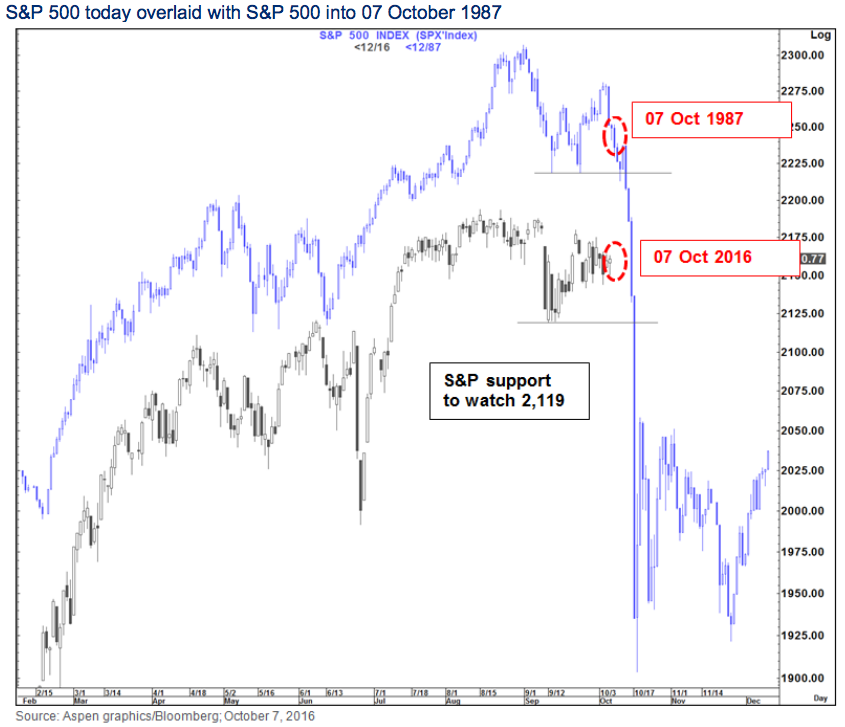

U.S. Stock Markets are in correction!

Professor Shiller’s Adjusted SPX P/E ratio of 27 is the third highest level ever recorded in history. This ratio is right behind the 1929 and 2000 tops. Trying to create any inflationary environment is impossible here! The perceived stimulus spending by the New Trump Administration will not achieve the desired results in our current environment. The uncertainty remains around President-elect Trump’s administration and policy stances. Mr. Wouter Sturkenboom, Senior Investment Strategist at Russel Investments, stated ”The markets had a nice run, but it’s also in the process of running out of steam”.

