Investors around the globe are concerned with the economic outlook, not only with the United States but with virtually every country. This has caused not only investors but banks and countries to start buying gold & silver in order to be protected incase of a currency melt down in the coming years. The price of gold continues to rise because investors are not selling gold, instead holding it for long term gains/profits.

While the majority is concerned about the eroding economy, we have seen the opposite in the financial market. Gold and equities have risen… That being said the volume in the market remains light simply because the average investor is no longer putting money into the market for long term growth. Instead individuals are now focusing on saving and paying down debt.

That being said we all know light volume market conditions allow Wall Street powerhouses to bid the market up. Not to mention with quantitative easing taking place I’m sure that has also helped the market of late. While we don’t know for sure that QE is taking place as we speak, the sharp drop in the dollar and strong move up in gold are pricing this into the market.

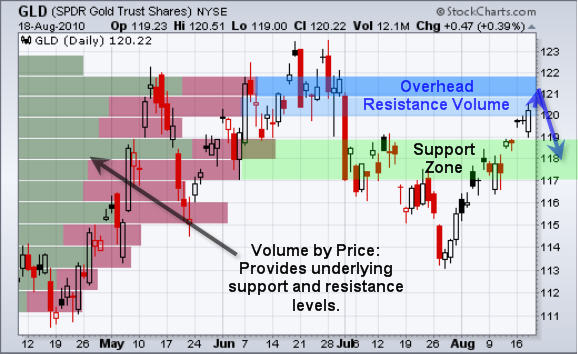

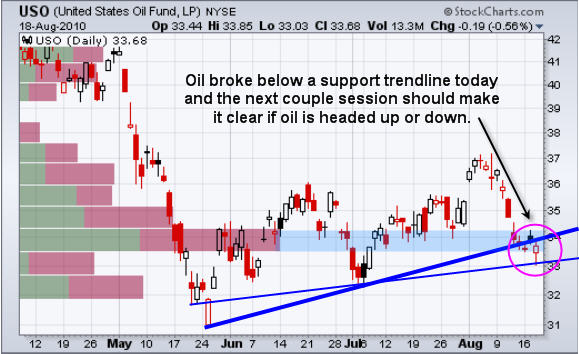

Let’s take a look at some charts…

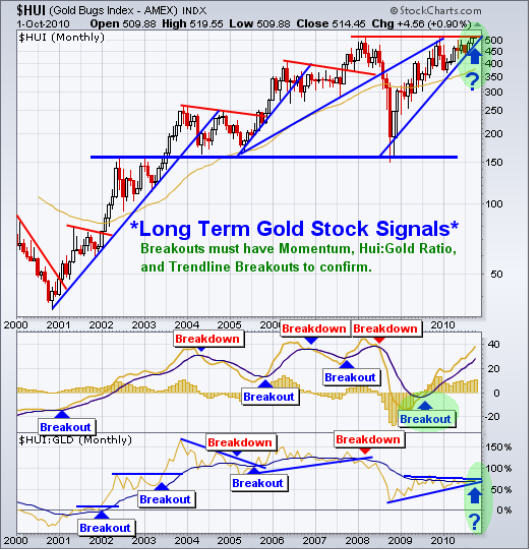

HUI – Gold Stock Index

This long term monthly chart of the HUI index provides valuable trading signals for both gold stocks and gold bullion. As you can see below this index is trading at a key resistance level after forming a bullish 3 year Cup & Handle pattern. The next 1-2 months for the precious metals sector will be interesting as it tries to break above key resistance. I would really like to see the HUI:GLD ratio break to the upside to confirm if the breakout occurs.

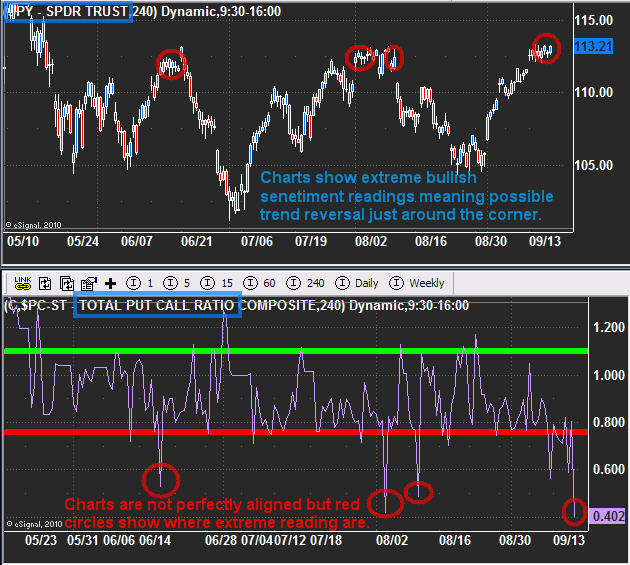

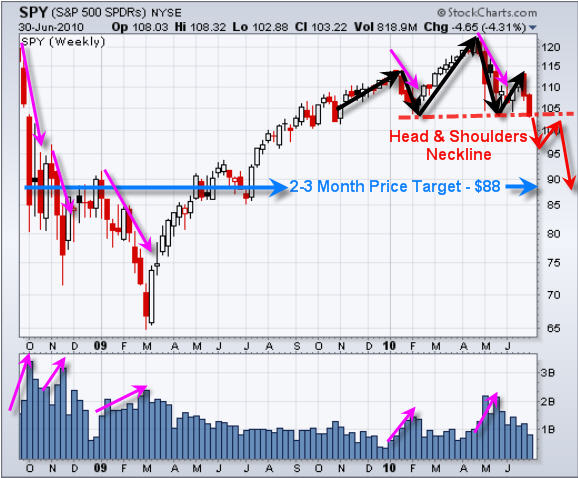

SPY – Daily Long Term Trend

The broad market looks to be forming a short term topping wedge. If this is to occurI expect it to take several weeks to play out. Looking at the chart if we use Fibonacci retracements along with trend line support we can get a feel for where this pullback should correct to.

That being said the broad market breadth and internals seem to be holding up indicating higher prices over the long run. While the short term price action is overbought and I expect a pullback to form, my analysis is pointing to higher prices as we go into year end.

UUP – US Dollar Daily Price Action

Although the majority of investors have a bearish outlook on the economy, we have seen a large price appreciation in equities and precious metals. This is largely due to the fact that the US dollar is quickly getting devalued. Simply put, as the dollar drops, it helps boost commodities and stock prices.

While a rising stock market is great to see, at some point the dollar will become so cheap that it will start to have a very negative affect on the US economy, commodities and stocks. Being from Canada it has always been more expensive to take holidays in the United States, and I remember paying $1.50-$1.70 for every $1 green back. But now the dollar is almost at par making holidays very affordable. The big question/concern is when will they ease off on the printing? At the rate which they are printing the greenback will be at par with peso… well not that extreme but you get the point Eh!

Weekend Market Conclusion:

As we all know the market has a way of making sure the majority of traders miss major turning points. The saying is, “If the market doesn’t shake you out, it will wear you out” and it seems we are getting the later…

The never ending grind higher in precious metals has not had any big shakeouts, rather its wearing out any short positions before rolling over to take a breather. As for the stock market, we are getting much of the same thing as the market grinds higher day after wearing out the shorts before rolling over.

That being said, there is more at work here than just regular market movements. With the light volume in the market we know there is price manipulation and QE (quantitative Easing) which is helping to boost prices and exaggerate market movements.

I’d like you to have my ETF Trade Alerts for Low Risk Setups! Get them here: http://www.thegoldandoilguy.com/specialoffer/signup.html

Let the volatility and volume return!

Chris Vermeulen