Today we had a reversal day for the broad market, us dollar, precious metals and oil. The market is over extended. We have seen the market rally 20% since the July low.

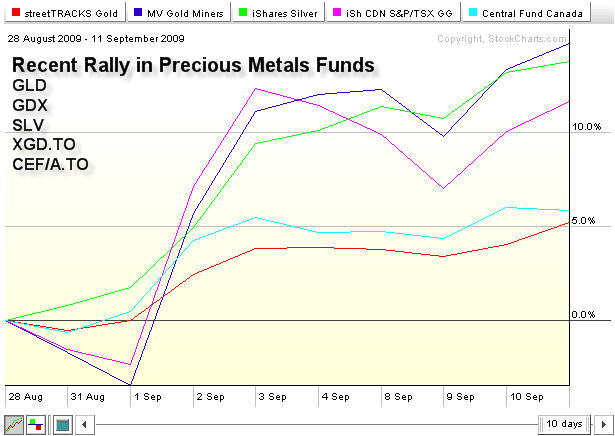

Inter-market analysis is important to understand because everything is related in some way. The next month will be very interesting with the US dollar trying to rally, which will put pressure on precious metals, stocks and commodities.

DIA ETF – Dow Industrial Fund

Stocks look to have formed a similar pattern as the March rally this year. The market has the same feel and price action that we saw during the June high, which is telling me we should move stops up to protect profits. Wednesday the market had an intraday reversal and that is a sign of weakness. The past four trading day’s is the same as the July bottom (multiple Doji Candles). Doji candles indicate a possible reversal.

DIA ETF Trading Newsletter

Broad Market Volatility Index

Here is a weekly volatility chart that shows we are at a long term support level. The saying is, buy when the VIX is high, sell when the VIX is low. Just to be clear, I am not saying sell everything. I am just pointing out that the market is ready for a multi week correction. I am tightening my stops and limiting my position size for new log positions.

VIX Volatility Index Trading

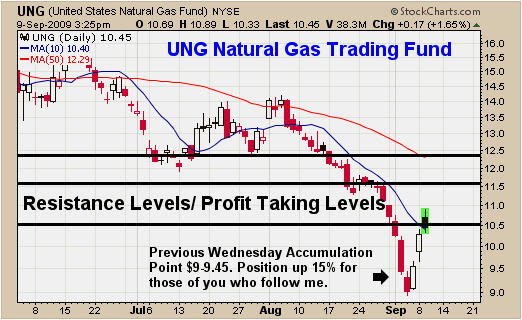

UUP ETF – US Dollar Intraday Price Action

The dollar sold down Wednesday, then rallied very strong into the close, indicating a shift in momentum. The dollar has been trending down for several months and ready for a bounce.