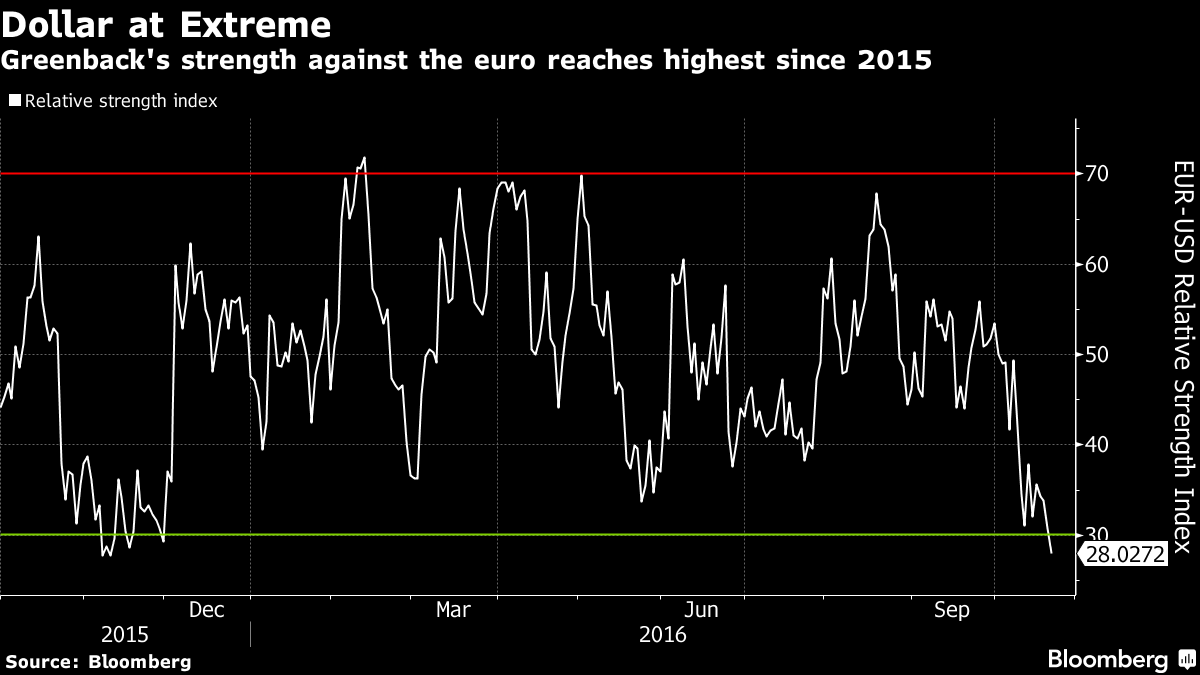

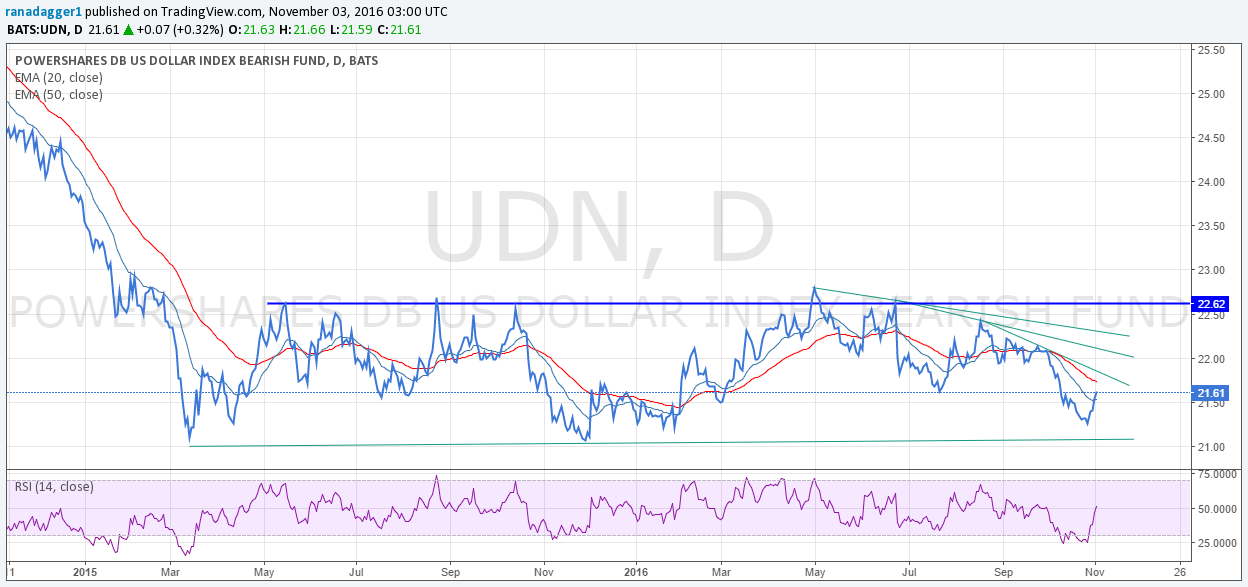

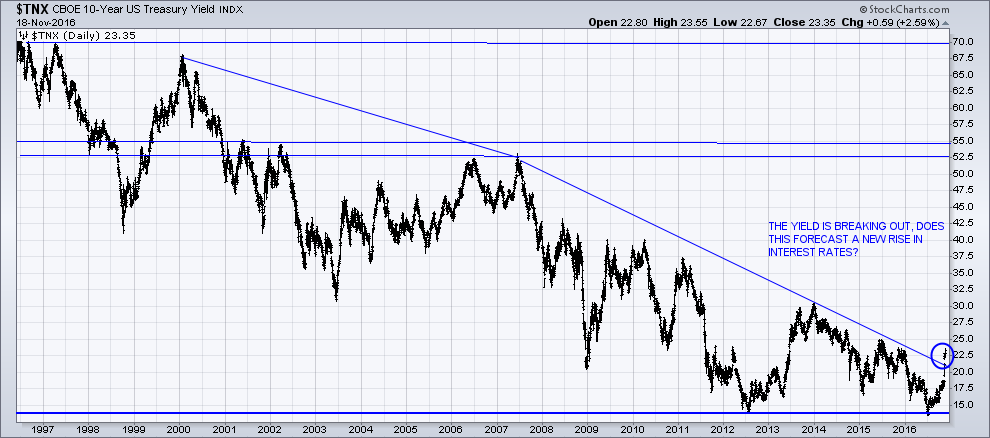

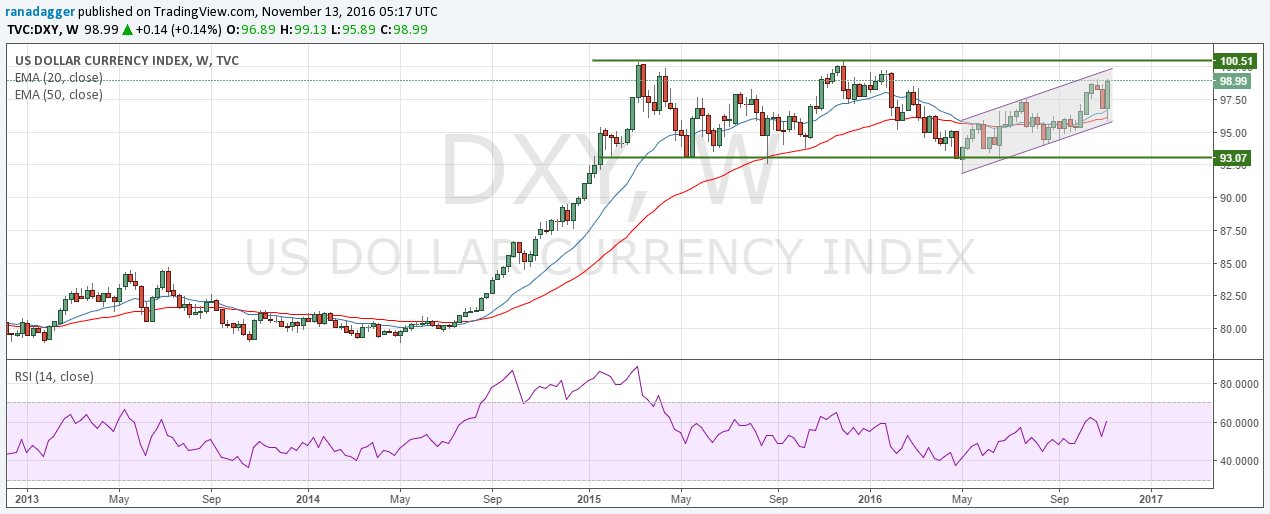

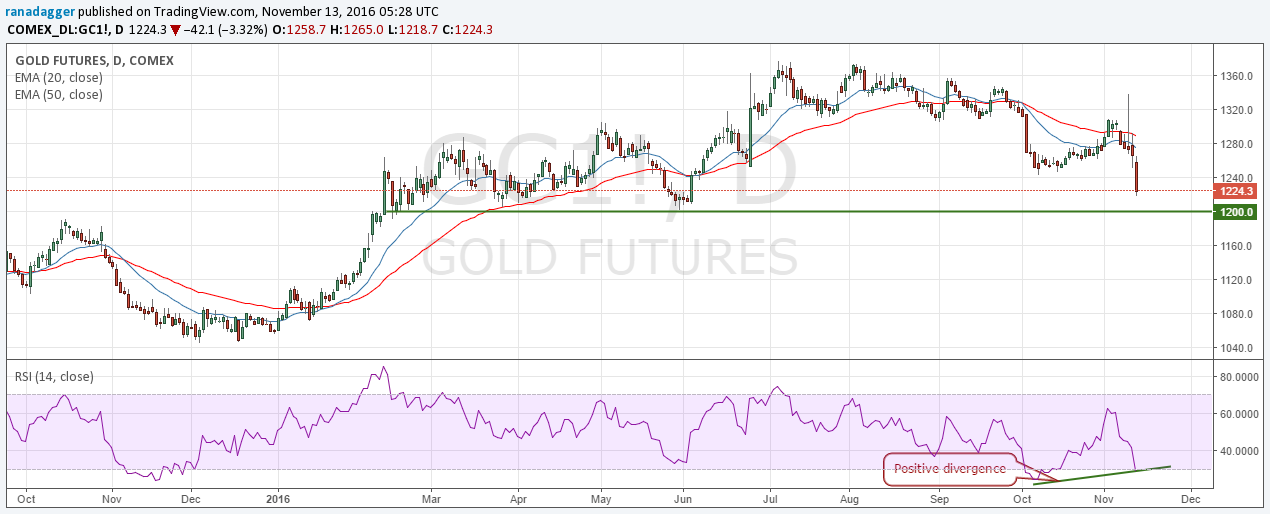

The financial markets have mispriced all the many asset classes. The increased expectations for the return of inflation are not rooted in the real underpinnings of this