Virus Curve, Market Crash, and Mortgage Massacre

In this last segment of our multi-part research article, we want to highlight our expectations of the Covid-19 virus event and how the next 6+ months of global market activity may play out. We’ve covered some of the data points we believe are important and we’ve touched on the collateral damage that may be unknown at this time. Today, we’ll try to put the bigger picture together for investors to help you understand what we believe may be the 12+ month outcome.

As the global central banks and US Fed attempt to come to the rescue, the reality is that monetary policy works better when consumers are able to actually go out and engage in spending and economic activity. If the Covid-19 virus event contracts global consumer activity, as it has recently, for an extended period of time (4 to 6+ months), then we have a real issue with how QE efforts and consumer activity translate into any real recovery attempt.

The real risks to the global markets is an extended risk that the Covid-19 virus creates a contracting economic environment for many months/quarters and potentially fosters an environment where extensive collateral damage to corporations, consumer activity, credit/debt markets, and other massive financial risks boil over.

Before you continue, be sure to opt-in to our free market trend signals

before closing this page, so you don’t miss our next special report!

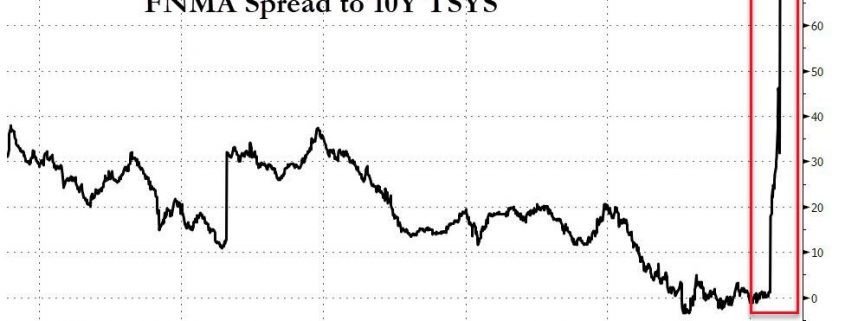

News is already starting to hit that QE is not helping the deteriorating situation in the Mortgage banking business. Remember, this is the same segment of the financial industry that started the 2007-08 credit crisis event. News that mortgage lenders and bankers are already starting to experience margin-calls and have attempted to contract their exposure to the risks in the markets (a bit late) are concerning. This is a pretty big collateral damage risk for the global markets.

Additionally, as we expected, applications for new mortgages have collapsed to their lowest level since 2009. Until consumers feel confident in their ability to get out, engage in real economic growth and take on home loans they know are relatively secure in their ability to repay – there is going to be a continued market contraction. The next phase of this contraction is a price reduction, forced selling/foreclosures and a glut of assets waiting for a bottom.

“Home-purchase applications dropped by 14.6% while

refinancing applications plummeted 33.8%… “

I think the most important aspect of this global virus event is to remember that we will survive it (in some form) and we will live to rebuild after this event completes. Yet, the reality is that we were not prepared for this event to happen and we don’t know the total scope of this Covid-19 virus event. We simply don’t know how long it will take to remove the threat of the virus and for societies to reengage in normal economic activity – and that is the key to starting a real recovery.

Hong Kong has recently reported a “third wave” of Covid-19 infections. I believe we should attempt to learn from places like Hong Kong, where news is moderately accurate and reported via social media and other resources. If we want to learn what to expect in the US and how the process of containing this virus may play out, we need to start learning from other nations that are ahead of us in the curve.

It appears that any attempt to resume somewhat normal economic activities while the virus is still active spouts a new wave of infections. This would suggest that the only way to attempt to reengage in any somewhat normal economic activity would be when a vaccine or true medical cure is in place to allow nations to attempt to eradicate the virus as these waves continue. (Source: https://www.marketwatch.com/story/third-wave-hong-kong-thought-it-had-a-handle-on-coronavirus-it-doesnt-2020-03-23 )

The price collapse in 2008-09 represented a -56% decline from top to bottom. Currently, the S&P has fallen by just over 35%. We don’t believe the bottom in the US stock market has setup just yet and we do believe there is a greater downside price risk ahead. We don’t believe the housing market will be able to sustain any of the current price levels for much longer. We believe the collateral damage of this event is just starting to be known and we believe a greater economic contraction is unfolding not only in the US but throughout the globe.

Skilled traders need to understand the total scope of this event. We’ve attempted to highlight this risk in this article and in our “Crunching Numbers” research article (PART III). An economic contraction, like the Covid-19 virus event, could contract global GDP by as much as 8 to 15% over an extended 16 to 36+ month span of time. Are we concerned about the Real Estate market? You Bet! Are we concerned about global markets? You Bet! Are we prepared for this as traders? You Bet! Are the central banks global nations prepared for this? We certainly hope so.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for short-term swing traders.

Visit my ETF Wealth Building Newsletter and if you like what I offer, and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

www.TheTechnicalTraders.com