53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Archive for month: February, 2018

Yesterday we shared with you Part I – big picture analysis “math” Behind the recent sell-off. Today, we want to show you the what the math is pointing to in the short term and what to expect next.

For this type of analysis, we are going to use the Adaptive Dynamic Learning (ADL) modeling system that attempts to tear apart price and technical data from within a chart and reconstruct future price data by learning from the past. In these examples, we will focus on Weekly and Monthly data going forward about 25 periods. The intent is to clearly illustrate how our earlier analysis (completed near the end of December 2017) is still aligning with our current analysis. Amazing how these things all plug together like a big puzzle when you think about it.

Remember, in late December 2017, we predicted a massive rally to start 2018 that would peak near the end of January or early February with a downside price rotation before stalling near the February 20. At that time, we predicted that a new rally would start and would likely peak near or after March 15.

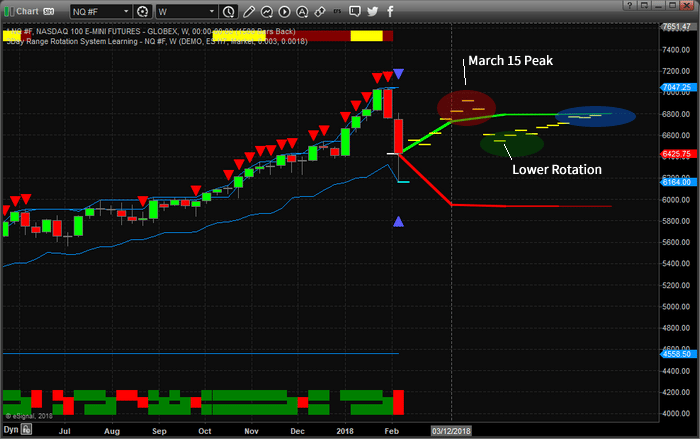

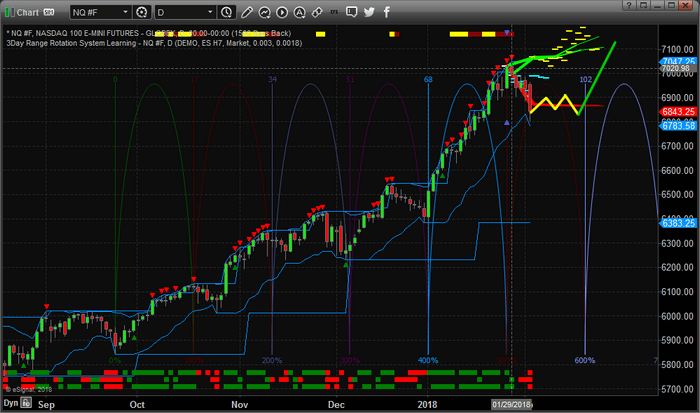

Take a look at this Weekly NQ ADL chart and tell me what you think of our analysis and predictive modeling systems after understanding how accurate this type of work can be. Yes, nearly two months ago, we predicted this move and our current analysis (as of February 9, 2018) is providing this current prediction.

Based on Weekly data

_ The NQ price should stall and rotate about 100~200 pts higher over the next 2~3 weeks

_ Near March 1, the NQ price should begin another rally that will likely peak near March 15 (+400 pts)

_ After that March 15 peak, the price should fall to near 6600 (-400 pts) before finding support and stalling.

_ Moderate upside price activity will likely follow with more narrow price volatility.

So, are you starting to get a picture of what to expect in the future? Of course, any outside news event (war, catastrophe or other global conflict) could dramatically alter the outcome of price action in the future and our system can’t predict for these types of events. But given historical price action and technical data, this is the most likely outcome (based on 54 unique instances of related data over 10 years of history showing the likelihood of this data being almost 97% accurate).

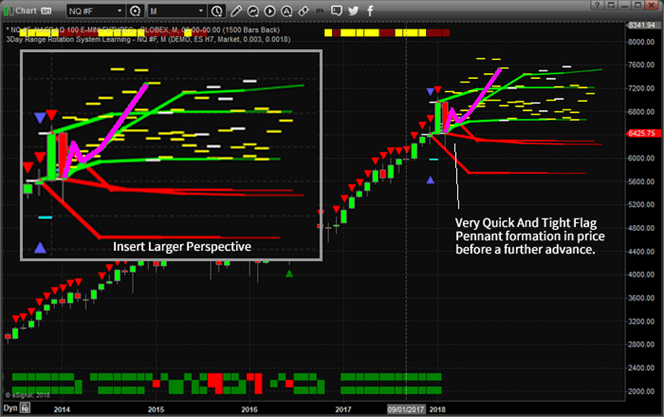

At this point, we are going to reiterate our earlier call of a very QUICK and TIGHT “Flag” or “Pennant” formation in prices over the next few weeks that will result in support likely being found near $6500~6600 in the NQ before another attempt at higher prices is launched. Remember, we are predicting a future where a new rally may start near or after February 20 and a peak in prices should be reach near or after March 15.