economy. The current debt loads are deflationary in nature which is why we are seeing a “contracting economic environment”. The massive amounts of QE and Zero Interest Rates have been covering up the true economic picture. The reality is that we are currently in a deflationary environment.

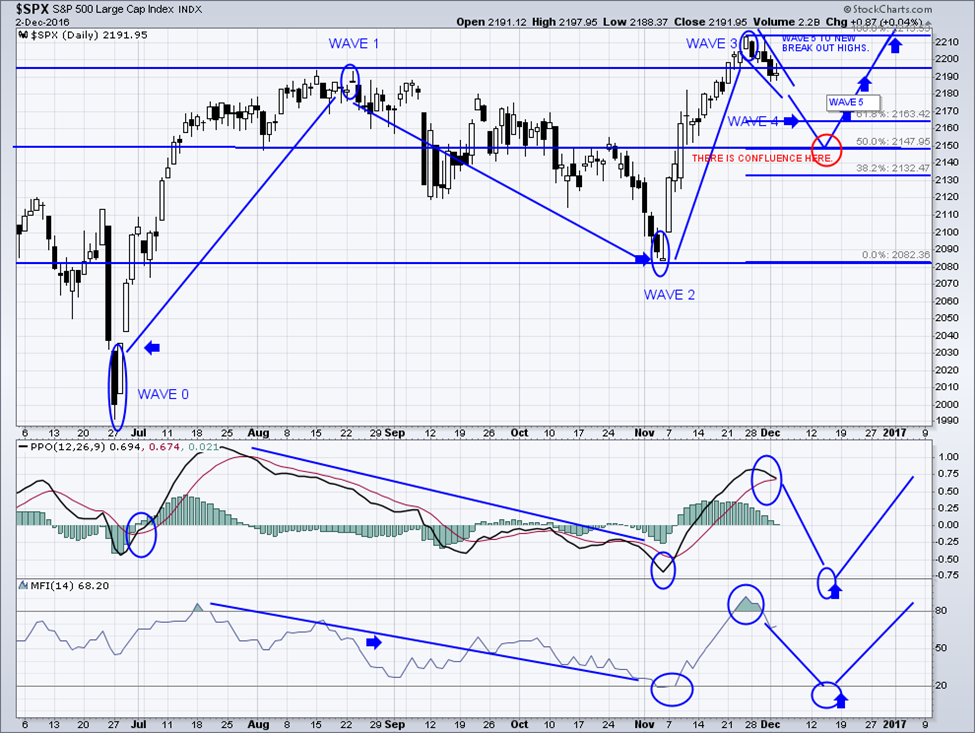

Understanding My Implementation Of the Elliot Wave Theory:

The market has moved from extremely oversold conditions to extremely overbought conditions within a very short period. This move is not sustainable and a correction is required before the next advance will occur.

The Elliott Wave principle is based on Ralph Nelson Elliott’s conviction that social or crowd behaviors tend to trend and reverse in identifiable patterns or cycles.

