Using the S&P 500 to Profit from the Passage of Time

Most traders follow the S&P 500 Index closely, but few equity or futures traders are able to structure trades that are profitable based solely on the passage of time. Option traders use a variety of trade structures, called credit spreads to actually make the passage of time a profitable endeavor. Unfortunately there is one catch . . . the price of the underlying asset has to cooperate.

What many readers may find interesting is that I structure my option portfolio around being positive Theta. This essentially means that the portfolio collects option premium as time passes which will be converted into profits if prices cooperate. I attempt to consistently capture close to 1% of my account value per day in positive time decay.

Inquiring minds might ask how I accomplish this task.

The answer: multiple iron condor spreads. An iron condor spread is a credit spread where a trader takes a call credit spread and a put credit spread simultaneously. In many cases, the trader expects the underlying asset to consolidate or trade in a specific range.

I have several high probability iron condor spreads in my portfolio all the time. I trade the same trade structure using the same underlying assets over and over again. In many cases, I will have more than one iron condor spread on the same underlying asset on my books at the same time. The underlying assets that I focus my iron condor strategy around are primarily index options and index etf’s.

I trade the S&P 500 cash index (SPX), the Russell 2000 cash index (RUT), the Nasdaq 100 ETF QQQ, and the Dow Jones Industrial Average ETF which is DIA. These are just a few of the underlying assets that I trade using the iron condor strategy. I traditionally enter the trades at about 50 days to expiration using a probability of success of around 80%. Most of the time, the broader index would have to move roughly 2 standard deviations from the current price at entry to create losses in my portfolio.

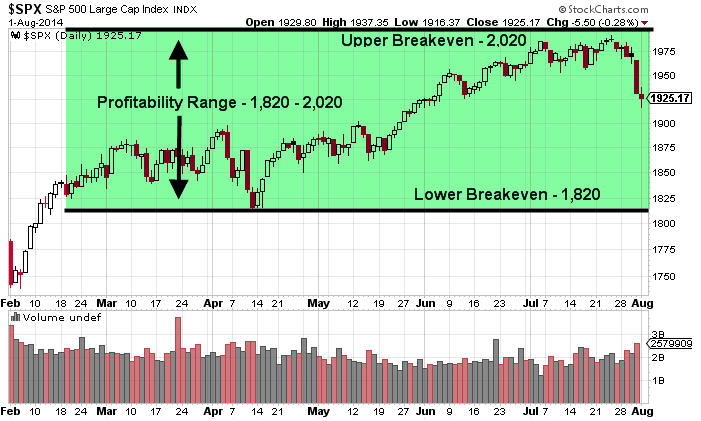

Back in early July I entered an August SPX Iron Condor Spread which presently is boasting profits of around 10% on maximum potential risk. However, I wanted to show readers that recently I entered a September SPX Iron Condor Spread with about 50 days to expiration. The probability of success was around 80% for the trade to be profitable. The following chart of the S&P 500 demonstrates the price range where the new September SPX Iron Condor Spread will be profitable if held to expiration.

As can be seen above, the new September SPX Iron Condor Spread is profitable as long as the SPX price stays between 1,785 – 2,050. The trade was entered on July 22nd in addition to the August SPX Iron Condor Spread that I was holding at the time. The chart below shows the price range in the S&P 500 Cash Index (SPX) which will be profitable if both SPX iron condor spreads are held to expiration.

If both SPX spreads are held to expiration, the profitability range for both trades held simultaneously is 1,820 – 2,020. The probabilities are quite favorable that one if not both trades will be profitable at the August and September expirations.

The combined strategy offers a probability of close to 80% to make a positive return. Based on maximum possible risk, the typical return is between 10% – 15% depending on implied volatility changes during the holding period of the trade. At first glance, many traders write this strategy off as a poor strategy based on risk / reward. However, what other strategy offers nearly a 10% – 15% return on maximum risk with a near 80% probability of success at the time of entry?

When paired with other directional trades, having multiple, high-probability iron condor spreads on the books at the same time builds a high level of positive theta that helps support consistent portfolio profits. So far, the recently launched Technical Traders’ option service is boasting two closed trades thus far. Both trades that have been closed were quite profitable.

The first winning trade was in Facebook which was directional biased to the upside and a call diagonal spread was the trade structure chosen to use. The trade had a maximum risk of $493 per spread and produced a gross gain of $111, or 22.51% per spread. The other big winner was a FXE Put Butterfly Spread which was designed to profit partially from the passage of time and from lower FXE prices. The trade was entered with a maximum risk of $141 per spread and produced a gross gain of $53, or 37.59% per spread.

Overall, the new option service is off to a great start and currently has several additional trades which are profitable at this time. For more information, click the following link to check out the new cheaper, upgraded options service at: www.TheTechnicalTraders.com/options/

Chris Vermeulen