Over the past month the gold and silver markets have taken a good drubbing. Silver has dropped from 19.50 to 15.00 and gold from 1227 to 1044 as the US Dollar has finally rallied after a long drawn out correction.

Since the advent of ETF’s market players have been able to invest in gold and silver for the first time without using Futures and investors have made the gold and silver ETF’s a very popular way of investing in the precious metals. The advantages of ETF’s are many versus buying a futures contract. Investors can hold them for the long haul, there is no contract switching every few months, investors can buy as much or as little as they want and there is no need to worry about a leveraged position. But are there any disadvantages to ETF’s versus a futures contract?

The chart below is the silver ETF with the symbol (SLV). Because the precious metals are a global commodity and one that has been in the spotlight lately, like most commodities they trade on a world wide scale 22-24 hours per day. Since ETF’s only trade during stock market hours there can be drastic changes to price when local markets open up the following day.

The arrows I’ve drawn show how the price of silver has been vulnerable to severe price drops on the open of trade in these stocks. The recent severe correction in silver is an excellent example of how prices can open much lower than the previous day’s close. Technicians call them price gaps when they appear on a chart pattern. Investors who are using the ETF’s to be long the metals call them EQUITY gaps because of the drop in price that occur affect their bottom line.

When investors awake to learn that gold or silver is down heavy overseas, the natural tendency for short term traders is to bail out on the open for fear of losing more money than they already have. Since these ETF’s have been closed for trading about 16 hours previously, big price changes can and do happen.

Now let’s look at a futures chart of silver. The chart below is a 1000 ounce silver futures contract.

Notice how there is only one price gap on the entire chart since the top price in January. That is because this contract trades 22 hours per day and price gaps only reflect the changes that occur from about 5 PM to 7:20 PM EST time. The remainder of the time the market is open somewhere in the world and the globex market is linked to all of them. Therefore an investor can avoid nasty drops in price over night by choosing to trade a futures contract.

Futures contracts are not for everyone as the mini contract has 1000 ounces as a minimum and most be rolled over every three months or so to a new contract. Most of the time there is a few cents difference in price as well and this is called a premium. For someone who is buying 1000 shares of the silver ETF and is an in and out short term trader might want to consider trading futures. The commissions can be much cheaper if you have the right broker charging under $3.00 commissions to trade a 1000 ounce contract which only requires a minimum margin of $1600 to trade $16,000 dollars worth of silver and the cost to fund an account is as low as $5000 dollars to open.

Probably the best advantage is that trading on these contracts begins on Sunday evening (in USA), a full 14 hours before the ETF’s open up for New York trading. On weeks such as we’ve seen this can be a marked advantage, especially when a severe correction begins to develop as the markets reopen from a weekend or Holiday.

Another advantage is the ease of which one can short these contracts. Unlike ETF’s one can short a contract just as fast and as easy as going long. It only requires a click of the button.

What about disadvantages?

Trading in futures is a leveraged game and while the gains can be magnified, so can the losses. However, if you’re already trading 1000 shares of SLV there is no difference. If you’ve never traded futures before it can be at times more emotional. Probably the biggest advantage is the ability to trade with ease and this can cause the user to overtrade and therefore accumulate more losses if you don’t have a game plan.

What about liquidity?

I’ve traded these contracts and have never ever had a problem getting in and getting out. However once in a while these contracts can fluctuate a bit more in after hours when trading is thin. I’ve seen 10-20 cent price rises after the market closes only to pullback to its original price before the markets close for those few hours a day in which there is no trading.

If you’ve been frustrated with your silver ETF when it opens down 50 cents in the morning you might want to look into trading a futures contract instead. But be sure to read up on futures and possibly try a demo trading package so as to get used to the ebb and flow and psychology of trading futures versus ETF’s. They are not for everyone, but for those who are disciplined and experienced traders; futures can offer advantages that the ETF counterparts don’t.

While we are on the subject, let’s take a look at the silver chart from a technical standpoint.

The chart below shows that silver has suffered some technical damage on the charts that should have technicians concerned.

