Two Traders Share How to Trade Stocks Secrets

Christopher Uhl an Award-Winning Trader, Entrepreneur, Author, Podcaster, Speaker, and Coach talks with Mr. Vermeulen to find out how they can help others learn to trade.

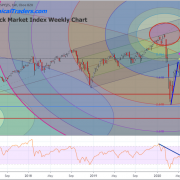

Chris Vermeulen, Chief Market Strategist at http://www.TheTechnicalTraders.com has been trading since he was 16 in high school and been trading full time in college. He’s 100% chartist and he loves swing trading and getting into the momentum trading.

Chris focuses on GDX GDXJ. According to him, it’s pretty much a line across the chart. If we go back to 2010-2011, we’ll actually see there’s a series of major rallies from back then.

Gold miners have just broken out of a stage 1 phase. Now we’re going into that bull market phase.

He thinks that they have the opportunity now to outperform for several weeks, do exceptionally well, but they might start to get under some pressure if the stock market does sell-off.

It’s so much easier to just find a trend that’s going in one direction, either up or down, and participate along with it.

Subscribers of my Active Swing Trading Newsletter had our trading accounts close at a new high watermark. We not only exited the equities market as it started to roll over in February, but we profited from the sell-off in a very controlled way with TLT bonds for a 20% gain. This week we closed out SPY ETF trade taking advantage of this bounce and entered a new trade with our account is at another all-time high value.

Ride my coattails as I navigate these financial markets and build wealth while others watch most of their retirement funds drop 35-65% during the next financial crisis.

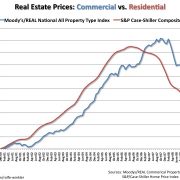

Just think of this for a minute. While most of us have active trading accounts, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during the next bear market, you could lose 25-50% or more of your net worth. The good news is we can preserve and even grow our long term capital when things get ugly like they are now and ill show you how and one of the best trades is one your financial advisor will never let you do because they do not make money from the trade/position.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Passive Long-Term Investing Signals which we issued a new signal for subscribers.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.