This image of the Monthly ADL system is showing, very clearly, that prices will likely rotate within the current price range while establishing a technical pattern for further advancement. We believe our analysis from late December 2017 is still very valid and accurate. We believe this new FLAG formation is a result of the price correction we expected from our earlier analysis, yet we could not predict the severity of the move at that time. We did know that NQ prices had already exceeded our predicted boundaries and because of that we felt that prices were going to contract in a moderately aggressive manner – we even warned our members of this potential.

As of right now, we expect the markets to open next week with moderate price volatility in a pattern that will result in a very quick and tight market FLAG formation. By the time February 20 hits, we believe the US Majors will begin advancing higher towards a March 15th peak.

We’ve included an “Insert Larger Perspective” which is a zoomed in capture of our ADL analysis to help you understand what we are seeing in the markets.

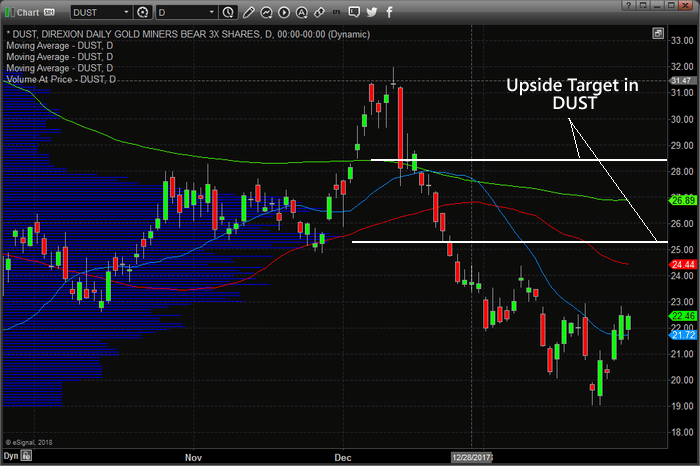

Remember, opportunities exist every week for traders and investors to take advantage of market rotation and key market moves. This is much like our gold miners sell-off prediction report showing the big opportunity using DUST etf.

If you want to learn more of what we offer our members and how we can assist you in staying ahead of the markets visit: www.TheTechnicalTraders.com. You can also read all of our public research documents on our site as well as talk to a live representative if you like. We look forward to helping you find success in the future.

Get ready for some price recovery and be prepared for a moderate upside move before March 15.

Between my research team and I, we have 53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

BECOME A TECHNICAL TRADER AND PROFIT TODAY! – CLICK HERE

After surviving one of the biggest market rotations in the last 3+ years, we have been getting quite a bit of request for a detailed analysis of this move and asked what our specialized modeling systems are telling us is likely to happen. Our research team at Technical Traders Ltd. has put together this short reference of “the math behind the move” that will show you what is happening and the underlying price mechanics that are going to be driving prices in the future.

Now, before we get into the details of the mathematics of this recent rotation, we want to preface the fact that our current analysis indicates that the Tuesday low appears to be the ultimate low at this time and that future price activity will either confirm this or create an alternate price outcome. As we are going through the mechanics of this move, remember that we predicted a massive price advance for the beginning of 2018 that would result in a “relief pullback” near the end of January before finding new support and launching into an additional advance culminating in a price peak near March 15 (this was the furthest future point that our predictive modeling systems could identify at that time in December 2017). As of right now, our analysis was DEAD ON.

So, what do our predictive modeling systems tell us now and what should you be doing as investors/traders? Let’s get into the details – shall we?

