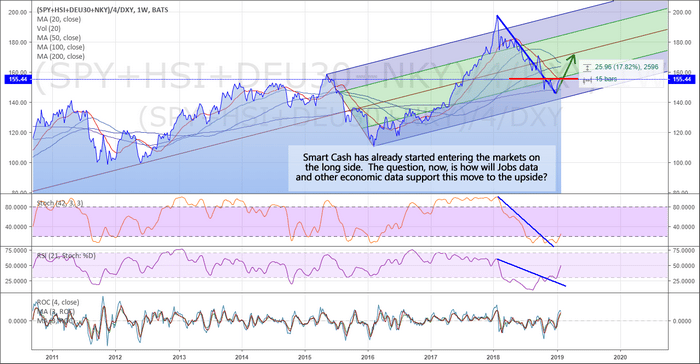

Over the past 4~5 months, our research team has authored numerous articles and research posts attempting to help traders and investors understand the future market moves. As today is the last day of January 2019, we thought we would highlight some of our research to help you better understand exactly how our unique skills and tools can assist you.

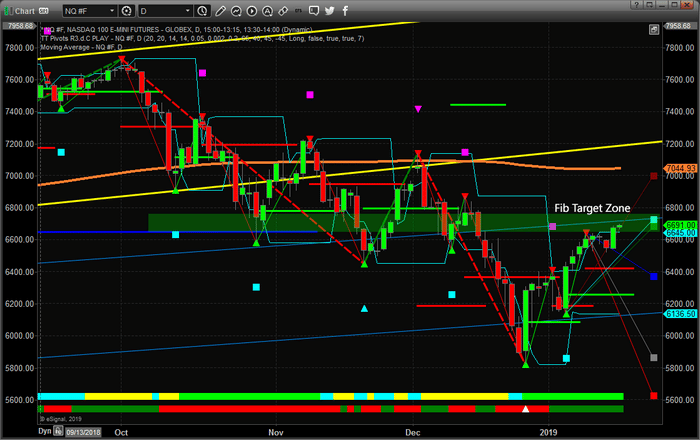

Remember, at the time of the first post, September 17, 2018, the markets were still about 2~3 weeks away from setting up a major top. There wasn’t a single analysis, except our team, that had the foresight and knowledge to make the predictions we did on that day. We still get comments from our members asking us how we did it.

Take a minute to read through this detailed history or our research posts to learn why Technical Traders Ltd. is continuing to be one of the best informative forward research and trading solutions you can find anywhere. We believe our team and proprietary price modeling tools are superior to many others out there and our record stands for itself. We are not perfect, but very few others can call the markets future 5+ months in advance and pretty much “nail it”.

We are currently revamping our Wealth Trade Alert Newsletter members only area to provide our live technical charts and tools so they update throughout the day with our signals, morning index day trades with live chatroom, SP500 index momentum and swing trades, and our special MRM “Momentum Reversal Method” for small and mid-cap stocks.

Keep in mind, these new and exciting new features are being created and we hope to move to the new member’s area and format over the next few weeks.

We help make big trend trading simple for investors and traders to find success and execute better trades in 2019.

