https://thegoldandoilguy.com/wp-content/uploads/2021/12/2021-12-14_ROW_Debt.jpg

380

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2021-12-15 10:19:282021-12-15 10:19:38US Fed Actions 1999 to Present – What’s Next? Part II

https://thegoldandoilguy.com/wp-content/uploads/2021/12/2021-12-14_ROW_Debt.jpg

380

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2021-12-15 10:19:282021-12-15 10:19:38US Fed Actions 1999 to Present – What’s Next? Part IIImprove your trading and

https://thegoldandoilguy.com/wp-content/uploads/2021/12/2021-12-14_ROW_Debt.jpg

380

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2021-12-15 10:19:282021-12-15 10:19:38US Fed Actions 1999 to Present – What’s Next? Part II

https://thegoldandoilguy.com/wp-content/uploads/2021/12/2021-12-14_ROW_Debt.jpg

380

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2021-12-15 10:19:282021-12-15 10:19:38US Fed Actions 1999 to Present – What’s Next? Part II

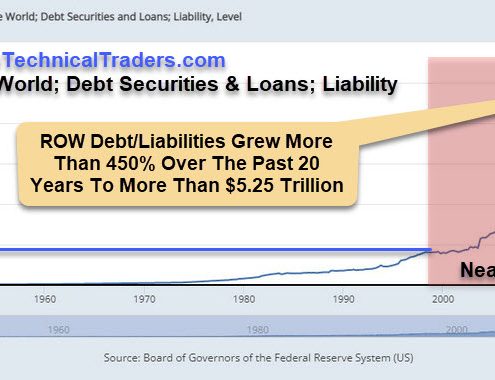

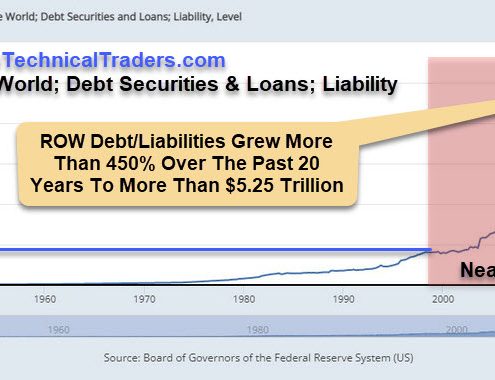

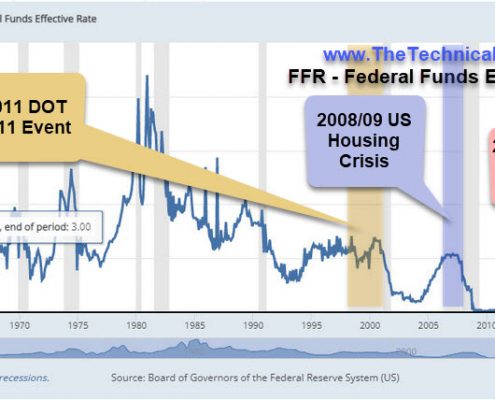

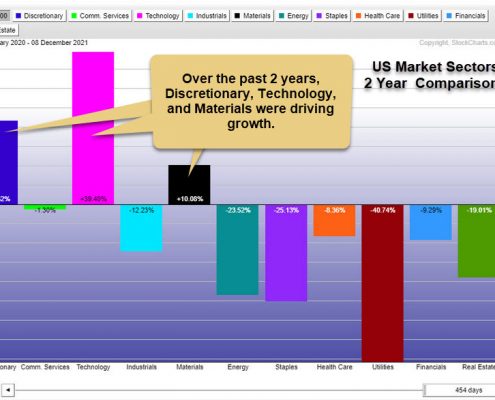

US Fed Actions 1999 to Present – What’s Next?

I find it interesting that so much speculation related to the US Federal Reserve drives investor concern and trends. In my opinion, the US Federal Reserve has been much more accommodating for the global economy after the 2008-09 US Housing…

Natural Gas ETF UNG – Trader Tip Video Analysis

UNG ETF trader tip: Using the daily charts, Chris Vermeulen of The Technical Traders goes over the Natural Gas ETF UNG recent moves. Based on the 50-day moving average, there seems to be a 15% to 17% upside move. Natural Gas…

Financial Sector May Rally 11% – 15% Higher Before End Of January 2022

The financial sector is poised for a very strong rally into the end of 2021, and early 2022 as revenues and earnings for Q4:2021 should continue to drive an upward price trend. The US Federal Reserve is keeping interest rates low. At the same…

2022 Precious Metals Forecast Video

Chris sits down with Craig Hemke of Sprott Money to talk about their Precious Metals forecast, latest moves, next year's projections, and discuss commodity/food inflation.

Precious Metals have been struggling and trading sideways or lower…

Deleveraging COVID Bubble – Possible Volatility Risks In Foreign Markets

I get asked all the time what my opinions are regarding the markets. As much as I could go into really deep details regarding technical analysis and other factors of my research, the simple answer is that we've been living through 2~4+ years…

Materials Sector WOOD & Homebuilders Sector ETF XHB – Video Analysis

WOOD & XHB ETF trader tip: Using the charts, Chris Vermeulen at The Technical Traders goes over the Materials ETF WOOD and the Homebuilders ETF XHB. WOOD has had a very strong run from the covid lows and has been flagging sideways for…

Omicron COVID Variant-Possible Strong Rally-INDU & TRAN

As we've been watching the markets recoil away from risks related to the new Omicron COVID variant and other factors, one simple thought keeps running through my head. What if the markets suddenly shift away from this panic selling…

Global Markets-It’s Do-Or-Die Time

Almost all of the US and global markets volatility has taken place over the last 6+ trading days. Even though economic data continues to show a strengthening US economy and jobs market, the news of the Omicron COVID variant has spooked the…