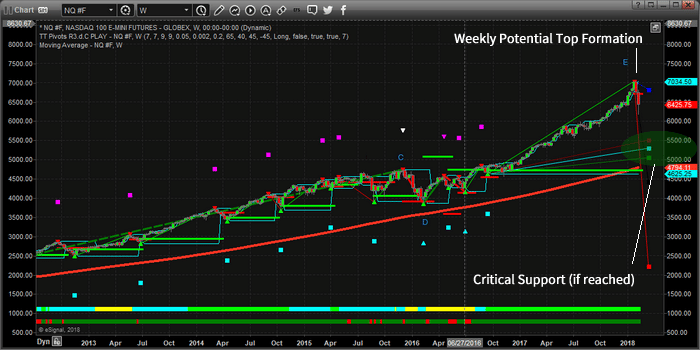

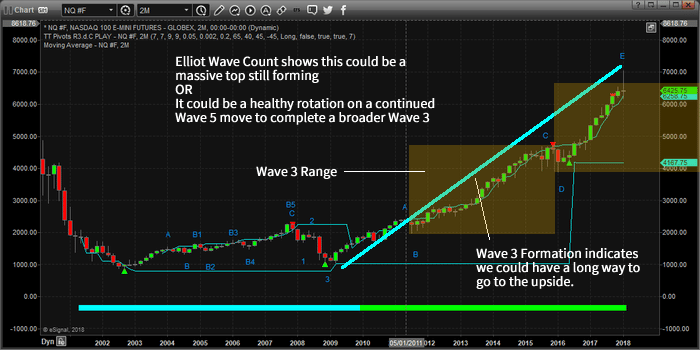

This monthly chart of the NQ provides a pretty clear picture of the current Elliot Wave formations and presents a clear understanding that we are currently in a WAVE 5 expansion of a broader WAVE 3 move to the upside. These WAVE 5’s can be somewhat extensive and are often equal to or greater than the previous WAVE 3 move. Thus, we have just recently reached the EQUAL price range in the current WAVE 5 compared to the previous WAVE 3. This means we should be expecting a bit of rotation and consolidation near these levels before price determines if this WAVE 5 move will continue.

This next Weekly chart is using our Fibonacci/Elliot Wave modeling system that assists us in determining critical price levels and turning points. As or right now, on the hard right edge of this chart, we are seeing that the current price is warning of a moderately deep retracement that is setting up as long as the price stays below $6720. Additionally, it is showing very strong support near the $5000~5500 level. This modeling system tells us that if recent lows are breached, the change that prices would fall to near $5500 is fairly strong.

Again, remember that we are “potentially” nearing the end of WAVE 5. We don’t have any real confirmation of this move yet, and all we can do is be aware that WAVE 5 if this is the end, will create a short-term corrective wave (Intermediate Wave 4: down) that will end with the creation of a massive broader WAVE 5 higher. So, at this point, we have a healthy rotation that may turn into a WAVE 5 top.

Now that we’ve completed the MACRO analysis, we have to understand what the MICRO analysis and modeling systems are telling us. Remember, these two charts are Monthly and Weekly modeling systems that are showing us the very long term price potential (over many weeks, months or years). For a more immediate analysis of what we should expect over the next few days, we have to use other modeling systems which paint a very clear and exciting picture for us as traders. Tomorrow we will post PART 2 of this report showing you exactly where the markets are headed over the four weeks.

Remember, opportunities exist every week for traders and investors to take advantage of market rotation and key market moves. Please visit www.TheTechnicalTraders.com to learn more of what we offer our members and how we can assist you in staying ahead of the markets. You can also read all of our public research documents on our site as well as talk to a live representative if you like. We look forward to helping you find success in the future.

Get ready for some price recovery and be prepared for a moderate upside move before March 15.

Between my research team and I, we have 53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Chris Vermeulen

www.TheTechnicalTraders.com

We’ve received many comments and questions from our members over the past few days regarding the recent US market crisis asking what to expect next. Is this the start of something bigger? Deeper? What should I do with my open long positions? What should I do to prepare for anything in the future? All of these are valid questions. So, we wanted to help our members and all of our followers by showing what we believe will be the most likely price action going forward a few weeks out.

The recent downside moves in the US majors did freak a lot of people out. It was something that startled people and pushed a panic button for many. Certainly, the rotation in the VIX and volatility related ETN’s pushed many people over the edge. In fact, recent news is that these volatility related ETN’s exasperated the selloff as the VIX shorts were pushed out of positions and into a protectionist mode with the massive spike in volatility. As the old floor trader saying goes “want to know what causes the markets to crash? Buyers that turn into sellers to protect from unwanted losses”.

In fact, the fear and selling were so strong it sent the safe havens tumbling lower, which we took advantage of trading the DUST gold miners ETF for a quick 20% profit.

