PART II – US Markets Higher Until November 2018

Now, we are ready to share some new research that will help all of us understand the current and future market conditions given the ratios of the capital markets to GDP as represented in our previous article Part I. The research team at…

PART I – US Markets Higher Until November 2018

Our research team at Technical Traders Ltd. have been laboring over the recent market moves attempting to identify if and when the market may be likely to turn lower or contract. We've been pouring over all types of various data from numerous…

Technical Analysis and Rates Unchanged – Here We Go

The US Federal Reserve is one of the only central banks to attempt to raise rates consistently over the past few years, has possibly learned a very valuable lesson – no good comes from raising rates to the point of causing another market collapse. …

US Stock Market Sector Breakouts Taking Place

Now is the time for traders to really pay attention to the rotation in the US Stock market as well as the continued price rotation in certain sectors. As we have been warning for the past few months, this really is a stock pickers market. …

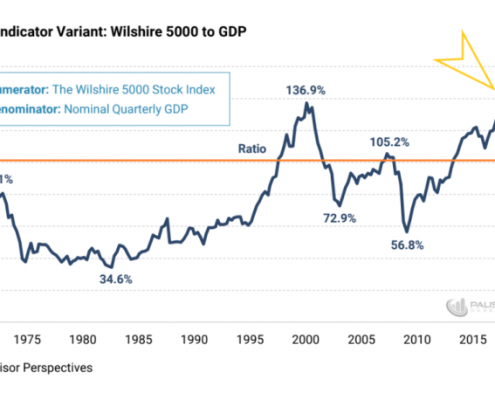

Q2 GDP vs. Technology Concerns vs. Foreign Markets

This past week has been very interesting in the US markets for a couple of reasons. It is time we took a hard look at what to expect going forward and how this news will likely drive future market moves.

First, the Q2 GDP number came in…

Foreign Currencies Show Massive Volatility/Rotation Setup

Our research team has been watching the foreign currency markets with great interest. Recently, the strength of the US Dollar has put extended pressures on many foreign currencies. The recent crash of the Chinese Yuan has alerted many traders…

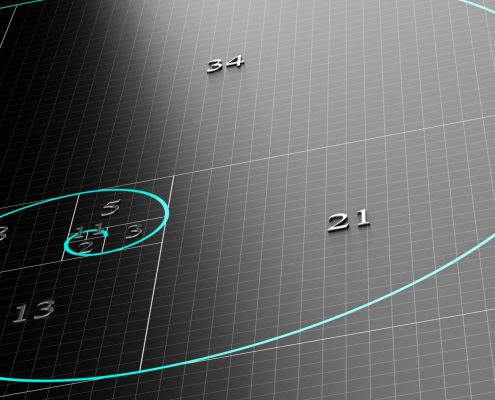

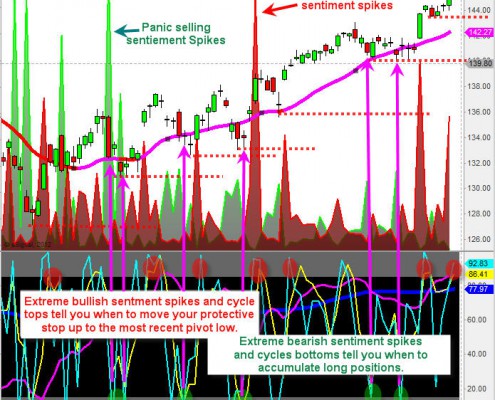

Proprietary System Shows Rally Could Extend Higher

The following Weekly charts are illustrations of one of our proprietary price modeling systems that shows trends, market breadth and much more. We use this almost exclusively on longer-term (Weekly, Monthly, and Quarterly charts) to help us…

Custom Global Market Indexes May Be Sounding Alarms

Over the past 4+ months, we've been working away trying to keep our readers aware of the risks and concerns that were originating out of some foreign markets and how that might relate to the US markets. We remember a point in time back in…

Bitcoin Rallies to Upper Channel – What Next?

Even we were concerned with Bitcoin briefly traded below $6k in late June. Yet, the recent upside price move was incredibly quick and the price of Bitcoin ran right up to our upper price channel. We believe this will become a new price peak…

Longer-Term Charts Show Incredible Potential

Our weekend analysis of the markets continues to amaze our research team simply because we see so many other researchers continue to miss the signals. We've been calling this market bottom since the middle of February 2018 and we have stuck…