Since the market crash in late 2008 we have seen investors favor quality stocks that pay dividends and have steady earnings. Fast growth companies and equities with physical resources like commodities have also done well.

Let’s examine the monthly charts of gold, silver, oil and natural gas – and observe how they have traded in comparison to their mining equities

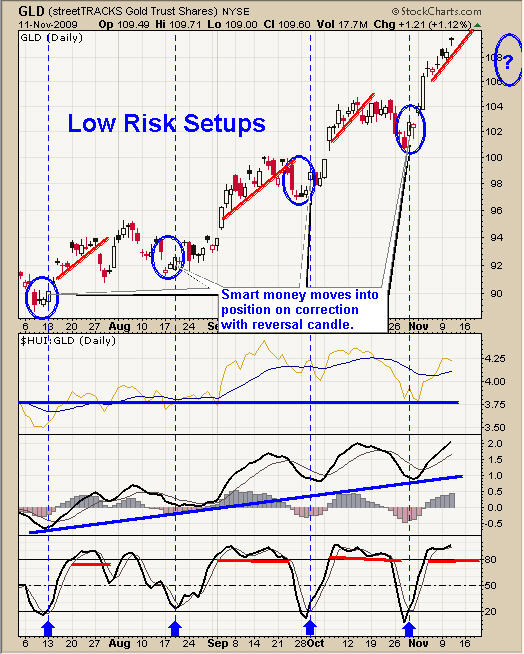

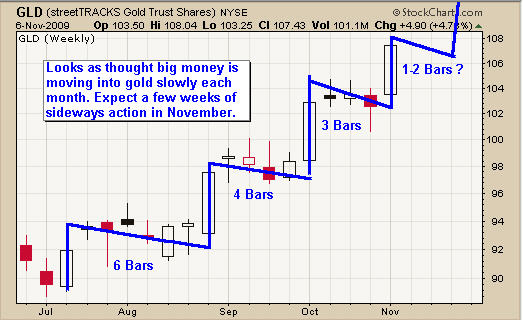

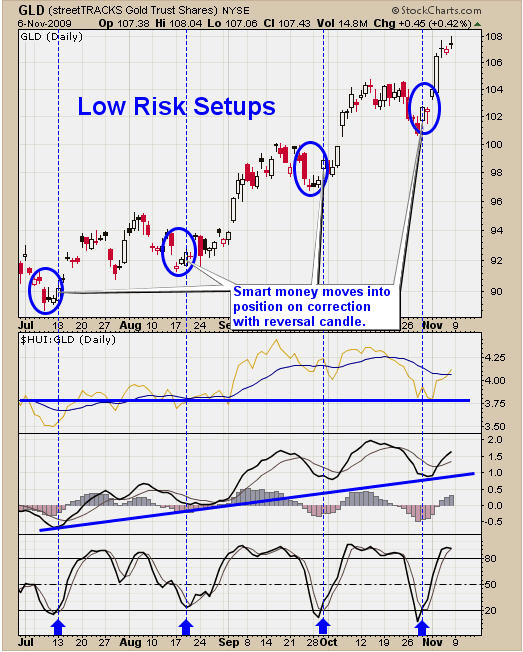

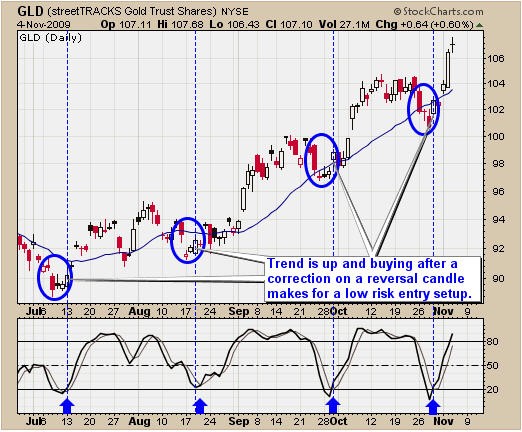

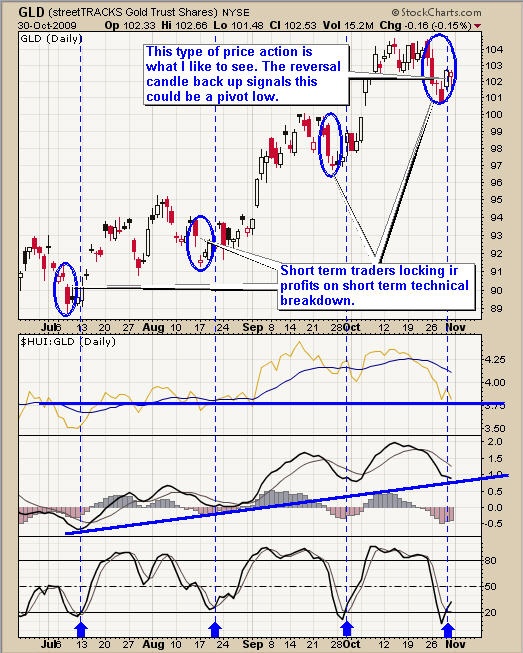

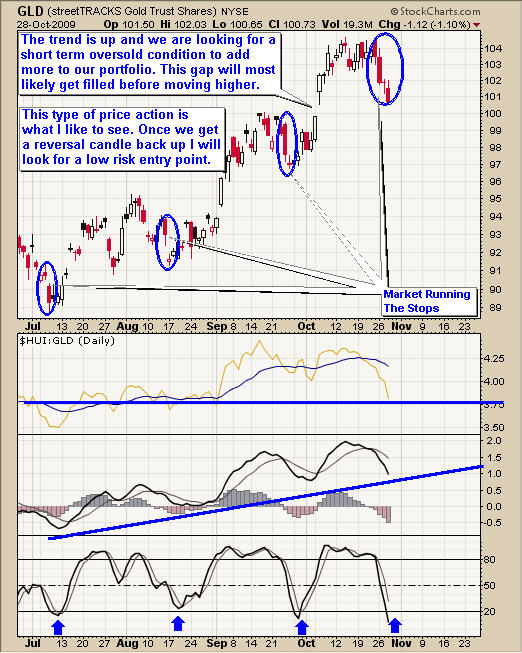

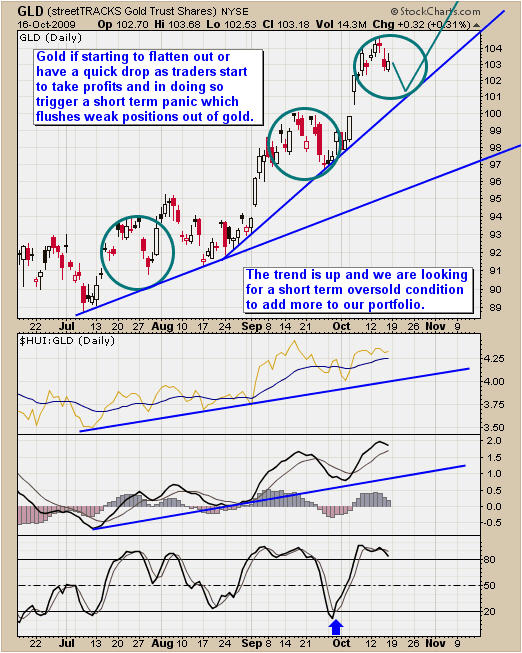

Gold – Monthly Chart

Looking at the monthly chart as far back as 2004, we see that gold has formed the same patterns repeatedly. This has created a stair step pattern and allows us to calculate measured moves and a time frame for this to take place.

As we can see gold has broken its 2008 high and is starting another rally which we have seen several times before. I figure we could see gold rally for another 3-5 months and possibly reach the $1500 -$1600 level before forming a multi month or year consolidation.

Investors around the world are buying gold because it is a physical product which has been proven to hold its value.

