Archive for month: July, 2016

A Cycle Top In The Stock Market Next Month

It was “Panic Buying” that pushed the Dow Jones and the SPX Indices to record highs. To be sure there is trouble brewing in this rally. Smart money has left the stock market, as the charts at the end of this article will display!

While Wall Street insiders appear to know that something is seriously amiss with the economy, no one is warning the retail investor.

The SPX continues to develop and complete its Broadening Topping Pattern. The next trend is downwards! We are NOT currently in a trending mode…so tread lightly during these choppy times.

What Emotion Is Driving The Market Now?

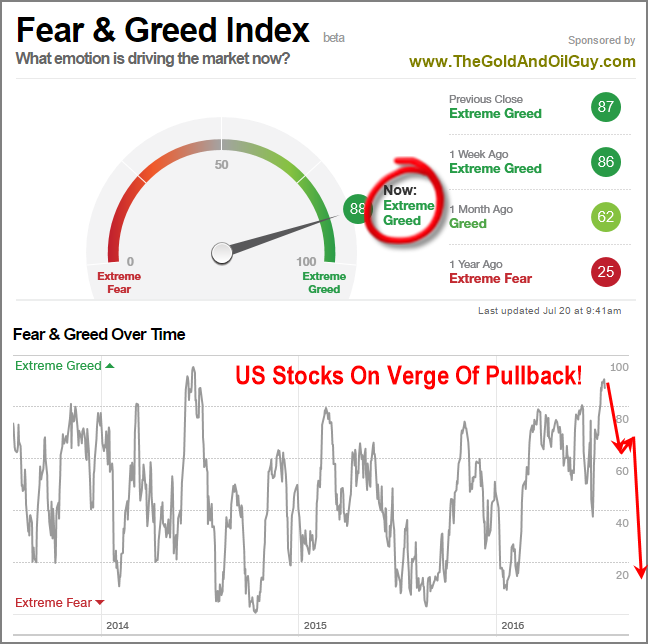

CNN’s Fear & Greed Index tracks seven indicators of investor sentiment.

It’s displaying that the markets are way too frothy at the’ current reading of 86. It is important to note that this is a contrarian indicator, meaning when everyone is bullish and buying. Consequently, the market should be close to topping out…and falling in value.

As the markets are pushing higher, investors tend to become warier by nature. This often leads to the markets climbing the proverbial “wall of worry”. Are investors missing out on the opportunity of higher prices?

This Is Classic Negative Divergence

I believe the market is topping near these levels, because of the divergence between the Dow Industrials and the Transports. The Industrials have made a new all-time record high, but the Transports have not.

One of the many near-term indicators I am watching pertains to Dow Theory. It is one of the more visible core tenets of Dow Theory. Moreover, it’s important to see price confirmation (directionally) from both the Dow Jones Industrial Average (DJIA) and Dow Jones Transportation Average (DJT). The Industrials reached new all-time highs, while the Transports have not. The Russell 2000 (IWM) have NOT confirmed this high either, confirming there is a broad weakness in stocks. The Russell 2000 typically leads stock market rallies and selloffs.

The market trend is UP when both forge higher highs. The market trend is DOWN when both forge lower lows. A “non-confirmation” is present when only one forges a higher high, but other makes lower lows.