Elliott used the stock market as his main source of research because it was an easy way to chart both current and past behaviors of a crowd having similar interests. He identified several patterns of movement, or ‘waves’, that reoccurred in combination with larger and/or smaller versions of the same patterns.

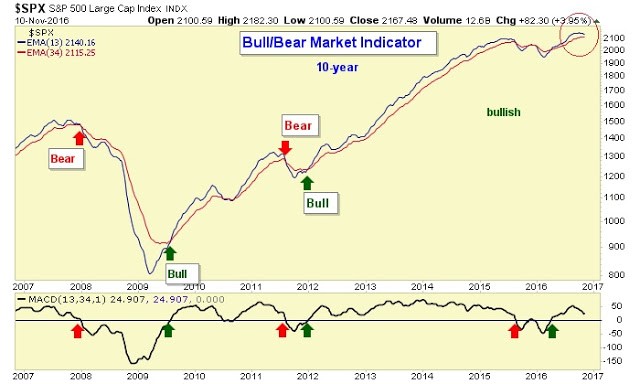

The SPX just finished WAVE 3 UP:

Wave 3: Wave three is usually the largest and most powerful wave in a trend. The current news is now positive and fundamental analysts start to raise their earnings estimates. Prices rise quickly whereas corrections are short-lived and shallow. Traders looking to “get in on a pullback” will miss the boat.

The SPX is currently in WAVE 4 DOWN:

Wave 4: Wave four is ‘corrective’ in nature. Prices may meander sideways for an extended period. Volume is well below that of WAVE THREE. This is a good place to buy a “pullback” if you understand the potential ahead for WAVE FIVE. FOURTH WAVES are very frustrating because of their lack of progress in the larger trend.

WAVE 5: Is the final leg in the direction of the dominant trend. The news is universally positive and everyone is ‘bullish’. Unfortunately, this is when many traders finally buy in, right before the top!