Over the past 14 months silver has been in an uptrend defined by a parallel channel that has recently been broken on the downside and it has done so on heavy volume. As you can see by the chart, silver’s Friday lows were comparable to prices from April 2009, almost a full year ago. The correction from December has wiped out almost a year’s worth of gain in two short months. The break of the lower channel line confirms this downside momentum and has considerably weakened the technical picture.

We can see how the 16 dollar area was a key support level and when it got taken out a lot of stop loss orders were probably lying underneath that target area. Investors who had bought last spring saw all of their gains taken away in a few short months and the panic selling that ensued can be witnessed by looking at the volume spike.

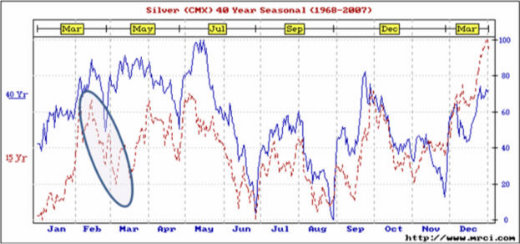

Investors should not be totally surprised. The January/February period for the precious metals tend to form tops in price from which late winter corrections are born and from which spring or summer bottoms are formed. This pattern has been more often than not the modus operandi during the bull market run of the past 9 years.

We can see by the seasonal chart below that this time period is usually met with a sell-off that lasts unto month end. Readers of my past articles have been shown the following chart before in other updates.

As we have stated in the past, the month of February is not usually a good time to be in precious metals and this month’s action confirms that very well.

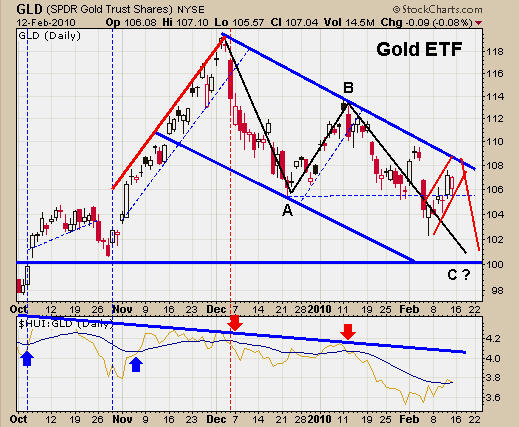

What about Gold ?

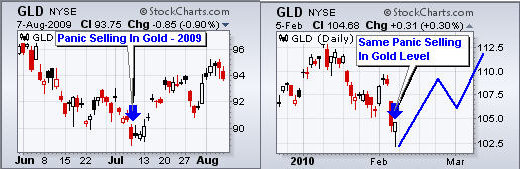

The chart above shows that gold recently took out a very important support area. For a few months the 1075 area in gold and the 105 area in the gold ETF (GLD) has been a key point technicians have been focused on. Last week’s rout finally took that area out. We can see that last week’s lows were below that line and that gold is trying to now climb back above it and maintain price in order to regain its support area. The important thing about a channel or support line is not whether it is penetrated by price but what price does immediately afterward. For the moment gold is trying to make its mind up as to whether it will forge forward here or breakdown to the next support area on the chart.

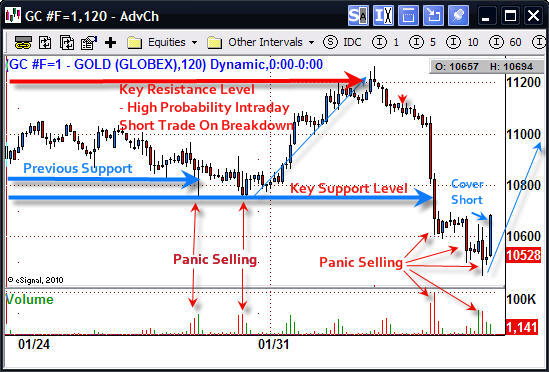

The next major channel line on our chart is all the way down at the 95 area on the chart. However, if we look at the September high and the October low during this rally we can make a case for support at the 100 area. For gold this would equate to the 975-980 area in spot gold. So at this current moment we remain neutral in the precious metals waiting for gold to make its decision on the next leg it is to embark on. Let’s look at the short term pattern by zooming in on the 60 minute chart of the April Gold Futures contract.