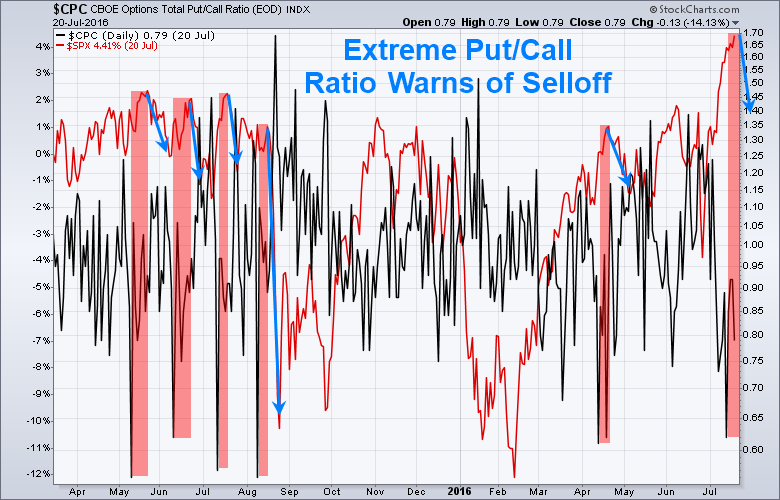

The Volatility Index VIX recently dropped to a multi-year low. It is now trading at levels where it was last August 2015, before it exploded to 40. In fact, a few days ago, there was a good article talking about the put/call options ratio and VIX and how they are both at extremes – pointing to a significant correction in the next couple weeks.

Another Chart You Need to View

Helicopter Money

During the last couple of weeks, gold prices have been in a corrective wave. However, this pattern calls for a continued uptrend to begin within the next couple of weeks.

Japan has promised to buy One Trillion Yen worth of new government debt…and perhaps even begin the “Helicopter Money” plan of direct government debt monetization going forward.

There are two events that will occur within 36 hours of each other this tomorrow, July 27th, 2016 and Friday, July 29th, 2016:

Wednesday, July 27th, 2016 – FOMC meeting ends with “Fedlines” announced at 2:00 pm EDT. Expect no rate changes!

Friday, July 29th, 2016 – The Bank of Japan meets and releases its latest QE plans. Former Federal Reserve Chairman Ben Bernanke told Prime Minister Shinzo Abe that there were still “various tools available” for monetary policy to spur growth.

A Reuters’ poll showed 85 percent of analysts expect the BOJ to ease on July 29th, 2016, alongside the fiscal spending boost Abe is set to announce this month.

In Japan, where government bond yields have fallen below zero, and faith in “Abenomics” is flagging, gold sales are soaring.

It is not unreasonable to expect the same here in the US between now and November 2016…and beyond.

Tracking Insider Activity Matters

Insider behavior matters because research based on real-time signals has shown that a properly modeled picture of insider actions can provide the most accurate reflection of the prospects for the company, industry, economic sector, or even the stock market in general, going forward.

This makes perfect sense from an intuitive perspective. Corporate insiders possess all the necessary skills and characteristics that one could use to describe the “successful” investor. A couple days ago I did talk in detail about how company executives disguise poor earnings numbers through the share buybacks we have seen the past year.

The chart and tables listed below are tough to read but the heading above each chart explains what each chart is telling us what insiders are doing with their money.

Daily Insider Buying Amount Is Down Sharply for 2016

HUGE Insider SELLING of Oil, Gas And Pipeline Companies

HUGE Insider SELLING of Internet Providers/Services/Technologies

HUGE Insider SELLING of Large Conglomerate Companies

HUGE Insider SELLING of Real Estate Based Companies/Funds

- REIT Offices

- REIT Retail

- REIT Diversified

- Hospitals

Concluding Thoughts

We believe the average market participants who are bullish on the stock market, and feeling really great about their future, will soon be left holding a huge portfolio of stocks trading 30-50% below the value they paid for them.

Wall Street insiders have been, and continue, to sell their shares as they see the music stopping sooner than later — and do not want to be the ones left holding equities when the bottom falls out.

When the equities market does roll over, money will be looking for a safe place to hide, which will be precious metals and US bonds.

Major market tops, like the one that has been forming for many months now, do take time to unfold. Moreover, they tend to take longer than one expects. Based on many different types of market and economic analysis, it’s just a matter of time now before something, or someone, triggers a selloff in stocks.

The exciting side of all this is that the stock market falls 3 to 7 times faster than it rises. And through inverse exchange traded funds and VIX ETF trading strategies one can profit from a collapsing stock market.

