US Equities Roar To Life After Elections

Our research team is writing this message to alert all investors and traders of a pending rotation in the US stock market that may happen between now and November 15. The upside price breakout that is occurring on November 7, the day after the US mid-term elections, is an incredible display of global investor sentiment regarding the GOP success in the Senate and the continued business-friendly expectations originating out of Washington DC. The move, today, shows how clearly a global capital market shift is still engaged in the US markets and how much global investors are counting on the US to drive ROI and economic growth going forward.

Yet, we feel it is important to urge investors that our modeling systems are still suggesting an ultimate price bottom should be setting up near November 8~15 and that we could still see a bit of downward price rotation over the next few days before this ultimate price bottom completes. It might be too easy to get caught up in this move, today, and fail to properly understand the price rotation risks that are still active in the time/price horizon.

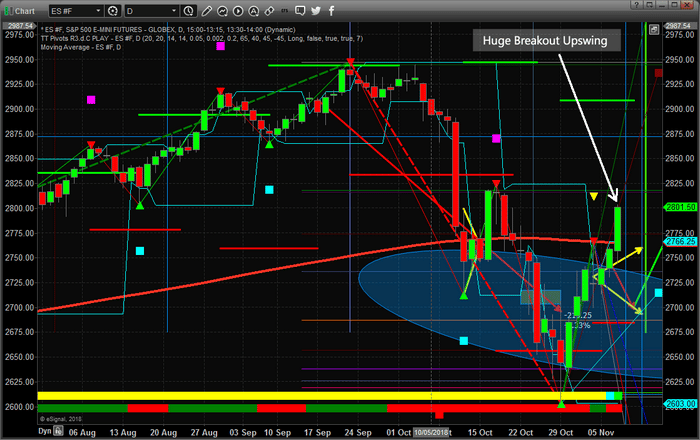

The ES is currently +48.00 as of the creation of this post (+1.74%). This is an incredible move higher and the 2790 level becomes critical support for the markets as long as price is able to stay above that level.

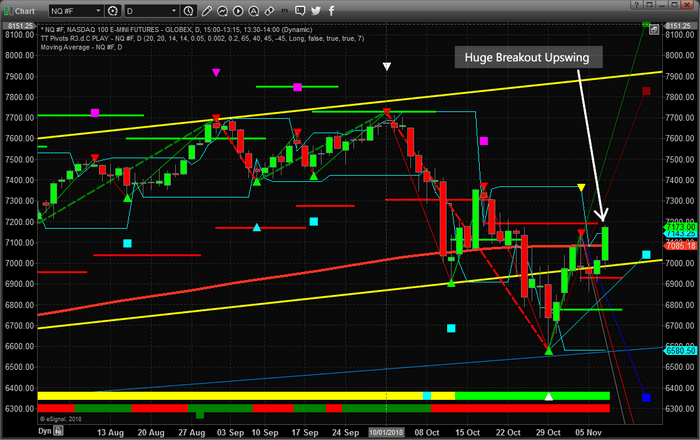

The NQ is currently +172.50 (+2.45%) and shows just how clearly investors are piling into technology, healthcare and bio-tech after the US elections. This is a real vote from investors that they believe President Trump will be able to navigate any issues going forward and that the US economy will continue to push out strong numbers.

Follow our analysis to read our most recent research posts. We have already positioned our members for this “ultimate bottom” that our predictive modeling systems suggest is in the midst of forming. We called this entire downside move, bottom rotation and the ultimate bottom pattern setting up near November 12th back on September 17. If you want to learn how we can help you find and execute better trades, visit www.TheTechnicalTraders.com to learn more.

Chris Vermeulen