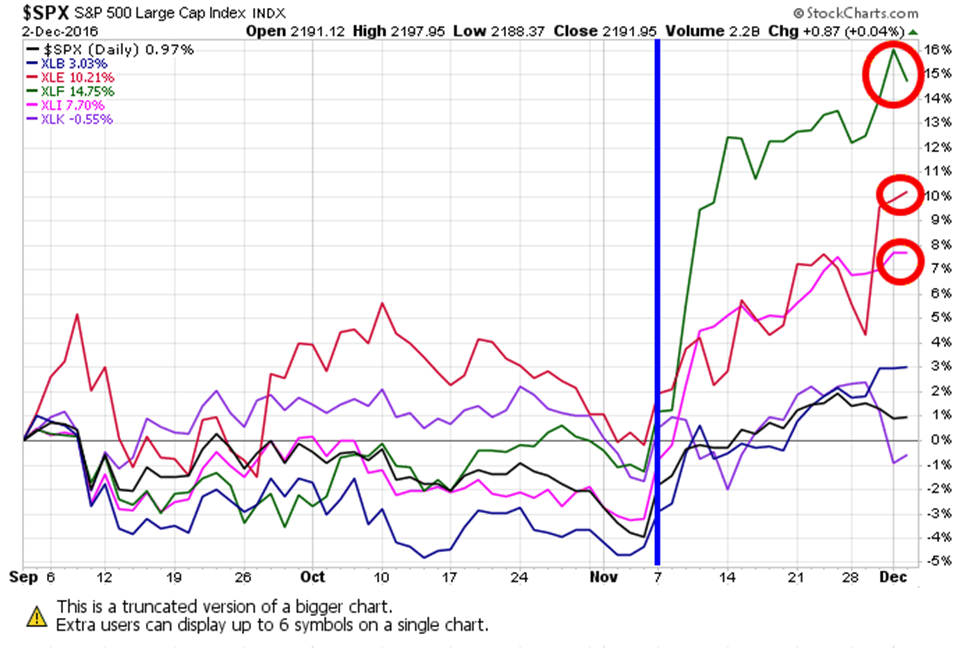

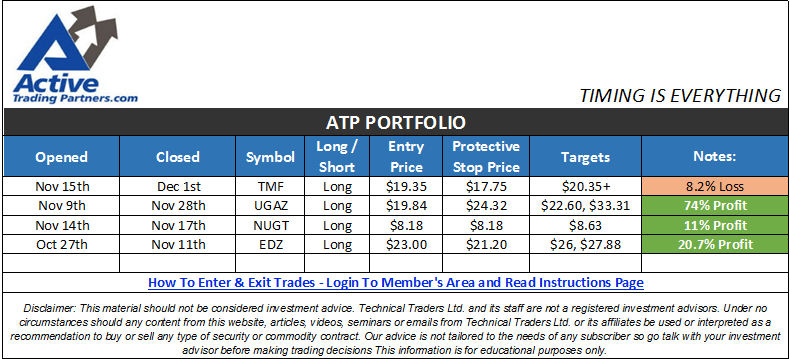

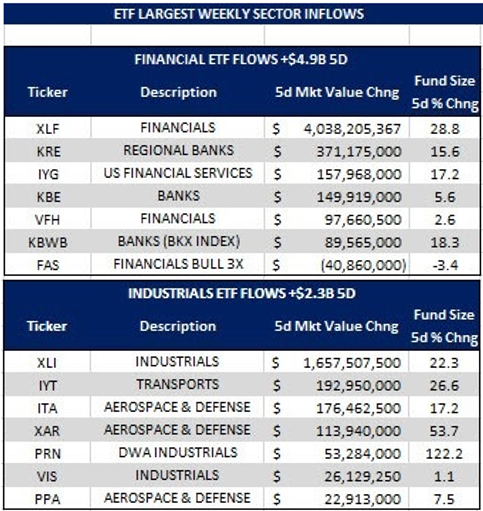

The SPX sector rotation, of the presidential election, which led to the financial markets new highs. Now, these leading sectors, financials, energy and industrials are in correction.

FED to Hike Rates in December?

U.S. jobs reports from November 2016 point towards a Fed rate hike in December 2016:

The government’s latest jobs report noted a decline in the unemployment rate. It was largely embellished with distortions and misrepresentations. John Williams, Shadow Government Statistics, reports on the latest of Uncle Sam’s statistical discrepancies. This report runs completely counter-intuitive to all those glowing reports coming out of Washington D.C. which would have us all believe that unemployment is at a nine-year low and that economy and labor markets are improving. There was a reported decline in average hourly earnings which is the only information, from the report, that I believe to be valid.

Mr. Williams stated that “The 23% unemployment rate is consistent with the declining Civilian Employment-Population Ratio and the declining Labor Force Participation Rate. The rise in discouraged workers is reflected in the decline in these ratios,”

Conclusion:

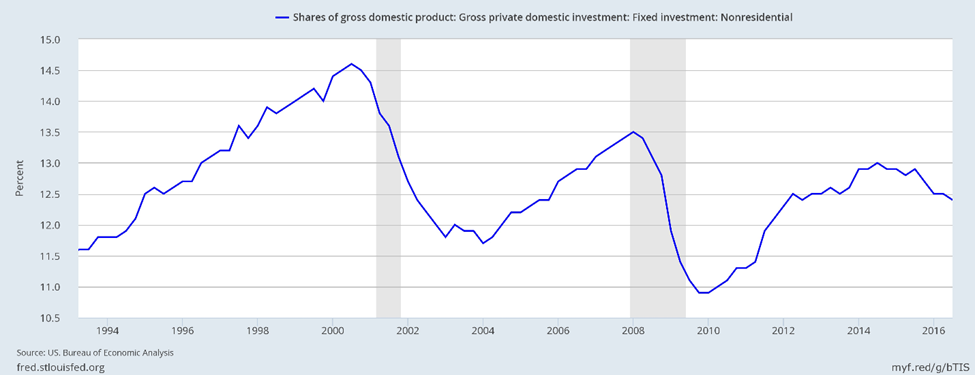

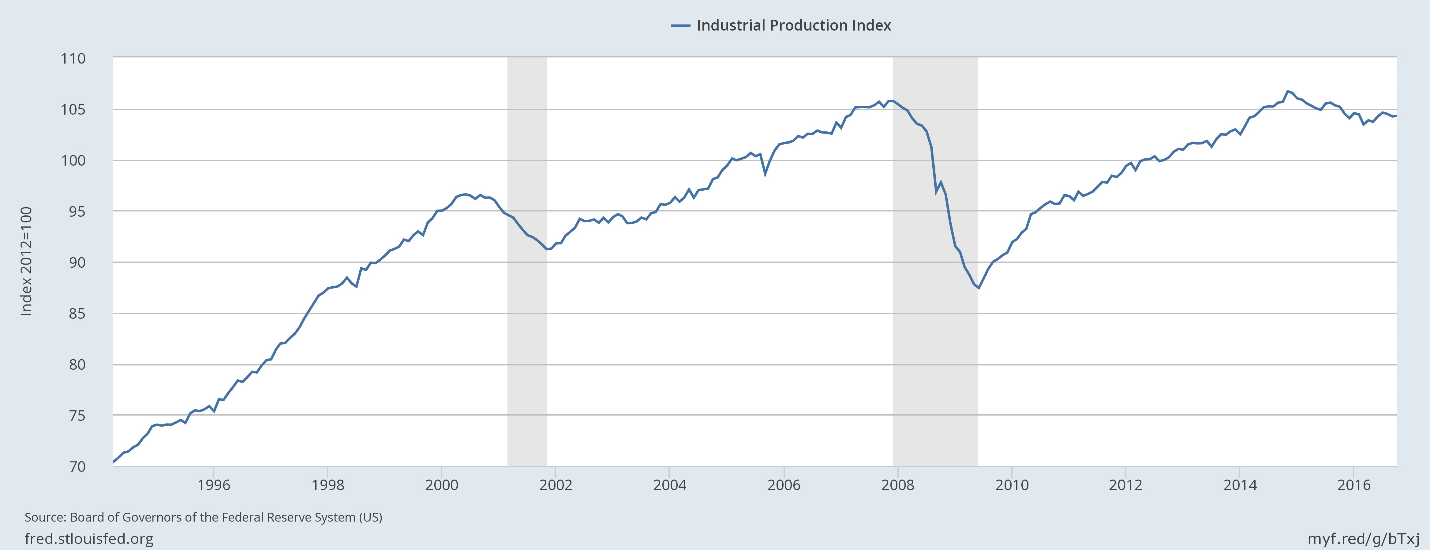

It will be difficult for corporations to continue to grow earnings in this environment. Business investment is falling. Corporations will continue investing their money into stock buybacks rather than into new capital spending projects. This does not and will not increase construction and/or industrial production. It merely gives the equity markets an artificial sense of security. GDP will never increase!