Get My ETF Signals And Profit – CLICK HERE

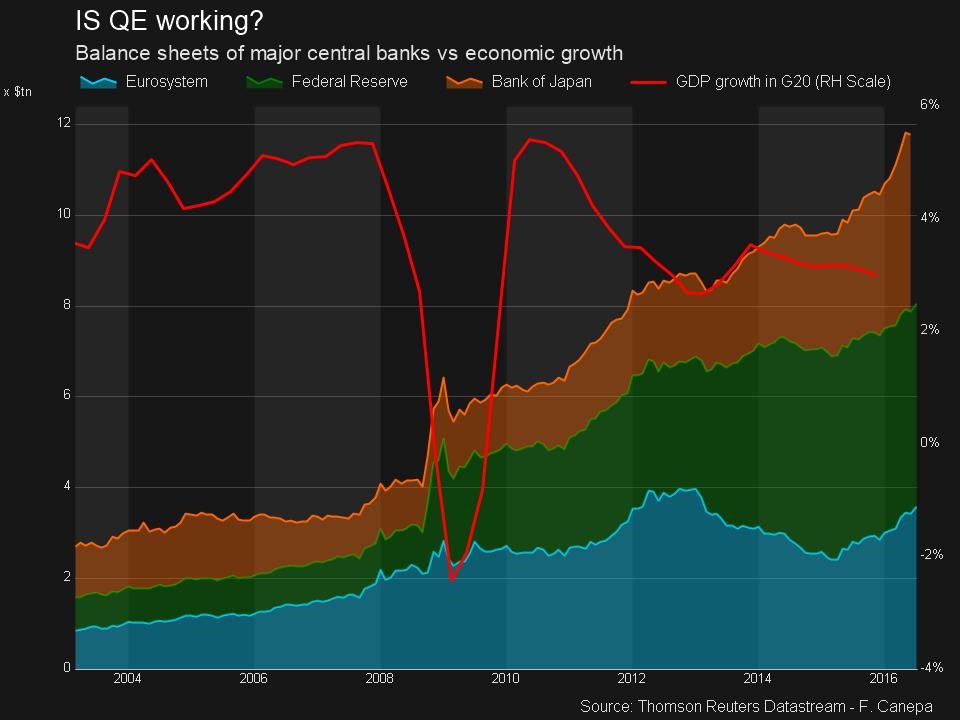

All bubbles burst; the question is when? Quantitative Easing (QE) is much like an addiction. One needs more and more to get the initial effect, however, this becomes an asymptotic result, whereas, eventually, one needs an infinite amount that will no longer give a positive effect! So, now that QE has failed, I believe there will now be the introduction of “Helicopter Money”.

Global central bankers constantly continue to spend their way out of their contracting economies, which are now resulting in large budget deficits. The deficits that these policies have produced are unsustainableand have now created a new fiscal crisis within their countries. A second response has been to expand the central banks’ balance sheets as a way of providing liquidity to the private sector. These policies have also sent interest rates into unprecedented historical lows. European countries and Japan have sent their rates into negative territory, thereby reducing returns to fixed-income investors. Low interest rates have encouraged corporations to borrow more money but, in turn, harm the investors savings for their future.

Implementation of these monetary policies temporarily assisted the economy so as to reduce the impact of a new economic and financial crisis back in 2008. However, it was not the prudent policy to continue after everything became stabilized. The real solution was for an implementation of a new round of fiscal policies. This would have restructured the debt and allowed the global financial system to reset itself. Unfortunately, we are currently sitting on a ticking time bomb in all of the global financial markets.

True GDP growth comes from increasing productivity and real employment and allocating resources for proper economic activity. Global Central Banks have been applying monetary policies for so long, now, that they have become reckless and never created an exit plan. They never created any real required economic growth. The global central banks’ intervention, over eight years ago now, was to be the initial response in preventing a financial meltdown, however, monetary policy did not generate changes in productivity nor in the amount of economic resources that are required for any economy to expand. It is only the private sector that can generate the economic growth necessary to increase corporate profits and equity prices. As the size of the private sector shrinks, it becomes more difficult to generate growth within that economy.