Well, now that this rotation appears to be almost over either this week or early next week, let’s take a look at some of the technical channels and fundamentals that should drive the markets going forward.

First, we have strong economic and fundamental US and global data that is showing increases in the global economy, GDP, output, employment and more. In reality, the global markets are pushing hard for greater growth. The one factor that is still concerning for us is the US Fed and Interest Rates as well as regional housing levels. We have been watching these levels quite closely over the past few months and watching what is happening in major metros across the US and globally. We are still seeing price appreciation and strong activity in most locations which indicates the top has not formed yet.

Therefore, we believe this February market crisis is, as of right now, a unique instance of a “shakeout” after a lengthy period of very low volatility. Almost like the market needed to “breathe” and in order to do that, it needed to roll out of a low volatility range. Now that this is taking place now. We believe the markets are setting up for a very quick FLAG/Pennant formation that will prompt a burst higher towards a March 15th peak.

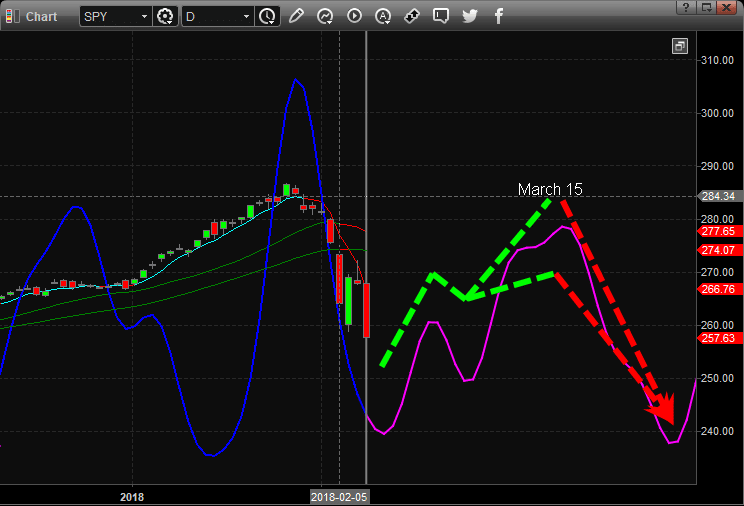

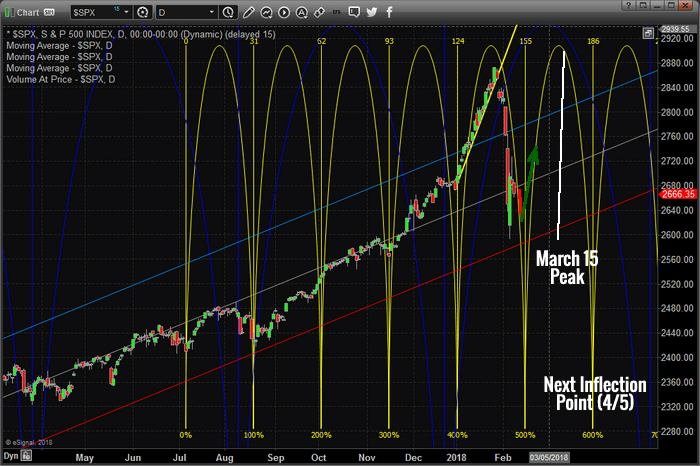

This chart of the daily SP 500 (SPY) is showing our primary longer-term price cycles. As you can see, this chart is showing that a bottom in price cycles is happening this week and next and that we would likely see price rotation and moderately higher price activity over the next 3~5+ weeks. We are still expecting weakness that could retest the lower price channels (which you will see in additional charts), but overall we are expected a very quick and tight FLAG/Pennant price formation that will consolidate price before an upside price breakout.

