Are The US Markets in Stage #4 Of The Excess Phase Peak Pattern?

In 2020 & 2021, we published a very well-received series of articles related to a longer-term pattern we called the Excess Phase Peak pattern. At that time, we highlighted the five (5) components of the Excess Phase Peak pattern and provided a number of examples showing how it usually played out for traders.

You can review our first article: How To Spot The End Of An Excess Phase.

One more article to review is Revisiting The Excess Phase Peak Pattern, which contains links to many of our previous Excess Phase articles. We received so many comments and emails from this article that we thought now would be a great time to bring it forward once more. It highlights how the SPY appears to be moving into a Stage #4 Excess Phase Peak pattern again. Recently we’ve seen the SPY move through Phases 1, 2, & 3. Now, we need to see if the next breakdown in price will start or confirm the Phase #4 price breach.

Why Is The Excess Phase Peak Important?

The Excess Phase Peak pattern is a very common transitional phase for the markets where psychology and economic trends shift over time. Global markets typically require periods of pause, reversion, or a reset/revaluation event to wash away excesses. We’ve seen these types of setups happen near the DOT COM and 2007-08 market peaks. What happens is traders are slow to catch onto the shifting phases of the Excess Phase Peak and sometimes get trapped thinking, “this is the bottom – time to buy.”

The reality is that as long as the individual phases of the Excess Phase Peak continue to validate (or confirm), then we should continue to expect the next phase to execute as well. In other words, unless the Excess Phase Peak pattern is invalidated somehow, it is very likely to continue to execute, resulting in an ultimate bottom in price many months from now.

The 5-Phases Of The Excess Phase Peak Pattern

The Excess Phase Peak Pattern starts off in a very strong rally phase. This rally phase normally lasts well over 12 to 24 months and is usually driven by an extreme speculative phase in the markets.

Once a price peak is reached and the markets roll downward by more than 7~10%, that’s when we should start to apply the five unique phases of the Excess Phase Peak Pattern. If each subsequent phase validates after the peak, then the Excess Phase Peak Pattern is continuing. If any phase is invalidated, then the pattern has likely ended. For example, if we start by completing Phase #1 & #2, then the market rallies to a new all-time high – that would invalidate the Excess Phase Peak Pattern.

Here are the Phases of the Excess Phase Peak Pattern:

- The Excess Phase Rally Peak

- A breakdown from the Excess Phase Peak sets up a FLAG/Pennant recovery phase.

- Sets up the Intermediate support level – the last line of defense for price.

- Price retests #3 support & breaches the support level – starting a new downtrend.

- The final breakdown of the price is below the Phase 4 support level. This usually starts a broad market selling phase to an ultimate bottom.

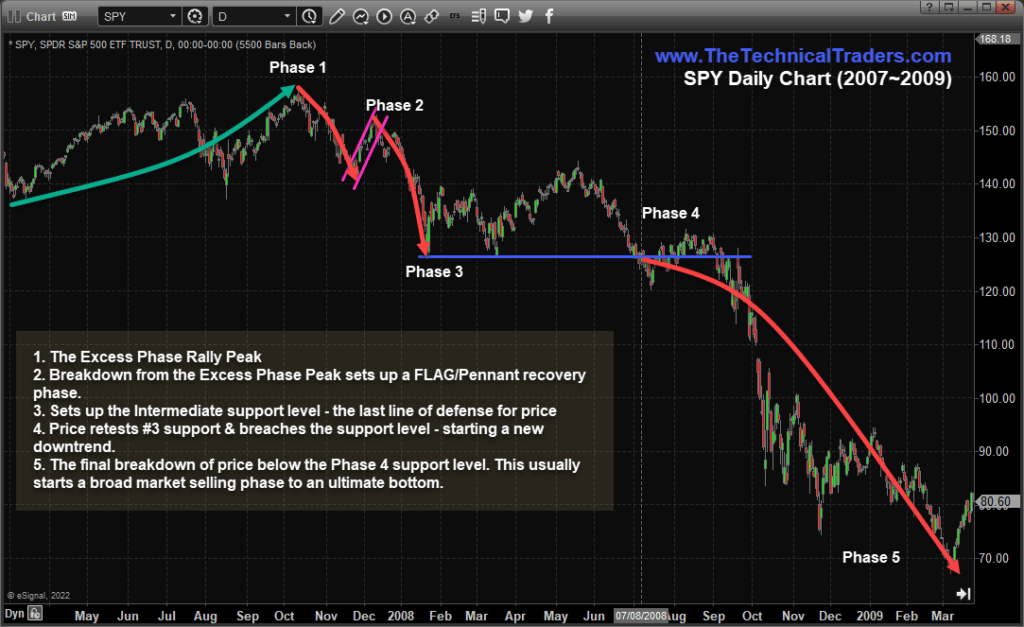

Now, let’s take a look at the 2007-09 SPY market peak to see how these phases played out.

2007-2009 Excess Phase Peak Pattern

Highlighted on the chart below, Phase #1 & #2 played out perfectly, with a lower high for Phase #2 and a Phase #3 breakdown. By the time Phase #2 broke downward, we should have been keenly aware of the potential for a Phase #3 support level to set up and extend.

Phase #3 can sometimes result in an upward-sloping support channel (like a Bear Flag), but in this case, it is validated as a horizontal support level. We could have used the May 2008 peak as a reversal/breakdown trigger showing us an early Phase #3 change in trend. Having said that, until the Phase #3 support level is breached – these could turn into false breakdowns.

Once Phase #3 support is breached, and we clearly start a deeper downward price trend (moving into the Phase #4 search for the ultimate bottom), traders need to stay very cautious of risks. Phase #3 is one of the most troubling and difficult phases to navigate. It always seems like a “perfect new bottom in price” – until Phase #4 hits.

