A Trading Plan That Could Save Your Portfolio

This week I would like to share with you the strategy that I am deploying to my own investment portfolio. As the US stock market nears completion of a major topping pattern I expect a multiyear decline in the price of equities.

During the past month my focus has been on big picture analysis. Because what I believe is about to unfold will have a dramatic life-changing affect on your financial situation and it is crucial that you realize what is very likely going to happen.

Let’s talk about the masses for a moment. Unfortunately most traders and investors are extremely bullish on stocks right now and for good reason. Over the past six years you virtually had to just throw a dart at the board and over time you would have generated substantial gains. But because of this luck/success most investors have become overly bullish and continue to buy stocks at an alarming rate even though evaluations are high and warning signs of the stock market top is near.

Simply put there is a time in the market when you should be accumulating shares. And there is also a time when you should sell your equity positions and exit the equity market.

According to my analysis and experience I feel investors should exit positions in equities and focus on a large cash position and/or moving thier money into bonds and other asset classes.

Looking forward 8 to 24 months to protect your portfolio and continue to grow its value will be in Canadian bonds (not US Bonds), precious metals, and in the commodity market as a whole.

Let me explain my thought process behind these ideas briefly:

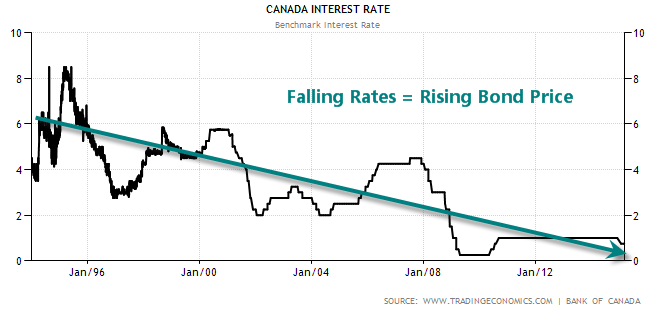

Canadian Bonds: unlike the US Canadian rates continued to decline. As rates fall we tend to see the price of bonds rise. And when fear hits the overall stock market in both Canada and the USA money will naturally flow out of equities and into bonds as a safe haven. This double flow of money will send the price of bonds dramatically higher.

Precious Metals: precious metals will act as a safe haven, a hedge against currency devaluation which is a huge concern in the future. Small speculative traders are finally not interested in this sector which can been seen by reviewing the COT report on gold. Speculative traders (small average Joe) are now net short gold.

Commodities: resources tend to perform well during late stage bull markets and bear markets. With several of the main commodities trading at long-term support levels and have formed basing pattern we should expect strength in commodities over the next 12 months.

The Plan Conclusion:

Last week I started liquidating a large portion of my equity positions in my long-term investment account. I am currently sitting heavily in cash and will be liquidating more of my equities and rotating money into bonds, precious metals and commodities.

My recent investment purchased was precious metals (gold and silver). This accounts for roughly 2.8% of my portfolio. I intend to build my precious metals holding to be roughly 10% of my portfolio over the next few months. I do have a potential downside target for gold to reach $815 per ounce before bottoming and rocketing higher. Because this is a long-term investment looking forward one to five years I will be scaling into this precious metals position each week as I see fit.

The commodity portion of my portfolio is 3.4% of commodity related investments with a plan to build it to 5%.

After six years of gains in my long-term portfolio I am very comfortable holding 75% Canadian bonds, 10% precious metals, 5% commodities basket, and 10% equities.

Until we get a bear market correction or new analysis points to substantially higher prices for equities I will be playing defense to preserve capital so I have lots of gun powder to re-enter the equities market when valuations, dividends, and higher share prices are in favor.

If you want to avoid the next bear market and possibly generate oversize gains from falling equity prices then join my newsletter today!

Chris Vermeulen

www.GoldAndOilGuy.com