7 Year Cycles Can Be Powerful And Gold Just Started One

Our research and predictive modelling systems have nailed Gold over the past 15+ months. We expected Gold to rally above $1750 before the end of this year, but the global trade wars and news cycles stalled the rally in Gold over the past 2…

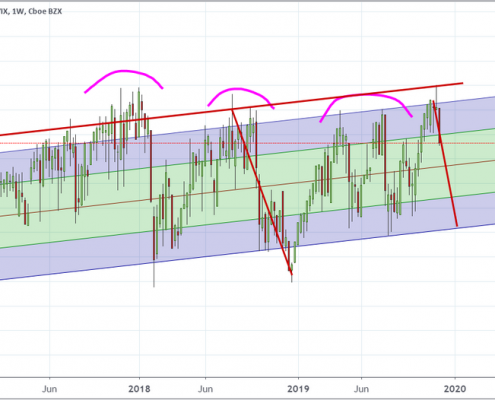

About To Relive The 2007 Real Estate Crash Again?

Does history repeat itself? Are price patterns and chart patterns reliable enough to suggest that a global Real Estate market collapse may be set up? What would it take for another Real Estate collapse to take place in today’s global market?

First,…

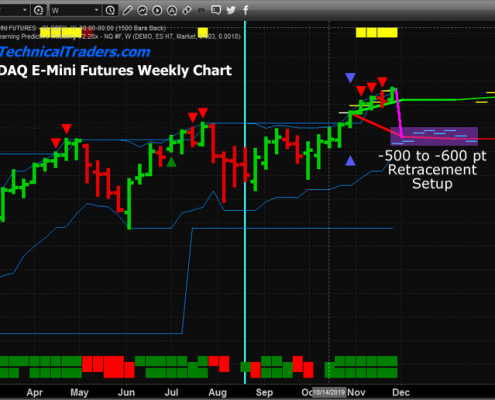

Is The Current Rally A True Valuation Rally or Euphoria?

Our research team has been warning that the US stock market price rally over the past few months has been more of a zombie-land price rally than a true valuation rally. Our researchers believe the continued push higher has been more about…

New Predicted Trends For SPX, Gold, Oil Nat Gas

This week should be more volatile as we mentioned last week. In fact, equities are all over the place in pre-market up, and now down with strong volume. While money, in general, is still flowing into the risk-on (stocks) be the average investor…

Liquidity & Volume Diminish – What Next?

As the Thanksgiving holiday passes, traders should begin to understand that liquidity and volume in the US and global markets typically begin to diminish over the next 30 to 45+ days. Typically, between mid-November and early January, trading…

100% Measured Moves May Signal A Top

One type of Fibonacci price structure we use to attempt to measure price trends and identify potential tops/bottoms is the “100% Measured Move” structure. This is a price structure where a previous price move is almost perfectly replicated…

Market Fears and Flash Crashes

I want to wish everyone a Happy Thanksgiving and if you find this type of analysis interesting be sure to visit my website and sign up to get both my swing trade and investing analysis.

ETF trade signals at 41% discount, plus a free bar…

The Bond Market Is Telling Us Some Weakness Could Be Entering The US Markets

Chris Vermeulen joins me to look at the charts for US markets, bonds, gold, and natural gas. He points out that bonds have rebounded and are showing that some of the smart big money is taking a more defensive position. However gold is lagging…

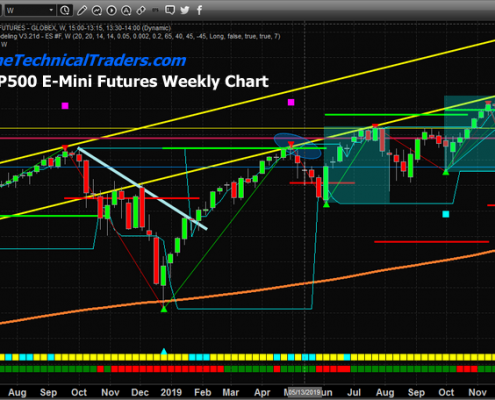

Range-Bound Into The End Of 2019?

Two of our favorite charts for following the US markets are suggesting the markets are range bound headed into the end of 2019. The news may continue to push the price higher as the overall bias has continued to be to the upside. Yet, our…

Consumer Discretionary Sector and Corporate Bonds On Verge of Sell-off

I have been warning of a peak in the markets and a continued capital shift in the global economy that continued to push the NASDAQ and DOW towards new all-time highs while the foundations of the global markets continued to weaken.

I authored…