Earnings Management

“Earnings Management” is the practice of attempting to intentionally bias financial statements in order for them to appear better looking than they actually are! Managers, in fact, make their earnings appear better, as well as their incentives for manipulating earnings, which is calculated and misleading to the shareholders. There are red flags for two different forms of revenue manipulation. One is manipulating earnings through aggressive revenue recognition practices, which is the most common reason that companies get in trouble with government regulators for their accounting practices. The other red flag for manipulating earnings is through aggressive expense recognition practices, which is the second most common reason that companies get in trouble for their accounting practices.

Share buybacks allow companies to repurchase their own shares on the market. Why do those companies want to do this? The number of shares held by the public will be reduced, which will increase the earnings per share, even if the total earnings are the same. The value of shares being traded will increase. It is valuable for a firm’s manager to buy back shares when it believes that the firm’s stock is currently trading below its intrinsic value. Executive compensation is often tied to executives’ ability to meet earnings-per-share targets. When it is difficult to meet the targets, the executives may repurchase shares in order to receive their executive or managerial bonuses.

Buybacks are not all created equal. The skills of the management in capital allocation and the culture of the company can make a difference in the outcome of the buybacks. Although buybacks are viewed as positive for stock prices, a lot of them happen at exactly the wrong time and destroy value for shareholders. I did talk with HoweStreet radio about how these high stock prices are deceiving.

Take a look at the chart below. This is a real eye opener for most, as it clearly shows how aggressively publicly-traded company executives are buying back shares to keep the earnings-per-share number high and cover up their lack of sales and growth. Eventually, this will come to an end, as does everything.

Currently, buybacks are at the same level reached before the last stock market top. I expect buybacks will end sooner than later, but the cover-ups will continue as long as executives have capital to spend.

You should know how to spot and recognize earnings management and get a more accurate picture of earnings so you will be able to spot the bad person(s) in finance reporting!

A variety of assumptions and accounting estimates are used in arriving at the final earnings figures. In assessing the health of a company, both lenders and investors alike almost always look at the quality of it’s earnings first. However, it is nearly impossible for a company to consistently report stellar periodical earnings over a lengthy period of time. This is because a company’s business activities are affected by changes in economic cycles, seasonal changes, new legislation, and other extraordinary events that occur.

In order to normalize the continuous succession of ebbs and flows in financial results that are characteristic of any typical business, company managers, more often than not, resort to a practice known as earnings management. Earnings management occurs when managers use judgment in financial reporting and in structuring transactions in order to alter financial reports so as to either mislead some stakeholders in regards to the underlying economic performance of a company or to influence contractual outcomes that depend on reported accounting numbers. In other words, earnings numbers are deliberately manipulated by management for the purpose of meeting their company’s objectives, whatever they might be!

The Death of Investing!

Why is it that banks are holding so many excess reserves? What does the data tell us about current economic conditions and about bank lending behavior and practices? Some observers claim that the large increase in excess reserves implies that many of the policies introduced by the Federal Reserve in response to the financial crisis have been ineffective. Rather than promoting the flow of credit to firms and households, the data, as shown in the chart below, indicates that the money lent to banks and other intermediaries by the Federal Reserve since September of 2008 is simply sitting idle in banks’ reserve accounts. The FED has been intentionally discouraging banks from lending to Main Street, which has increased unemployment and stalled out the economy.

There is a new crisis just around the corner known as The Long Wave Winter Of Discontent.

Global governments have built up large debts that far exceed their GDP. They have even larger future liabilities in terms of pension and health care for retired workers. So how is it that investors can anticipate an increase in profits, which is necessary to generate and maintain higher stock prices?

It is quite evident to me that it is because of these conditions that expectations of future corporate profitability will fall and that equities will experience a substantial decline very shortly. This also means that unless the conditions, as cited above, change, equity prices could be the same as they were in the early 1980’s or lower.

Bill Gross, noted bond investor of Janus Capital Group Inc., stated that “investors should worry, for now, about the return of one’s money, not the return on it. Our credit-based financial system is sputtering, and risk assets are reflecting that reality even if most players (including central banks) have little clue as to how the game is played.” Global central banks have gone way too far!