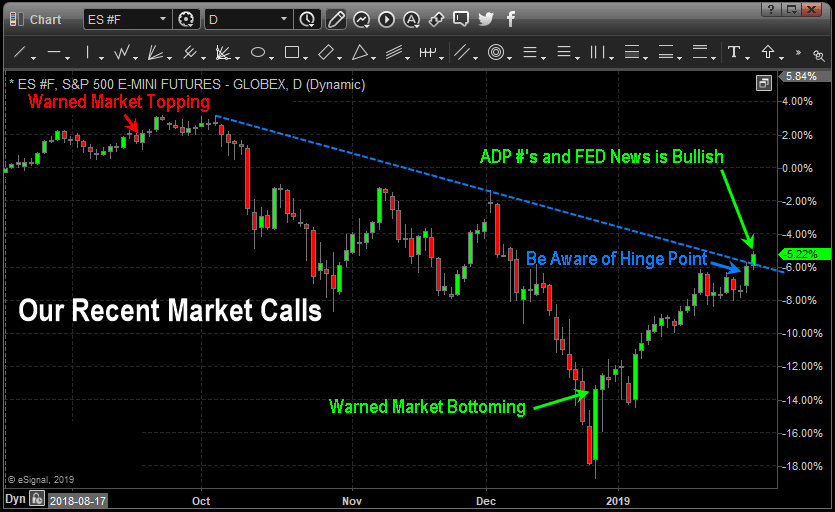

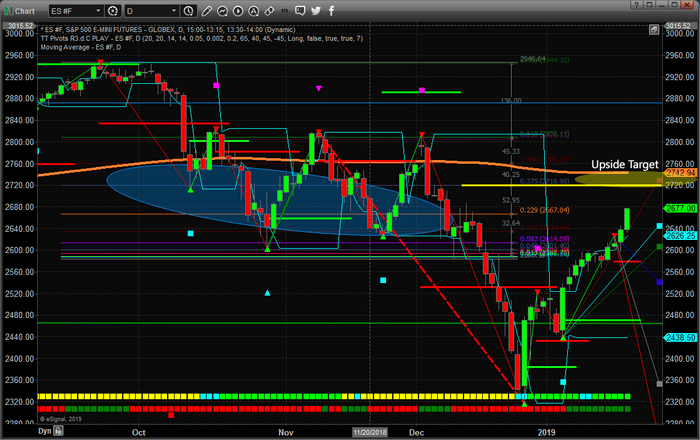

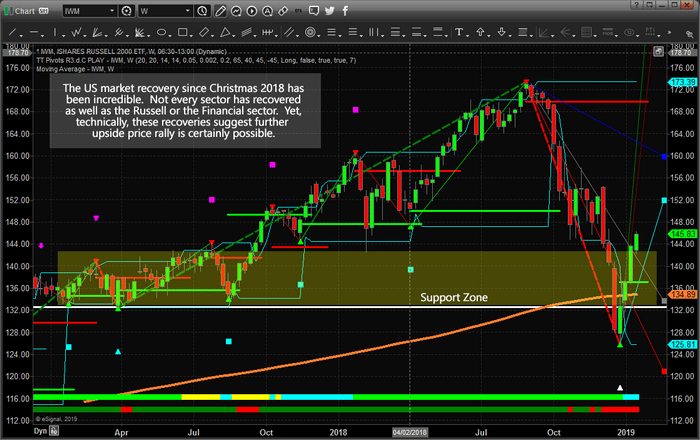

STOCK MARKET CALLS

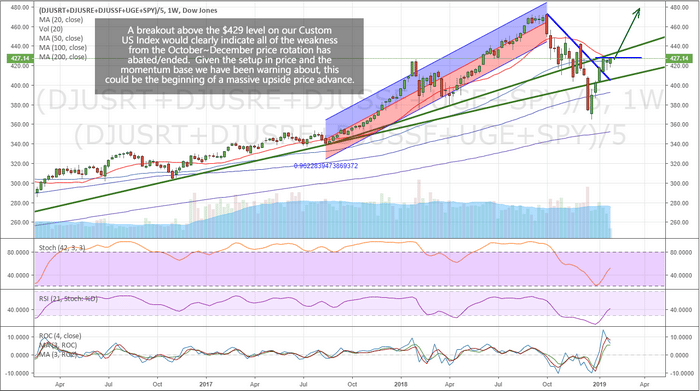

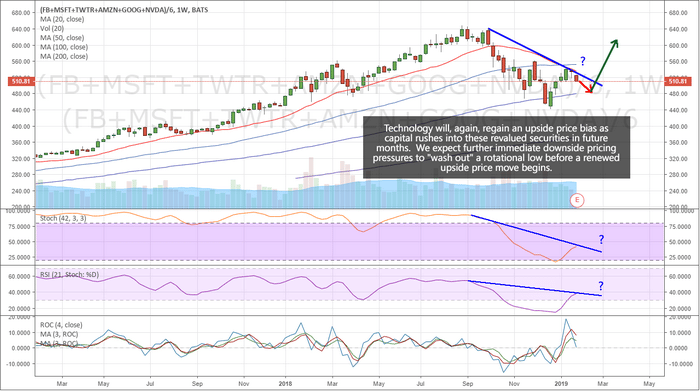

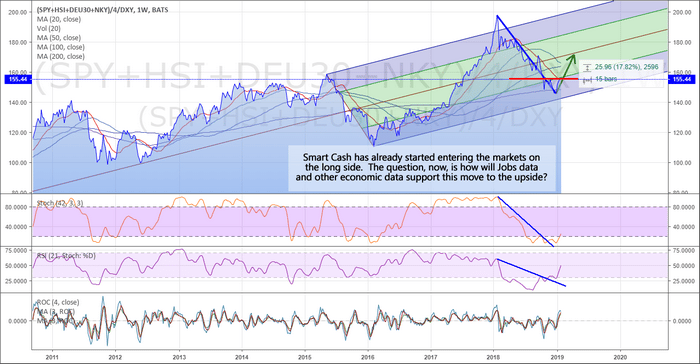