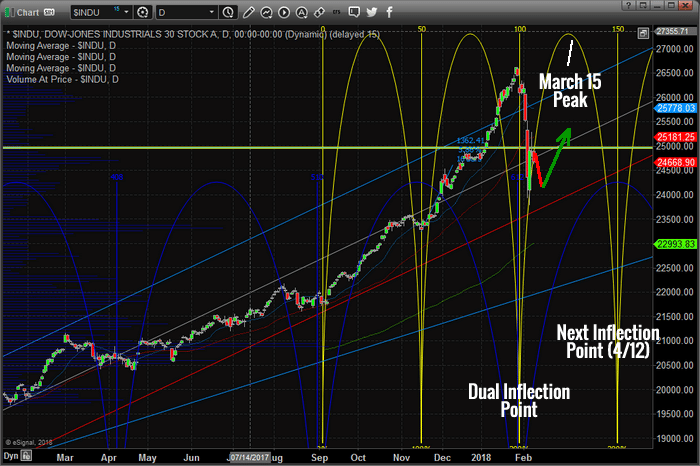

This chart of the INDU (Daily) shows our cycle analysis and key cycle points. Notice the Dual Inflection Point in early February that warned of a potential price reversal/correction. Also, pay attention to the price channels that are at play in the current uptrend. These tell us that this recent price rotation was critical for the global markets to “breathe” and rotate in a very healthy way to allow for further growth. The markets had been in such a tight volatility range for over 11 months and this type of price movement is somewhat unhealthy. The market operates on the premise that price continually rotated (attempts new highs or new lows) and without that rotation, the market becomes heavily biased to one side or the other.

These cycle points play a role in telling us when to expect potentially critical market turning points and what to expect in terms of intensity of price swings. This recent downside move was aggressive in nature and we believe this is relative in terms of how narrow the volatility (VIX) had become. In other words, the markets had been so tight and narrow (biased) that breadth was minimal. The markets needed this type of rotation to allow for further price moves.

Putting all of this together, our analysis is that the markets will continue to rotate in a moderately wide range while creating a very quick and tight FLAG/Pennant formation. Culminating in a price breakout, we believe to the upside, in correlation with the predictive analysis that is telling us of a March 15th price peak. Therefore, we believe this rotation was a healthy move that allowed the markets to recover a functional price range (creating support and resistance) that could prompt further price advances.

Certainly, there is the risk of further downside price activity. Certainly, some news item could come out in the future that could drive the markets substantially lower. We believe the US and Global markets are strong fundamentally and that the new growth in the economic output will continue to try and push equities higher as expectations of increased global economic activity continues. Immediately, we are targeting the March 15th price peak. From that point, we will reevaluate our analysis and update our members.

In a video I posted the other day I walk you through gold, stocks, volatility, vix, and bitcoin using my predictive price cycle analysis and technical analysis show your where these asset classes should be headed next.

Also, I had a great conversion with Cory Fleck from the Korelin Economics Report you should hear.

Between my research team and I, we have 53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience

Chris Vermeulen

CLICK DOWNLOAD LINK TO LISTEN: DOWNLOAD SHOW

Our articles, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors to explore the tools and techniques that discretionary and algorithmic traders need to profit in today’s competitive markets. Created with the serious trader and investor in mind – whether beginner or professional – our approach will put you on the path to win. Understanding market structure, trend identification, cycle analysis, volatility, volume, when and when to trade, position management, and how to put it all together so that you have a winning edge.

BECOME A PROFITABLE TECHNICAL TRADER TODAY – CLICK HERE

Chris Vermeulen

Our articles, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors to explore the tools and techniques that discretionary and algorithmic traders need to profit in today’s competitive markets. Created with the serious trader and investor in mind – whether beginner or professional – our approach will put you on the path to win. Understanding market structure, trend identification, cycle analysis, volatility, volume, when and when to trade, position management, and how to put it all together so that you have a winning edge.

JOIN US TODAY AND BECOME A WINNING TECHNICAL TRADER – CLICK HERE

Chris Vermeulen

Founder Technical Traders Ltd.

It has been an emotional ride for most traders since stocks started to sell off last Friday in a big way. This crash we just experienced is VERY much like the Aug 2015 crash. Price and volatility both have parabolic price movements that could either make you a lot of money or lose a bundle depending on where your money was positioned.

This post is to quickly share three recent trades we have taken one of them (REALLY BAD) and what to expect in the markets moving forward.

On Monday while the markets were under serious pressure cascading lower our only open position at the time was DUST. This is an inverse gold miners fund that allows us to profit when gold stocks fall in value. We had been expecting gold stocks to fall for a couple weeks and got into the position on Jan 26th. Gold stocks fell quickly and we took partial profits at 11% within 3 days.