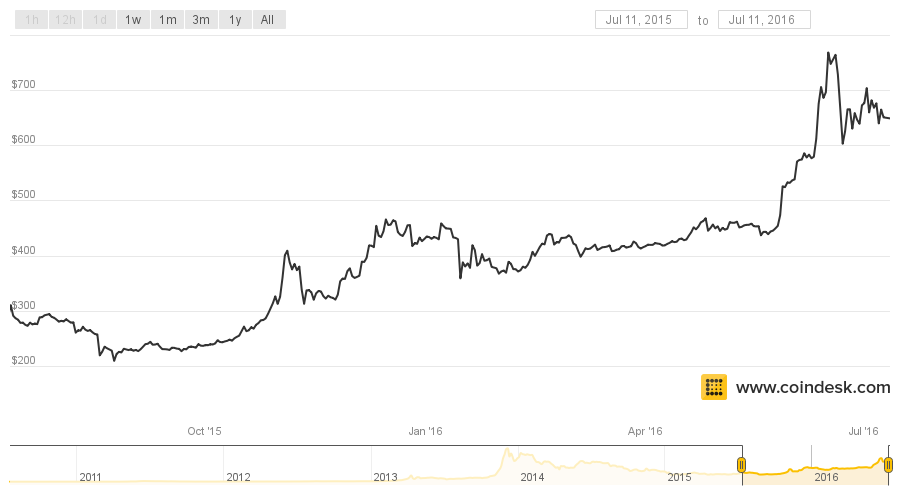

Recently I have share some insight on a new and fast-growing type of money or asset class, which removes the central banks from the entire equation. It’s just a matter of time before these assets explode in value and the FED/central banks are scrambling to gain control again.

Concluding Thoughts

In short, I have been talking/warning about the US stock market topping out for about a year now. This lengthy process is taking a long time to play out, as most major market tops do, but each month we move closer to another life-changing financial event for the global economy.

While I am not yet short the US stock market so that I can profit from falling prices, subscribers and myself have been long bonds and precious metals for a while and enjoying the ride up.

Various markets are starting to become VERY interesting, and huge opportunities are just around the corner!

Follow My Analysis & ETF Trades at: www.TheGoldAndOilGuy.com

Chris Vermeulen

The world has woken up to the fact that the Central Banks are a curse, rather than a boom to the global economies, and their time left is slowly coming to an end because of new technologies and currencies I talked about last week.

People are starting to park their money in digital currencies, like Bitcoin and Ethereum, rather than parking them in fiat currencies – I buy and hold my currencies in this crypto wallet CoinBase. This is primarily due to the Negative Interest Rate Policy as well as Zero Interest Rate Policy of the Central Banks, which explains the sharp rise in the price of Bitcoin, this year as seen in the chart below.

Billionaire resource investor, Carlo Civelli, believes that the Central Banks cannot get away with all the monetary printing. And I believe that the more they print, the more they push investors away from wanting their fiat currency.

“If we all talk about the end game and a scenario of total collapse, I can see the governments telling everybody that your money is now worthless and the bonds you own are now worthless. You all have to take a haircut”, said Civelli.

The institutional investors are recognizing this outcome,

hence, they are the largest group of Bitcoin buyers.

Jeremy Millar, Founder and Managing Partner at Ledger Partners in London, believes that people at hedge funds and family offices contribute 50% to 90% of the Bitcoin’s current $6.4 billion market cap.

“What is clear though is that over the last two years, bitcoin has emerged from its ‘hacktivist’ origins to a more institutionalized ecosystem which includes the participation of hedge funds, traders, and professional investors,” said Millar, reports Reuters.

Lack of regulation was scaring a few customers; not that regulation helped in any way during the 2007 crash, and neither will it help in the next crash. Nonetheless, the entry of the Winklevoss twins has given the whole industry an entrepreneurial boost. The twin brothers have co-founded the Bitcoin exchange Gemini.