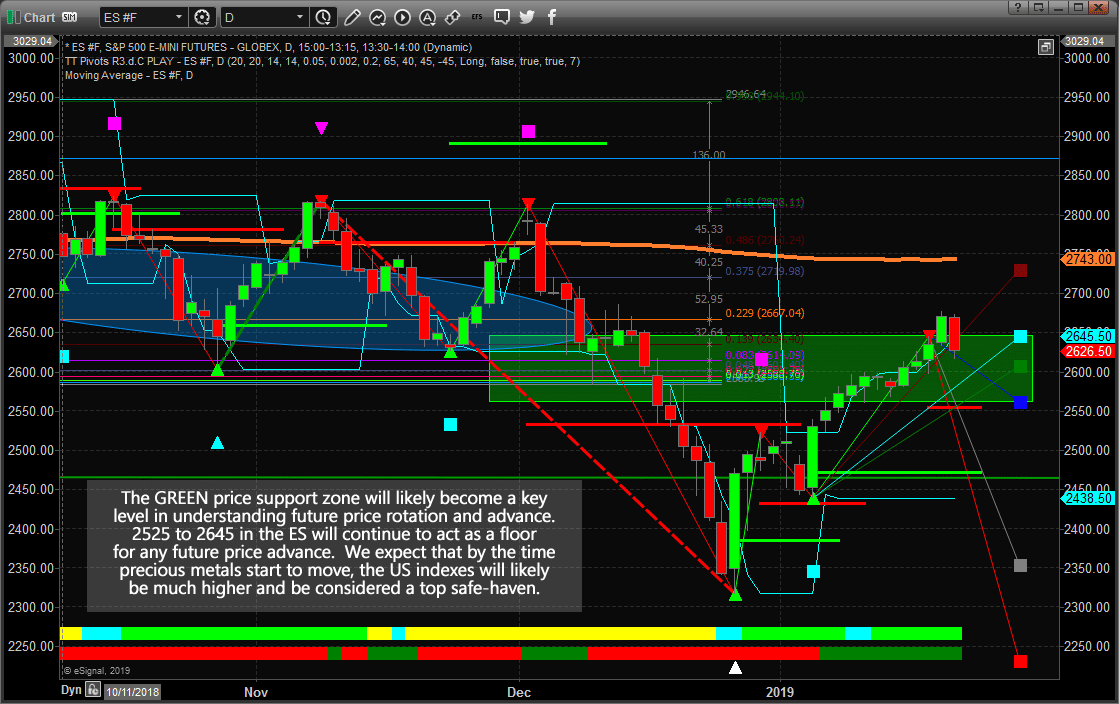

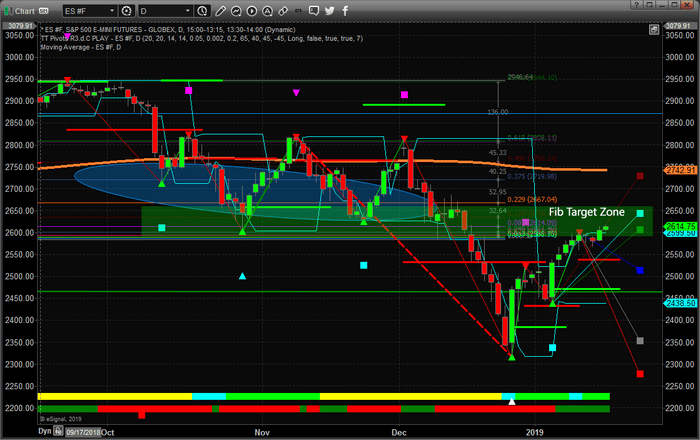

September 17, 2018: PREDICTIVE MODEL SIGNALS MARKET TOP

https://www.thetechnicaltraders.com/predictive-trading-model-suggests-falling-stock-prices-us-elections/