Ever since the December peak at 1227 the gold market has been in a correction that has shaved off about 180 dollars from peak to bottom. We can see that each attempted rally above the moving averages has ended up in failure. Last week, spot gold touched the 1143 area, just 10 dollars shy of the original breakout point of 1033. This return move to the point of breakout is not a rare occurrence in the commodity world and there are myriad examples of such a move before the “big” one came after the breakout. The 1044 area is also the place where India made their large purchase of gold last fall and from which the news launched the market much higher when it was announced they had purchased 200 tons of the precious metal.

Thus there are two key areas for gold to watch for. First a move back above the support shelf of 1075-1090 in gold would at least put gold back in a neutral pattern instead of a downtrend. Then if gold can above the 1100-1110 area it would provide impetus for a potential test of the highs at 1125 and 1163.

In summary, the February time frame is usually a weak time for gold and usually leads to a spring rally. The early peak in December opens up the potential for gold to attempt a March or April rally. In the meantime, one would be wise to watch the current areas of support.

1075-1090 – previous support area we need to get back above.

1010-1033 – The 200 day moving average and the original breakout point.

975-980 – The first support area of the last up leg in price that began in September.

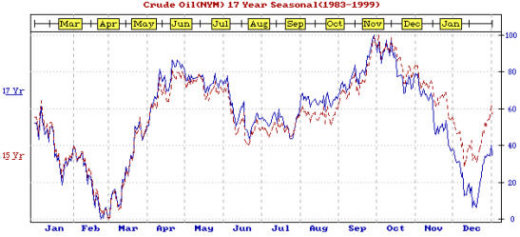

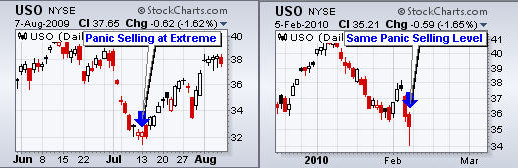

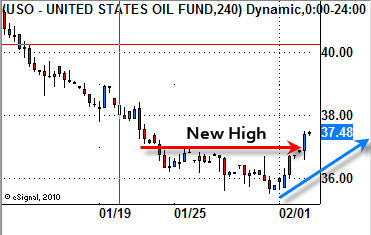

Finally let’s look at the crude oil market.

In my past few updates I have advocated that a great play is to sell some precious metal holdings in early winter and raise some cash into the spring. Not only is this good due to the seasonal tendencies of gold to correct but it allows one to begin to deploy some of that cash into the crude oil market in late February. As you can see the oil market is usually much more seasonal in trend and that time of the year is approaching.

As you can see below, the crude oil chart shows price from March2007, 2008 and 2009. All three times oil turned out to be a great buy. The current pullback from the 83 area got as low as 71 before reversing this week and price is right at the 200 and 50 day averages. Thus the 200 day average is one place we should be on watch for as support. We are close enough now that we should be on guard for a seasonal low. Should there be a selloff as in the precious metals; the 58-60 area would offer a good chance at a seasonal bottom. If the rally has already begun the 200 day average or more importantly about 5 dollars below it would be a good support area.

We are constantly watching for low risk set-ups to get our subscribers into plays like this. Feel free to check this website for my past reports. They have advocated the same strategy as I have in this article. Why not drop by our website and see what we might have for low risk entry opportunities as we await the potential seasonal trend changes and position ourselves to take advantage of them.