Gold Newsletter

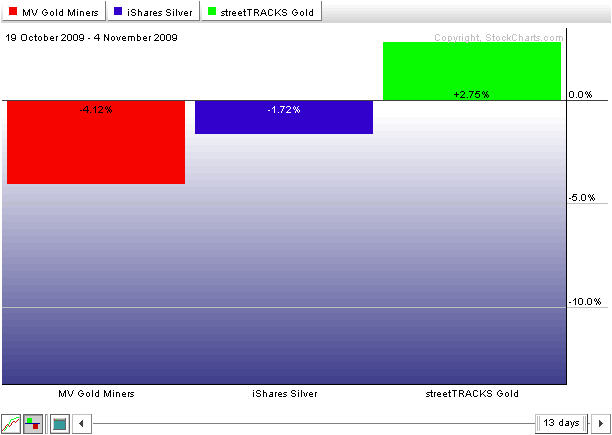

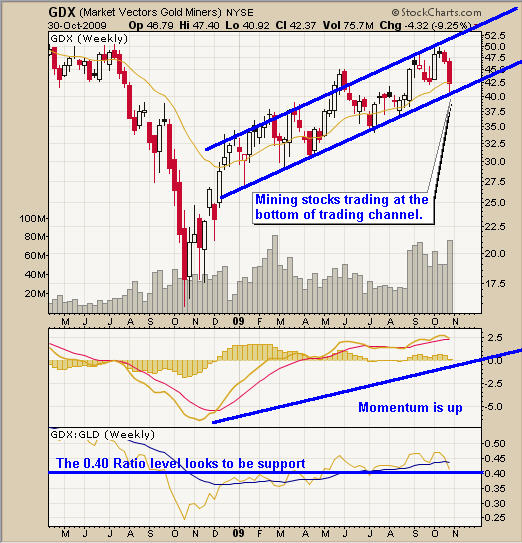

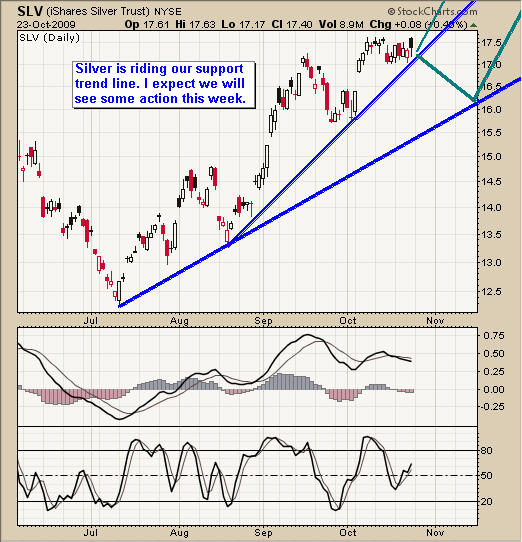

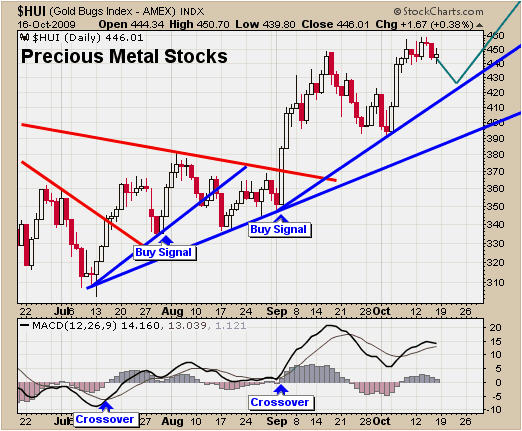

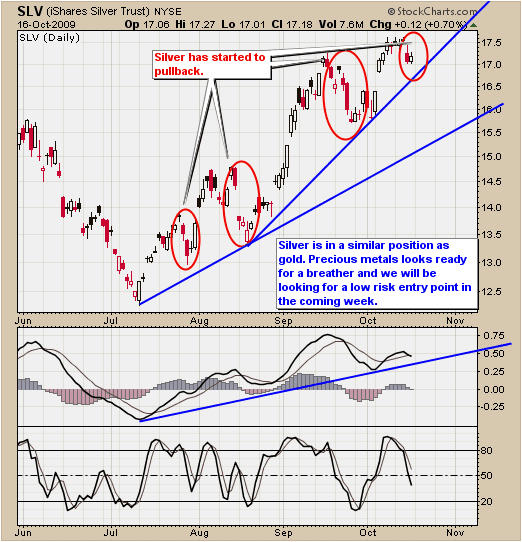

Silver & Precious Metal Stocks – Monthly Chart

Silver and PM stocks have been trading in tandem since 2004 and we can see this by looking at a price performance chart of both silver and the HUI index. The interesting part is that the physical commodity silver has held its value better than the stocks during corrections.

Apparently investors prefer tangible investments over stock certificates of mining companies in periods of increased volitility. Lower risk is in the commodity.