December 26, 2018: STOCK MARKET BOTTOMING

https://www.thetechnicaltraders.com/has-this-selloff-reached-a-bottom-yet/

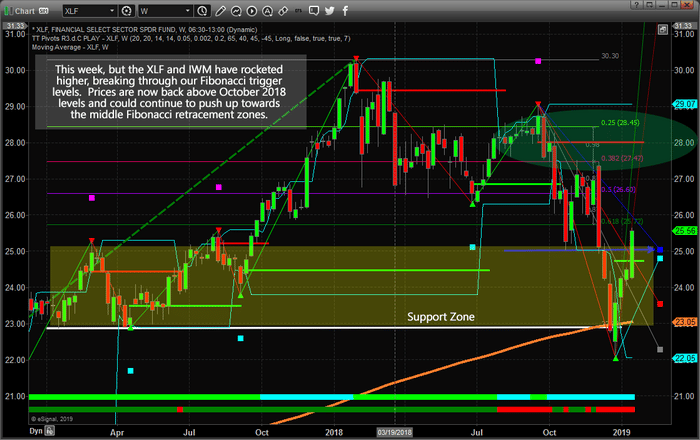

January 30, 2019: US EQUITY MARKET RECOVERY HINGES ON THE NEXT MOVE

https://www.thetechnicaltraders.com/us-equity-market-recovery-hinges-on-the-next-move/

January 30, 2019: ADP NUMBERS AND THE US FED HIT THE LAUNCH BUTTON

https://www.thetechnicaltraders.com/adp-numbers-and-the-us-fed-hit-the-launch-button/