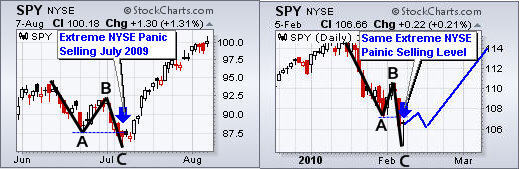

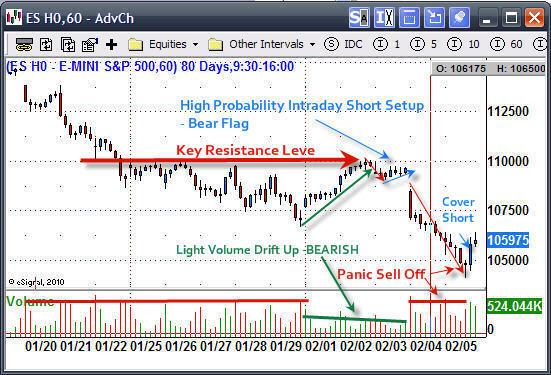

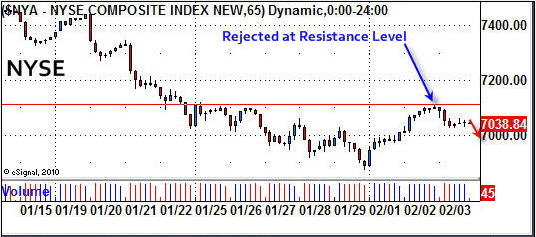

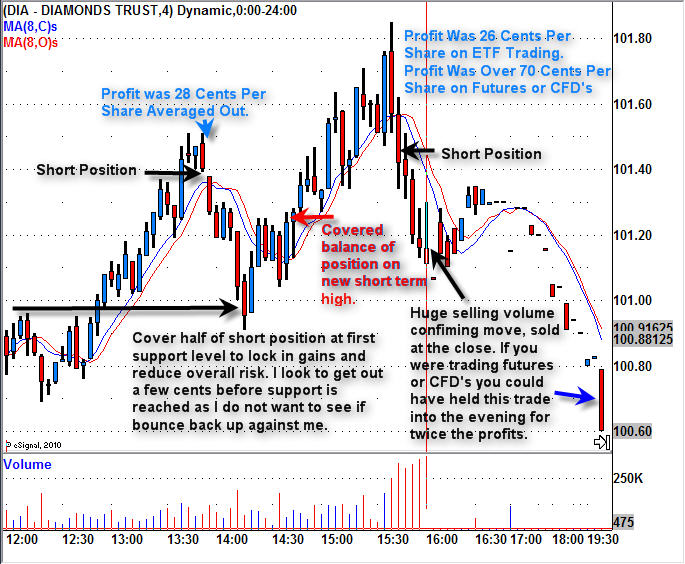

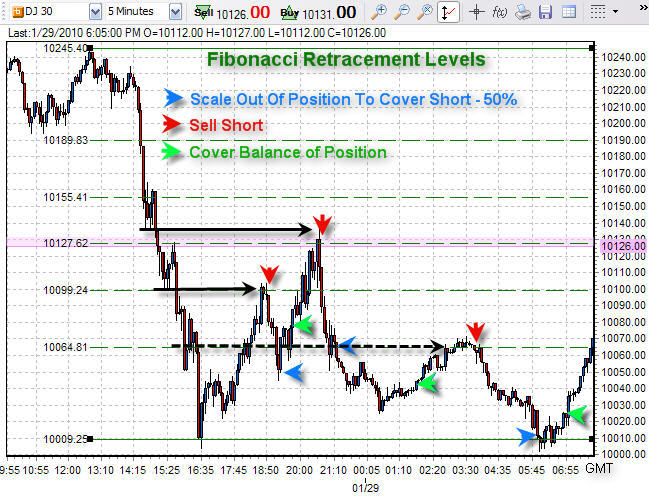

Deciphering the SP500 Trend

The SP 500 and the markets topped one day after my Jan 18th forecast to our subscribers that the market had met all conditions for an interim top. This followed my Feb 25th, 2009 forecast for a huge bull market rally which we rode with aggressive stock trading. I am now forecasting an ABC correction likely lasting 3-5 months into June. We have adjusted our trading plans from individual stocks to Leveraged ETF’s to take advantage of the increase in volatility. Our ETF trading is designed to work in high volatility bull or bear cycles and has a 90% historical accuracy rate with profits typically within 24-48 hours of entry. The market moves in very clear herding behavioral patterns, and we identify those early and trade accordingly at David Banister. Here are his latest views, and you can read more at www.activetradingpartners.com/articles

If you would like to receive our Free Weekly Trading Charts and Analysis please visit our website at: www.TheTechnicalTraders.com

Chris Vermeulen