Silver Newsletter

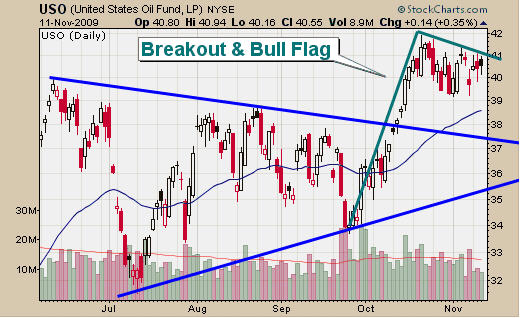

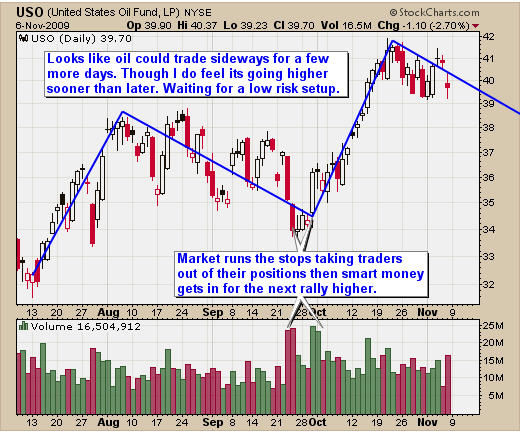

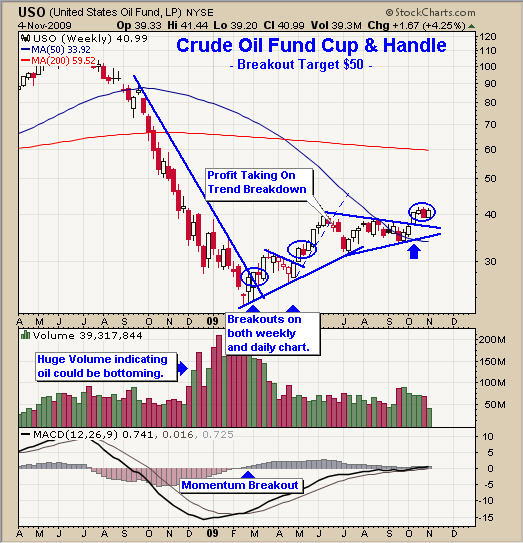

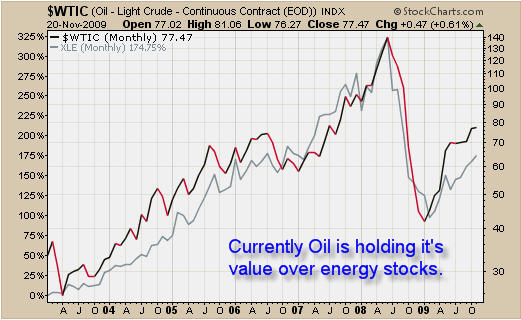

Oil – Monthly Chart

Crude oil has held its value over energy stocks for the majority of the time since 2003. And currently, investors are more comfortable holding oil as a safe investment over energy stocks.

Oil Newsletter

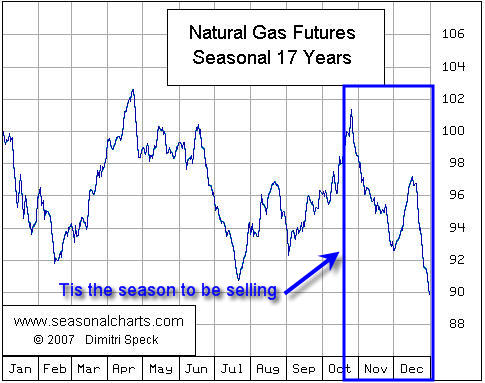

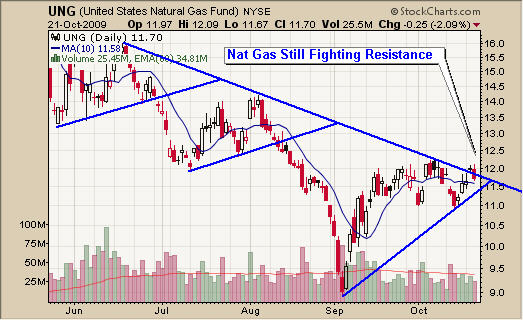

Natural Gas – Monthly Chart

Natural gas is the energy sector’s underdog in my eyes. The world has found so much natural gas in the ground and discovered cost effective ways to collect gas that it will continue to see investors move away until inventory start to deplete.

Natural Gas Trading

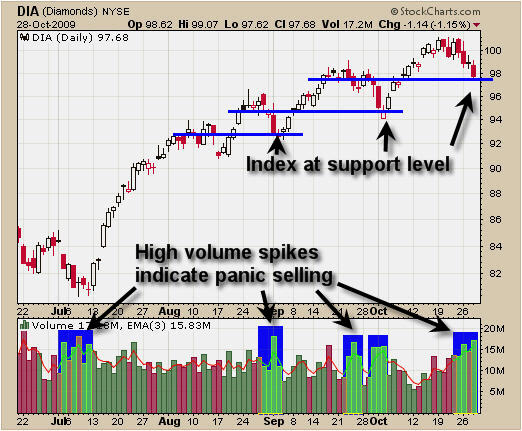

Commodity Trading Conclusion:

Investors around the world continue to put money into gold which is a universal hedge against inflation. The broad market appears to be trading at a major resistance level. Tops in the market generally take a much longer than to reverse directions than market bottoms. We will not knot for sure if we are entering a top for a couple months as the charts unfold. Now that commodities are trading back at reasonable levels I think they will hold up better than equities if the market starts to correct.

We continue to enter low risk setups and trade with this strong up trend but are aware that we must be protected and focus on the lower risk plays.

If you would like to receive my weekly trading reports please join my reports newsletter:

Chris