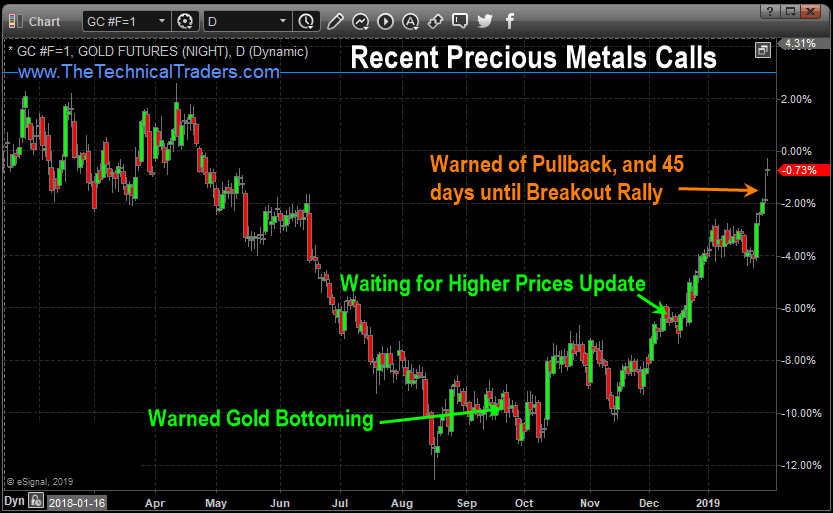

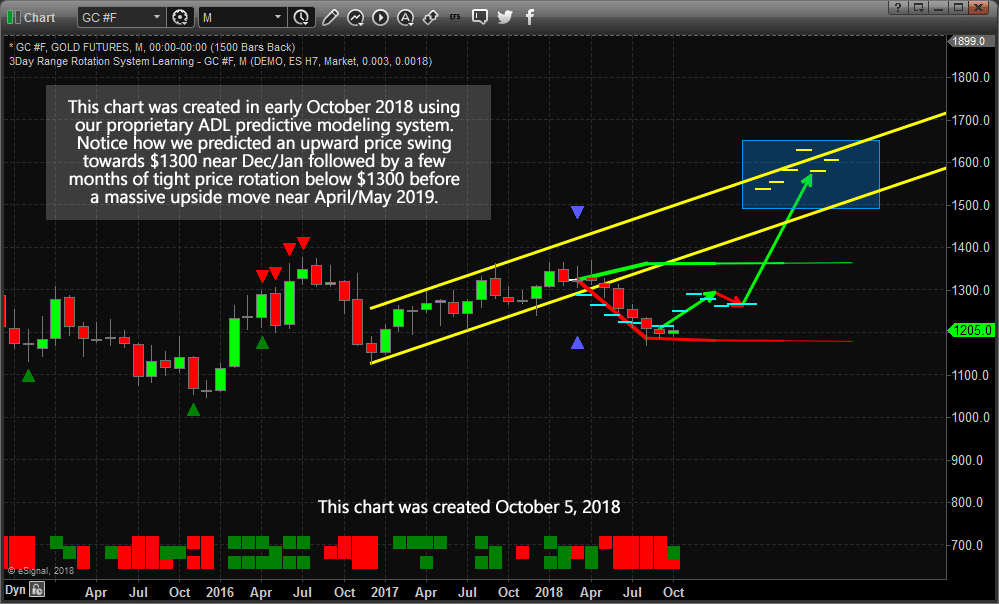

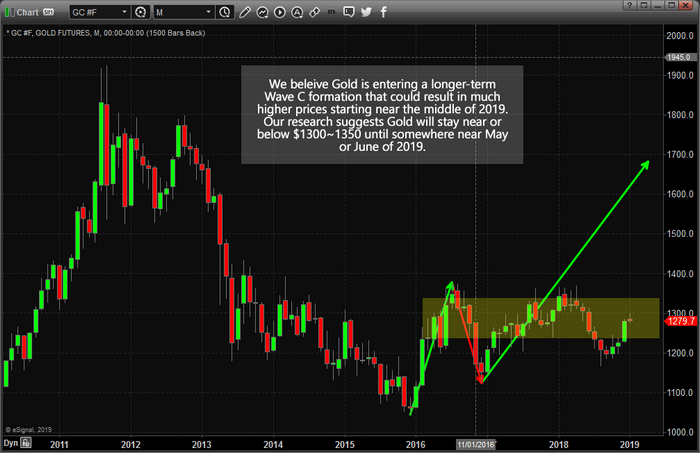

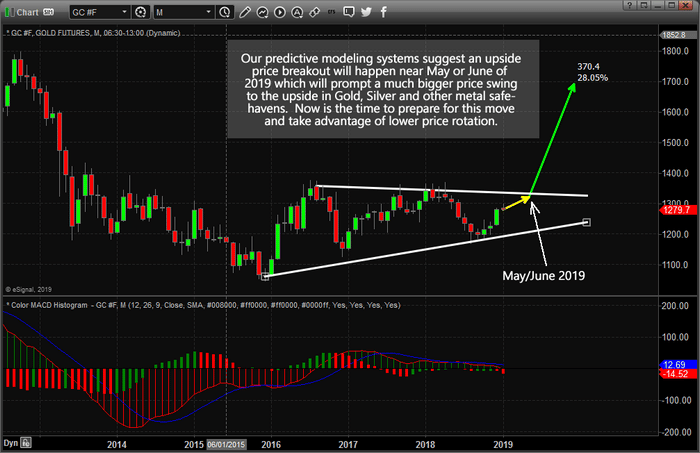

PRECIOUS METALS CALLS

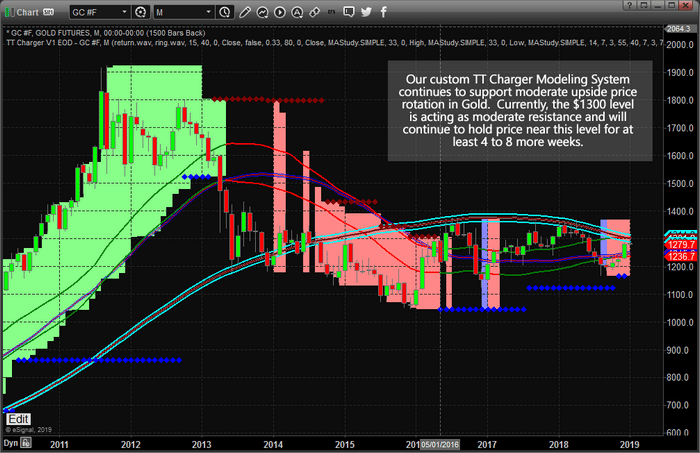

September 23, 2018: WARNED PRECIOUS METALS BOTTOMED

https://www.thetechnicaltraders.com/gold-and-miners-are-about-to-explode-upward/

December 12, 2018: JUST WAITING FOR GOLD & SILVERS NEXT RALLY

https://www.thetechnicaltraders.com/expect-gold-silver-to-pullback-before-the-next-move-higher/