We continued to hold the balance of DUST in anticipation of a second leg down in gold stocks which our technical analysis was showing should happen within a couple days which it did. On Monday, Feb 5th while stocks were under more selling pressure money rotated into the gold stocks as a safe haven and that is we decided to close the position with a 20% profit it 7 days. This was a good trade, but the next one isn’t. You can see our play-by-play trade alerts for this here

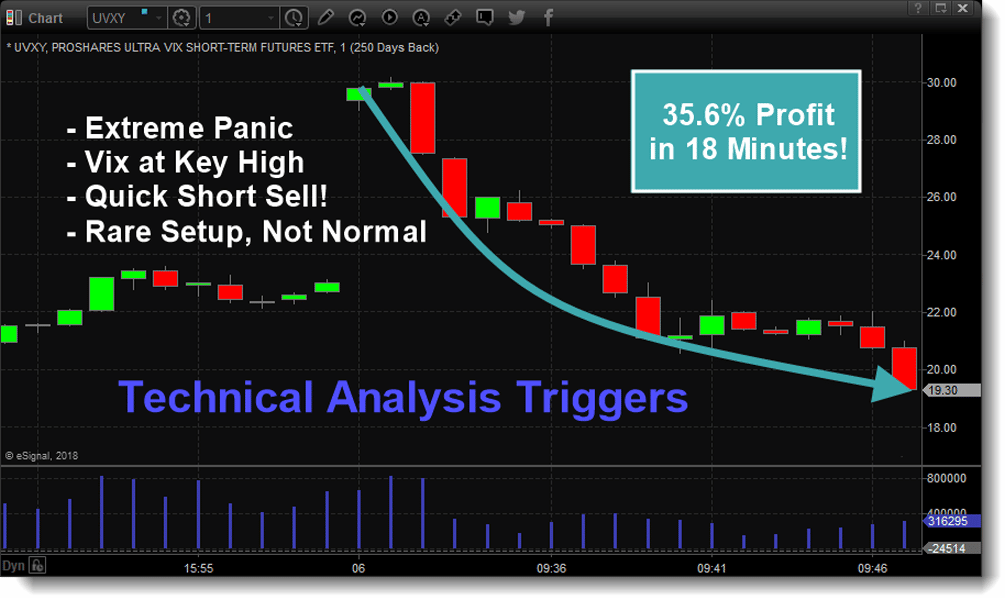

Also, on February 5th we were anticipating the panic selling and looking for a washout low to be put in place Monday/Tuesday of this week. Thus far everything has played out exactly as we expected in terms of price action. What I love about technical analysis is that if done correctly you can predict, or at least have a very good idea of what price should do next, and because we knew panic selling was coming we were not totally caught off guard. But I will admit, I expected half the price movement and volatility that actually took place this time around.

TERRIBLY UNFORTUNATE TRADE

– I always short UVXY when the vix is high, and fade the fear. But no shares were available to short Monday.

– The only other way to do this was to buy XIV and inverse VIX fund which works in most cases but not nearly as good as short selling UVXY.

– Volatility jumped 100% Monday, XIV fund imploded and lost 98% of its value catching hedge funds, professional traders, and us off guard.

– XIV is still trading, it will take many months to regain and reduce some of its drawdown.

TUESDAY’S CLAWBACK TRADE

During extreme situations like XIV position dropping 98% there are two ways to deal with it. Take the loss and move on, or use the extreme market conditions to get back into a trade and catch the next big move to help minimize XIV drawdown. So we took a short sell trade on UVXY Tuesday at the open. The Vix was set to gap sharply higher into a level it has only ever reached a few times in before. By shorting the vix it means we profit when the vix falls in value which it did.

We opened the trade right at the opening bell and the vix when into free fall hitting our first protic target within 18 minutes for a 36% profit. We still hold half the position expecting a larger gain over the next few days. Currently, this short UVXY position is up over 50% and we are looking for roughly 70% before we close it out.

Take a listen to my audio Squawk Box broadcast today to subscribers to get a feel for the XIV, volatility, and the stock market.

CONCLUSION:

In short, February has been exciting, to say the least. I feel this price action is a major warning and signal that the bull market is coming to an end. What I feel is going to unfold is similar price action we say from Aug 2015 crash – Feb 2016. Big price rotation, and elevated volatility. And this time, stocks may not find support at the lows created this week and trigger the first leg down in a new bear market.

It’s likely going to take most of 2018 to form and unfold, but we aware…

Join us at Technical Traders Ltd. Wealth Building Newsletter and take advantage of the next major trend changes and profit.