“With Gemini, we’re a regulated trust company in the state of New York; we’re regulated under banking law, so we operate and have the same controls and procedures that you would expect of any financial institution (like your bank). That didn’t exist in the early days of Bitcoin. Quite frankly, it didn’t exist a year ago . . . It was a Wild West in the early days,” said Tyler Winklevoss.

It is not only the U.S. and the European investors who are worried about their currencies but the Chinese investors are worried, as well, about the decreasing value of the yuan.

Zennon Kapron, founder of Financial Technology Consultancy Kapronasia and author of a book on Bitcoin said, “it seems that China is leading a lot of the movement. People are protecting their investments [by converting yuan into bitcoin],” reports the Wall Street Journal.

The chart below shows the Chinese appetite for Bitcoin. The two Chinese exchanges, Huobi and OKCoin, both witness approximately 92% of the global trade in Bitcoin.

“There’s a lot of hot money in China that has to go somewhere,” says Du Jin, Chief Marketing Officer at Huobi, reports The WSJ.

Austrian economist and investor Tuur Demeester believes that “it is important to use Bitcoin as part of a diversified portfolio.” He adds that bitcoin “offers a counterbalance to a series of growing risks that are associated with traditional investment practices,” reports the Brave New Coin.

“We think a well-rounded portfolio includes investments in a basket of block chain technologies (altcoins), with an emphasis on Bitcoin. This portfolio can play a part in three distinct strategies: as an insurance policy, as a hedge in a broad speculative portfolio and as a calculated bet on an early retirement,” wrote Mr. Demeester, in his report.

He goes on to add that “we believe returns of 100x over 10 years are possible, though obviously not guaranteed.”

Conclusion:

My readers know that I do not big believer in owning fiat currencies for the long-term. My main emphasis is to find ‘alternative’ asset classes, which are mature enough, but not saturated. The risk-reward in such classes should be high. I buy and hold my currencies in this crypto wallet CoinBase

Gold and silver are a great investments but are still controlled and manipulated by the banks and crooks of wall st.

Stay Tuned For More Updates and New Trade/Investment Ideas at www.TheGoldAndOilGuy.com

Chris Vermeulen

I was recently looking at the CNN money website where they post this fear & green index. I caught my attention because many other aspects of the market are now also showing signs an imminent correction in the stock market.

This analysis is a contrarians play, meaning you believe that when mass majority of market participants are thinking and doing the same thing, you believe the market is about to change direction.

Let me share with you a few data points that are screaming that the masses are overly bullish and on stocks, buying shares like they know what they are doing, and have no fear of stocks dropping in value.

Take a look at the fear & green index below from CNN money.

Notice the current level “Extreme Greed”, and also the chart below showing the historical data. Its trading up near record levels and there is only one way to go from here – down!

What will change these participant’s minds? Well, they need to see stock prices fall fast and hard and for the crap to get scared out of them before they change their line of thinking.

The total put/call ratio is something you may follow. I used to follow it, but now just focus on during what I feel is a critical turning point in the stock market, like right now.

This is a messy/noisy chart but the important thing to get out of this is that the black line that is down at extreme lows tells us everyone is betting and leveraging their money in anticipation of higher stock prices. There is a delay from when we see low reads like this till the market tops and that time looks to be any day now.

The red line on this chart is of the SP500 index, which will fall in value once this last bit of upward momentum stalls out.

The volatility index is trading near long-term lows and “when the vix is low, its time to go”, as the old saying says.

Below is not a chart of the vix but rather of a VIX ETF symbol VXX. I talked about this recently in a trading analysis video for subscribers of my ETF newsletter.

Long story short, you will see the repeating price pattern that takes place. Because of the way VIX ETFs are built they naturally lose value over time, but that is not the point here. In fact, because of the natural price decay of this ETF it clearly exaggerates this repeating price pattern in the VIX would is very difficult to see without the exaggeration of price decay.

Conclusion to Greed, Volatility, and the Put/Call Ratio:

What does this chart point to? Well, keep in mind this is the WEEKLY chart. But in short, we should expect a BIG spike up in the VIX shortly and a sharp decline in stock prices.

There are many different ways one can play this next move. In one of my next article I will share with you a couple very interesting VIX ETF trading strategies for this next move.

