Crude Oil May Not Find Support Above $60 This Time

Crude Oil has been a major play for some traders over the past few months. With price, rotation ranges near $5~$7 and upside pressure driving a price assent from below $45 to nearly $75 peaks. This upside price move has been tremendous.

Over…

Emerging Markets Could Be Starting A Relief Rally

Over the past 4+ months, many emerging markets have come under pressure as the global markets were roiled by the sudden and relatively deep market retracement in early February. For many, this downward price trend has been frightening and…

US Equities Set For Further Advances As Q2 Earnings Start

The upside price moves recently in the US Equities markets have been dramatic. While many people believe the US Equity markets are overvalued and setting up for a top, we believe just the opposite – that the US Equity market and strong US…

China, Asia and Emerging Markets Could Result In Chaos

Recently, quite a bit of news has been originating from Malaysia, China and other areas of South East Asia. Much of it is concerns with multi-billion dollar projects and excessive corruption and graft. Malaysia is taking the lead with this…

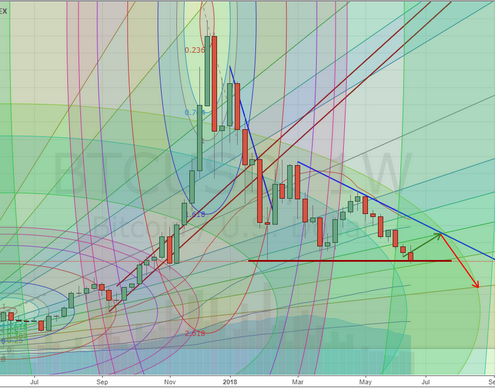

Crude Oil Possibly Setting Up For A Big Downside Move

Our research team has identified a potential major price rotation setup in Crude Oil that may be one of the biggest opportunities for traders in a long while. Traders need to be aware of this potential move because it could coincide with other…

Micron/China Holding Markets Back

Just before the July 4th holiday, the US equity markets were about to rally above a defined wedge formation that has been defining price range for the past 7+ days. As the markets opened on July 3rd, prices had already started to rally and…

Index Support Zones In Play For Bigger Upside Move

As we start the July 4th trading week, it is time to look at the current market setup for signs of future strength or weakness. Yes, there is a lot of outside economic and geopolitical factors at play right now that could cause some major…

Buy When They Cry, Sell When They Yell!

We have been pouring over the charts to find out what to expect over the rest of 2018 and our advanced predictive modeling tools are showing us a few key elements that all traders need to be aware of. So, let's get right to it.

First, the…

Gold & Miners to Rally as US Equities Fall On Fear

The US Equities markets rotated over 1.35% lower on Monday, June 25, after a very eventful weekend full of news and global political concerns. Much of this fear results from unknowns resulting from Europe, Asia, China, Mexico and the US. …

Could A Big Move In The Global Markets Be Setting Up?

Over the past few months, our research team has authored many articles regarding the weakness in China/Asia as well as the recent rotation in the global markets as trade issues, debt issues, the G7 meeting and, more recently, concerns in the…