Ultimately, a Phase #5 bottom sets up (the ultimate bottom), and this usually coincides with extreme selling pressures. Often, the US or foreign governments are involved in trying to contain global risks or address global corporate/financial concerns. We must wait for confirmation of a bottom before we can really take advantage of the lower price levels – but this can be accomplished using technical indicators and price theory.

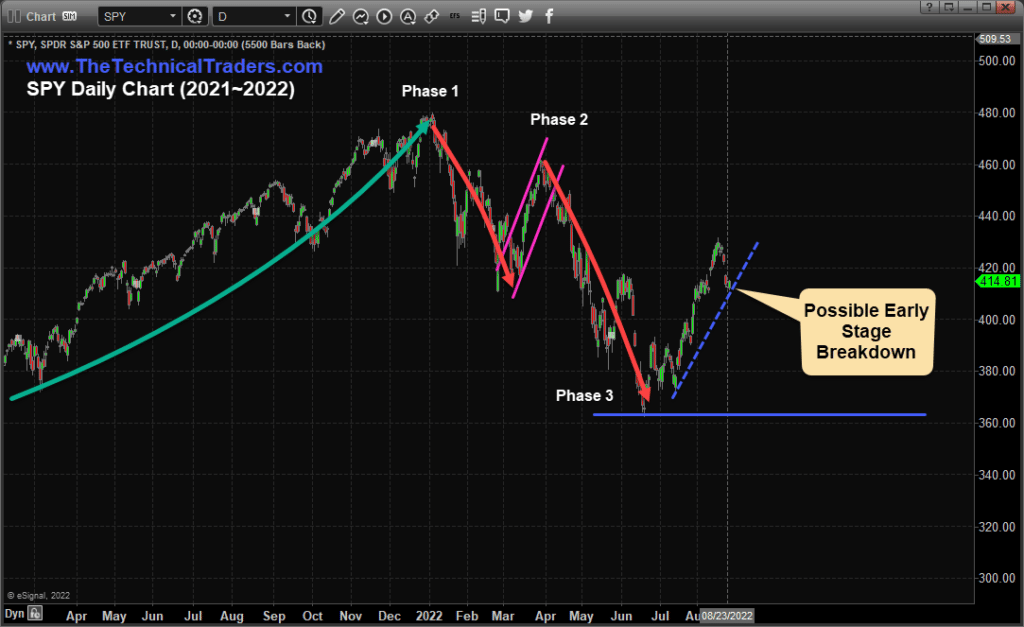

The Current 2022 Excess Phase Peak Pattern Setup

On the chart below, I estimate we are in the midst of an early Phase #3 potential reversal setup. We’ve already seen a very clear Phase #1 peak, a -13.80% downtrend setting up the Phase #2 bullish Flag/Pennant trend. Then we watch as the Phase #2 breakdown took place, resulting in another -21.60% price decline. Those lows set up the current Phase #3 base/support level near $363.

I’m cautiously watching the blue-dashed trend line as a potential early warning trigger for the Phase #3 bullish recovery cycle. Usually, within a Phase #3 recovery, after establishing critical support, the rally phase becomes very important to validate/confirm the potential Phase #4 & #5 processes.

If the Excess Phase Peak Pattern is going to invalidate at this point, the critical support level will stay unbroken, and a new upward price trend will be established from the Phase #3 support/bottom. So, this is when we need to watch very cautiously for any significant shift in central bank policies, foreign capital risks, shifting sentiment, or anything else that may provide the needed support for the markets to keep rallying higher. Otherwise, we should expect the Excess Phase Peak to continue unfolding.

In Conclusion

Traders and Investors should stay very cautious in this phase of the markets. Going “all-in” with a bullish or bearish expectation right now can be very dangerous to your bottom line. I found my tactical asset revesting strategy provides above-average growth and capital protection.

Learn why I rely on my proprietary CGS, BAN, and TTI strategies to assist in identifying opportunities in various market trends and how I use these to find opportunities to trade within the Excess Phase Peak Pattern. Volatility is still quite high, and there are opportunities for great trades if you understand risk factors.

LEARN FROM OUR TEAM OF SEASONED TRADERS

In today’s market environment, it’s imperative to assess our trading plans, portfolio holdings, and cash reserves. As professional technical traders, we always follow the price. At first glance, this seems very straightforward and simple. But emotions can interfere with a trader’s success when they buck the trend (price). Remember, our ego aside, protecting our hard-earned capital is essential to our survival and success.

Successfully managing our drawdowns ensures our trading success. The larger the loss, the more difficult it will be to make up. Consider the following:

- A loss of 10% requires an 11% gain to recover.

- A 50% loss requires a 100% gain to recover.

- A 60% loss requires an even more daunting 150% gain to simply break even.

Recovery time also varies significantly depending upon the magnitude of the drawdown:

- A 10% drawdown can typically be recovered in weeks to a few months.

- A 50% drawdown may take many years to recover.

Depending on a trader’s age, they may not have the time to wait nor the patience for a market recovery. Successful traders know it’s critical to keep drawdowns with reason, as most have learned this principle the hard way.

Sign up for my free trading newsletter, so you don’t miss the next opportunity!

We invite you to join our group of active traders who invest conservatively together. They learn and profit from our three ETF Technical Trading Strategies. We can help you protect and grow your wealth in any type of market condition. Click on the following link to learn how: www.TheTechnicalTraders.com.

Benefits of Retirement Asset Revesting are to reduce account volatility while increasing and creating more consistent growth while stabilizing an investor’s emotional journey.

Chris Vermeulen

Founder & Chief Market Strategist