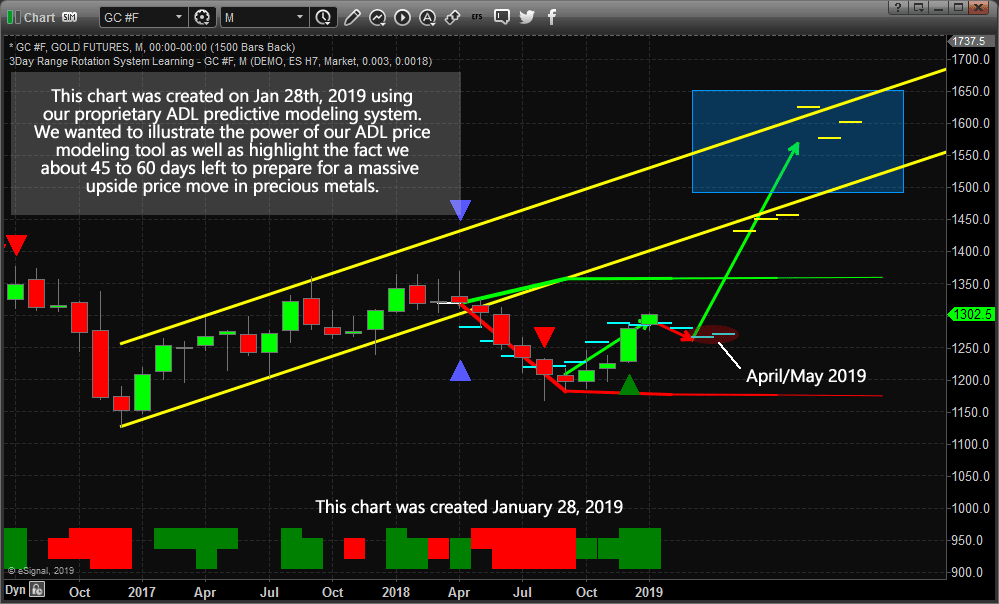

January 28, 2019: 45 DAYS UNTIL A MULTI-YEAR BREAKOUT IN PRECIOUS METALS

https://www.thetechnicaltraders.com/45-days-until-a-multi-year-breakout-for-precious-metals/

