https://thegoldandoilguy.com/wp-content/uploads/2021/12/SmartCashIndex_W_F.png

581

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

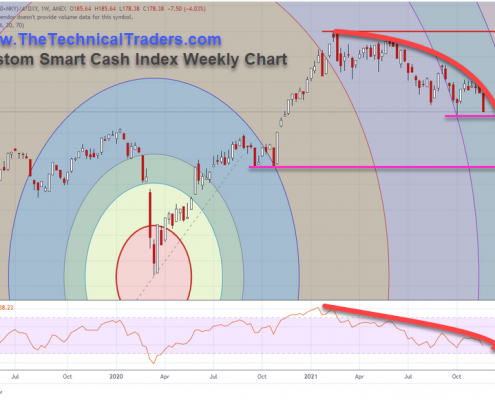

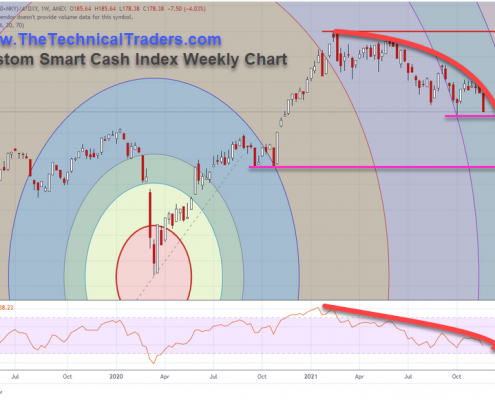

admin2021-12-12 01:31:512021-12-12 01:31:55A Major Turning Point In Stock Market Is Taking Place

https://thegoldandoilguy.com/wp-content/uploads/2021/12/SmartCashIndex_W_F.png

581

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2021-12-12 01:31:512021-12-12 01:31:55A Major Turning Point In Stock Market Is Taking PlaceImprove your trading and

https://thegoldandoilguy.com/wp-content/uploads/2021/12/SmartCashIndex_W_F.png

581

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2021-12-12 01:31:512021-12-12 01:31:55A Major Turning Point In Stock Market Is Taking Place

https://thegoldandoilguy.com/wp-content/uploads/2021/12/SmartCashIndex_W_F.png

581

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2021-12-12 01:31:512021-12-12 01:31:55A Major Turning Point In Stock Market Is Taking Place

Tech Sector ETF SMH – Trader Tip Video Analysis

SMH ETF trader tip: Using the charts, Technical Traders goes over the Technology Sector SMH ETF's recent runs and price actions. We've seen a big run-up from the Covid lows back in March. During this time choppy price action occurred indicating…

Historical Trends Suggest A Strengthening Bullish Trend In December

I received many messages and emails asking my opinions related to the recent market volatility and sideways trending in the US markets. Many traders see the recent downward price trend as a warning of a potential shift in trends. Yet, I see…

Natural Gas, Crude Oil, Inflation, Utilities: Latest Moves – Video

Chris sits down with Jim Goddard on HoweStreet.com to review the recent price rallies in natural gas and crude. The long-term charts are still pointing to dramatically higher price actions. Natural gas has a lot of volatility, but…

Financial ETF Sector XLF Pullback Sets Up A New $43.60 Upside Target

The recent downward price rotation in the Financial Sector ETF (XLF) may have frightened some traders. My research, however, suggests this move is setting up a future bullish price target near $43.60 – a more than +11% move. The end of the…

Total ETF Portfolio – Best ETF To Buy Now

Finally, the creating, testing, fixing, testing, fix....well you get the idea...is done for the new homepage for Technical Traders! It has been a long and very informative process and I give sincere thanks to our subscribers who had a hand…

Real Estate ETF IYR – Trader Tip Video Analysis

IYR ETF trader tip: Using the daily chart, Technical Traders goes over IYR ETF, which had a beautiful pullback over the last month and a half and has rallied back up. Chris details how this can be seen as two different types…

Cannabis ETF MJ Basing & Volatility Patterns

Recently, the Cannabis sector has shown signs of increased volume, volatility, and a reasonably strong potential for a price base. Volume started increasing near mid-September as the price of MJ fell below $15. This support level…

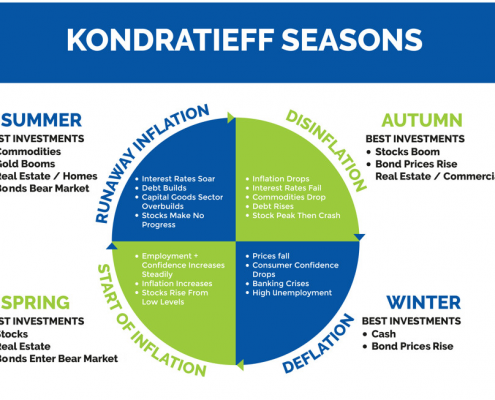

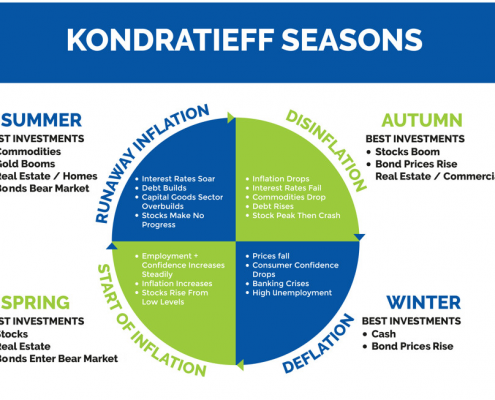

Kondratieff Full-Season Rotation – Part II

In part one of this article, I highlighted my opinion that the US and Global markets rolled through a hyper-active Kondratieff full-season rotation throughout the COVID-19 virus crisis. In 2017 and late 2018:

Bonds were trading lowerGold…