Get My Articles and ETF Trades Delivered To You Inbox: www.TheGoldAndOilGuy.com

Chris Vermeulen

This Is Just Like Buckley’s Cough Medicine Slogan…

“Tastes Terrible,

But You Don’t Need It For Long!”

Last week I mentioned what I did years ago to get my trading and emotions in control so that I could trade for both weekly income and long-term account growth.

I will be honest with you, it was not exciting or fun by any means, and I did come to the realization of my trading weaknesses and core issues with my personality/emotions that held me back from being able to avoid losing big money, and from missing all the what would have been huge winners that I identified yet missed.

I have no doubt that you have pulled your hair out and screamed at the market for stopping you out just before a huge move in your favor. Well, we have all been there, done that, and have not told our wives or husbands about some of the big losses we took 😉

These things scar us financial and emotionally. They damage our ability to trade profitably going forward, which brings me to the point of this email.

I’m going to be blunt because it’s the only way to breakthrough barriers and get you do to what sucks, yet is critical for your success as a trader and long term investor.

In short, if you want to be truly successful as a trader and investor financially then you must take this super dull “Trading As Your Business Trading Program” just like I did – years ago.

If you want to fix your trading then you must swallow the pill and face your fears and weaknesses head-on and get through them instead of dancing around them afraid to face the reality that you are likely a loser when it comes to trading.

Let face it, you have likely not done a course like this yet because it hits the nerve that you know sucks, which are:

– Trading is business and requires planning, It’s not a get rich quick solution

– And, that you can’t separate emotional trades from the real trade setups

This mini-course will get you over these issues and you will feel like a million bucks once completed.

Remember, I took this course years ago, become a successful trader and investor, and now, years larter Brian McAboy the man who created this course, him and I have been great friends ever since.

He has put up this short intro video for you to watch at your leisure talking about what his program covers and will do for you. Again, its nothing super exciting, but its one of those things you just have to take the time to do once and your trading and mental state will be improved for the rest of your life.

Watch Boring Into To Course Now: http://www.insideouttrading.com/cmd.php?af=1498838

BETTER YET! – Save your time and just buy the course, book off a morning and do it!

Click Here To Take Action: http://www.insideouttrading.com/cmd.php?Clk=5534798

Talk with you soon,

Chris Vermeulen

On Friday, July 15th our exclusive filtered SpikeAlerts service nailed another winning trade to lock in a quick and easy $399+ profit in less than 10 trading hours for subscribers.

This signal was sent out at 5:02pm ET which members were advised to buy UPRO, SSO, or ES futures contract in post-market trading hours. I should mention that if your broker does not allow post-market trading of ETF’s then you really do need to get with a full service, direct access broker that allows you to trade pre and post hours stocks and ETF’s. These are my preferred brokers.

Spike Alert Email/Chart Sent at 5:02pm:

Alert Results 10 Trading Hours Later…

WATCH HOW OUR FILTERED PRICE SPIKES WORK!

‘Bitcoin’ is on a tear away rally. Its’ performance, over the last year, has been outstanding and it has outperformed most ‘asset classes’, by a wide margin. It is probably the only asset class which beats out both gold and silver, in 2016. Why is it shooting into outer space?

People look at alternate asset classes when their confidence in traditional assets fades. Since the beginning of the year, both the stock and the commodity markets have been on a roller coaster ride while catching both the bulls and the bears, on the wrong side.

The macroeconomic situation of the world does not give confidence to the astute investors which is evident by the return of the legendary George Soros, who has come out of retirement to short the overblown markets. Similarly, other hedge fund managers are stocking up on gold, which supports our view that a ‘financial crisis’ is right around the corner.

The “Brexit” results have also opened up a possibility of another round of easing by the central banks, around the world. The Bank of England will most likely resort to an easing schedule during the next meeting which will be followed by the European Central Bank and the FED. Post victory in the elections, the Japanese Prime Minister Shinzo Abe is likely to push the Bank of Japan to announce another round of ‘easing’.

