Another blood bath in the market today but this time it’s a total market melt down with Stocks, commodities, precious metals, and the US Dollar plummeting lower.

Since late April the market has become very unstable with large intraday price swings. Since then it has only gotten tougher and tougher to trade. While there have been some decent setups having caught a few nice SP and gold trades, this is a time when the big money guys step back from the market until the dust settles. Only taking small quick trades to profit from the wild daily swings which happen in a blink of an eye.

Gold, its trading at a key support level now that is dropped $20 to $1220. But this type of selling tends to carry over for a 1-2 days in gold as the rest of the world realizes the drop and they sell out of their position. So I’m not doing much on gold right now. If we get a nice low volume drift up today or tomorrow we could take a short position but going into the long weekend I think cash is the safe thing to do. We could see gold dip to the 1200, 1175, or 1150 area depending on how the rest of the world reacts to today’s sell off.

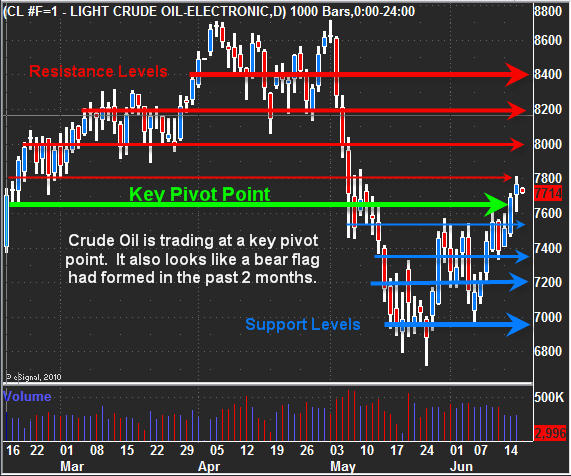

Oil, it’s in a down trend selling off hard with the US dollar which is not normal. If we see the US dollar bounce I figure oil will take another beating… It could drop to $62 a barrel over the next month or so…

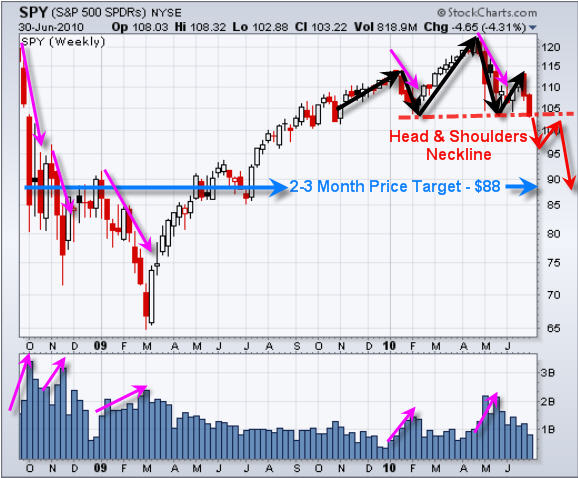

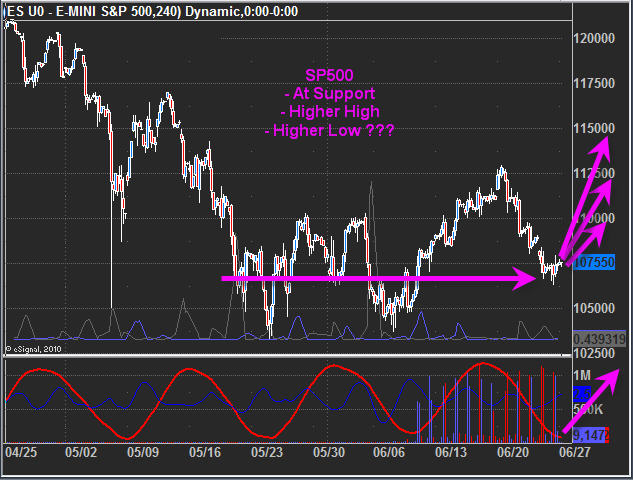

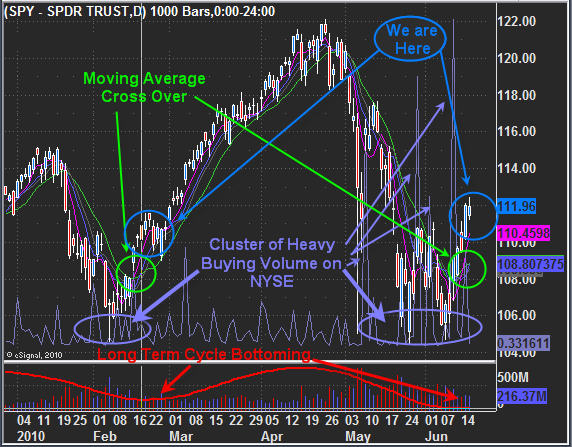

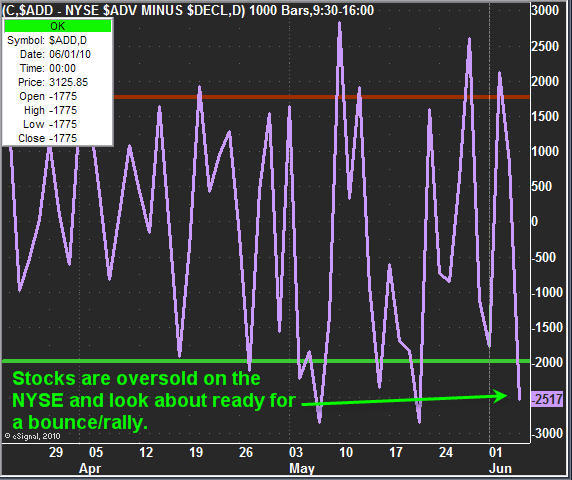

SP500 is WAY oversold, and has been for about a week now. The index went from an uptrend and we bought the oversold dips, but then the market turned into a down trend and shorting the bounces is what we are now looking for. On the short term basis, trading the SP with a swing trade carries a ton of risk. If this is the breakdown of the head & shoulders pattern everyone is talking about then we could see the market drop another 100 points real quick. On the other side of that coin, this week we have seen 90% of volume being selling volume which indicates washout panic selling and tends to be a bottom for a bounce or rally. So you can see how shorting an oversold market is dangerous and why buying a falling knife is also equally dangerous. Waiting for a setup is crucial.

I am not sure if I will be around for the close today as I’m spending the holiday with my wife and daughter which is much needed. But what I am thinking could happen if the market stays down at least 0.5% lower for the day is an afternoon sell off around 3:40-3:45 when end of day orders, margin calls and the leveraged ETF rebalancing starts to happen. This sell off tends to last 4-10 minutes but it has the chance of triggere a much larger sell off into the close so scale out quickly once some of your position is in the green.

If any of you are day traders then you will know trading between 11:30 – 3:00 is a waste of time in most cases. The best trading is between 9:35 – 11:00, and 3:30 – 4:00pm. That’s when the market makes real moves/trends which are tradable for making real money. Many of you are trading through the afternoon and just churning your account trying to make money but you just paying a lot in commissions and adding more stress and risk to trading than there needs to be. As much as we don’t like to see large moves without us, part of trading is to wait for some good plays and not get sucked into trading the noise in the market…

Get my Real-Time Trading Alerts at: www.TheGoldAndOilGuy.com

Talk to everyone later

Chris Vermeulen