https://thegoldandoilguy.com/wp-content/uploads/2019/11/1-1.png

516

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

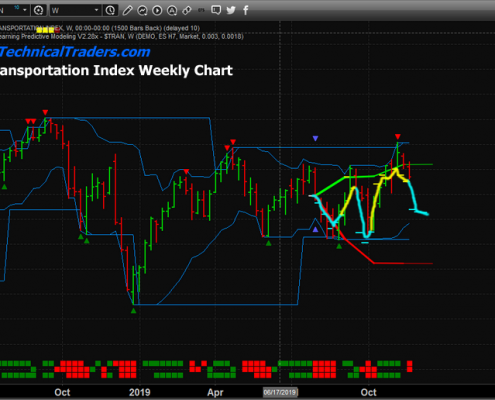

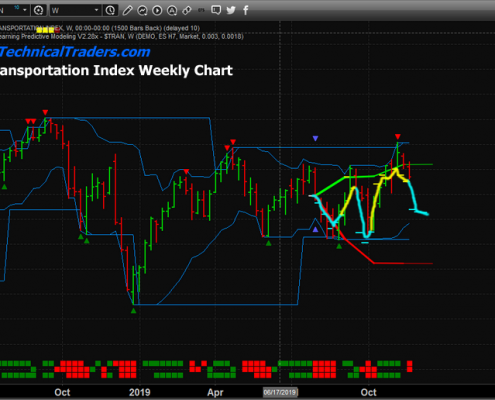

admin2019-11-22 09:58:352019-11-22 09:58:35Adaptive Predictive Modeling Suggests Weakness Into 2020

https://thegoldandoilguy.com/wp-content/uploads/2019/11/1-1.png

516

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2019-11-22 09:58:352019-11-22 09:58:35Adaptive Predictive Modeling Suggests Weakness Into 2020Improve your trading and

https://thegoldandoilguy.com/wp-content/uploads/2019/11/1-1.png

516

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2019-11-22 09:58:352019-11-22 09:58:35Adaptive Predictive Modeling Suggests Weakness Into 2020

https://thegoldandoilguy.com/wp-content/uploads/2019/11/1-1.png

516

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2019-11-22 09:58:352019-11-22 09:58:35Adaptive Predictive Modeling Suggests Weakness Into 2020

Oil Begins To Move Lower – Will Our Predictions Come True?

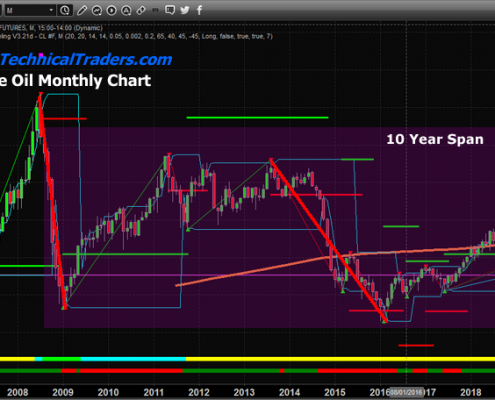

Recently, we posted a multi-part research post suggesting a collapse in Crude Oil could be setting up and how we believe this decline in energy prices may lead to a broader market collapse in the near future. Crude oil fell more than 3% on…

Vix Warns Of Imminent Market Correction

The VIX is warning that a market peak may be setting up in the global markets and that investors should be cautious of the extremely low price in the VIX. These extremely low prices in the VIX are typically followed by some type of increased…

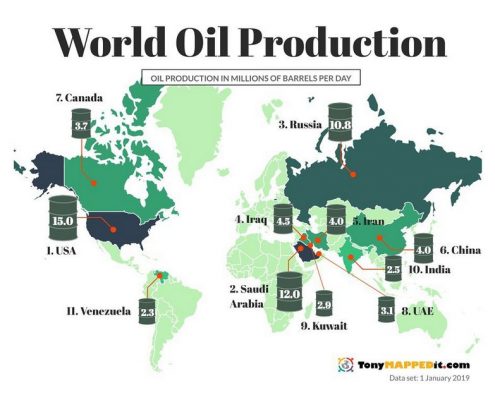

What happens To The Global Economy If Oil Collapses – Part 3

This, the final section of this multi-part research article, will continue our exploration of the consequences that may result from our ADL predictive modeling system’s suggestion that Oil may continue to fall to levels below $40 over the…

What happens To The Global Economy If Oil Collapses – Part 2

In the first part of this research article, we shared our ADL predictive modeling research from July 10th, 2019 where we suggested that Oil prices would begin to collapse to levels near, or below, $40 throughout November and December of 2019. …

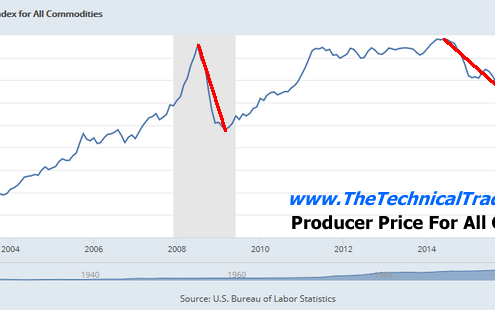

What happens To The Global Economy If Oil Collapses Below $40 – Part I

Currently, commodity prices are the cheapest they’ve been in over 40 years compared to equity prices. US Equities have continued to rise over the past 7+ years due to a number of external processes. QE1, 2, 3, and Fed Debt Purchases Share…

How To Use Price Cycles And Profit As A Swing Trader – SPX, Bonds, Gold, Nat Gas

News does drive certain market events and we understand how certain traders rely on news or interest rates to bias their positions and trades. As technical analysis purists, so to say, we believe the price operates within pure constructs of…

How to be a technical trader for gold mines, oil, nat gas, and S&P 500

https://youtu.be/gVClhCl-lVI

CLICK HERE TO GET REAL TIME TRADE ALERTS!

Welcome To The Zombie-Land Of Investing – Part 2

In Part I of this research post, we highlight how the ES and Gold reacted 24+ months prior to the 2007-08 market peak and subsequent collapse in 2008-09. The point we were trying to push out to our followers was that the current US stock…