UUP US Dollar Trading Fund

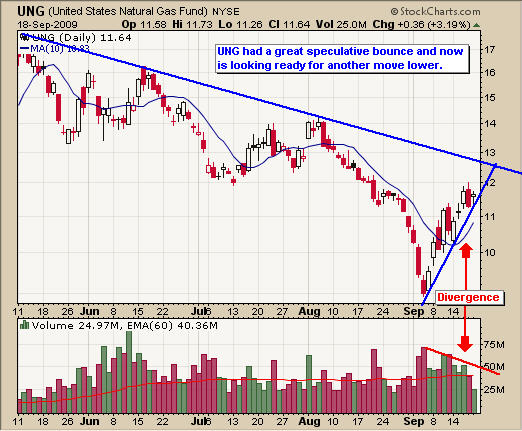

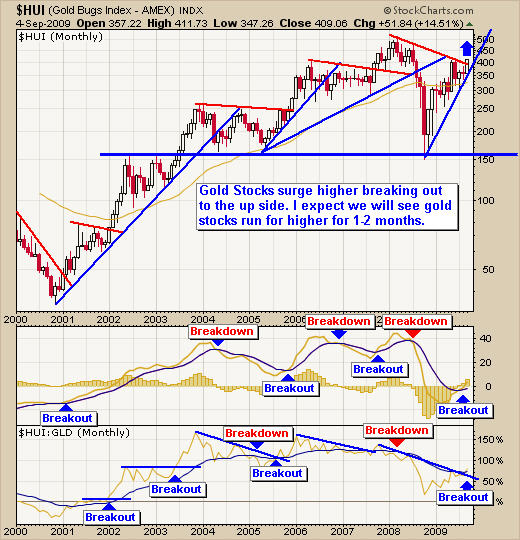

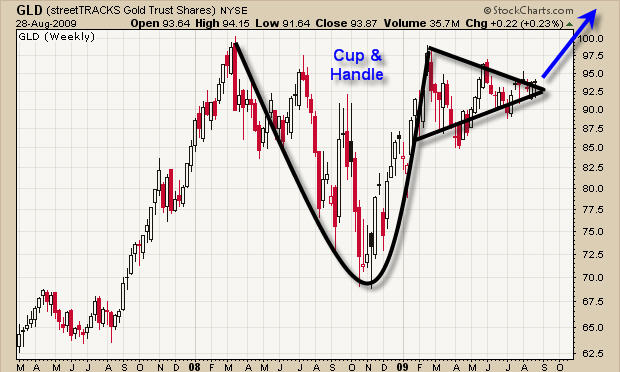

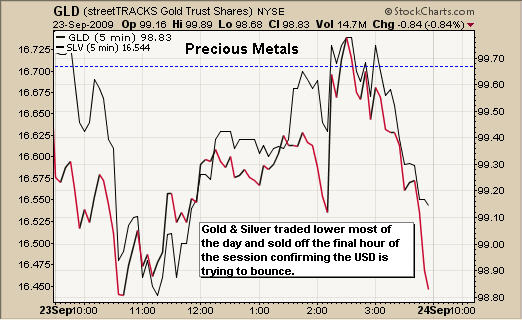

Precious Metals Under Pressure

Below is a chart of Gold and Silver showing the weakness on Wednesday and the sharp sell off late in the session, when the US dollar started to rally.

Precious Metals Trading Newsletter

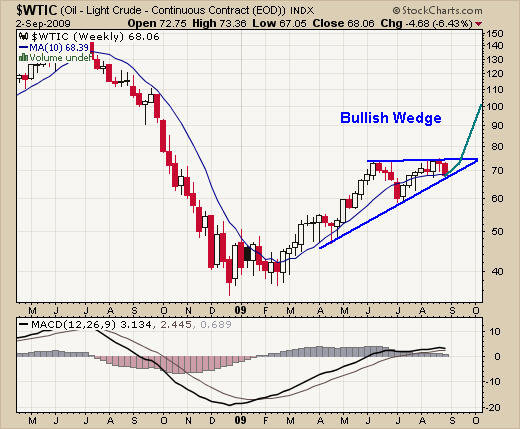

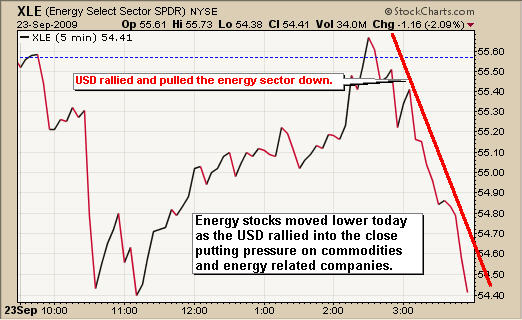

XLE Energy ETF – Intraday Chart

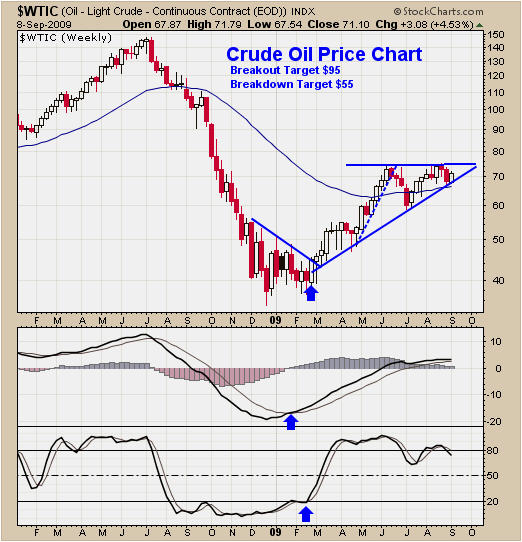

Energy sector moved down in the morning and managed to wiggle its way back to positive territory late in the day, but when the US dollar rallied, crude oil and the energy sector sold off sharply.

XLE Energy Trading Newsletter

Inter-Market Analysis Conclusion:

In my opinion things look to be setup for a multi week shift in momentum. It looks like the US Dollar will bounce putting pressure on precious metals, stocks, and commodities like crude oil.

Stocks look ready to correct and a bounce in the dollar will trigger the correction.

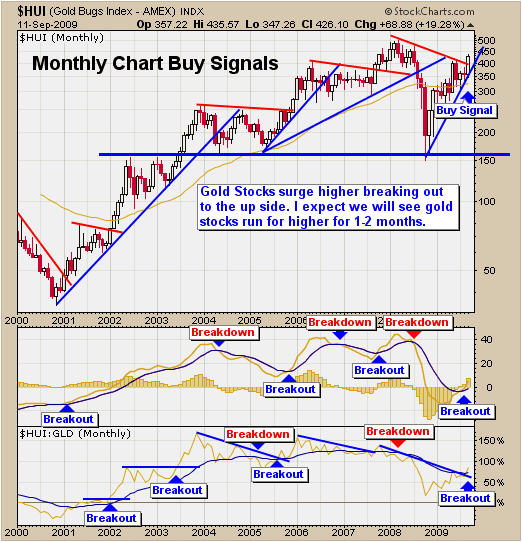

Gold is at a major resistance level, and taking a breather at this level would be normal price action. Gold has also been trading in sync with stocks, so this relationship is most likely still in place. If stocks move down, so will gold.

Crude oil is having a tough time moving higher and with Wednesday’s higher than expected oil inventory levels, there will be more down side pressure.

Currently we have several profitable position and we will be tightening our stops and looking for new opportunities in the coming days.

If you would like to receive my Free Weekly Trading Reports for ETF’s or Stock Trading Reports please visit my websites: www.GoldAndOilGuy.com and www.ActiveTradingPartner.com

Chris Vermeulen