Chris Vermeulen

www.TheTechnicalTraders.com

We’re certain that many of you are asking yourself this question after seeing the markets rotate to the downside so hard recently. If you had been reading our past analysis for the early portion of 2018, you would likely know the answer to this question. If not, this research article will assist in your understanding of the market’s rotation and what to expect over the next few weeks/months.

We called a market advance in early 2018 nearly three weeks before the end of 2017. We also called the current move, lower, at that same time. Recently, we’ve made calls regarding the US Dollar, metals markets, and natural gas that have played out exceptionally well for our members. Now, we’ll show you what to expect in the markets for the next few weeks.

First, we want to alert you that this downside move in the US majors is, in our opinion, a rotational motion to establish support for a bigger and stronger upside leg resumes. We are certain that others will be posting research calling this a “major top” and warning of extended downside risks. In reality, that analysis could be true if the markets completely fall apart or some external factor drives the market below critical support levels. But right now, this is not the case and we don’t see it playing out in this form because many economic fundamentals are pointing to much higher price levels.

The NASDAQ Daily. We can see the beginning of 2018 started with a massive upside rally originating near the $6400 price level. Currently, the $6800~6900 price level is our “upper boundary” from our original analysis prior to the end of 2017. When the price level reached these levels, we were certain that the pullback would be exaggerated as well. Thus, this move lower, last Friday, is a perfect price reaction to the extent of the rally that started 2018.

At this time, though, we are moving right into our “upper boundary” range and most of our readers want to know what to expect next. In our previous research, we identified many key dates that we thought would play out as critical price rotation dates. Additionally, our cycle analysis dates assist us in understanding broader cycles. Our current analysis is that the downward price cycle in the NQ will stall near the $6668 price level and extend into a sideways price channel till near February 21st. Near that time, February 21st, prices will likely begin a new advance higher with the potential for an explosive rally to the upside which should end near March 15th.

After the March 15th cycle top, we will have to review the market setups then determine what is the likely outcome. Overall, we believe the markets will rotate lower, again, in a similar manner to how they have moved in the past year plus. Each move of 4~7% lower has been a measured price rotation that supports a further price advance. We don’t believe there is any reason, currently, to be concerned about critical market failure. We are watching our sources for early warning signs and are paying very close attention to China and the EU.

Lastly, we wanted to share with you a larger perspective of the market’s rotation as it plays out over the next few months. April and May are always somewhat interesting in the markets because US citizens are dealing with the IRS/TAX issues at that time. Additionally, the markets will likely consolidate into the lower volume Summer trading.

Our expectations are that the US Majors will move broadly higher towards the March 15th peak, then rotate lower for a week or two, then begin a move higher again ending near April 15th. All of this analysis is based on our research of cycles and price modeling systems. This allows us to see into the future a bit with some basic understanding of what is likely to happen. Yet, we can’t be 100% certain all the time, in fact, we re-analyze the markets daily and our forecasts slowly change as the markets evolve which is why it’s critical to receive our up-to-date research each week. The best we can do it to make educated expectations and make trades that provide us with the advantage over the markets. Our most recent trade in DUST shot up 11% in less than 2 days.

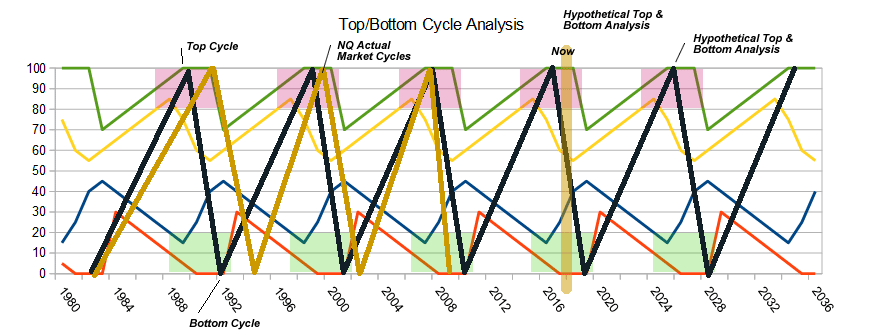

All traders must understand that the global markets are reacting to the new US President and his new business-friendly policies. Overall, there are major cycles still at play in all the markets and they may become extended in some form or another. Yet, these cycles are still fundamental to the operations of global economics.

As you can see from the following image below, the current market cycle is well within the topping range and has been pushed deeper into the topping range by recent policy. It is our opinion that without these policy changes and the new US President, we would have already been in a major market correction (bear market) by now. This cycle is still very relevant and important. At some point in the future, this will become critical for all investors.

