U.S. EQUITY INDICES

- Comparative Percentage Chart: U.S. Dollar ETF VS U.S. Equity Indices ETFs

- Timeframe: January 6, 2021, to present

- 372 bars, 539 days, 77 weeks, 17.9 months, or 1.47 years

- +10.65% USDU ETF: Wisdom Tree Bloomberg U.S. Dollar Bullish Fund

- +2.75% SPY ETF: S&P 500

- +2.61% DIA ETF: Dow Jones Industrial Average

- -8.15% QQQ ETF: Nasdaq 100

- -12.01% IWM ETF: Russell 2000

- Maximum spread equals 22.66% (+10.65% USDU vs -12.01% IWM)

- Forecast is that the spread will continue to expand

WISDOMTREE BLOOMBERG U.S. DOLLAR BULLISH FUND • USDU • ARCA • DAILY

VALUABLE INSIGHTS FROM SUCCESSFUL TRADERS

Market Wizards by Jack D Schwager (www.Amazon.com) is packed with insights from successful traders who have shared their wisdom based on firsthand trading experiences. Here are a few of our favorites:

Tom Baldwin:

- “My secret to trading success is perseverance.”

- “You have to love it to do it.”

- “You cannot let ego get in the way of a trade that is a loser; you have to swallow your pride and get out.”

Tony Saliba:

- “You can make money in any kind of market if you are using the right strategy.”

- “I scale in and scale out of my positions so that I can spread out my risk.”

- “I do not like to do all of my orders at any one price in or out.”

Dr. Van K Tharp:

- “Good rules, cut your losses short and let your profits run.”

- “Stress is not good as our brains have limited capacity in processing information and can shut down during periods of high stress.”

- “You have to take some hits if you are going to be successful, just keep them small.”

- “Many people allow their emotions to control their trading.”

LEARN FROM OUR TEAM OF SEASONED TRADERS

In today’s market environment, it’s imperative to assess our trading plans, portfolio holdings, and cash reserves. As professional technical traders, we always follow price. At first glance, this seems very straightforward and simple. But emotions can interfere with a trader’s success when they buck the trend (price). Remember, our ego aside protecting our hard-earned capital is essential to our survival and success.

Successfully managing our drawdowns ensures our trading success. The larger the loss, the more difficult it will be to make up. Consider the following:

- A loss of 10% requires an 11% gain to recover.

- A 50% loss requires a 100% gain to recover.

- A 60% loss requires an even more daunting 150% gain to simply break even.

Recovery time also varies significantly depending upon the magnitude of the drawdown:

- A 10% drawdown can typically be recovered in weeks to a few months.

- A 50% drawdown may take many years to recover.

Depending on a trader’s age, they may not have the time to wait nor the patience for a market recovery. Successful traders know it’s critical to keep drawdowns with reason, as most have learned this principle the hard way.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

We invite you to join our group of active traders who invest conservatively together. They learn and profit from our three ETF Technical Trading Strategies. We