Since the last ‘financial crisis’, the combined central banks have pumped massive amounts of money into the system and they continue to do so, at a rapid pace, nonetheless, the world is closer to a ‘financial crisis’ than ever before.

The FED’s money printing policy had led the commodity Guru Jim Rogers to remark: “The FED will continue to print money until there are no trees left in America.”

‘Bitcoin’ is doing the opposite of central banks:

Compare this with the cryptocurrency ‘bitcoin’. Unlike the traditional currencies, the ‘Bitcoin’ has an upper limit of 21 million coins, post which no more Bitcoins can be mined.

Every subsequent mining will become difficult and will reduce the reward associated with mining each block. Satoshi Nakamoto programmed that post-mining of 210,000 blocks, the rewards will be halved.

Initially, the reward was 50 ‘Bitcoins’ for every block, which was halved by the end of 2012, at which time the reward was reduced to 25 ‘Bitcoins’ per block.

The next round of halving took place, last week, when the rewards were reduced to 12.5 ‘Bitcoins’ per block.

While the central banks have been on a printing spree, the ‘Bitcoin’ is on a tightening route which boosts its’ price, as is visible in its’ sharp rise, this year.

A few miners will find it difficult to continue mining at the halved rewards which is likely to slow down new mining as halving will continue, in the future.

“The block halving will dramatically decrease the bitcoin being added as we approach 75 percent of all bitcoin issued. People understand that in this world of ever expanding assets and printing of money, we have something that’s fixed and limited in issuance. It gives a decent alternative for people who want to hold assets that can have sustained purchasing power,” stated Bobby Lee, Chief Executive of BTCC which is one of the largest’ bitcoin’ exchanges, in the world, based in China reports CNBC.

I recently watch a fantastic TEDX talk on Bitcoin and digital currencies and how they are changing the world, financial systems, and lives in huge way, and this is only the tip of the iceberg. This TEDX Talk makes so much logical sense why bitcoin and other currencies are so important for us as individual’s – Watch Video

However, the ‘Bitcoins’ volatility has dropped dramatically over the past few years with the lowest linear level of volatility seen since is this asset class started. It has become easier to use for trading, purchasing and using for purchases. I am presently only highlighting that readers will do well to keep an eye on ‘Bitcoins’ and other crypto/digital currencies, along with gold and silver.

In fact, I have been researching the digital wallet solution where I can purchase many up and coming digital currencies within one location as a NEW ASSET class for my portfolio. Why? Because I firmly believe the masses will slowly migrate their money into various digital currencies a safe haven store of wealth and for ease of use. Payments can be made with your mobile phone to anyone, anywhere in the world and for any amount with ZERO fees/costs, and in many cases it cannot be traced. I buy and hold my currencies in this crypto wallet CoinBase

Sir John Templeton, the legendary mutual fund manager and founder of Templeton Group, said:

“Invest in many different places – there is safety in numbers.”

So in short, I will share with you in future articles and as a subscriber to my trading and investing newsletter exactly which digital wallet, and digital currencies I will be buying and interested in learning more about as the world and financial systems evolve. When the time is right to invest my followers will know.

Chris Vermeulen – www.TheGoldAndOilGuy.com

GET THIS VIDEO EVERY DAY BEFORE THE MARKET OPENS – CLICK HERE

I wrote and exclusive article for CNA Finance today which I want to share with you. It talks about the Kondratiev Wave.

Just like all major long-term/big picture trends and cycle changes, nothing happens quickly. Its very much a process and the market will continue to move in a direction that makes no sense longer than most traders and investors think. Just like those who warned about the 2001 market crash, 2008 financial crisis, real estate crash, and now the 2016 stock market crash… most of these big picture analysts like myself see these things coming well in advance sometimes 6 months – 1 year before they happen.

We warn about these events happening and slowly position ourselves to not only avoid the crashes but to profit from them. But these take time to unfold as these are multiyear cycles and they do not turn on a dime.

Read Article: http://cnafinance.com/the-long-wave-winter-of-discontent/10209

Chris Vermeulen