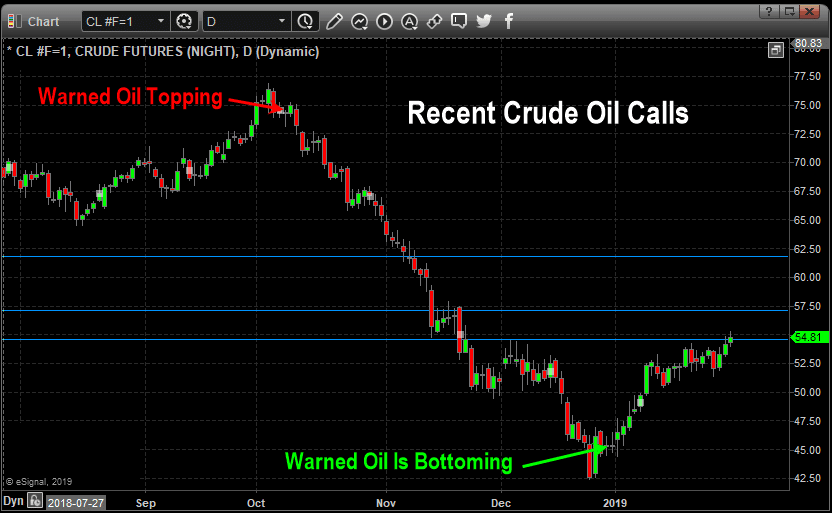

CRUDE OIL CALLS

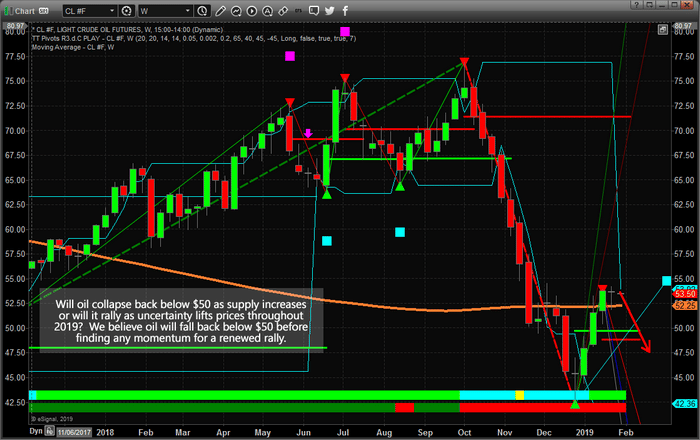

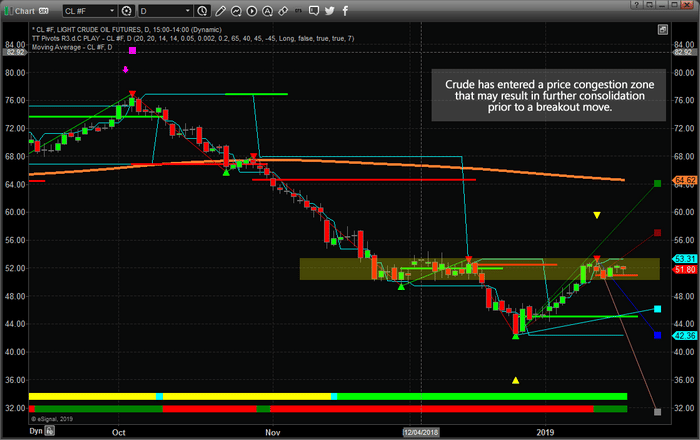

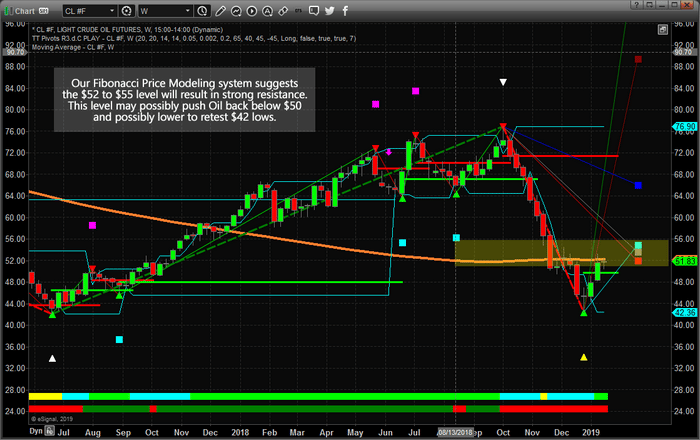

October 7, 2018: PREDICTIVE MODEL SIGNALS OIL TO FALL

https://www.thetechnicaltraders.com/will-oil-follow-historical-patterns/

December 31, 2018: OIL – WHAT TO EXPECT WITHIN THE FIRST 3~5 MONTHS OF 2019

https://www.thetechnicaltraders.com/what-to-expect-within-the-first-35-months-of-2019/

WHAT SUBSCRIBERS ARE SAYING

I just want to tell you how much I appreciate your no nonsense. I’ve read other advisors who hedge their bets with so many caveats that you could never actually put on a trade. So far, you have been crystal clear with your analysis and, even better, it has been correct!

JOHN BRIERLYTeacher

I really appreciate how hard you are working for us members… and how we’ve been able to make money recently when I might have been panicking without you. I’m learning a lot from you. Thanks.

TOM ROBERTSAccountant

I am looking to expand my knowledge in trading, and I like your methods. I am new to the game and I’m finding your advice very helpful and very profitable! I almost can’t wait for the updates.

STEVE USHINSKIVideo Editor

We look forward to seeing you in our member’s area to experience our newest tools for traders/members.

SUBSCRIBE TO OUR WEALTH TRADE ALERT NEWSLETTER RIGHT NOW!

Chief Investment Strategist

Technical Traders Ltd.