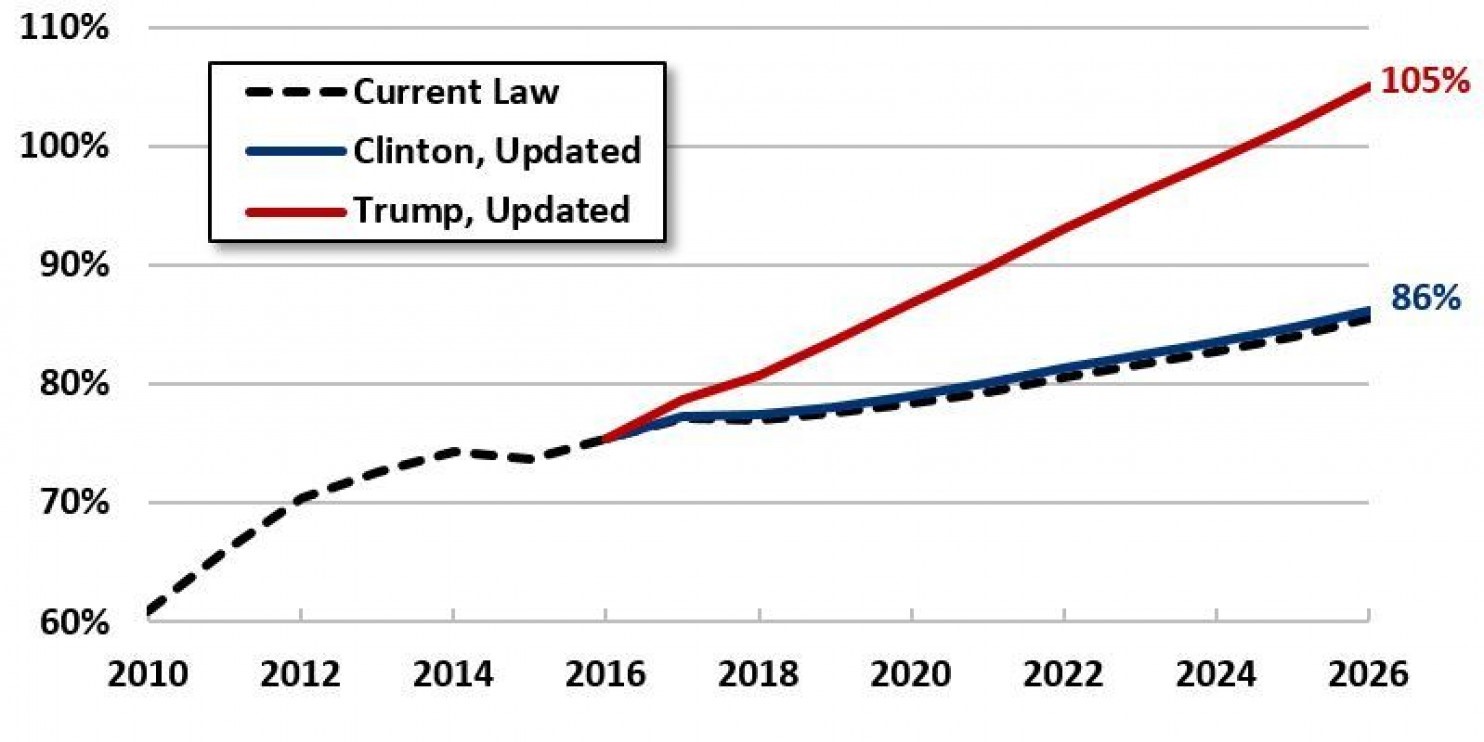

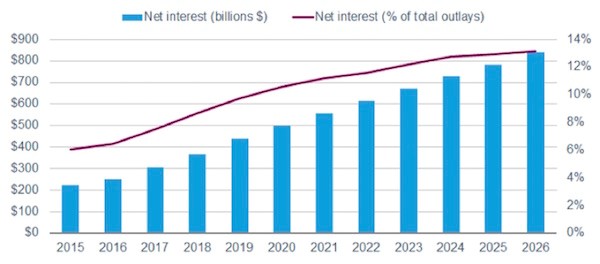

Construction spending is slow. President-elect Trump’s proposed infrastructure spending will not be the solution to our economic problems as it will only increase our federal deficit exponentially ((http://www.usdebtclock.org/).

What is necessary is to pay down the federal deficit as the Debt to GDP, (http://www.tradingeconomics.com/united-states/government-debt-to-gdp) is currently at 104.17%! In financial terms, this means that the U.S. government is slightly bankrupt!

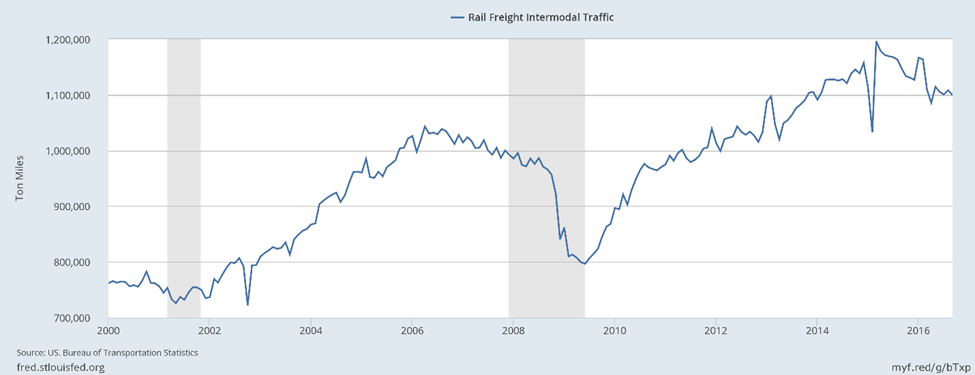

Industrial production has been declining since 2014.

(

(