If you find our research and articles helpful and insightful, then please visit Technical Traders Ltd. to learn more about our service that provides daily forecasts and swing trade alerts for stocks, ETF’s, and index futures and commodities to traders and investors.

Our objective is to help you find opportunities and success each and every day. We deliver our Daily Market Video early each morning telling you what to expect in the markets each day and we deliver text-based updates throughout the day (as needed) to alert you to opportunities. Try joining for one month to see how we can help you become a better and more successful trader – visit www.TheTechnicalTraders.com today.

53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple highly effective way to provide our customers with the most convenient, accurate, and clear market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Chris Vermeulen

53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple highly effective way to provide our customers with the most convenient, accurate, and clear market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Become A Profitable Technical Trader Today and Enjoy the Experience – Click here

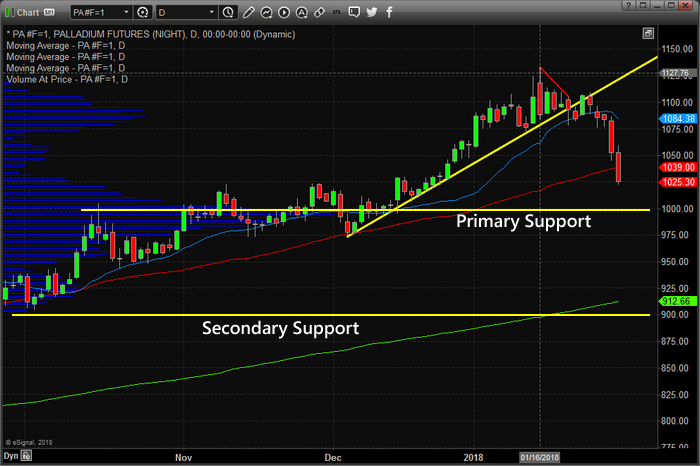

Just a few days ago we alerted our members and followers to a massive setup in the Palladium market that had not been seen in years. This chart formation provides an incredible opportunity for a trader to take advantage of and profit from the expected price decline. We alerted our members and followers on January 24th of this move.

As of today, Palladium has rotated downward by over 9% from the recent highs and should continue to move lower as this multi-month rotation extends. Even though this initial move lower (-9%) reaches our initial predicted target levels, we still believe support won’t be found till prices reach near the $1000 price level. If that support fails to hold, the price of Palladium could fall to the $900. This total move could be over -20% by the time this downward swing ends.

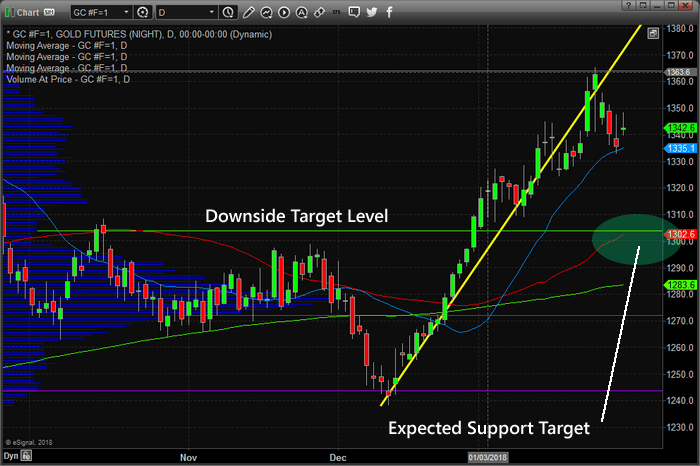

We warned weeks ago about this cycle top in gold and how it should rotate lower and move to near $1300 before finding support. This move has just started really and would equate to a -3.8~4.2% downward price correction.

The overall potential from our DUST trade remains substantial. Currently, we have already locked in +11% for our members and we believe the final move could be much larger.

The reason we are alerting you, today, of the progress of our calls, is that the market conditions are changing, and these types of trade setups are going to happen every month and a lot of money can be made by taking advantage of them each month. Join our Wealth Building Newsletter at www.TheTechnicalTraders.com and let us boost your trading returns with our daily analysis video, market updates, and trade alerts.

We just closed out another winning trade and members locked in a quick 9.1% profit with falling price of natural gas.

JOIN US TODAY AND BECOME A WINNING TECHNICAL TRADER – CLICK HERE

Chris Vermeulen

Founder Technical Traders Ltd.